Thorston Asmus

iShares BB-rated Corporate Bond ETF (NYSE: HYBB) covers the majority of BB-rated fixed income securities in the U.S. corporate debt market. Two key factors to look at are credit rating and maturity.We believe credit spreads This number is a bit too low in the current environment, given the uncertain economic situation, especially uncertain inflation conditions and the corporate debt risks posed by the upcoming maturity wall. Regarding duration, we also believe HYBB’s duration is too high, given the trajectory of interest rates and the market’s tendency to overestimate the likelihood of a soft landing. HYBB is not an option right now.

HYBB failure

The expense ratio is 0.25% This makes perfect sense considering this is a more tailored corporate credit portfolio rather than just a Treasury portfolio.

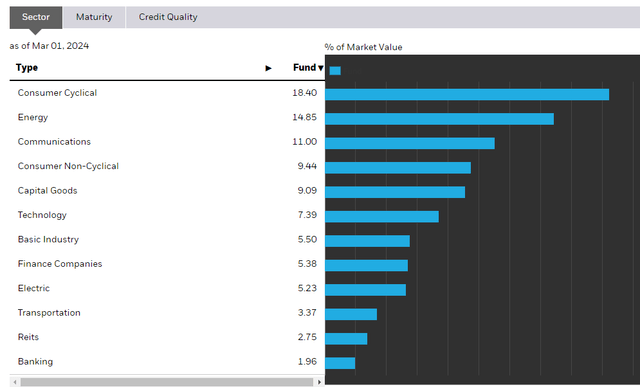

From the perspective of credit status, more than 92% The portfolio’s corporate credit rating is BB. In terms of industries, there are substantial risks in consumer cyclical, energy and communications.

Department(iShares.com)

The validity period is 3.67 years.

macro review

Let’s start with credit risk. We want credit spreads to be commensurate with credit risk given the macro environment. We believe this is not currently the case.

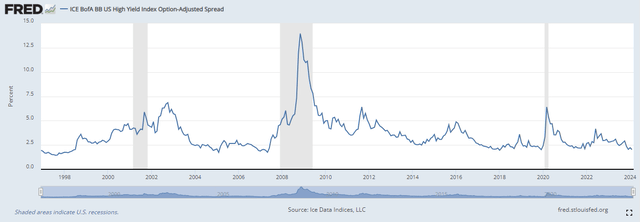

Credit spread (FRED)

Credit spreads are at historically low levels, which is not a good start as we believe credit risk is not at all historically low and therefore premiums for that risk should be higher. Higher interest rates, of course, mean greater financial pressure on businesses. Interest rates are more than double what they have been in a decade or more, but credit spreads are similar to where they were when the economy was undamaged and interest rates were much lower. Even if interest rates are expected to fall, they remain high and much of the U.S. corporate debt will have to be refinanced in 2024 and 2025. Just in 2024, 25% of outstanding debt will come due, and 2025 will be another big year. Many U.S. businesses have been benefiting from fixed-rate debt, and even if interest rates fell significantly, these refinancings would see the average increase in interest paid by businesses be very substantial, but we don’t think that will be the case.

Regarding the issue of credit spreads and duration (a measure of the sensitivity of an instrument to changes in prevailing interest rates), both are issues of the duration of falling interest rates. Currently, interest rates have not been cut, although the Fed may cut rates slightly at some point in 2024. But the magnitude of the rate cut is crucial for HYBB because its duration is not that short. The cuts will also impact the financial health of U.S. businesses. We don’t think the cuts will come that soon. Optimism about a soft landing improves access to capital and reverses the impact of Fed policy, making it more likely that high interest rates will remain high for longer. Importantly, wage growth remains well above the inflation run rate and the policy rate target, which underpins expectations, while the level in the survey is also well above the policy rate. Apart from the impact of rising inflation, there is no reason to believe that inflation is falling significantly. A longer-term move higher would exceed expectations for longer-dated instruments.

Returning to credit spreads, the impact of term walls and rising average interest rates in corporate America may also start to trickle into the job market and lead to more aggressive cost-cutting measures. While this may help interest rates fall further, it comes with demand-side issues that will create a particularly big problem for consumer cyclical stocks, especially energy. This will also be a reason for the market to drive up credit spreads.

bottom line

We believe that given the higher interest rate environment, there is a risk that the term wall will impact the burden on corporates in some way, some of which started with lower-rated issues and will start to have a harder time repaying their debt. Even in the best-case scenario, a higher interest rate environment will not blend with credit spreads consistent with a much lower interest rate environment. Additionally, we believe all indicators point to quite strong inflation, which will exacerbate credit spread concerns and technically impact HYBB through duration effects. For these two reasons, we would be on the fence about a duration BB-rated ETF like HYBB.