Antonio Correa de Almeida/iStock via Getty Images

investment thesis

NetApp (NASDAQ:NTAP) released Q3 2024 results and outlook last month, and the stock was up +12% in after-hours trading; I believe the name NetApp should be What investors should focus on in 2024. At its core, NetApp is an intelligent data infrastructure company that combines its unified data storage, integrated data services and CloudOps solution offerings to create a silo-free infrastructure and enable superior data management. In my opinion, NetApp rode the dot-com bubble back in the 1990s and is now in the midst of the AI boom.

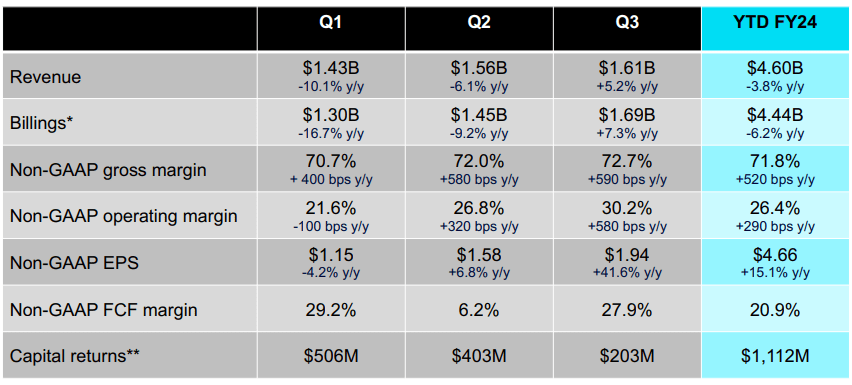

company Report earnings Net revenue last month was $1.61 billion, up from $1.53 billion in the same period last year, an annual increase of 5%, and up from $1.56 billion achieved in the second quarter 2024. NetApp’s fiscal 2024 results to date reflect sequential upward trends in billings, revenue and its all-flash array annualized revenue run rate, which in my view is primarily driven by the company’s expanded all-flash portfolio. I started buying NetApp because I see this upward trend continuing into next quarter and into FY2025. NetApp’s performance and outlook lead me to believe that the rebound in NAND flash memory and the boost from artificial intelligence will support the company’s top-line growth and provide greater upside to current consensus numbers.

NetApp Value Proposition

Data has never been more valuable, so it’s never been more important to store and manage it in the simplest, most efficient way; that’s where NetApp’s all-flash portfolio comes into play. Since the dot-com bubble, NetApp has shifted gears to provide data-centric solutions in the cloud to hyperscale providers, including Amazon (AMZN) , Google (GOOG) (GOOGL) and Microsoft (MSFT), among others . In my opinion, the company’s position in the industry and the expanded flash portfolio highlighted in this quarter’s earnings call make it one of the storage brands best positioned to achieve revenue growth on the back of AI momentum.

The proof is in management’s outlook for the fourth quarter: Management expects fourth-quarter revenue in the range of $1.585 billion to $1.735 billion, while Wall Street expects revenue of $1.65 billion. On top of that, management also raised its full-year 2024 guidance to $618.5 to $6.335 billion. Management’s fiscal 2024 guidance tells me two things: 1. We are still in the early stages of generative AI adoption, driving the need for customers to extend their underlying data models; 2. This new imperative will Memory business has a positive impact through NetApp’s expansion. NetApp has widely accepted For the fifth consecutive year, it has been a leader in the 2023 Gartner Magic Quadrant for Primary Storage and ranked first in hybrid cloud IT operations. I believe this will have a positive impact on management’s fiscal 2025 guidance, which will be released next quarter. The chart below shows NetApp’s fiscal 2024 earnings results to date and sets the tone for Q4 results and FY25 outlook.

NetApp Q3 FY24 Presentation

NetApp is getting attention for its position at the intersection of data management and artificial intelligence. During this quarter’s earnings call, CEO George Kurian conveyed NetApp’s strong position in artificial intelligence through customer wins during the quarter, including “large-scale NVIDIA SuperPOD and BasePOD deployments.” Kurian noted: “There were several eight-figure deals in the third quarter, and one of the largest oil and gas companies in the world built their AI supercomputer… One of the largest genomics companies in the world relied on us (NetApp) technology to accelerate genomic analysis with NVIDIA and NetApp, one of the largest media companies in the world is leveraging us to drive some of the early stages of their generative artificial intelligence efforts.” I emphasize this because we are in the midst of every It’s a moment when everyone wants to get on the AI bandwagon, whether or not they have real AI growth, and this is reflected in TMT companies frequently mentioning the push for AI on earnings calls. The difference with companies like NetApp is that I see the tailwinds from AI reflected in deals and customer traction.

Just as importantly, I see NetApp leveraging its powerful data management capabilities to “perform operations such as model versioning, security of mission-critical data, and the ability to deploy and connect data pipelines from production to training.” Therefore, NetApp’s No. The third-quarter results should not be viewed as a one-time home run or a window to calculate profits and exit the stock, but rather as a sign of a longer-term uptrend supported by artificial intelligence and the NAND flash memory rally.

Adapt to industry transformation

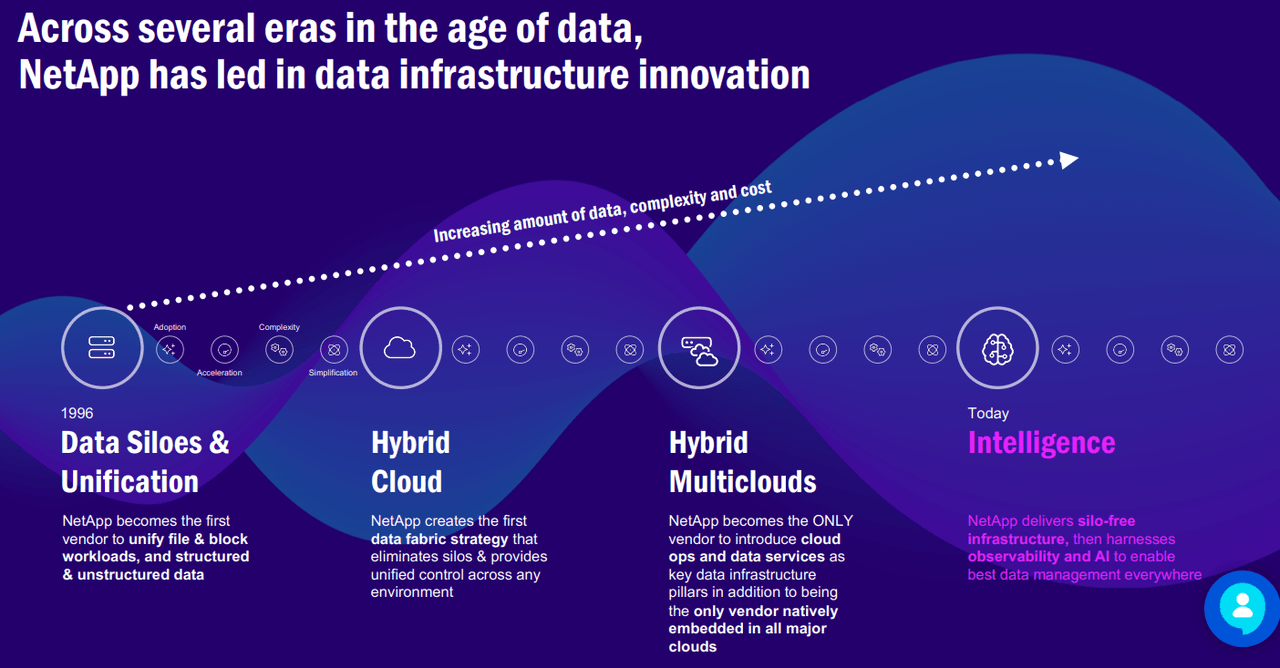

Another reason I seek to bring long-term investors to NetApp is that I believe NetApp’s position in the storage market and its co-evolution with the industry inspires confidence in the company’s ability to ride the rising demand for smart data infrastructure. Artificial intelligence craze. In the 1990s, NetApp generated most of its revenue from the sale of “network file managers and caching devices,” and the company is known as one of the original network-attached storage, or NAS, file managers. NetApp adapted to the rapidly changing environment brought about by the dot-com bubble and began selling storage products to Internet companies until, of course, 2002, when NetApp soared during the dot-com bubble. Since NetApp rebounded, its focus has shifted to hybrid cloud, hybrid multicloud and now smart transformation.

While the company has received some backlash for being late to the NAND flash memory space, I’m focused on the company’s forward risk-reward profile, which I believe is attractive at current levels. . I believe NetApp’s silo-free infrastructure provides the adaptive operations, flexibility and security requirements to achieve high product traction in today’s AI-driven market.The picture below is from the company earnings report Third-quarter results outline NetApp’s innovative position in data infrastructure over the past two decades.

NetApp third quarter fiscal 2024 financial results

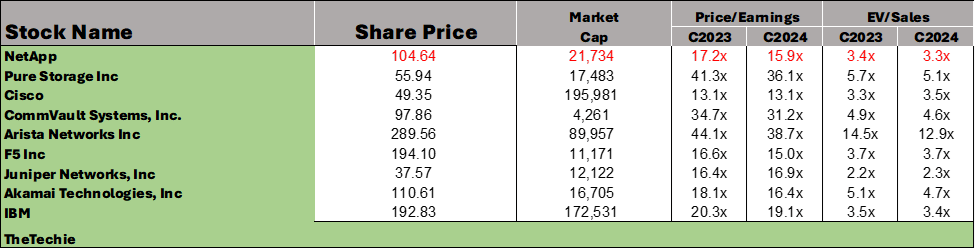

attractive valuation

Based on relative approaches to stock valuation within my coverage universe, NetApp presents an attractive investment opportunity for its position in the data management and artificial intelligence markets. According to Refinitiv data shown in the table below, NetApp stock is trading at a ratio of 16.3 in 2024, which is relatively lower than the industry average ratio of 27.1. NetApp has a similar relative valuation for its 2024 EV/sales ratio, which currently stands at 3.3, again below the peer average. Due to NetApp’s AI exposure in 2024, I still believe the stock has a favorable risk-reward profile and believe NetApp is largely undervalued given its current position in the market.

Image created by The Techie using data from Refinitiv

What problems might arise?

Although NetApp offers an attractive risk-reward profile, risks remain. NetApp is in the data storage hardware and management software business.this means Company sells storage Provides enterprises and service providers with equipment to store and share large amounts of digital data across physical and hybrid cloud environments. The majority of the company’s revenue (about 90%) came from its hybrid cloud segment ($1.455 billion) during the quarter, with the remainder coming from its public cloud segment (net revenue for the quarter of $151 million).

The company’s biggest concern right now is the sluggish growth of its public cloud business, which grew 1% annually this quarter. I’m not too worried about a slowdown in growth there, as NetApp made it clear to investors on its earnings call that the company “expects approximately $20 million in ARR headwinds from non-renewed subscriptions. The impact on revenue will be to a minimum and should be largely offset by growth in first-party and marketplace services.” Another factor easing my concerns is that the company enters Q4 and FY25 in a stronger position than it does in FY24 , during this period, NetApp and the broader storage market faced NAND pricing pressure and weak end demand. I think there is more room for customer demand for high-performance file storage solutions to train AI/ML workloads amid the AI boom to offset other near-term headwinds.

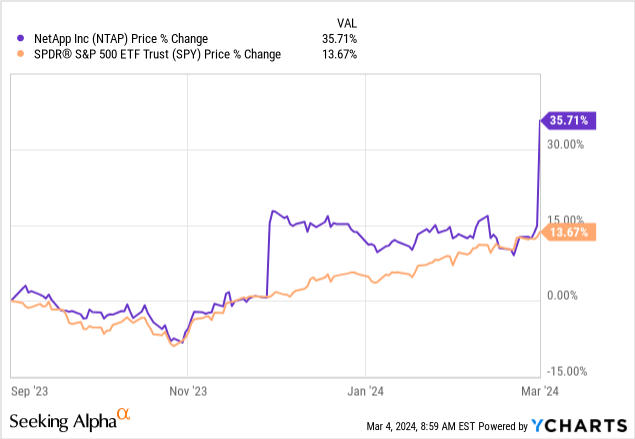

Still, I caution investors to be cautious when exploring entry points into the stock. I believe a lot of the positive sentiment surrounding the NAND flash memory rally and AI tailwinds following management’s earnings call has been priced into the stock. The stock has gained about 36% over the past six months, outperforming the S&P 500, which has gained just 14% during the same period, as shown in the chart below. I believe investors should explore entry points into the high $80 range.

YCharts – SeekingAlpha

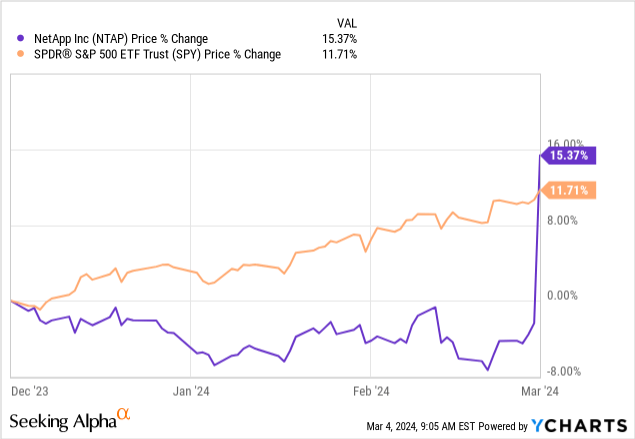

The company’s shares have traded just slightly higher than the S&P 500 over the past three months. NTAP stock has gained 15% over the past three months, while the S&P 500 has gained 12% during the same period, as shown in the chart below. I think NetApp has more upside than current consensus numbers due to its position in the enterprise data management and storage solutions market, due to its all-flash solutions as well as AI momentum and better NAND flash memory demand and Pricing dynamics, its share gains have seen a solid sequential rebound. I think NetApp is uniquely positioned to ride the upward trend in the NAND flash resurgence as the company’s Q3 ’24 reflected strong momentum.

YCharts – SeekingAlpha

What’s next?

In my opinion, NetApp should be on investors’ watch lists in 2024. The company offers mature and developed data management capabilities. It has close ties with strategic partners that will allow it to leverage its capabilities for revenue growth during the AI boom. I expect NetApp to make up for its lack of growth in the past by expanding its all-flash product portfolio, which I’ve seen in the company’s deal wins this quarter and raising its fiscal 2024 guidance.

I understand investors’ concerns that stock price performance will be vulnerable to market sentiment positive for artificial intelligence. Nonetheless, I think NetApp will be a long-term beneficiary of the AI boom in fiscal 2025. I see more upside to the current consensus numbers and expect the stock to move higher in the second half of 2024 as enterprises and service providers significantly increase their AI-related capex investments this year compared to last year.