PeopleImages/E+ via Getty Images

I presented my “Buy” Junk Connection thesis (NYSE: WCN) In my previous reporting, I emphasized that the landfill problems in California and Texas are temporary in nature.they reported their Fourth quarter fiscal year 2023 February results Ranked 13th on the back of strong revenue growth and margin expansion. I reiterate a “buy” rating with a fair value of $175 per share.

Strong margin expansion and pricing growth

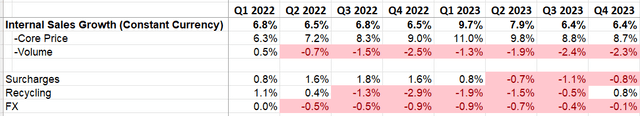

In the fourth quarter of fiscal 2023, Waste Connections achieved internal sales growth of 6.4%, with price growth of 8.7% and volume growth of -2.3%, as shown in the table below. It is worth noting that their adjusted revenue increased by 24.2% year-on-year, and their profit margins expanded significantly.

Waste Nexus quarterly results

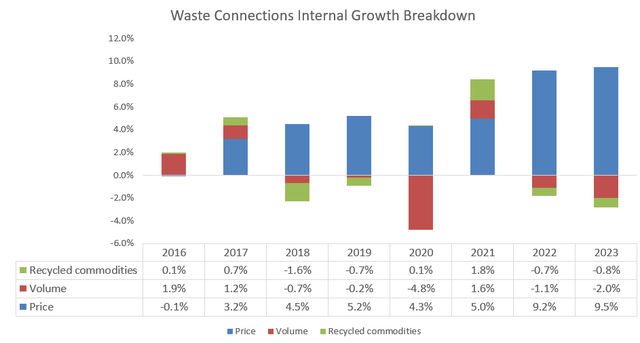

As shown in the chart below, Waste Connections’ core pricing grew 9.5% for the full year, but sales fell 2%.Core pricing growth was primarily driven by the company’s contract review initiatives, as I explained in mine Previous article. They strategically exited some unprofitable and low-margin contracts, which helped their core pricing grow this season. For the full year, the company’s profit margin increased 70 basis points to an adjusted 31.5%. EBITDA margin. Excluding commodity price fluctuations, core profit margins expanded 130 basis points from the same period last year, which is indeed impressive.

Waste Connection 10Ks

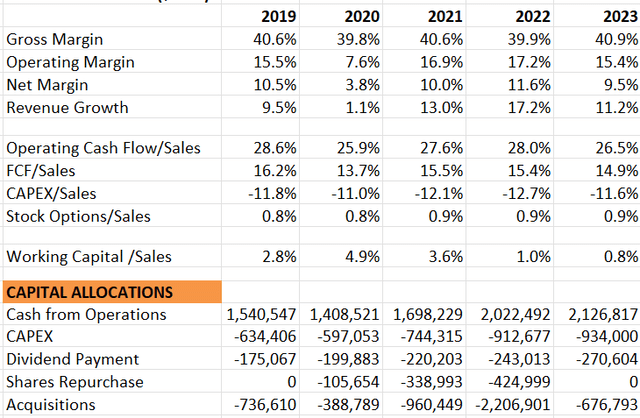

Waste Connections maintains a strong balance sheet, with a total debt leverage ratio of 2.6x. They generated $1.19 billion in free cash flow for the full year and paid $270 million in dividends but did not repurchase stock.

The company’s growth has been fairly stable in the post-pandemic era, and its free cash flow conversion remains healthy, as shown in the chart below.

Waste Connection 10Ks

My biggest takeaway from the earnings call was that their margins grew significantly, and there are several factors contributing to their margin improvement. Waste Connections achieved core pricing growth of 9.2% in fiscal 2022 and another 9.5% in fiscal 2023, and its management expects core pricing to grow another 7% in fiscal 2024. As mentioned earlier, the exit from low-margin contracts drove growth in its core pricing. Additionally, wage inflation begins to normalize in fiscal 2023. The company experienced wage inflation of 8% at the beginning of the fiscal year before slowing to 6% by the end of the fiscal year. On the earnings call, their management forecast 5% salary inflation for fiscal 2024, suggesting less cost pressure in the near future.

landfill California and Texas updated questions

As I mentioned in my last post, Waste Connections has encountered unexpected landfill problems in California and Texas. In the fourth quarter of FY23, the company incurred $160 million in costs related to landfill closures and post-closure liabilities. Their management expects their fiscal 2024 free cash flow to be negatively impacted by $75 million due to rising temperatures in Chiquita Canyon. During the earnings call, their management hinted that it would take several quarters to fully address the heat issues in Chiquita Canyon.

In the long term, it is critical to understand whether these events will result in additional operating costs for managing all landfills. During the earnings call, their management stated that the company has implemented engineering protocol changes at selected centralized landfills that will monitor landfill temperatures more frequently. Additionally, their management does not expect future increases in material costs to manage the existing landfill. I agree with their management’s assessment that since high temperature issues are fairly rare events, the additional costs would be minimal if more frequent temperature monitoring and adjustments to waste disposal procedures were implemented.

Fiscal Year 2024 Outlook

Waste Connections expects revenue to grow approximately 9% in fiscal 2024 and adjusted EBITDA to grow 13.3%. The guidance means margins will improve significantly in the new fiscal year.they closed get Secure Energy acquires 30 energy waste treatment and disposal facilities in Western Canada for C$1.075 billion. The transaction is expected to add approximately $325 million in revenue in fiscal 2024, increasing overall revenue growth by 4%. Assuming the company can achieve 7% core pricing growth in line with management’s forecast, total revenue will still grow 9% in fiscal 2024 even if sales decline 2%. The company’s sales fell 2% in FY23, with part of the decline due to its contract review measures. As the contract review is nearing completion, assuming a 2% sales decline in fiscal 2024 is quite conservative.

On the profit side, the company will benefit from pricing growth and slower wage inflation. I expect their operating expenses to grow 5.4% in fiscal 2024, which could drive margin expansion by 320 basis points. Therefore, their full-year guidance appears realistic and achievable.

Valuation update

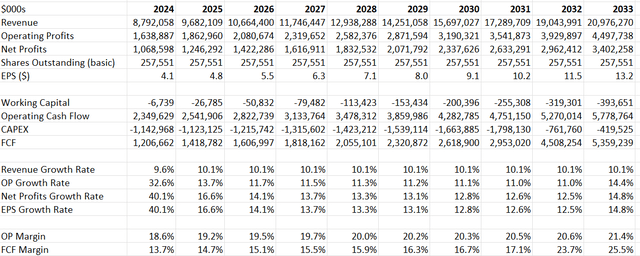

Key assumptions for fiscal 2024 are consistent with the company’s guidance and reflect strong pricing growth and modest payroll cost pressures. I calculate free cash flow for fiscal 2024 to be $1.2 billion, in line with their guidance. Notably, free cash flow includes the $75 million impact of the two landfill costs previously discussed.

For normalized growth, I expect organic revenue growth of 5.5%, with pricing growth of 3% and volume growth of 2.5%. Pricing and sales growth are in line with historical averages. Assuming companies spend 8%-9% of annual revenue on acquisitions, M&A will grow their revenue by 4.6%. Therefore, the normalized total revenue growth rate in the model is expected to be 10.1%.

Additionally, I expect their operating expenses to increase 9.7% annually, leading to operating leverage and margin expansion of 20-30 basis points annually. Based on these parameters, my estimate is that the fair value is $175 per share. Excluding the $75 million one-time cost, the stock currently trades at 30 times forward FCF, which in my opinion is a pretty reasonable multiple for a company that is steadily growing.

Waste connection DCF – author’s calculation

Main risks

Waste Connections repurchased $424 million of stock in FY22 and $338 million of stock in FY21. However, they suspended stock buybacks in fiscal 2023. It’s unclear why the company stopped stock buybacks, especially considering it has a fairly strong balance sheet.

Additionally, while Waste Connections has made progress in resolving Chiquita’s heat issues, the timing and final penalties remain uncertain at this time. The company could face huge fines in the future.

in conclusion

I admire the company’s strong core pricing growth and margin improvement. Shares remain undervalued and I maintain a Buy rating with a fair value of $175 per share.