DIMUSE

I’ve been buying phone and data systems (NYSE:TDS) 6.00% Series VV Cumulative Preferred Stock (NYSE: TDS.PR.V) from the end of 2023, with a view to holding the assets for at least five years.they will make full use of The impending sale of United States Cellular could be a double catalyst in the near term (NYSE:USM), the Federal Reserve will begin cutting interest rates this summer. TDS owns 83% of the total number of USM common shares outstanding and initiated a sale process for the asset last year.

Fiscal Year 2023 Telephone and Data Systems Form 10-K

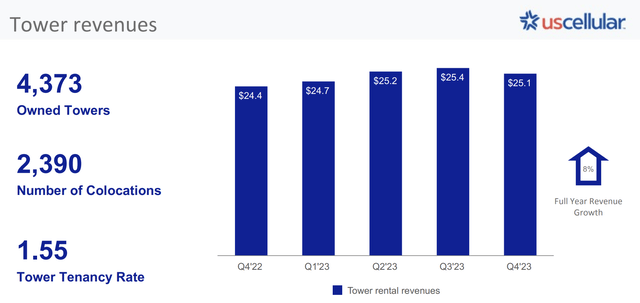

US Cellular is the fourth largest full-service wireless operator in the United States. Its latest reported revenue for the fourth quarter of fiscal 2023 was US$1 billion and net profit per share was US$0.16. TDS launches USM policy review in August The main update since then is that the process has gained interest including from T move (TMUS), AT&T (T) and Verizon (VZ). However, the timeline for completion of the sales process is unclear, and TDS has experienced some weakness in recent weeks as a result.The most relevant acquirers are likely to face greater regulatory scrutiny, and the diversity of USM’s assets, which include 4,373 cell towers and a range of spectrum licenses including 700MHz, C-band, cellular, 37GHz and 39GHz bands, means There are many variables that go into the closing of a potential transaction. USM’s third-party tower revenue exceeded $100 million for the first time in 2023, an 8% increase from the same period last year.

USM – TDS FY2023 Q4 Presentation

Risks, Deep Liquidity Events, and Preferred Equity and Bond Series

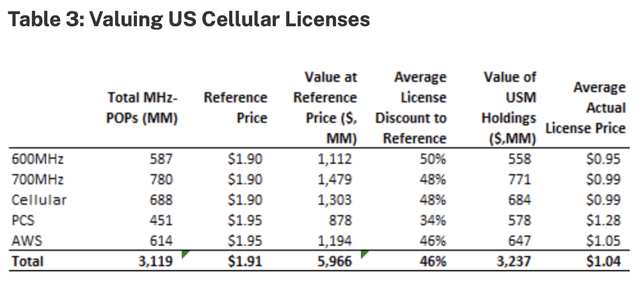

New Street Research puts the value of the USM spectrum license at approx. $3.2 billion, Partly based on T-Mobile’s 2023 Buy 600MHz Spectrum From Columbia Capital. USM also gets bids for its cell towers from certain tower REITs like American Tower (AMT) or Crown Castle (CCI).American Tower recently sold its loss-making India business to an affiliate of Brookfield Asset Management (BAM) US$2.5 billionand may seek to build out its U.S. portfolio.

New Street Research

However, the identity of the potential acquirer remains unknown and I believe the transaction may take longer than initially expected, with my current timeline for completion being the end of the astronomical summer in September. USM’s bonds and TDS’s preferred shares are likely to rise sharply on any such close, as they currently trade at high yields and at significant discounts to the $25 liquidation price. Crucially, the preferred form of TDS Compelling buy amid USM sale pending liquidity event.

| Preferred/Bond Series | Liquidation Price Discount ($25) | annual distribution | Cost yield% | redemption date |

| USM 6.25% The senior notes will mature on September 1, 2069 (NYSE:UZD) | -17.2% ($20.69) | $1.5625 | 7.55% | September 1, 2025 |

| USM 5.50% Senior Notes Maturity Date 06/01/2070 (NYSE:UZF) | -25% ($18.74) | $1.375 | 7.33% | June 1, 2026 |

| USM 5.50% The senior notes will mature on March 1, 2070 (NYSE:UZE) | -24.8% ($18.79) | $1.375 | 7.32% | March 1, 2026 |

| Total dissolved solids 6.625% Cumulative preferred shares (NYSE:TDS.PR.U) | -28% ($18.13) | $1.65625 | 9.14% | March 31, 2026 |

| Total dissolved solids 6.00% Cumulative preferred shares (TDS.PR.V) | -37% ($15.66) | $1.50 | 9.58% | September 30, 2026 |

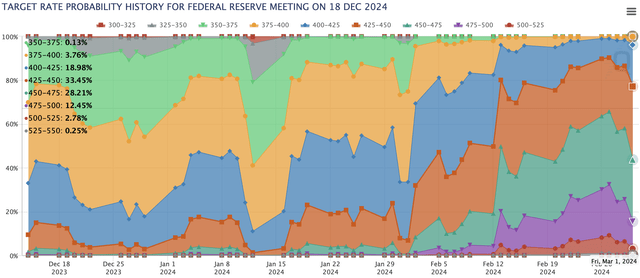

The 6.00% Series VV preferred shares offer an annual coupon of $1.50, which implies a yield on cost of 9.58%, as they currently exchange hands at $15.66 per share, which is about 63 cents. The deep discount to its liquidation value is an opportunity for bulls and should tighten in response to a cut in the federal funds rate, currently at a 22-year high of 5.25% to 5.50%. Preferred stocks are essentially quasi-fixed income securities with positive duration risk, so their value declines due to aggressive rate hikes in 2022 and 2023. In late 2021, just before the Fed began implementing its liquidation, Series VV was trading a dollar above its liquidation value. Fight against soaring inflation. A black swan reflation event could cause the opposite to happen and undermine the likelihood of a rate cut this year. This remains a core risk for TDS preferred stocks.

CME Group Fed Watch Tool

We’re not returning to zero interest rates just yet, but a return to the Fed’s target and rate cuts through 2024 should boost preferred stock values. The CME FedWatch tool puts the likelihood of an exit in 2024 with rates remaining at current levels. 0.25% Baseline expectations are for interest rates to be cut by at least 75 to 100 basis points, with the first potential cut scheduled for sometime in the summer. TDS’ preferred stock payments will be $69 million through 2023, or approximately $17.25 million per quarter. Both series corresponded to $219 million in operating cash generated in the fourth quarter. However, TDS spent $305 million in capital expenditures on growth initiatives this quarter, meaning its overall free cash flow profile is more diverse. I think the risk and reward profile of TDS preferred shares is clearly tilted towards the return side given the interest rate cut and the end of the USM sale. The VV Series’ near 10% yield seems out of sync with these catalysts, and I think they will be worth even more in two years.