sua photos

Back in early December, I wrote about Targa Resources (NYSE:TRGP), which has some of the best growth prospects in the midstream space, initiated a Buy rating on the stock. Since then, the stock has returned nearly 20%.Report with the company Last month’s results, let’s fill in our names.

Company Profile

As a quick reminder, TRGP is a midstream company with operations in multiple U.S. basins. In its Gathering and Processing (G&P) segment, the company gathers, processes, treats and transports natural gas and, to a lesser extent, gathers natural gas and stores crude oil. The Permian is the division’s largest operating area.

Meanwhile, the company’s logistics and transportation arm is involved in LNG transportation and fractionation, LPG export and marketing. The Grand Prix pipeline is its most important asset in this area.

Fourth quarter results

In the fourth quarter reported in mid-February, TRGP’s adjusted EBITDA grew 14% to $959.9 million from $840.4 million a year ago.

The company’s G&P segment adjusted operating profit was essentially flat at $722 million.

Natural gas throughput this quarter was 7.1 Bcf/d, an annual increase of 10%. NGL throughput increased by 15% year-on-year to 881.7 MBbl/d. Badlands crude throughput averaged 105.2 MBbl/d, down -7% from the same period last year, while Permian crude throughput fell -3% to 27.5 MBbl/d

In the Permian, natural gas throughput climbed 11% to 5.3 Bcf/d, while NGL throughput jumped 15% to 708.9 MBbl/d.

In the logistics and transportation segment, adjusted operating margin increased 24% to $638.6 million.

NGL shipments surged 44% to 722.0 MBbl/d, while fractionation increased 13% to 844.8 MBbl/d. Export volumes climbed 45% to 434.5 MBbl/d.

TRGP generated $709.7 million in distributable cash flow for the quarter and $2.62 billion for the full year. Free cash flow for the quarter was $73.7 million, and free cash flow for the full year was $392.7 million.

TRGP’s year-end leverage ratio was 3.6 times. It repurchased 475,040 shares during the quarter at a weighted average price of $85.52 per share.

Looking forward, TRGP expects adjusted EBITDA to be US$3.7-3.9 billion, an increase of approximately 8%. The company said a 30% change in commodity price assumptions ($75 for WTI, 65 cents for NGL and $1.80 for Waha natural gas) would have a negative impact of $75 million on results, while a 30% increase in prices would $165 million in positive impact.

TRGP forecasts growth capital expenditures to be between $2.3-2.5 billion. Maintenance capital expenditures are expected to be approximately $225 million.

The company expects adjusted EBITDA in the first quarter to be lower than in the third quarter of 2023 as cold weather impacts sales.

With key expansions set to be completed in early 2025, 2025 growth capital expenditures will fall to around $1.4 billion.

Chief Financial Officer Jennifer Kneale said during the fourth-quarter earnings call when discussing the outlook for 2025 and beyond:

“We believe that Permian production on our system will continue to grow strongly going forward, which will drive incremental production through our downstream assets, requiring continued investment that will continue to yield attractive returns, especially given our on increasing fees and expenses to the bottom line. Downstream projects are larger and spending is more volatile. As these projects come online, we benefit from the operating leverage associated with increased available capacity and our growth capital expenditures will slow, and we currently expect CapEx will reach $1.4 billion in 2025. Over the next few years, we expect capex growth in an environment where sales continue to grow to approximately $1.7 billion. We are bullish on the Permian Basin’s future growth, but are often asked Questions like: How much capital is needed to maintain production? Our answer is around $300 million. This is not what we expected. It is just meant to be instructive and hopefully help demonstrate the strength of Targa’s value proposition in a downside scenario, Because our free cash flow generation and balance sheet strength will put us in a very strong position.”

Despite soft natural gas and LNG prices, TRGP delivered solid quarterly results, with adjusted EBITDA and DCF growing steadily. The company is about 90% fee-based, but it does have some sensitivity to commodity prices.

Meanwhile, the company expects good growth in 2024, although 2025 should be very strong as many projects came online early in the year. TRGP’s capex spend is approximately 5.5x, which will add more than $400 million in EBITDA from the current program in 2025, depending on the timeline. As growth capex declines in 2025, the company will be able to reduce debt, buy back stock, and increase its dividend.

Valuation

TRGP trades at 9.7 times consensus 2024 EBITDA of $3.83 billion. It’s valued at 8.8x based on consensus 2025 EBITDA of $4.22 billion.

The stock has a free cash flow yield of about 1.8% and a discounted cash flow yield of about 11.8%. Based on an expected 50% dividend increase next quarter, the company pays a 3% dividend yield.

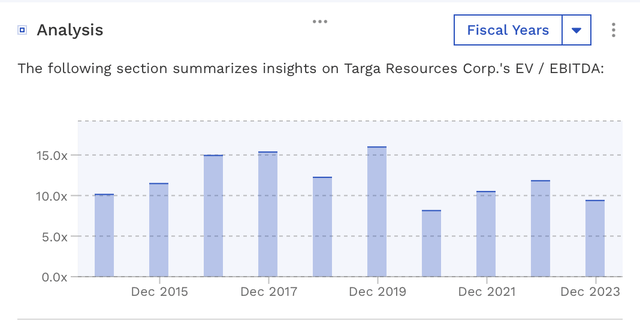

TRGP is one of the higher-cost midstream operators, although it has the best growth prospects in the coming years due to its growth projects. Historically, the company has also had a high price-to-earnings ratio, often exceeding 10x EV/EBITDA.

TRGP historical valuation (fen box)

Based on 9-11x 2025 adjusted EBITDA, I believe TRGP is valued in the range of $103-$141, with a midpoint of $122.

in conclusion

TRGP just posted some solid fourth-quarter results and very positive comments about 2024 and 2025. The company has some of the best growth in the midstream segment and is very well positioned to benefit from growth in the Permian Basin.

At the same time, as capital spending declines in 2025, the company will generate a lot of cash, which it can then use to increase its dividend, buy back stock, and pay down debt. However, it still has a good chance to continue growing in the Permian in the coming years.

Given its strong outlook and slate of growth projects, I will raise my target to $122 from $108.50 to reflect this strong outlook. I continue to rate the stock a Buy.

The biggest risk to the stock is slowing growth in the Permian Basin. The basin has encountered natural gas transportation bottlenecks in the past, resulting in slower production growth. But that risk appears to be easing now, with major companies such as Exxon Mobil (XOM) and Chevron (CVX) touting strong growth in the Permian Basin. Of course, there’s always the possibility that weak oil prices could change drilling plans.