Kevin Dickey/Getty Images News

introduce

Now serving (NYSE: Now) stock has been selected as one of the Top Picks for 2024 by analysts at BofA Securities.After conducting my own research on the company, I completely agree with the analysts Bank of America Securities. 85% of the Fortune 500 companies are NOW customers, demonstrating that the company is dominating one of the most competitive markets for this technology in the United States. This leads me to believe that NOW is well-positioned to expand its dominance in Europe and Asia, where the company is not currently as extensive. I also believe that the ongoing global digital transformation is likely to provide NOW with opportunities to penetrate new workflow areas, given the company’s large IP base and management’s prioritization of innovation. My discounted cash flow analysis suggests the stock is 20% undervalued, making NOW a “Strong Buy” right now stock price level.

Fundamental analysis

ServiceNow is a software-as-a-service (“SaaS”) company that provides customers with a platform to help manage workflows across various business functions.

ServiceNow Profit Demonstration

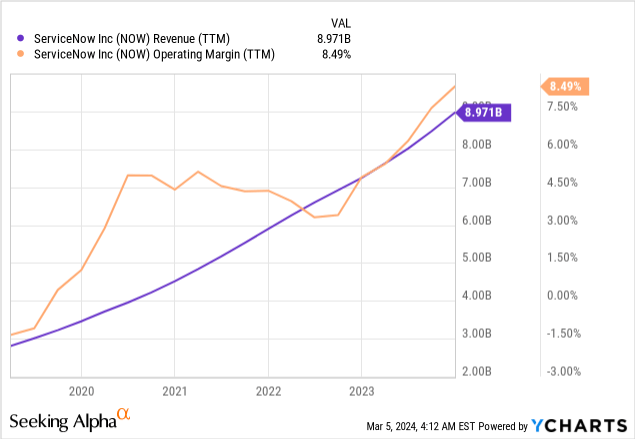

Smart workflow tools are critical for enterprises to undergo digital transformation. According to NOW’s financial report, 85% of Fortune 500 companies rely on the company’s solutions. I think the largest companies in the U.S. will probably go with the best option on the market, regardless of price, because competition is fierce. Therefore, I believe NOW’s platform truly delivers superior value to its customers, which enables the company to generate unparalleled profitability and exponential revenue growth.

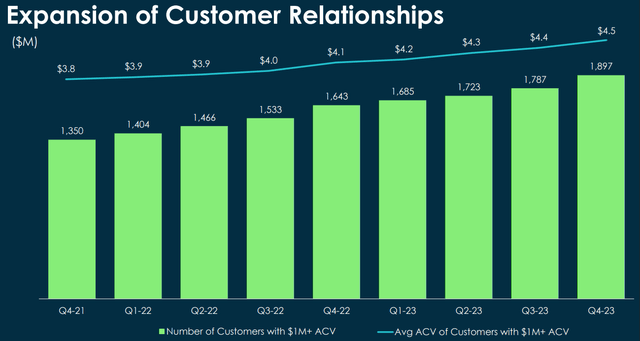

We live in a world where resources are not unlimited, and neither is the number of potential customers. Management seems to know this, as the company has a 99% renewal rate and continues to expand customer contract values.The company’s engineers and management are always working on the development of new services and working closely with Artificial intelligence is expanding rapidly. NOW has more than 8,000 customers around the world, which means that NOW has enough big data to support its AI and ML algorithms to maximize value for customers. The company held more than 2,000 U.S. and foreign patents as of the end of 2023, according to the Form 10-K, underscoring management’s commitment to innovation.

ServiceNow monetization report

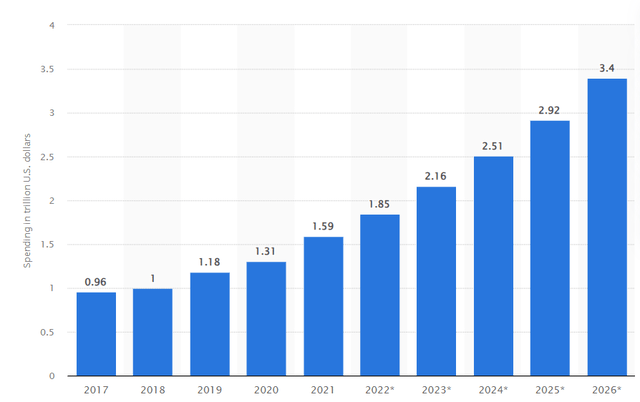

I see several strong positive potential catalysts for ServiceNow’s further business expansion. The global digital transformation is still ongoing and is far from over. According to Statista. Global digital transformation spending is expected to reach $3.4 trillion in 2026, nearly double the amount in 2022. Therefore, the industry still has strong growth potential and is a solid driving force for ServiceNow.

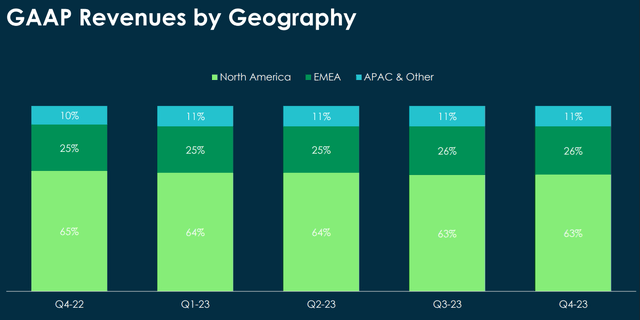

politician

The company started out as a technology workflow provider, with relatively new customer and employee and creator workflows and a much smaller revenue mix. As global digital transformation threatens to disrupt most businesses’ internal processes, I see the potential for NOW to extend its workflow solutions to other business processes. Another potential growth driver for NOW is geographic expansion. 63% of the company’s sales come from North America, which means there’s huge potential for expansion in Europe and Asia.

ServiceNow monetization report

I am confident in the company’s ability to successfully expand internationally as it becomes the clear industry leader in North America, the most competitive and innovative market where thousands of technology companies of all sizes operate.

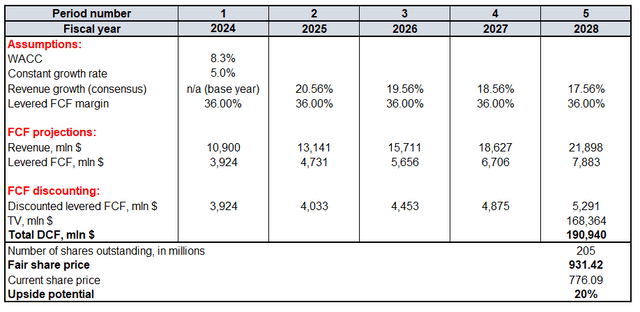

Valuation analysis

NOW’s market capitalization is nearly $160 billion, close to its all-time high set a month ago. Consecutive quarters of solid profits have fueled a massive 74% rise in the 12 months.To assess whether this rally is fair, I’m running a discounted cash flow (“DCF”) model 8.3% Discount Rate. Considering all the positive trends that NOW could benefit from, I include an ambitious 5% constant growth rate in the terminal value (“TV”) calculation. I rely on consensus estimates for fiscal 2024-2025 revenue and expect a natural deceleration of 100 basis points per year as comparative growth grows. A TTM leveraged FCF margin of 36% is already high; therefore, I do not predict metric expansion. According to Seeking Alpha, NOW currently has 205 million shares outstanding.

Calculated by the author

By my calculations, the stock’s fair price is $931. To today’s skeptics, the assumptions I put forward may seem too aggressive, but they are consistent with the company’s past stellar performance and all positive industry trends. As a result, valuations look very attractive.

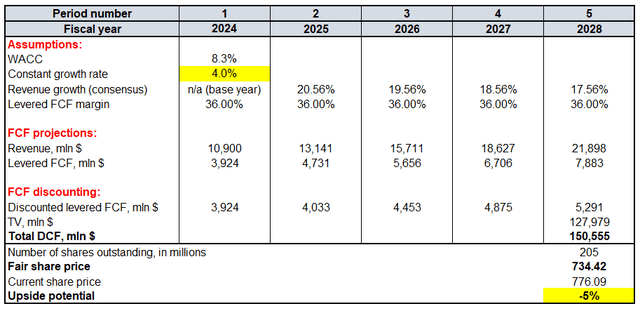

Mitigating factors

As I typically do with growth stocks, I highlight that changes in underlying assumptions and estimates could result in significant downward revisions to fair price. A cut of just 100 basis points in constant growth would diminish the overall upside potential from 5% constant growth. I believe that changes in growth forecasts and assumptions are a major risk for growth investors.

Calculated by the author

Now, let me evaluate the factors that could adversely affect NOW’s growth prospects. I don’t expect the positive industry trends to abate, but there are some company-specific risks. The software industry is a crowded space with several giants present. Managers at companies like Microsoft (MSFT), Google (GOOG) or Amazon (AMZN) are also willing to create value for shareholders and drive revenue growth. If one of these giants becomes a direct competitor of NOW, the company may have difficulty maintaining its stellar growth trajectory or unparalleled profitability.

Any software company faces cybersecurity risks. In the current reality Internet crime statistics continue to worsen, It becomes one of the major threats faced by companies like NOW. I believe NOW can be threatened because even giants like Microsoft and Google sometimes get threatened. under cyber attack. I believe that any cyber attack will not destroy ServiceNow’s business, but any leakage of sensitive information may cause significant reputational damage, which may lead to the loss of customers.

in conclusion

ServiceNow has a good opportunity to maintain its excellent business expansion path by leveraging digital transformation trends and geographic expansion potential. A commitment to innovation works well for the company in the long run, as it is able to maintain strong customer retention and upsell statistics. Valuation looks very attractive, and my Strong Buy rating suggests that NOW is likely to continue its rapid share price appreciation trend that began over a decade ago.

exist