Black Jack 3D

After the market closed yesterday, CrowdStrike Holdings Inc. (NASDAQ:CRWD) reported solid fiscal fourth-quarter (the period ended January 28) data, sending cybersecurity stocks soaring.The result is to provide an unnecessary level of comfort after peers’ less-than-stellar data assembly.mine investment thesis Still bearish on CrowdStrike as the market fully priced in future opportunities but failed to properly account for competitive risks, the stock soared 24% in after-hours trading.

Source: Seeking Alpha

revenue decline

CrowdStrike reported strong quarterly results for Q4 2024, with revenue increasing 32.6% year over year. The cybersecurity company beat analysts’ expectations by $5.3 million, to $845.3 million.

Although the company reported strong growth, revenue growth fell from 47.9% in the previous quarter. The revenue growth rate even declined from the 35.3% in the previous quarter, continuing the trend of slowing revenue growth.

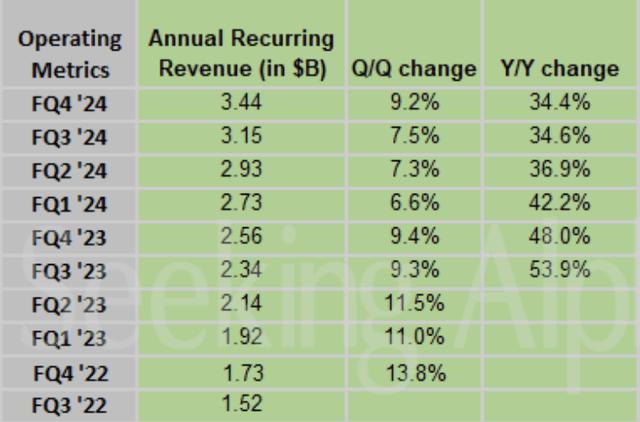

The market usually does not reward Revenue growth has slowed, but investors have seized on higher annual recurring revenue (ARR) growth in the quarter. ARR in fiscal 2025 grew by 34% to $3.44 billion, but ARR in the fourth quarter only grew by 27% to $282 million.

The market certainly attaches great importance to the sequential rate of change in ARR. CrowdStrike’s ARR grew 9.2% quarter-on-quarter, higher than the trough growth rate of 6.6% in the first quarter of 2024.

Source: Seeking Alpha

CrowdStrike’s growth rate is impressive, with the company on track to hit $4 billion in FY25 revenue. At the same time, the stock beat its projected growth rate through fiscal 2025.

While one might argue that growth trends are slowing, CrowdStrike is already highly profitable. The company reported fourth-quarter net income of $213 million, or earnings per share of $0.95, while generating an impressive quarterly free cash flow of $283 million.

Like many related companies, executives are throwing out a ton of total addressable market (“TAM”) data as artificial intelligence drives stocks soaring. CrowdStrike now predicts that TAM will grow from $100 billion in 2024 to $225 billion in 2028 due to artificial intelligence-related demand.

The company represents just 3% of TAM in fiscal 2024, while a similar amount in fiscal 2028 would bring in $6.75 billion in sales. CrowdStrike needs to gain significant market share to hit analysts’ consensus revenue target of $10.2 billion in fiscal 2029 (CY28).

Guidance questions

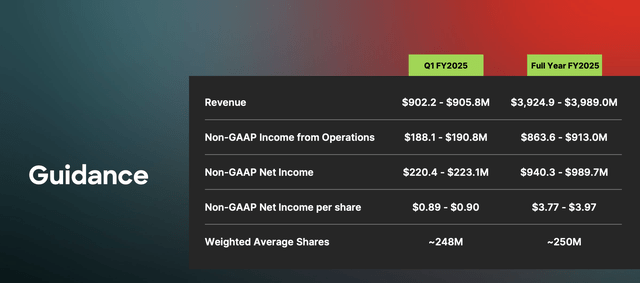

CrowdStrike expects revenue for Q1’25 (current quarter) to be approximately $904 million, but those numbers aren’t as impressive as this year’s progress. The company expects mid-point revenue for FY25 to be $3.957 billion, compared with the consensus estimate of $3.94 billion.

Source: 2024 Season 4 Presentation

What’s concerning here is that as revenue growth continues to decelerate, the growth rate dropped to 29%. Not to mention, despite FQ4 beating expectations and providing guidance for FQ1’25, and with accelerating ARR growth rates, CrowdStrike still hasn’t been able to hit higher numbers.

One has to question whether there is some concern Palo Alto Networks (PANW) drives customers away from existing customers by switching to cybersecurity platforms that offer free services. There are concerns that CrowdStrike faces additional pressure due to competitive pricing pressures in the industry.

In the earnings call for the fourth quarter of 2024, CEO George Kurtz clearly gave the following answer to the competitive treatment of the platform concept advocated by Palo Alto Networks:

As you might imagine, I heard a lot about deplatforming last week. To me, it’s a made-up term, but I believe our competitors are talking about bundles, discounts, and freebies, which is nothing new in software and security software. Been doing this for the past 30 years. So when we think about where we’ve been with other competitors in the past, we know that free isn’t free. What customers are saying is that more consoles, more point products masquerading as platforms, will create fatigue in their environment. One of the things that we’re focused on again is that single agent architecture, single platform, single console allows us to stop breaches, but more importantly, reduce operational costs and deliver many use cases or solve many existing use cases.

The stock soared nearly 25% in after-hours trading on positive sentiment about the quarterly results and management’s aforementioned positive comments on the earnings call. Market capitalization surged by about $19 billion in the process, but the cybersecurity company only forecast revenue for the current fiscal 2025 quarter by about $17 million above expectations, suggesting the market is reading too much into quarterly earnings.

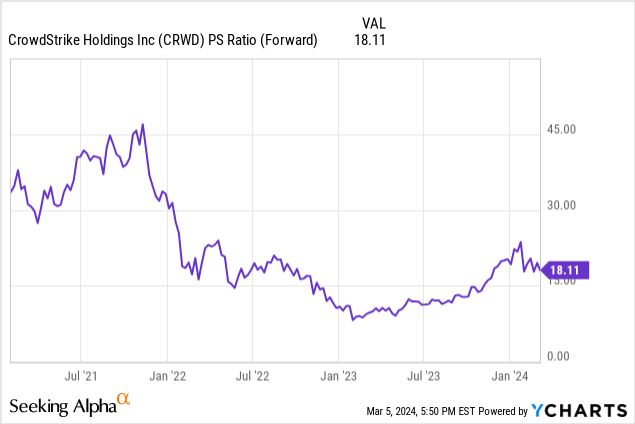

The stock is already trading at 18 times forward sales, and a 25% gain would only push the forward P/E ratio to ridiculous levels. CrowdStrike didn’t materially change the company’s financial outlook and even suggested performance wouldn’t improve over time, suggesting Palo Alto could become an issue.

CrowdStrike didn’t exactly perform beyond our initial expectations. Financial performance didn’t significantly beat expectations, and Palo Alto Networks’ results highlight the risks that cost businesses in a competitive environment like cybersecurity.

CrowdStrike stock trades at 95 times FY25 EPS target of $3.87, and the company already generates huge margins with limited future margin expansion.

take away

The key takeaway for investors is that CrowdStrike is priced so perfectly that it will require AI acceleration to ensure the stock price approaches $300+. Instead, the cybersecurity company may face pricing pressure in the industry as peers give away products and fiscal 2025 guidance hints at slower growth.

Investors should use this rally as another gift, allowing exits from positions at extremely high premiums.