boy willat

I upgraded AGNC Investment (NASDAQ: AGNC) upgraded his rating to “Buy” in June on the premise that the Fed’s tightening cycle may be coming to an end and it’s time to start adding stocks.include After dividends, the stock has since generated a return of over 5%. As recently as January, I wrote that the company’s prospects were looking brighter now that the Fed seemed set to begin cutting interest rates.

AGNC recently attended two investment conferences in late February, so I wanted to know about this name.Note that the company rarely attends investment conferences, its last appearance was at February 2023 attend one before then September 2022.

Company Profile

As a reminder, AGNC is a mortgage REIT that invests primarily in agency mortgage-backed securities (“MBS”).The company produces Its profits come from the spread between the interest it earns on the MBS it holds and its borrowing costs. The company uses leverage to further boost returns.

AGNC invests primarily in MBS backed by Fannie Mae, Freddie Mac and Ginnie Mae. These investments are backed by government-sponsored entities and therefore are essentially free of credit risk. It also holds certain non-agency residential mortgage-backed securities (“RMBS”), commercial mortgage-backed securities (“CMBS”) and credit risk transfer (“CRT”) securities.

AGNC’s portfolio value at the end of the fourth quarter of 2023 was $60.2 billion, with $53.8 billion in agency MBS securities, $5.4 billion in TBA mortgage-backed securities, and $1.1 billion in CRT and non-agency securities. At year’s end, approximately 94.6% of its portfolio was in 30-year fixed-rate MBS.

Mortgage Market Insights

AGNC CEO Peter Federico spoke at the Bank of America Financial Services Conference and discussed how the Fed aggressively purchased agency-backed mortgage-backed securities during the early stages of the quantitative easing cycle. After the fourth round of quantitative easing, the Federal Reserve expanded its balance sheet and held $2.7 trillion in MBS, accounting for 30% of the entire market. This has resulted in the narrowest spread between mortgages and the 10-year Treasury note on record.

When the Fed began to reverse course, not only had it raised rates 525 basis points over the past two years, but the spread between mortgages and the 10-year Treasury note had surged from 40 basis points to nearly 200 basis points, which was about Historically high levels.

Against this backdrop, it’s no surprise that AGNC performs so poorly in 2022 and 2023. The stock’s portfolio has been hurt not only by rising interest rates, but also by a rise in spreads from historically tight to all-time highs. The value of AGNC’s portfolio, as measured by its tangible book value (“TBV”), fell -49% from the beginning of 2022 to the end of the third quarter of 2023, before the market finally saw some relief as the Fed stated Action may be taken. Rate hikes will begin in 2024.

Given that institutional mortgage REITs’ valuations depend on their TBV, it’s not surprising that the stock has followed its portfolio’s decline in value.

While a combination of a Fed rate cut and spread tightening would be an ideal scenario for AGNC, the company isn’t counting on the latter. The firm believes mortgage spreads of 150-190 basis points over the past five quarters may become the new normal. However, this spread makes investment agency MBS more attractive relative to other credit assets, including Treasuries and corporate debt, and the lower volatility should benefit its business.

Now, the spread between MBS and Treasuries isn’t the only spread risk AGNC faces, but the spread between mortgage rates and short-term funding could also be a risk. Federico was asked about the current inversion of the yield curve and how AGNC is dealing with it. He said:

“If we buy long-term mortgages, which we do, and fund them with short-term debt and not hedge them, the shape of the yield curve and the inversion of the yield curve will pose a challenge to the business model. In that case, There’s a huge risk that our short-term funding costs will go up 525 basis points and there will be a massive compression. So that would be in a very negative environment. But that’s not how we hedge the portfolio. We do use 30 days or even less We fund our portfolio with 30-day repurchase agreements. There’s no question about that. But our hedge ratio is also over 100%, especially in the recent environment. That means we’ve taken on all of our short-term debt, and we It’s essentially hedged so that we convert short-term debt synthetically into long-term debt consistent with the maturity of our portfolio. So despite the inversion of the yield curve and rising short-term rates, our cost of funds has remained relatively consistent over the past two years. Stable. … As of last quarter, the spread was still at 308 basis points. That’s actually the broadest spread, we’re close to the broadest spread we’ve ever had (printed).”

This nicely explains how AGNC helps significantly reduce this risk, and why the company is able to generate such strong net interest income in a market where short-term interest rates are higher than long-term interest rates. Essentially, the way it hedges is to get leveraged returns from the spread between mortgages and the yield curve, so it could generate some strength as mortgage and Treasury spreads stabilize at 150 basis points and above The net investment income is then used to pay dividends.

At this point, the company appears to be in a win-win situation. If spreads narrow, its book value will rise. If spreads remain relatively stable, it will continue to generate strong NII and pay very respectable dividends. I highly doubt spreads will widen above their all-time highs.

At the UBS Financial Services Conference later in February, Federico said that the current spread is about 175 basis points, at which level, with 7-7.5 times leverage, its ROE will reach 14-18% . The company says this is one of the best return-on-investment environments it has ever seen.

He noted that the company was slightly underleveraged at 7x at the end of 2023 as the company continues to adopt a more defensive stance. He said more information will emerge over the next three months that should help provide more clarity on what actions the Fed will take, not only on interest rates but also on the composition of the Fed’s balance sheet.

If you look back at the end of 2018, AGNC’s leverage was 9.0x and at the end of 2019, it was 9.4x. Therefore, if conditions improve, the company still has the opportunity to increase leverage and generate stronger investment returns, as the company has been willing to increase leverage to 10x in the past.

in conclusion

Investing in mortgage REITs is as much about the management team as it is about the environment. AGNC has been well managed. Federico has been CEO for less than three years, but he has been with the company since 2011 and before that served as finance chief at Freddie Mac. You’ll also get some great insights as experienced institutional mortgage REIT executives talk about their businesses and current market conditions. AGNC management hasn’t talked much about its stock over the past few years, but it’s good to see them attending investment conferences and promoting its stock this year.

At the end of the day, AGNC is not a hold-and-forget-it stock for investors. But there are certain environments where you want to have it, and we’re currently getting into that. As the Fed begins to consider lowering interest rates later this year, mortgage rates should start to fall, which should help their book values. At the same time, wide but stable spreads and the ability to leverage from here will result in continued stable NII and dividends.

ANGC has experienced a poor environment for institutional MBS investors over the past two years and is now entering an environment that should be very attractive in the next few years.

I think it is not impossible that the book value will return to $11 after three rate cuts by the Fed. However, the biggest risk now appears to be that expected interest rate cuts are delayed and extended for longer. Prepayment risk looks fairly low, as does a rise in interest rates or a continued widening of Treasury spreads.

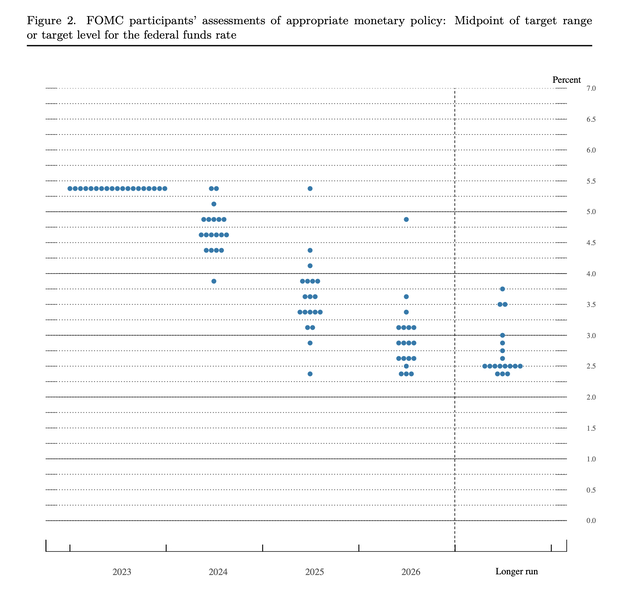

Currently, the latest Fed dot plot predicts interest rates will fall by 2.5% by the end of 2026. This is very good for AGNC in the coming years, but these expectations may change.

Federal Open Market Committee

As risks are minimized and the environment shifts to a more favorable environment for institutional MBS, I continue to rate AGNC a Buy. My price target remains $12.