Black Jack 3D

Guangzhou Shipyard International Technology Co., Ltd. (NASDAQ:GSIT) are stocks that we continue to hold as part of our speculation, I’m crazy about money-Style exposure. The stock has started to show some meme qualities over the past few weeks, As of mid-February, prices have risen significantly from levels around $2. We believe that the main reason is that the market has conducted more in-depth research on artificial intelligence (AI) gameplay, and in the process encountered GSIT, which is definitely an AI gameplay, although it is far from commercial demonstration.

We’ve been covering GSIT for years, and its technology has the potential to be relevant to a wide range of artificial intelligence applications, whether or not they use sparse structures. The problem is that GSIT is still far from being APU ready.they just Now talking about Gemini-III, as we understand it, this is a chip design commercially promoted for data centers.

Comments on the Q3 Conference Call

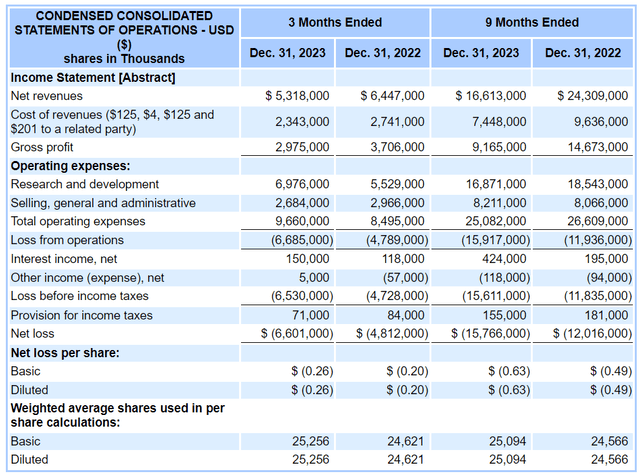

They’ve burned through about $6 million in cash over the past nine months. R&D continues to grow In order to support Gemini’s research and development, SRAM’s revenue is declining. Anti-radiation revenue that was supposed to significantly increase revenue came in, but it was too late. As a result, SRAM’s performance remains fairly mediocre. Better late than never, as it can still at least offset some of the development burden, which has always been the fundamental appeal of GSIT – it’s a lower-premium option.

They do claim they managed to win some new contracts that should start increasing revenue by 10%, but only starting in 2025. However, since the track record of delivering on promises is pretty weak, we wouldn’t put too much faith in it.

GSIT Information System (SEC.gov)

The current cash position is approximately US$21 million. They expect cash burn to rise from current run rates.

Our revenue this year will be around $13 million to $14 million. Yes, we will have an extraordinary expense this fiscal year that will require approximately $2.4 million in cash expenditures.

GSIT Treasurer Doug Schirle on the second quarter conference call.

That should give them nearly two years of runway as a base case, based on that disclosure. GSIT also reported that they are planning to sell a building they own for approximately $1-13 million, which will further delay any necessary action in the equity capital markets for a year, although given recent price conditions, they will Do an opportunistic small release. It would be great to do.

On the Gemini side, apparently they will get the Gemini-II from the fab in February and will begin some alpha testing with limited customers. They actually delivered on time when Gemini-II was supposed to exit the design phase. Now they will produce some and do sample testing to see how well they perform. It has enough on-chip memory to store more information, including specialized algorithms, which is a major improvement in Gemini-I performance. They now have some SBIR contracts with the Air Force Research Laboratory that will support defining the performance of Gemini-II and pave the way for Gemini-III, which they are already talking about.

The next step in the development of Gemini-III will be another considerable R&D burden, but it is also a product that should be popular among hyperscale enterprises. So they’re looking to set up some customer partnerships or other industry partnerships to ease the burden of developing it and actually scale it for manufacturing if they get some big orders. They also leave open the possibility of licensing the intellectual property, but have made some progress on Gemini-III development and are leaning toward going ahead on their own given what might happen. If they are able to secure any kind of financing for themselves, stronger price action could make this IP idea less likely.It’s worth mentioning that Gemini-III doesn’t have a timetable yet, while Gemini-II still has work to do

bottom line

Hyperscale processors are an important market because there is economic value in reducing the workload associated with large sparse matrices and search applications. We are already confident in this claim, but we also note that NLP also has many applications. We’ve discussed this issue in the past because NLP models use architectures that could benefit from Gemini. Furthermore, models that try to simulate human activities and thinking are usually suitable for data that follows Hebbian principles, whereas NLP models use a lot of sparse data and produce a lot of sparse layers because the language will follow Hebbian principles. To bring this into the context most relevant to large language models, GSIT’s APUs may have particularly useful applications in the following areas: Find context Notification responses to prompts.

We do like GSI Technology, Inc.’s long-term proposition, but we are cautious about the current price increase. It’s more likely that GSIT is going through a trading stock phase right now, rather than gaining a more permanent following. When it’s no longer a trading stock, liquidity drops and the only people who will continue to hold it are those who hold it for the long term. Prices are likely to stabilize at previous levels where holders took a long-term wait-and-see approach to Gemini-II’s performance and the next announcement of timeline ambitions for an eventual commercial push.

GSIT was already on the scene last year when major ChatGPT disclosures began to impact the market, so the circumstances behind GSIT were already well known. Nothing company-specific or new happens, and the true measure of APU’s success is still far off – it will have to be achieved after an industrial plan is developed and a commercial agreement is reached.

We believe the stock remains in a position where something meaningful and commercial needs to happen on the APU front before a more durable move can emerge. By then, GSI Technology, Inc. stock could be worth several times what it is now. With truly innovative technology, it could capture a huge share of the AI semiconductor TAM of around $327 billion by 2027 from its current valuation of $127 million.