Evan Schmick

investment action

I recommend to GFL Environmental (NYSE:GFL) when I last wrote this because I expected the stock to continue trading at a premium.According to my current opinion and Analyzing GFL, I recommend a Buy rating. Given how the share price reacted post-earnings, I don’t think the market realizes the potential upside to GFL’s fiscal 2024 EBITDA guidance. This provides investors with a good opportunity to adjust their positions as I expect GFL to exceed guidance. Additionally, management’s free cash flow guidance for fiscal 2024 reinforces my view that the company is on track to reach leverage levels similar to its peers, which is key for a valuation re-rating.

review

My high praise for GFL’s 2023 Q4 results is that it was excellent.The business reported 4Q23 Adjusted EBITDA of C$492 million Canadian dollars, higher than the consensus estimate of Canadian dollars 490 million. This growth was primarily driven by higher solid waste pricing and improved environmental service performance. GFL continues to see strong pricing tailwinds, with core solid waste prices rising 7.9% in 4Q23, outpacing sales volume declines of 3.6%. EBITDA margin in 4Q23 was also well in line with my full-year forecast of 26%, reaching 26.1%, an annual increase of approximately 200 basis points.

Contrary to my view on the results, GFL’s share price remained under pressure following the results, which I think is good as it gives investors an opportunity to adjust their positions. I believe the reason for this price action is the conservative guidance set by management (in line with consensus), which makes it difficult for investors to feel confident about fiscal 2024. My counter-argument is that GFL will easily beat its EBITDA guidance (FY2024 adjusted EBITDA of CA$2.215 billion), which reflects an EBITDA margin of 27.7%, implying a 100 basis point year-over-year improvement. I say this for several reasons. First, GFL’s repairs and maintenance (R&M) and labor turnover should gradually improve, which management has made clear will moderate and provide upside potential. Second, the key assumption made by management is that commodity prices will be lower than they actually are. Current levels (i.e. fourth quarter prices). For context, fourth-quarter prices were 20% above the fiscal 2023 average, and management assumes fiscal 2024 prices are 10% below average. The key thing to note here is that this guidance was provided 2 weeks ago (i.e. approximately 7 weeks into FY2024), and the fact that management used “current levels” suggests that Q4 2023 prices have continued into February Mid. Third, GFL should also see higher incremental profits from upcoming projects coming online at the Mount Arbor facility. Based on what management said, my inference is that they are only including projects that are commissioned in late 2023, no It is expected to be implemented in 2024. Finally, GFL expects to close the deal (signed) in the second quarter of 2024, and the asset is expected to be immediately accretive to profits. Additionally, to further bolster confidence in management’s guidance, consider that they have consistently exceeded their EBITDA guidance since they began issuing EBITDA guidance (since fiscal 2020).

We also expect the impact of labor mobility trends and supply chain constraints on productivity, risk costs, and repair and maintenance costs to moderate and may provide upside to our guidance.

Assume recycled commodity prices are at Q4 levels, 20% above average in 2023 but 10% below current pricing. If current pricing remains at Q4 levels, our 2024 guidance will have upside.

Included in this guidance is RNG’s approximately $30 million of incremental adjusted EBITDA, all from our Mount Arbor facility, which will be commissioned in late 2023.

More than half of that will be used for mid-sized acquisitions that we have already signed. This asset represents a vertically integrated solid waste operation in one of the fastest growing of our existing markets in the Southeast that will be immediately accretive to profits. 23rd Season 4 Phone

Another aspect that I think the market doesn’t appreciate is GFL’s ability to generate cash to deleverage its balance sheet. For fiscal 2024, management is guiding for adjusted free cash flow of approximately C$800 million, and this guidance essentially confirms my previous view that GFL could reach peer leverage levels of 3x in fiscal 2024. Assuming all C$800 million is used to repay debt, and GFL only gets half of the potential C$1.6 billion from divestitures, leverage would fall to 3.5x.

The deleveraging ratio has shifted almost across the board to over 50%, driven by the organic growth of the business. To optimize our footprint, we divested three non-core U.S. solid waste markets for $1.6 billion (more than a dozen times). 23rd Season 4 Phone

U.S. Environmental Protection Agency

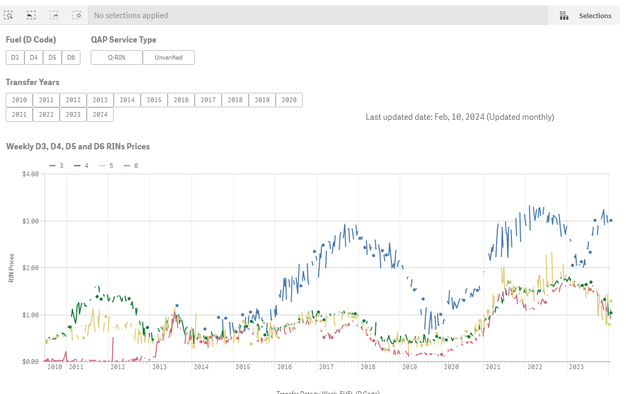

I think it’s also important to note that FY’24 capex was elevated due to the inclusion of C$250 to C$300 million of growth capex related to EPR and RNG projects, and given that D3 RIN value Expectations relative to management’s original EBITDA and FCF assumptions (currently priced at $3, management estimated $2). If prices remain at this level or higher, EBITDA and FCF will likely be higher, which means leverage may decline faster than I expect.

Valuation

author’s works

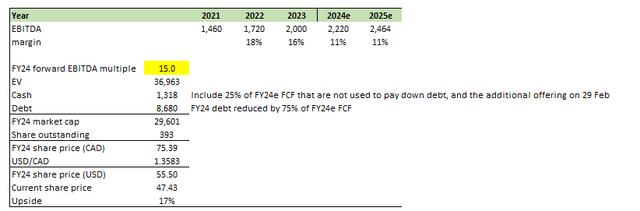

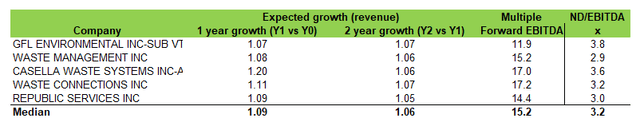

Considering operating leverage, continued pricing growth, and potential upside from the profit drivers I mentioned above, I believe GFL can continue to grow its EBITDA at a lower percentage without any issues. The 11% growth forecast is based on management’s FY24 EBITDA guidance. Fiscal 2025 EBITDA is now slightly higher at C$70 million compared to my previous model. The bigger change to my model is that I expect GFL valuation to recalibrate to 15x EBITDA. This belief is driven by fiscal 2024 FCF guidance, which gives me more confidence that GFL is on track to match peer leverage. As I noted before, GFL should gradually become in line with its peers when it shows material results that leverage is declining to peer levels. Currently, GFL trades at 12x forward EBITDA, and I expect it to trade at as high as 15x.

author’s works

Risks and final thoughts

A recession will lead to lower waste volumes and, over time, likely lower price growth, which will impact profitability. Given that mergers and acquisitions are an important part of GFL’s growth strategy, in an economic downturn, it may be difficult for GFL to continue to use the capital market to execute this strategy, thereby affecting growth.

I reiterate my Buy rating on GFL. I believe GFL has significant potential to exceed its FY2024 EBITDA guidance due to easing R&M and labor turnover issues, higher-than-expected commodity prices, margin-increasing acquisitions, and management’s strong track record of beating guidance. Additionally, GFL’s strong free cash flow generation will allow them to deleverage and match peer leverage, thereby unlocking valuation upside. As GFL makes progress on peer leverage levels, I expect the stock to be re-rated to a higher valuation multiple (15x vs. 12x currently).