koto_feja

generalize

Following my coverage of Capgemini (OTCPK:CAPMF) , I recommended a Hold rating as I wanted to wait to better understand when growth would reaccelerate before turning bullish, and this article aims to provide a Update on my thoughts on business and stocks. I upgraded my rating to Buy from Hold as I learn more about the growth prospects and am very optimistic about the trajectory of margin improvement going forward.

investment thesis

CAPMF FY2023 Results Basically in line with the consensus. The company reported that total revenue in fiscal 2023 increased 2.4% annually (organic growth 3.9%) to $22.52 billion, in line with market expectations of $22.5 billion. As for 4Q23, CAPMF reported a 1% decline in organic growth. Adjusted EBIT was also in line with market expectations (beating 0.8%), at $2.99 billion and $2.97 billion respectively. However, CAPMF’s full-year adjusted earnings per share came in at $12.44, up from $11.78 (a 5.6% beat).

As I noted above, the key obstacle preventing me from turning bullish is when growth will accelerate again. While Q4 2023 results show no signs of improvement yet, management’s qualitative comments and guidance are very encouraging. In terms of guidance, they expect organic growth of 0% to 2% in fiscal 2024, which would imply a return to mid-to-high single digit growth in the fourth quarter after the expected trough in the first quarter of 2024.While discretionary spending remains low, one sign of demand recovery is stabilization of customer decision cycles and slow but steady growth Demand for large transformational deals. I find the commentary on the stabilization of large deals very positive as it means that big money is flowing back into the sector and due to the longer sales cycle these deals are not yet showing up in the CAPMF P&L. Even in the weakest region, the United States, there are positive signs that things will improve soon, based on customer conversations and budgets (according to management). Therefore, I expect North America to rebound in fiscal 2024. Further, I think a recovery in the overall macro environment should also help drive demand. Powell has reiterated that the Federal Reserve will cut interest rates in 2024. Although the rate cut may not be too large, I think it will be enough to stimulate business spending and prepare for the next growth cycle.

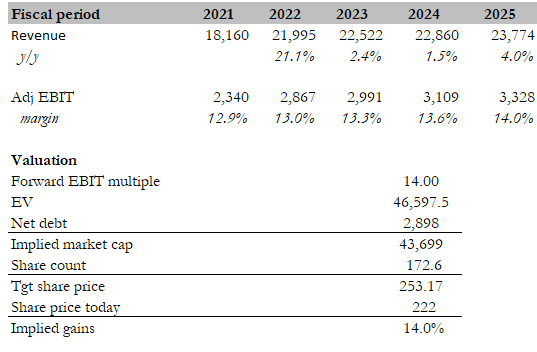

Now that the path to accelerated growth has become clearer, I expect margins to improve as well. In addition to operating leverage from revenue growth, another driver is a better cost structure, which management has hinted at in its guidance. If we look at guidance for fiscal 2024, revenue growth is expected to be between 0 and 3%, with 1.5% in the middle, indicating a slowdown from the 2.4% we saw in fiscal 2023. However, adj. EBIT margin is expected to remain at least at 13.3% (range: 13.3% vs. 13.6%). This represents a 30 basis point improvement in the CAPMF cost structure. While that doesn’t seem like much on an absolute basis, fiscal 2023 revenue grew 30 basis points to $67.6 million, and adjusted EBIT grew another 2.4%. I think 2.4% is a lot for companies where EBIT growth is generally in the mid-to-high single-digit percentage range. In my opinion, this shows that the management strategy of outsourcing the workforce portfolio is very effective. In addition to a structurally lower cost structure, labor productivity also appears to be improving, as evidenced by the fact that headcount decreased by 5% in 4Q23 but utilization increased in 4Q23. Therefore, I believe CAPMF can achieve its medium-term margin target of 14% in FY2025, and I expect a growth recovery in FY2025.

Valuation

Calculate yourself

Based on my model, my CAPMF price target is $253. I am changing the model assumptions from earnings to adjusted model. EBIT as it’s easier to compare to management guidance. My model assumes that CAPMF will achieve guidance-in-line growth in FY24 and accelerate in FY25. While my growth assumptions are weaker than in previous updates, I have become more confident in the business’s margin expansion trajectory. Based on improvements in cost structure and labor productivity, I expect adjusted EBIT margin to reach the high end of FY24 guidance, followed by another 100 basis points expansion (above FY24 expansion, as I expect FY25 revenue will accelerate). Judging from CAPMF’s historical forward EBIT multiple, its overall trend is between 10 times and 14 times. With EBIT growth expected to accelerate, I expect CAMPF to continue trading at the higher end of this range.

risk

I think the CAPMF stock story is well underway – with greater visibility of a growth recovery and margin expansion – and the market seems pretty optimistic about it, as evidenced by the rise in the share price. However, this also means more anticipated risks. If macro conditions worsen, CAPMF may not see any growth acceleration or margin expansion in FY24/25. This could cause investors to shift from a bullish stance to a neutral stance, which could impact stock prices.

in conclusion

I recommend buying CAPMF due to its improving growth prospects and huge potential for margin expansion. Management guidance and qualitative comments suggest growth will resume in the near term. Notably, a stable macro environment and growing demand for large transactions are positive signs for future growth. Additionally, despite lower revenue growth forecasts, CAPMF’s cost-saving measures, such as offshoring and improving labor productivity, are expected to result in improved margins. Therefore, I believe the company is capable of achieving its mid-term margin target of 14% in FY25. Nonetheless, a deterioration in the macro environment could hamper CAPMF’s growth and profit expansion plans, leading to potential investor disappointment and a decline in share price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.