Peter Schreiber Media

The problem with the modern economy is not the failure of economic knowledge; This is a failure of historical knowledge. ”——John Kenneth Galbraith

See what the wise bankers at the Bank for International Settlements have to say Considering that tech stock valuations may once again reach “extreme heights,” we decided to look to Irving Fisher’s optimistic words from 1929 when choosing our headline analogy. On September 3, 1929, the Dow Jones Industrial Average soared to an all-time high of 381.17, ending an eight-year period of growth that had expanded sixfold in value. “Stock prices have reached seemingly permanent highs,” Irving Fisher exulted in the pages of The New York Times.

In his 2007 classic book 100 Ideas for Creating Markets, Ken Fisher, who is not related to Irving Fisher, said:

Economist Irving Fisher wrote extensively in mathematical economics, value and price theory, capital and monetary theory, and statistics. In fact, it seems that he was touted as one of the great economists simply because he had a lot to say. He has authored at least 10 important books and taught at Yale University for more than 35 years. But a certificate doesn’t always mean you’re right. Indeed, in Fisher’s case, seniority allowed him to make mistakes on many major assumptions (such as the 1929 crash) and then bounce back with revised jargon after the fact. Clearly, Fisher’s greatest contribution to Wall Street was his own negative example, which should serve as a permanent warning to anyone who follows financial markets and economics to avoid the rhetoric of economists. Since Fisher’s day, various studies have shown that economists are wrong more often than they are right. ”——Ken Fisher

There is no doubt in my mind that Irving Fisher’s biggest mistake was making his infamous call in 1929, just a week before the stock market crash and ensuing Great Depression.

In this conversation, we want to focus on the price action of Bitcoin Gold and various asset classes given the continued “risk-on” environment.

If you have any questions or suggestions, please feel free to contact us.

- Everything sparkles, including gold

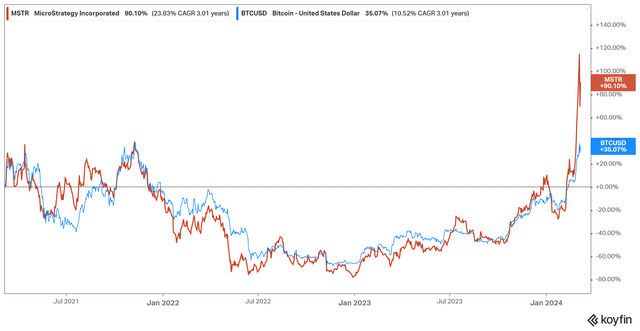

As noted in our Year of the Dragon conversation, we view MicroStrategy (MSTR) as a “derivative” of Bitcoin and has been more volatile but underperformed Bitcoin over the past 5 years:

MSTR vs. BTC 5 years (Macroeconomics – KOYFIN)

However, the three-year situation clearly shows a different “performance” situation:

MSTR vs. BTC 3 years (Macronomics – KOYFIN)

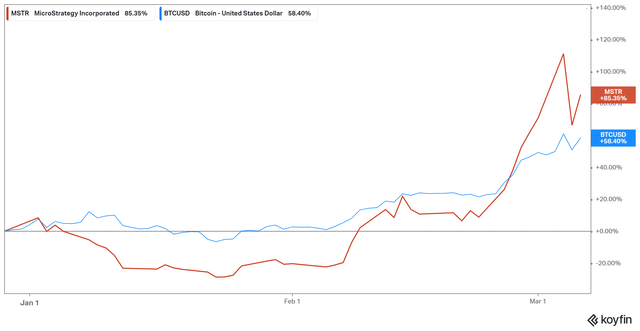

Moreover, MSTR has significantly outperformed Bitcoin year-to-date (YTD), and even more on a one-month basis (MSTR +137% vs BTC +56.5%):

MSTR vs. BTC YTD (Macroeconomics – KOYFIN)

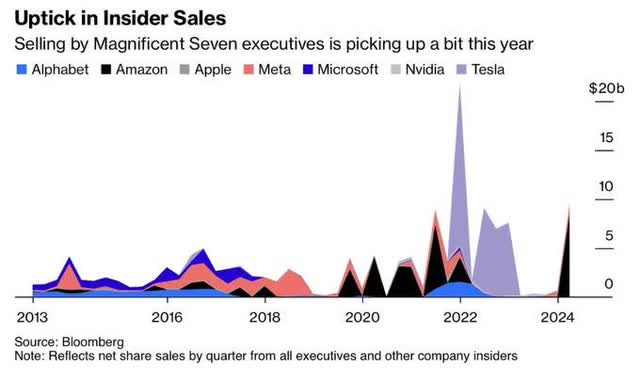

When we spoke in January, MSTR’s chief executive had begun cashing out his holdings for the first time in nearly 12 years. In a previous conversation with JPMorgan’s Jamie Dimon, we also discussed the increase in “insider selling,” the first since 2005, and the possible reasons behind it (fiscal-led and bond padding):

Insider Sales (Bloomberg-X/Twitter)

MSTR raised $700 million at an annual interest rate of 0.625%, due in 2030, and the strike price of its convertible bonds was 40% higher than yesterday’s closing price. All proceeds will be used to purchase more BTC. In January, we wondered whether MSTR would stop being a “proxy” short or “long” in light of the launch of a Bitcoin ETF. Instead, the latest convertible bond issuance will make it more “beta” sensitive to Bitcoin.

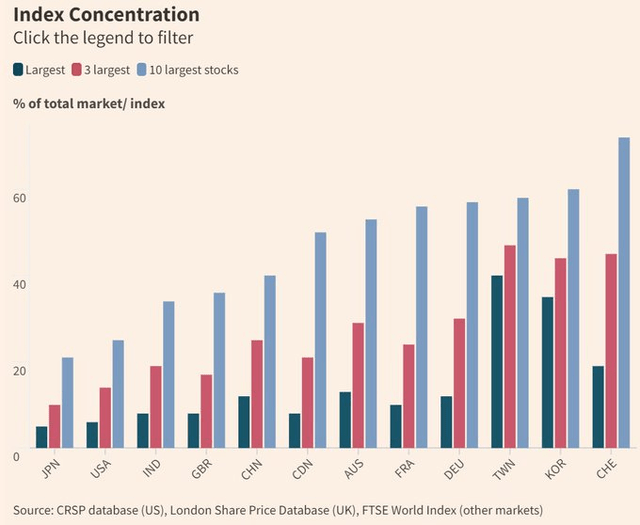

In our final thoughts, we touch on the topic of “market concentration”:

Index Concentration (Jeffrey Kleintop – Financial Times – X/Twitter)

Concentration risk per se is not the proportion of the top ten stocks in the index, as some markets have fewer stocks. Unlike the 500 stocks in the S&P 500, the MSCI Germany index has only 53 stocks, Charles Schwab CIO Jeffrey Kleintop noted on our X/Twitter. It is therefore not surprising that the top 10 German stocks account for a greater share of the index market capitalization, but as we said in our last conversation, in terms of performance, developed markets (DM) such as the S&P 500 show a high “Concentration” In the technology sector, we can see concentration in indices such as Emerging Markets (EM), such as the IBOV Index. This is why we say DM is the new EM.

Jeffrey Kleintop also made the following very important point:

“The real concentration risk is how much of the index’s performance comes from a small number of stocks.

True Concentration (Jeffrey Kleintop – Financial Times – X/Twitter)

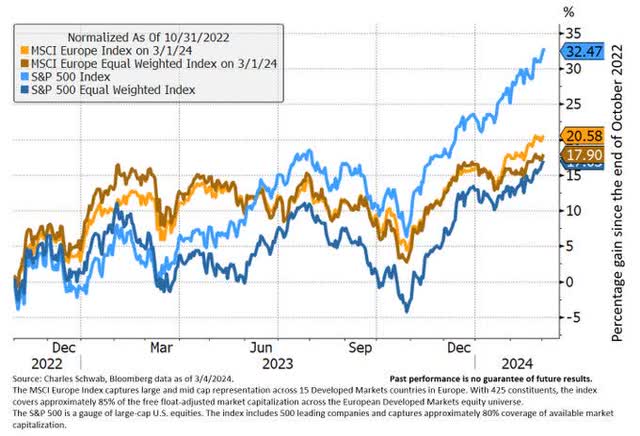

We can see from the market capitalization and equal weighted indexes that while European stock markets are more concentrated in top stocks, their performance is not concentrated in top stocks (cap indexes and equal weighted indexes perform similarly). But the U.S. has created a fragile gap between the performance of a handful of the largest stocks and all the rest. ” – Photo credit: Charles Schwab – Jeffrey Kleintop – X/Twitter

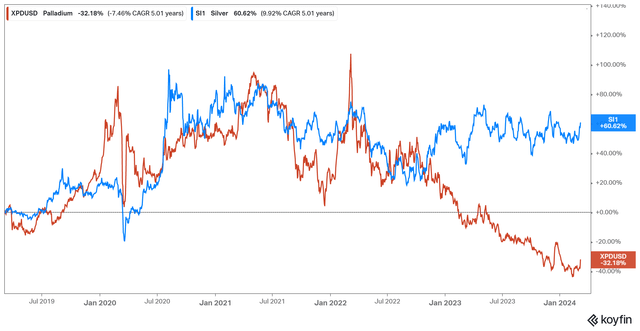

On a side note to our last conversation, we pointed out that both artificial intelligence and Bitcoin rely on silver for hardware. Looking at the 5-year chart below, we are also starting to look bullish on Palladium (red):

Silver vs Palladium 5 Years (Macroeconomics – KOYFIN)

As you know, palladium’s main commercial use is as a key component in catalytic converters, the part of automobile exhaust systems that control emissions, primarily in gasoline and hybrid vehicles. What interests us is the significant depreciation in used EV prices. Today, discounted electric cars cost the same as discounted gas. This has a very negative impact on new car sales and makes financing deals expensive (yes, interest rates matter in this area too). This results in deep discounts on new car sales, thus cutting into profit margins, and in the “price reduction” game, this is the game China is currently winning (BYD vs Tesla).

In our November 2022 conversation “The Scarcity Principle” we said the following:

Oil price caps or an EU ban on the sale of new petrol and diesel cars from 2035 do not appear to take into account “dynamic supply” (electric cars require 2.5 times the amount of copper as internal combustion engine cars). On average, electric vehicles require 6 to 12 kilograms of cobalt, equivalent to about 120,000 tons per year. More than 70% of the world’s cobalt is produced in the Democratic Republic of Congo, and any country that produces electronics will want to tap into this source. However, based on operating mines and projected demand, forecasters predict that supply will not be able to keep up with demand by 2030, or even as early as 2025. For electric vehicles (EV), you need to purchase products with the same “size” and “size”. We haven’t even discussed the urgent need for new nuclear power plants. Unfortunately for us, our current crop of leaders are living in a “different reality” and don’t seem to have grasped basic economic theory when it comes to commodity supplies and inventories, end of our rant. ” – Macroeconomics – November 2022

Currently, internal combustion engine vehicles still have more “residual value” like scrap metal. Electric vehicle batteries remain very expensive to replace and recycle. Furthermore, even in the event of a minor accident, it is almost impossible to detect battery damage. Keep in mind that Hertz decided to slash its electric vehicle business due to severe depreciation issues, which caused the company to lose money last quarter. Hertz subsequently halted plans to buy 65,000 electric vehicles during the electric vehicle downturn. Morgan Stanley noted the following in a recent report (H/T Carl Quintanilla):

“..EV demand continues to decelerate despite ongoing price cuts. Fleets are selling off EVs and strong hybrid momentum is vying for marginal EV buyers. Will Tesla lose money (sometimes) this year?” (Jonas )-Morgan Stanley

Aston Martin also admits that drivers don’t want “electric cars.” Yet another automaker is delaying the launch of electric vehicles in favor of hybrid/plug-in hybrids.

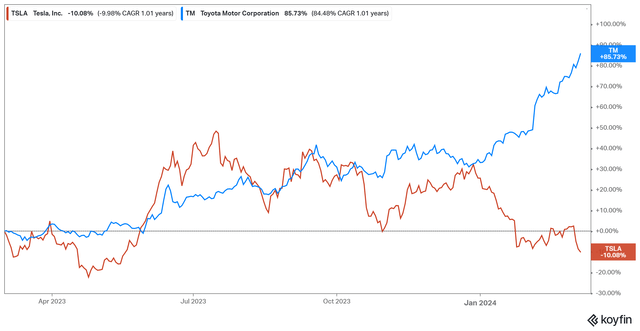

So, you can probably see why we are “bullish” on Palladium against the trend, playing a “mixed” game. Stock-wise, if you want to play, Toyota is the right place to be in our opinion based on the one-year chart below (Toyota vs. Tesla):

Toyota vs Tesla 1 year (Macronomics – KOYFIN)

Short Tesla/long Toyota and Palladium? we want to know…

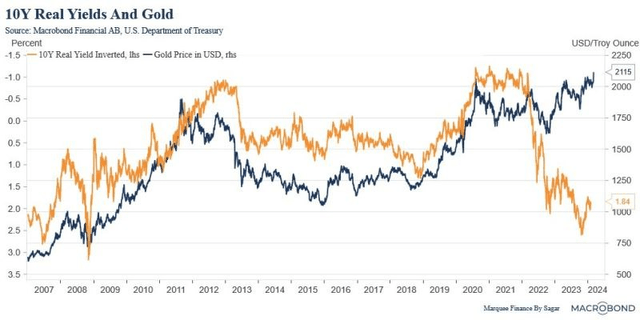

When it comes to “sparkling,” gold finally breaks out, as pictured below by Sagar Singh Setia on our LinkedIn feed:

Gold and 10-year real yields (Sagar Singh Setia – LinkedIn)

This is unprecedented! Over the past two years, gold has broken its two-year long correlation with real yields.

Despite higher real yields, gold prices have remained stable around $2,000.

However, with a Fed rate cut looming and real yields falling again, the shiny yellow metal’s rise may surprise everyone. “

One of the best diversified investments! No? 》-Photo source Sagar Singh Setia

Everything is sparkling including the S&P500, Dax, CAC40, Credit, Bitcoin and Gold. Permanent plateau?

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.