Aeon’s

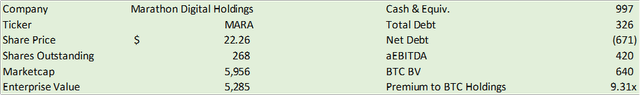

Marathon Digital Holdings (NASDAQ:MARA) finds itself in an interesting position, Bitcoin happened in April, essentially Double the cost For the same result of mining Bitcoin.This comes as Bitcoin prices recover The last high water level was in October 2022. Much of this interest may be influenced by the newly created Bitcoin ETF entering the market in January 2024, shortly after SEC approval. first bitcoin Spot ETFs. I believe this factor will result in MARA no longer being considered a Bitcoin spot proxy, as investors can now own Bitcoin spot through these ETFs. I believe the timing will play to Marathon’s advantage, with higher Bitcoin prices taking some of the pressure off growth and margins.I provide sell recommendations and prices for MARA stock The target is $16.69 per share.

To be clear, my thesis is not about the shortcomings of leadership. My investment thesis is entirely based on the diminishing returns of the Bitcoin mining complex and the trade-off of holding mining companies as Bitcoin proxies versus holding spot ETFs. This last point directly means investors are moving into Bitcoin spot ETFs and away from miners who hold Bitcoin.

operations

Marathon’s current business strategy is relatively simple, with some interesting opportunities at play.

In fiscal 2023, Marathon acquired two new data center sites for 179mm, one in Kearny, Nebraska and the other in Granbury, Texas. By acquiring two new data centers, Marathon will be able to better control utilization and have some control over power management. Since Bitcoin is currently competing with data centers employing artificial intelligence for computing power, I believe this will give companies greater flexibility and provide them with the ability to control capacity and utilization. Management expects that taking control of its own sites will help reduce operating costs. This could be very beneficial as the company can choose the power used by the data center, which is sourcing power from NextEra Energy (NEE) at the King Mountain site in Texas, according to their fiscal 2023 earnings call.

Management has discovered that Bitcoin mining can also be used as a recycled energy source, and the company is exploring the use of landfill methane and biofuels to power its Bitcoin mining operations. According to management, the mining operation will use methane to power the mining operation, and in turn, the heat generated by the mining operation will be used in a number of low-grade industrial processes. Management also found that heat generated by mining could be used to heat commercial buildings and residences, suggesting operating revenue may exceed its current capabilities.

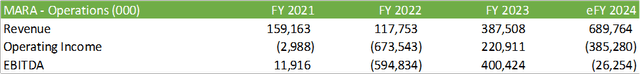

In terms of operational capabilities, Marathon increased its computing power to 24.7exahash/second, exceeding its FY23 target of 23exahash/second, and doubled its network computing power from 254exahash to 509exahash. Marathon also increased the fleet’s efficiency by 21%, from 30.9 Joules per terahash to 24.5 Joules per terahash. These improvements should provide Marathon with a substantial cushion in anticipation of the Bitcoin halving event. Despite these operational improvements, we cannot deny the fact that the Bitcoin halving will require the same effort to obtain half the results, resulting in a higher cost for the same result block. Bitcoin production has also grown significantly, from 4,144 Bitcoins in 2022 to 12,852 Bitcoins in 2023, an increase of 3.10 times. The company did face some challenges throughout the year, as its King Mountain and Granbury operations averaged capacity as low as 51% and 56%, respectively, in August before recovering to 92% and 99% in December.

Marathon sold a total of 9,482 Bitcoins in fiscal year 2023, realizing cash proceeds of $264. This only accounts for 74% of Bitcoin production in 2023. Proceeds are used to pay operating expenses, including energy hosting and other operating expenses. The company also raised $608 in an ATM stock sale and used the proceeds for growth capital and other corporate purposes. Management also elected to execute 417mm of convertible notes in exchange for 329mm of equity, reducing total debt by 56%, saving the company 101mm of cash through the transaction. Management has been working to strengthen its balance sheet, which currently has nearly $1 billion in cash and Bitcoin as of January 2024. As of fiscal 2023, Marathon held 15,126 unrestricted Bitcoins on its balance sheet.

Looking ahead to 2024, management is looking to increase the hash rate by more than 35% to approximately 35-37 exahash/second. Management expects this rate to further increase to 50exahash/second by 2025, nearly doubling current capacity. This was primarily driven by machine orders they received in partnership with Auradine, which will design custom chips for Marathon’s custom high-performance systems. I believe this factor gives an advantage over the competition because the best mining performance requires the best computing performance. Going back to the halving event, there may be some risk to profit margins as more computing power is required to mine the same Bitcoin block.

Valuation and shareholder value

company report

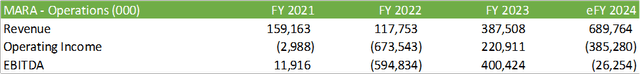

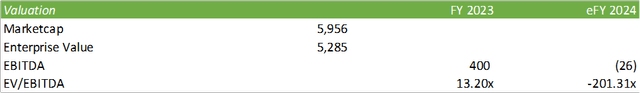

From an operating perspective, Marathon generated $387 in revenue in fiscal 2023, 58% of which was used to cover energy and hosting costs. The company’s aEBITDA was $420, a significant improvement from fiscal 2022 as the company recognized $331.5 in gains from its digital asset loan receivables.

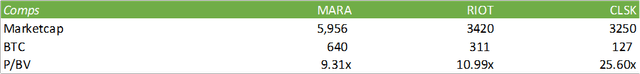

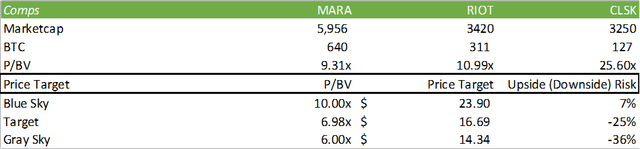

I believe valuing MARA stock is as tactical as it is based on valuation. The company currently trades at a premium of 9.31 times the book value of its Bitcoin holdings in fiscal 2023. The challenge with valuing companies based on book value is that Bitcoin’s value fluctuates so much that investors may be better off trading stocks based on technical analysis rather than fundamental analysis. Fred Thiel commented on their Q4 ’23 earnings call that he had to remove $55,000 from the script due to Bitcoin’s appreciation to around $60,000.

trading view

In terms of valuing the stock, I believe there are some operational impacts that need to be considered when building the case, including the cost of electricity, computing costs and other operating expenses, the Bitcoin halving and associated additional computing costs, and Bitcoin’s price volatility. I believe MARA will trade at a relatively similar rate to BTC; however, I do believe that as these costs translate into operations throughout 2024, the company’s valuation will see some pullback.

Mara Financial

On a comparative basis, MARA trades at a relative discount to its peers Riot Platforms (RIOT) and CleanSpark (CLSK).

company report

I believe that despite the valuation comparison, the above factors must be considered before buying or selling MARA stock. I think mining companies holding Bitcoin no longer have a proxy for the purpose of holding Bitcoin since spot ETFs are now available across trading platforms. I believe this factor, in addition to more challenging operating costs, will play a significant role in the valuation of Bitcoin mining companies. Taking these factors into account, I offer a sell recommendation to MARA with a price target of $16.69 per share, which is 75% of current valuation.

company report

In terms of diminishing marginal returns, I believe MARA will experience a challenging eFY24 due to rising costs. While I would not value growth technology companies based on EV/EBITDA, I believe that coming up with an operating-based valuation poses deeper challenges, and I think MARA faces deeper challenges in the coming year due to these higher costs. challenge.

company report

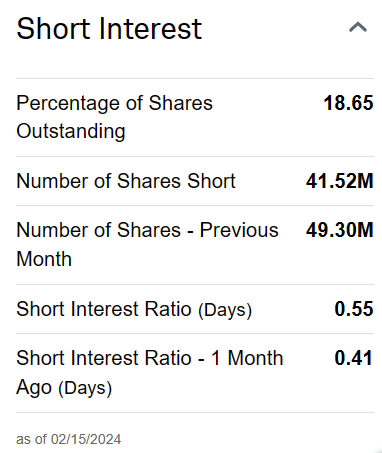

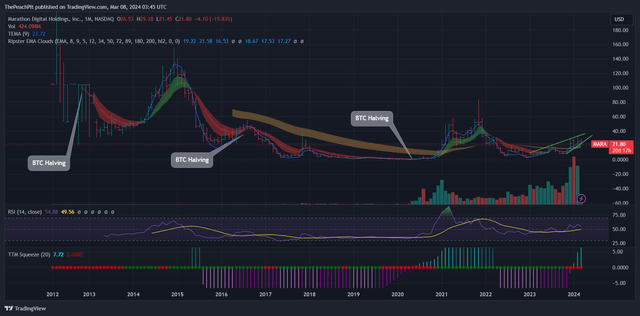

From a tactical perspective, MARA shares appear to be on an upward trend. I believe a significant catalyst for achieving my bearish price target will be the halving event and the cost impact revealed in the next earnings call. If you are looking to establish a short position in MARA stock, I believe it would be more ideal for traders to wait until the bullish pricing cycle ends. Buying put options can also be a more powerful strategy than directly shorting a stock. According to Schwab, 18.65% of MARA stocks have short positions.

The highest open interest volume for the MARA put is the June 21, 2024 contract with 4,504 open contracts and a strike price of $12/share. Open interest fell all the way to the strike price of $1 per share, indicating that investors are relatively bearish on MARA. At the other end of the day’s trading, open interest on the $30/share call was extremely high at 18,599 open contracts.

Schwab

Use caution when choosing to buy or short MARA stock due to the stock’s relatively high volatility.

trading view

Given their technical charts, I believe that if MARA stock breaks out of the bottom barrier, the stock price will drop to my $16.69/share price target. Using the Ripster EMA Cloud, MARA appears to be in a downtrend that could cause the stock price to break above the current theoretical price floor.

Diminishing Returns on Bitcoin Halving Complex

For those who are not very familiar with Bitcoin, the coin halves every 4 years. The halving event is exactly what it sounds like.this Events are basically halved The rate at which new Bitcoins are minted. This means that the contribution to mining Bitcoin is reduced by half. The result of this is that with the same computing power, miners will receive half of the reward. In operational terms, this would double the computational requirements to obtain the same reward and would result in higher marginal costs or diminishing returns. This does not affect the value of Bitcoins that are actively held or traded. However, this may change the perception of investors who actively buy and sell Bitcoin, as the incident is seen as an increase in Bitcoin’s scarcity. I think, like any investment, it’s unwise to assume history will repeat itself.

Mara Financial

I believe Marathon will face significant costs that will offset its increased operating footprint and turn its EBITDA margin into negative in FY2024 eFY.

Mara: Bitcoin Halving

Considering historical trends, MARA stock underperformed due to the halving event.

The trade-offs of owning a Bitcoin ETF

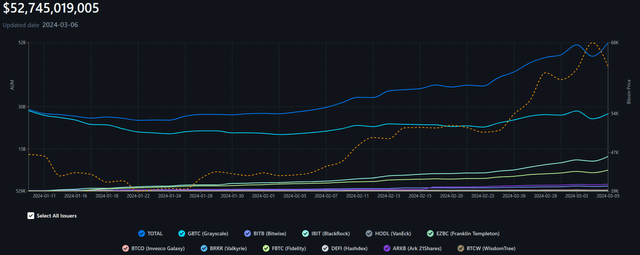

One of the available Bitcoin ETFs is BlackRock’s iShares Bitcoin Trust (IBIT), which has a net expense ratio of 12 basis points. This product eliminates any operational risk that Bitcoin miners may be involved in and provides investors with direct exposure to Bitcoin without having to purchase Bitcoin directly. The Fidelity Wise Origin Bitcoin Fund (FBTC) is also a competitive product as it has a net expense ratio of 0%. According to Bitcoin ETF Fund Flows, fund flows have exceeded $52b, indicating the huge interest in ETFs since they became available to investors. Therefore, it is too early to assess the stickiness of ETF investors, as the ETF was only launched at the beginning of this year; however, judging from the flow of funds, investor interest seems to be increasing.

Bitcoin ETF Fund Flow

MARA stock reacted negatively following the approval of these ETFs, falling about -31% before recovering.

MARA: ETF Approval Date

The benefit of owning ETFs compared to MARA is that ETFs eliminate any operational risk.One of the risks of owning a Bitcoin mining company is that approx. 9.5% of Bitcoins remain to be mined as the nominal cap remains at 21mm coins. According to the Blockchain Council, Bitcoin mining operations should continue until 2140. I believe that by this time, the cost of mining may be too great for the returns.