Alsgueira

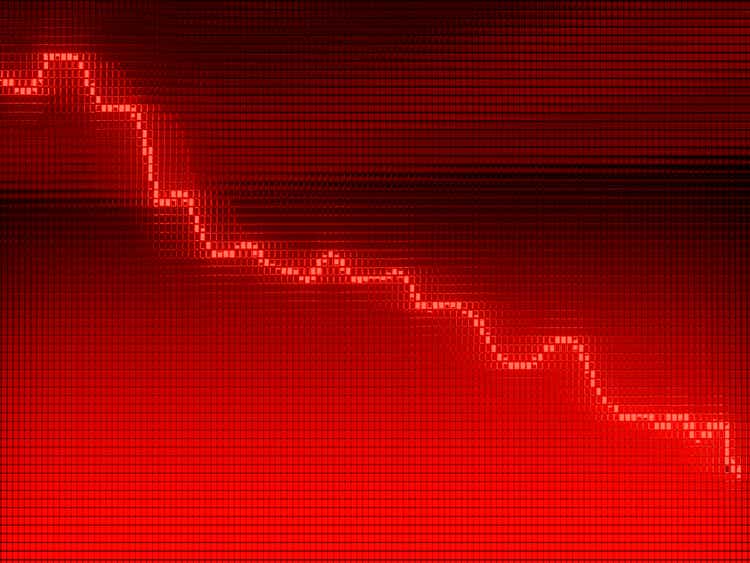

FS KKR Capital (NYSE code: FSKBDC faced significant selling pressure after the company reported net investment income results for the December quarter that were in line with adjusted NII consensus estimates.However, the otherwise good FS KKR earnings release was overshadowed. The increase in the non-accrual percentage unnecessarily creates dissatisfaction with BDC dividends. The current dividend is well supported by cash flow, primarily interest income from BDC’s loan portfolio, and I don’t see a cut in the dividend in FY24 unless the loan situation deteriorates dramatically. BDC shares are currently priced at an exaggerated discount to NAV, given that the dividend is backed by National Information Infrastructure (NII). I’m buying stocks that are falling and I’m ready to buy more if the price continues to fall!

Previous rating

I evaluate BDC bought in December 2023 – A Christmas gift with a 13% yield — due to what I consider to be resilient net investment income performance, a diversified portfolio structure, and a low P/E ratio at the time. FS KKR’s discount to NAV has widened significantly again following its fourth-quarter report, potentially providing dividend investors with an opportunity to play long-term in a BDC that still has enough cash flow to cover its quarterly distribution of $0.70 per share.

Portfolio Structure, New Investment Activityy. Overview of loan quality

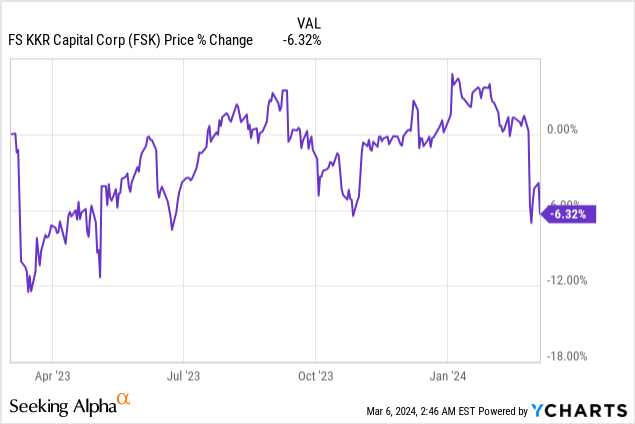

FSK shares fell sharply following BDC’s fourth quarter as the company reported its non-accrual percentage rose to 5.5% in the December quarter, up 3.1 PP sequentially. As I’ll demonstrate further below, the company’s NAV and NII per share are fairly stable, which means dividend investors may be overestimating dividend risk at the moment.

FS KKR

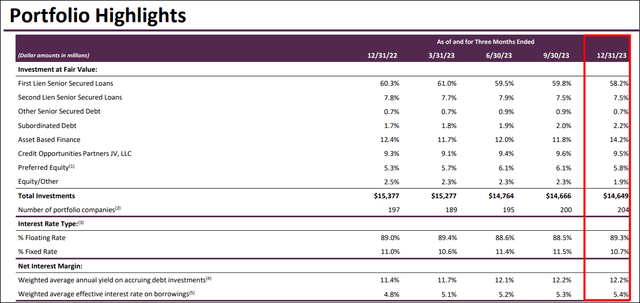

FS KKR operates a senior secured lending strategy with a core focus on first liens. BDC is the fourth largest BDC in the industry by market cap, with a portfolio fair value of $14.6B and 66% of investments classified as first or second lien. Asset finance, joint ventures and equity are other important investment categories for BDCs.

FS KKR

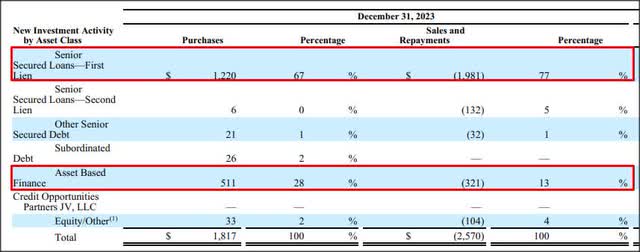

Fiscal 2023 was not a great year for FS KKR in terms of portfolio or net investment activity, primarily because BDC’s portfolio companies used the year to accelerate loan repayments. As loan costs reset higher across FS KKR’s variable-rate loan pool, the investment firm’s borrowers repaid $2.57B of investments in the last fiscal year, while the company initiated only $1.82B of new projects.

Most new originations and repayments occurred in the first lien and asset-based financing categories, which combined accounted for 95% of originations and 90% of repayments. With the Fed finally changing its tightening policy in 2024, I expect loan repayments to slow this fiscal year and new investment activity to increase.

FS KKR

Will FS KKR cut its dividend?

The key mistake many investors make when seeing a non-accrual percentage increase is assuming the dividend had to be cut. This is not necessarily the case, as BDCs typically invest in the top layers of the capital structure (first and second liens), and this structure is well protected through the posting of collateral. In addition, BDC has a recovery team experienced in resolving problematic debt situations.

So whenever a BDC reports an increase in non-accrual percentage, dividend investors should look at the distribution range to understand the true severity of dividend risk.

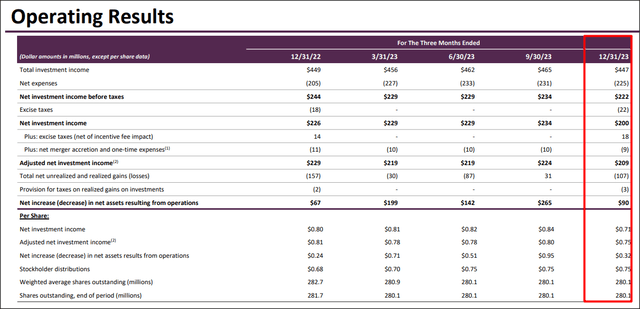

FS KKR reported that adjusted NII fell 9% year over year to $209 million, primarily due to higher net expenses. Calculated, the adjusted NII is 0.75 per share, which is in line with BDC’s cumulative dividend payments in the fourth quarter. The dividend payment of $0.75 per share in 4Q23 consists of a standard dividend of $0.70 per share and a supplemental cash distribution of $0.05 per share.

Putting supplementary cash distributions aside (as management can cut back at any time), FS KKR’s distribution coverage for FY23 was 1.11x, which fell to 1.07x in Q4’23. Nonetheless, the $0.70 per share dividend is well supported here and has a very limited impact on the NII-backed distribution coverage ratio in Q4’23.

FS KKR

FS KKR’s valuation

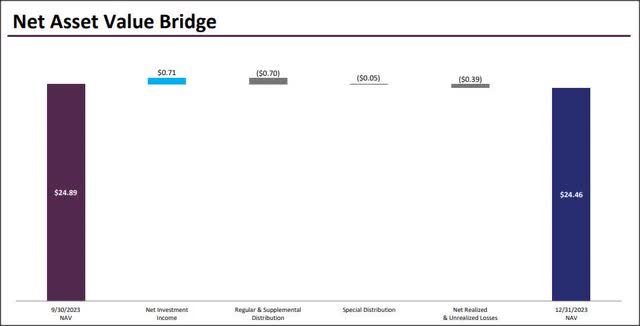

In my opinion, FS KKR’s valuation profile looks very attractive. As I described, the shares sold off after BDC filed its Q4 earnings scorecard… which resulted in a deeper discount to BDC’s NAV. Notably, FS KKR Capital’s net asset value fell only slightly in the fourth quarter (-1.7% quarter-on-quarter). BDC’s net asset value per share fell by $0.43 due to a realized/unrealized loss of $0.39 per share.

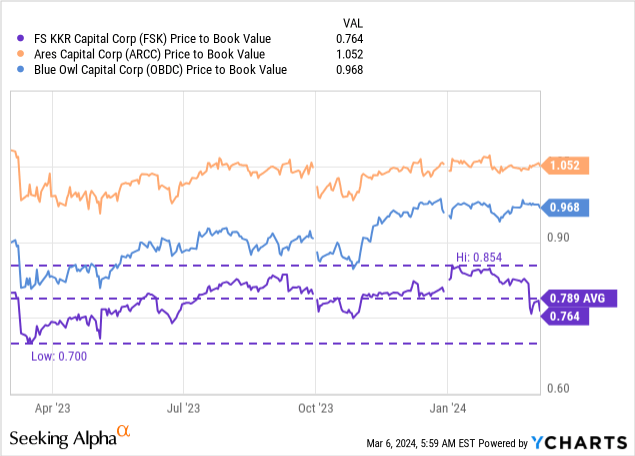

FS KKR Capital

After the fourth-quarter sell-off, FS KKR trades at 0.76 times P/E. This is below the 1-year average P/E ratio of 0.79x and contains a significant margin of safety, which is the main reason for my increased purchase. While I don’t have high expectations for capital growth, I believe the dividend here is fairly safe. Over the long term, I expect FSK to trade at 0.85-0.90x NAV, which will reflect BDC’s below-average loan quality. Ares Capital (ARCC) and Blue Owl Capital (OBDC) have higher P/E ratios due to their better loan quality profiles. You can read more about my thoughts on these two BDCs here: Ares Capital Q4: A Piggy Bank with a 10% Yield and Blue Owl Capital: A Decent 10% Yield for Income Investors.

FS KKR Risks

FS KKR is dealing with some non-accrual charges, but as far as I know the dividend is not immediately at risk. However, this situation may change in the future, especially if BDC has to add new non-accrual items to its NPL roster in the coming quarters. If BDC reports a shortfall in its net investment income, resulting in distribution coverage below 100%, my view on FS KKR will change.

final thoughts

FS KKR is a diversified BDC with senior secured lending strategies. The investment firm’s non-accrual percentage jumped sequentially, bringing fresh bearish sentiment to FS KKR’s stock. As a result, the share price fell below its one-year average P/E/NAV ratio. However, the rise in non-performing loans does not mean BDC will cut its dividend: in fact, the dividend is well supported by the cash flow generated by the company’s investment loans. BDC’s stock is also trading at what I believe is an exaggerated discount to NAV right now, creating an opportunity for dividend investors with above-average risk tolerance to participate in the long term!