Thorston Asmus

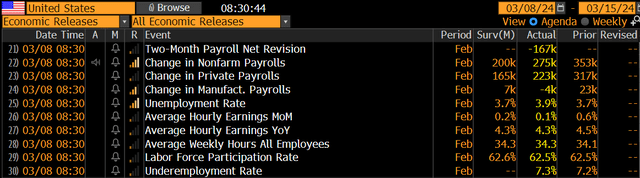

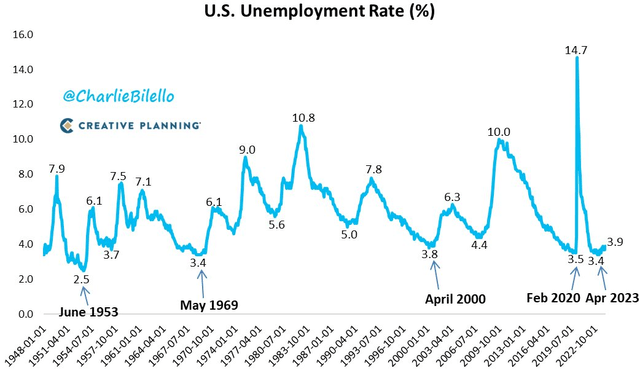

this February employment report Employment increased significantly by 275,000, well above expectations of +200,000. This is the 38th consecutive month that non-farm payrolls (“NFP”) has increased. However, the unemployment rate jumped sharply to 3.9%, the highest level since January 2022 and 0.2 percentage points higher than expected.Average Hourly wages increased less than expected, rising only 0.1% from the previous quarter, down from January’s 0.6% increase. Average hourly earnings are now 4.3% higher than a year ago. From the initial reading, employment fluctuations eased in January, which is a growing consensus in February’s non-farm payrolls report.

Following criticism of the large seasonal adjustment at the start of the year, January employment was revised down from 317,000 to 229,000, which appears to be the case. The two-month correction was very negative indeed, reaching –167,000 Work.

The average work week rose to 34.3 hours, the highest level since November and up sharply from 34.1 hours in January, so it’s a hot number, but coupled with the lack of earnings data, it’s not considered a strong number. so serious. The labor force participation rate remained unchanged at 62.5, slightly below consensus expectations, while the U-6 underemployment rate edged up to 7.3%. Meanwhile, a shaky household survey showed 184,000 people were sharply out of work – the third consecutive decline in household employment.

February jobs report solid, January data revised to be weaker

Christian Fromhertz

Employment situation remains ‘good, but not great’

Bureau of Labor Statistics

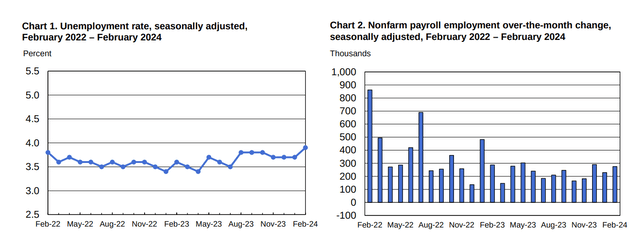

The unemployment rate rose by 0.2 percentage points and remained below 4%

Charlie Bilero

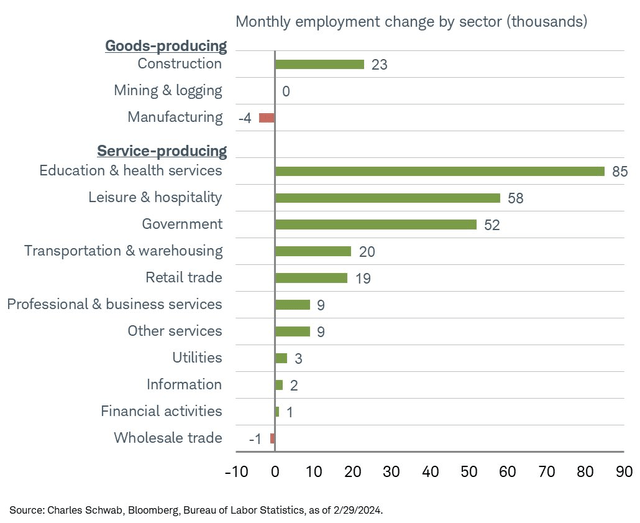

Strong growth in education and leisure employment

Liz Ann Sanders

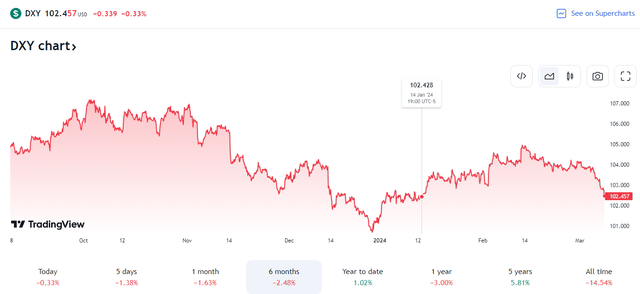

Markets saw wild swings after the jobs report was released. The 10-year Treasury yield (US10Y) initially rose but later fell back to morning lows. The benchmark 10-year Treasury note rate remains near its lowest yield since early February. Meanwhile, the dollar fell below 103, its lowest level since mid-January.

U.S. 10-year Treasury yield falls near 4%

trading view

U.S. Dollar Index (DXY) Falls Further

trading view

Stock futures rose following the release at 8:30 a.m. ET. I suspect the market wants to see January’s data be broadly slower than the initial release, with the rising unemployment rate being seen as a sign of health from the Fed. With inflation likely to continue to slow, interest rate cuts from the middle of this year will remain a focus of discussion.

Given that the real federal funds rate is close to positive three percentage points, current policy rates remain highly restrictive. Talk of a soft landing continues as the labor market normalizes and wage gains slowly slow down.

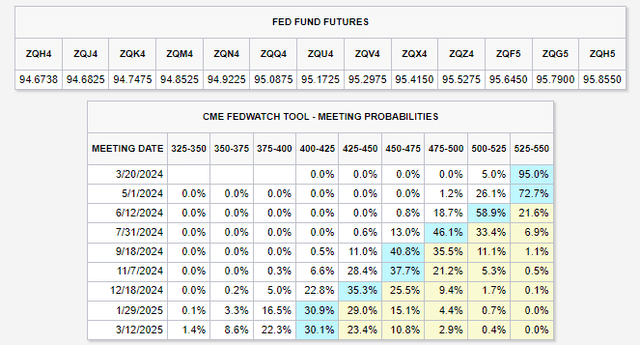

As things stand, interest rate traders now see a roughly 30% chance of a first rate cut at the May meeting, but a greater chance of one occurring at the June FOMC meeting.

Gold prices, which hit a record high earlier this week, surged $20 for the first time to near $2,200. Lower interest rates and a weaker U.S. dollar have been key catalysts for the precious metal.

Interest rates are expected to be cut in June and by 85 basis points in 2024

CME Group Fed Watch Tool

bottom line

February’s jobs report was exactly what bulls wanted to see. While we still hope to see further evidence of easing inflation in next week’s CPI report and personal consumption expenditure data later this month, the “Goldilocks soft landing” narrative continues to unfold. Currently, the overall non-farm payrolls data is stronger than expected, while wage growth is weaker than expected and has dropped sharply from January’s growth.

The first month of the year appears to have seen an unusually significant seasonal adjustment. Rising unemployment is seen as bullish – S&P 500 futures rose to a record high in premarket, while the 10-year Treasury yield fell to nearly 4%. The U.S. dollar index fell, helping to boost gold prices. All signs point to a first rate cut by the middle of the year, and perhaps three-quarters of a rate cut.