frog frog

Dear readers/followers,

It’s been a while since I updated my paper on Axfood (OTCPK:AXFOY) (OTCPK:AXFOF). My last article on the company can be found here and as I’ve rated it for some time, it’s a Hold.I have Axfood has been viewed as completely valuable for some time. While I realize there is potential for the local share price to rise above SEK 300 per share, I am still cautious about buying the company at prices above SEK 235, as is the current trend.

I may raise this PT in the future to reflect the company’s different strengths, but since the privatization and removal of ICA AB from the stock market, Axfood remains virtually the only FMCG on the entire Swedish market that investors can actually buy. This brings a level of “crowding” to the investment, which I think further exacerbates the problems that already exist. Valuation is too high.

Axfood is a great business. It is a dominant player in the Swedish fast-moving consumer goods market, with operating profit margins higher than the industry average. The company’s sales grew strongly and outperformed the market, thanks to a quality product selection and competitive pricing. Investments have increased slightly since my last article, and I want to clarify that this company represents over 3% of my entire portfolio.

That was after selling over 80% of my initial investment. Axfood was one of my earliest positions, I bought it for less than 120 SEK and at the most my YoC was close to 7%. Then Covid hit and I sold everything for over 320 SEK, making a huge profit of over 100%.

The company never reached such heights again, so I believe this is the right choice.

Let me update you on the full year and show you the investment characteristics of Sweden’s largest public grocer.

Axfood – 2024 Update

So about a year ago, when the company was trading below SEK 235, I bought back quite a bit of stock. The investment has exploded again. As I write this, Axfood is trading at SEK 290 per share.

I have sold some covered calls with strikes in the 310-320 range for about 5% of the position, including premiums over 325. I also keep a close eye on the company and the corresponding premiums on the options to be able to secure similar upside or quickly spin the button if the company reaches levels that prove it.

I used to be an investor in B&H, and you might notice that this way of speaking doesn’t sound like B&H. I would say I would buy now and hold until a better opportunity presents itself and the valuation of the original investment has reached a good “maturity” level.

This obviously opened the door to big mistakes – I made some smaller mistakes. But it also saved me from making the mistake of not selling – like this time with Castleme.

Castrum share price (Google Finance)

I bought Castellum as early as 2013 and held it until 210 points before selling. I’m not predicting a dividend cut or collapse beyond 2021 – but I think valuations are extremely inflated. The same goes for another Swedish real estate company. In this case, my strategy again ensured a return of over 100% and saved me from a sharp decline, almost to a negative return (excluding dividends).

So for me, my strategy is working – I will continue to apply it to Axfood and other investments.

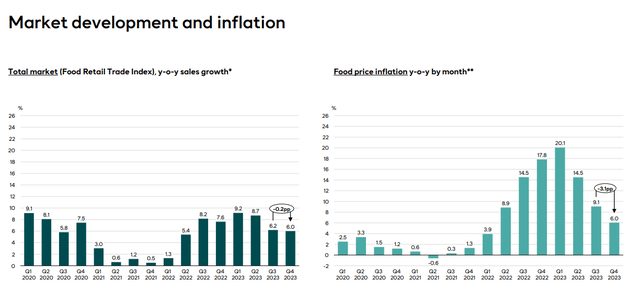

Axfood reports for fiscal year 2023. The results for FY23 were outstanding, as one would expect from a best-in-class FMCG. The company is dealing with food price inflation that is severely affecting the food retail industry. Although prices have been falling, the impact on Swedish consumers cannot be underestimated.

Ax Food Infrared (Akers Food Infrared)

Consumers here are definitely being “squeezed.” However, Axfood has walked a tightrope quite well while managing to outperform the broader indexes. During the same period, the company’s retail sales grew 8.7%, while broader market retail sales grew 6%. Over two years, Axfood has gained 28.2%, while the market has gained 14.1%.

Do you understand why I want to invest in Axfood?

Outperforming market performance is a business model. Axfood’s market share has been growing for more than 10 consecutive years, but few companies can achieve this. The company’s retail sales, net sales and earnings have been strong this year. Operating profit also increased due to higher prices and good cost control on the company’s part. The company managed to increase its adjusted operating margin to almost 4%, and while this may seem low, it is the market leader almost globally when it comes to fast-moving consumer goods or groceries.

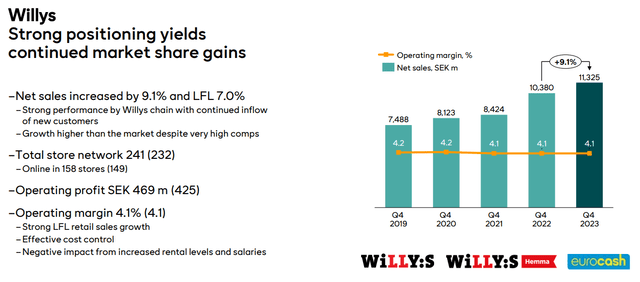

The company’s various segments are performing well. Willis continues to outperform.

willis infrared (Willis Infrared)

Hemköp typically grows at a slower pace, but it’s the company’s downtown grocery store/market that’s growing even faster than Willys, reaching double digits. The company is modernizing its more than 330 stores nationwide. However, the company’s downtown location, coupled with less efficient staffing (more people, less space), caused operating margins to drop from 4.2% to below 4% to 3.9% during the period. As expected, this was due to rising wages, rising rents and other factors that had a smaller impact in other areas. The company’s commercial operations and logistics businesses Snabbgross and DagAb are performing well – DagAb also includes the company’s various smaller investments in areas such as delis and apothecaries/pharmacies.

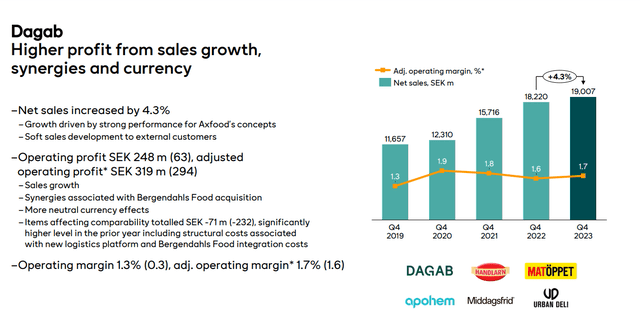

Ax Food Infrared (Akers Food Infrared)

As you can see, Dagab is by far the lowest margin business – which is natural when you consider that the company’s segments contain more investment and can be described as more “uncertain” compared to other segments .

Overall, though, Axfood isn’t worried. Yes, inflation is an issue to consider and yes we are seeing wages and other issues impacting profits, but Axfood is defending its market position. The company delivered double-digit net sales growth and adjusted operating profit growth, ultimately delivering strong operating margins that remained steady at 4.4% despite the current environment. This is one of the best operating margins in the industry, and the reason is something I experienced in my previous article on Axfood.

Fundamentals remain solid, with net debt below SEK 10B and equity ratio of approximately 24%. The leverage ratio is less than 1.6 times. If Axfood wanted so badly, they could invest, or do more – but part of what I like about this company is that it doesn’t fall into “left field” in order to operate.

Despite lower earnings, it’s still a very solid grocery business. As of the end of the year, the company’s ROCE was over 20%. The company’s outlook is one of continued growth, and Axfood is expected to continue to expand. The new Hemköp and new Willys stores are about to open.

Let’s take a look at company valuation.

Axfood Valuation – There’s a lot to like, but the price is still too high

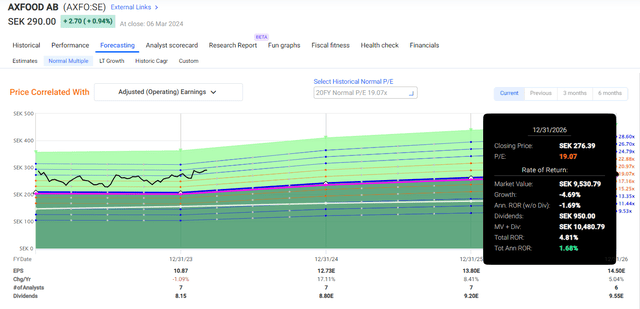

So the reason I haven’t “bought” more Axfood recently is because of valuation. Because even if you realistically value the company at 24-25 times earnings, the company’s projected annualized return (RoR) growth of 2-4% is no higher than 9-11%.

This was an insufficient RoR for me, and if you are looking for similar companies and RoRs like me, this should be an insufficient RoR for you as well.

Consider also that Axfood’s P/E ratio is also 5 times lower than its current P/E ratio on a 20-year basis, which is around 18-20 times, which I think is more favorable for a company that has grown and traded as follows Might be a long-term development goal indeed.

Ax Food RoR (quick chart)

Even if you factor in a conservative 20-year valuation for 18-19, your expected annual return is probably less than 2%, and that’s including dividends. If you have an argument as to why the company might be doing better, I welcome that – but I don’t think next year’s growth is enough to justify that.

Over the long term, I could increase the P/E ratio to 21-22x, but even that would produce a subpar return in this scenario.

I’m raising my PT to SEK 245 per share, and if the company’s recent performance is solid, I may raise it to SEK 250. But for now, I think a lot of FMCG is worth as much as it is right now.

The current yield of just under 3% is not bad, but I don’t think upside is likely.

I would say that if the company starts “sniffing” levels of SEK 310 or above, it would be a good idea to prepare to divest Axfood or consider a rotation. In my opinion, even a P/E ratio of 24-25x will not generate high single-digit returns.

As we are seeing with current market trends and volatility, I understand investors are turning to safety. But in my opinion, you shouldn’t pay this kind of valuation for a company, or even this kind of valuation for a company like this.

I say Axfood is clearly fully valued here and I will continue to view it as a “Hold” – but I won’t be rotating it unless we start to get to the 310-320 SEK level, which is also my current target underwriting Telephone.

question? Let me know otherwise, my current company paper is here, updated for 2024.

paper

- My Axfood thesis included the desire to own Sweden’s only publicly traded FMCG company at a great price. At such a favorable price, it combines a 3-4%+ yield with low double-digit or high single-digit annual upside, delivering compelling quality and safety while delivering superior market performance. sexual combination.

- For me, the company is a solid investment regardless of the price below SEK 230. At prices above SEK 245, double-digit upside becomes very risky at current valuations and size.

- I have a put and call trade on this company and plan to sell some attractive covered calls if the price reaches 290 SEK or above again, while selling puts below 245 SEK, And keep an eye on the 12-buy-sell annualized attractiveness forward basis.

- The company granted me the “hold” right at a price of SEK 260/share, with a maximum PT of SEK 245/share. This is updated for the 2024 period.

Remember, my whole purpose is to:

1. Buy undervalued companies at a discount—even if the undervaluation is slight and not mind-numbingly large—and let them normalize over time while reaping capital gains and dividends.

2. If the company moves well beyond normalization levels and into overvaluation, I would reap the gains and move the position to other undervalued stocks, repeating #1.

3. If the company does not enter an overvalued state, but instead hovers within the fair value range, or returns to an undervalued state, I will buy more shares as time permits.

4. I reinvest earnings from dividends, work savings, or other cash inflows specified in #1.

Here are my standards and how companies achieve them (italics).

- The overall quality of this company is high.

- This company is basically safe/conservative and well-run.

- The company pays a generous dividend.

- Prices from this company are very cheap at the moment.

- The company has realistic upside based on earnings growth or multiple expansions/returns.

The company lacks meaningful market-beating upside on a forward basis at over SEK 290/share, so I’m a ‘hold’ here.

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.