Microcap Center

In terms of companies reporting earnings, Oracle (ORCL), Lennar (LEN), and Adobe (ADBE) are the only names to watch next week.

Thursday night’s State of the Union (SOTU) speech and the 5% of potential new home buyers were interesting Tax credits, will the prospect of tax credits actually put off new home purchases as new buyers await the election results.

Oracle still retains a handful of customer accounts. This blog has covered the stock since the late 1990s.

Oracle generally doesn’t handle these major “mega-shifts” in software very well. For the database giant, the cloud is (or represents) both an opportunity and a threat, but mostly an obstacle.

Oracle made a lot of noise about PaaS, SaaS, and IaaS, but in the early years from 2010 to 2019, growth never really followed.Do Does artificial intelligence mitigate this threat? Probably not, but judgment will be reserved for now.

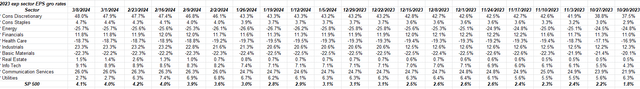

Overall, S&P 500 EPS and profit estimate revisions still look healthy.

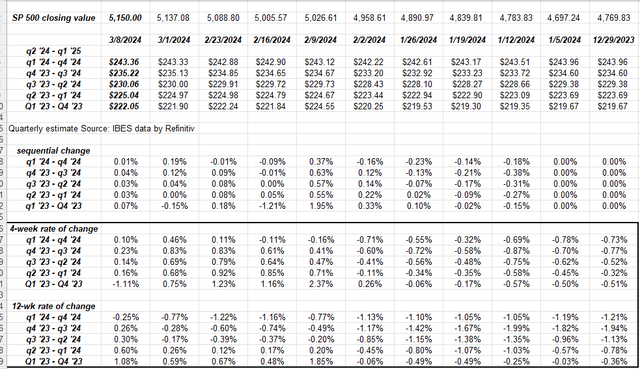

S&P 500 Index Data:

- The forward Q4 estimate (FFQE) rose to $243.29 this week from $243.23 the previous week, which doesn’t sound like much, but the typical trend is lower, so the fact that FFQE is rising is a plus.

- The expected price-to-earnings ratio is approximately 21 times.

- The S&P 500 Index’s “earnings yield” fell 1 basis point this week to 4.72% from 4.73% last week.

- The “upside surprise” in S&P 500 EPS remained healthy at 6.3% in 4Q23, compared with 7.2% in 3Q23.

- S&P 500 earnings also showed some upside surprises, but the +1.3% in 4Q23 was well below the +0.9% in 3Q23.

A key metric for S&P 500 EPS, if readers want it, is that as of January 5, 2024, FFQE was $243.98, but as of today, March 8, 2024, the same FFQE was $243.23.

In normal quarterly revision activity, this number typically falls 3-5% now as expectations for EPS tend to decline, and then once actual earnings are reported, the typical “upside surprise” is 3-5%.

Ed Yardeni calls it the “fishhook effect” because review activities are shaped like a “fishhook.”

What’s even more overlooked is that 2023 S&P 500 earnings per share are actually very strong: Here’s a table by industry, from late October 2023 through March 8, 2024, showing full-year 2023 S&P 500 earnings Earnings per share rose to +4.1% today from expectations of +1.8%.

Naturally, the technology sector contributed to the strong finish to 2023, as the sector’s expected growth rate for 2023 more than doubled in the past 12 weeks.

Rate of change:

Note that the 4-week and 12-week rate of change in S&P 500 EPS has actually turned positive over the last 4 weeks in borderline territory.

Summary/Conclusion: After the 4Q23 EPS decline spooked many investors into thinking 4Q23 was going to be bad, the overall trend in S&P 500 EPS forecasts as a benchmark metric looked healthy, but that wasn’t the case.

Here are the expected growth rates for S&P 500 earnings per share over the next three years:

- 2025: Currently expected to increase by 13% and sell for $276.00

- 2024: Now expected to rise 10% at $243.36

- 2023: +2% Current price $222.05

Q4 2023 earnings results could see further gains in the final three weeks, while 2025 could see a downward revision over time.

The 2024 EPS estimate of $243.36 has remained stable since early January 2024. Considering all the guidance details for the Q4’23 earnings release, it’s a positive that analysts have plenty of time to reduce the numbers based on 2024 guidance, but that hasn’t happened yet.

None of this is advice or advice. Past performance does not guarantee or imply future results. Investing may result in a loss of principal, even in the short term. All S&P 500 EPS data comes from LSEG. Readers should always assess their own comfort level with market and portfolio fluctuations and adjust accordingly.

thanks for reading.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.