59 yuan

Overview

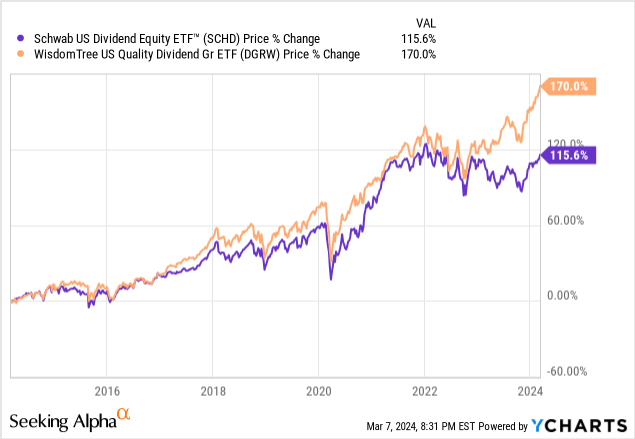

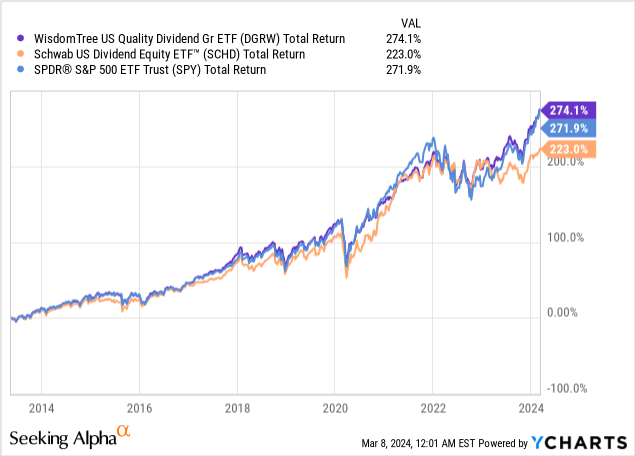

WisdomTree Dividend Growth Fund (Nasdaq ticker: DGRW) is a solid dividend ETF whose holdings focus on high-quality dividend-paying companies across all industries.This fund provides instant diversification and gives you access to some of the best funds companies around the world. While the dividend yield is at a low 1.6%, the fund has outperformed Charles Schwab’s U.S. Dividend ETF (severe heart disease) total return over a 10-year period. The thing to note here is that DGRW’s dividend growth has been pretty poor compared to SCHD’s dividend growth.

A dividend ETF is a bit like a tree in that you plant the seed early in life and continue to water it until it grows larger over time.As you continue to contribute capital and DCA (dollar cost averaging) to your dividend fund, the value of your dividend tree will grow, and size, and also sprout many different branches. On these branches are your fruits, also known as your dividends. Many people dream of growing a tree big enough to bear abundant fruit to feed them for a lifetime, and that’s exactly what dividend ETFs like DGRW and SCHD can accomplish. However, I will discuss why I believe trees grown from DGRW seeds are more likely to produce more fruit and be taller trees.

I believe that over time, outperformance is likely to widen due to positioning differences. In short, DGRW is jointly managed by the WisdomTree team and Mellon Investments. This ETF invests primarily in public stock markets in the United States, but most of the companies in it operate globally. The fund focuses on a variety of industries and favors dividend-paying growth companies. Since its inception, DGRW has successfully generated an average annual return of 12.05% for shareholders.

The fund has approximately $12B in AUM and is modestly sized expense ratio 0.28%. Unlike SCHD, whose portfolio is skewed towards financials, industrials and healthcare, DGRW is more oriented towards technology. As a result, prices experienced more increases. So it depends on the preference between total return and income. SCHD’s dividend is twice that of DGRW, so it will be a better choice for investors who value income. An important thing to consider with this ETF is whether you believe in the continued growth of the technology sector.

holding

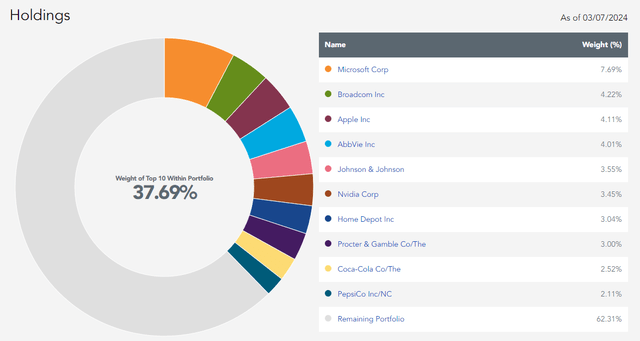

Technology stocks are the largest component of the ETF, accounting for nearly 30% of all holdings. In fact, DGRW’s top three holdings are all technology stocks, with the largest ETF holding being Microsoft (MSFT), with a shareholding ratio of 7.69%. It is followed by Broadcom (AVGO) (4.22%) and Apple (AAPL) (4.11%). The ETF holds a total of 299 stocks, and the top 10 holdings account for 37.69% of the total investment portfolio.

Healthcare is the second largest holding, accounting for 17.48%. The third largest holding portfolio is industrial, accounting for 12.96%. Since the largest industry among them is technology, there are many growth companies that could drive further price appreciation.

wisdom Tree

Since most of the holdings are in the technology industry, this is why the dividend yield is at a low level, only 1.6%. For example, Microsoft’s dividend is only 0.75%, Apple’s dividend is only 0.57%, and Broadcom’s dividend is higher at 1.56%. Despite lower yields, the technology stocks in the portfolio consist of many companies with a history of consistent dividend growth. For example, here are some highlights:

- Microsoft has increased its dividend for nearly 20 consecutive years.

- Broadcom has increased its dividend for 13 consecutive years, with a compound annual growth rate of 19.25% over the past five years.

- Coca-Cola (KO) is the dividend king, having increased its dividend for 61 consecutive years.

While some of the companies they own have seen solid dividend growth, others have seen significant price action. Nvidia (NVDA) is the best example, with its stock price rising more than 2,380% in the past five years. Even if we look beyond technology, we can find examples of excellent growth. AbbVie (ABBV) in the Healthcare industry has seen its price increase by 130% over the past 5 years.

I think this fund is a better choice for investors who have time. If you don’t have an urgent need to generate income from your investments, DGRW is a good choice for accumulation investors who want exposure to capital appreciation and stable dividend growth companies. It really also depends on how you envision the next ten years. I believe technology will continue to grow and create abundant value for the world over the next decade, so I’m fully willing to build a position here and hold it for the long term. I recently published an article rating Microsoft a Strong Buy because I believe technology is likely to continue to grow over the next decade. So, let’s discuss some future catalysts that will help enable growth.

growth catalyst

Jerome Powell recently comfirmed The rate will remain unchanged for the near future but may change in the second half of this year. While inflation is getting closer to where it needs to be, I believe that as the tide turns we may see stock prices start to take off again. The Federal Reserve’s interest rate cuts have made borrowing cheaper for companies, which is particularly helpful for companies in the technology industry. This is because it can lead to increased investment in research and development, which will become increasingly important in the field of artificial intelligence.

Next, I believe lower interest rates can spur consumer spending. Interest rates are now higher, which encourages people to save more and spend less. Saving more is beneficial as one can earn higher interest in a savings account. However, lower interest rates don’t just affect big purchases like a home or car. They are also important because they lower the cost of borrowing money to buy small, everyday items like smartphones, laptops and other products for which people tend to pay back monthly. Increased consumer spending will lead to higher revenues for many of these consumer companies.

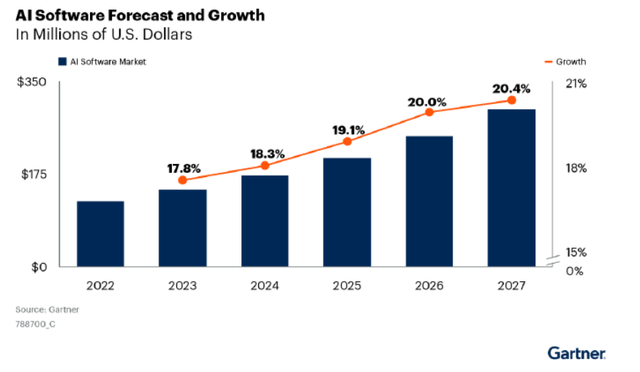

Gartner Corporation

Finally, I think artificial intelligence (AI) will continue to generate widespread interest and growth.By 2030, the artificial intelligence market will Expected By 2027, the market size will be approximately $297B. This means that from 2022 to 2027, the compound annual growth rate is expected to be 19.1%. Companies like NVDA, MSFT, CSCO, and many other technology companies are working to gain their fair share of the market growth within artificial intelligence.

Probably from Bloomberg It is even shown that the growth of generative AI will reach US$1.3T by 203, which means that the market is expected to grow at a compound annual growth rate of up to 42% in the next 10 years. As mentioned earlier, DGRW’s holdings are well-positioned to benefit from the artificial intelligence boom. Since inception, DGRW has outperformed the S&P500 (SPY) in total returns as well as SCHD, as a huge mix of technology stocks helped drive the gains. Given these catalysts, I believe this growth and outperformance will likely continue.

dividend

As of the latest declared dividend of $0.08 per share, the current dividend yield is approximately 1.6%. What stands out about DGRW is that dividends are paid monthly, which is great if you want dividends distributed to your account more frequently. Despite being a dividend-focused ETF, the dividend history here is rather patchy. While you pay dividends monthly, the monthly dividend amount will vary based on the performance of your portfolio.

wisdom Tree

In addition to lackluster dividend growth, you should also realize that your monthly distributions won’t be the same every month. Therefore, this fund is certainly not suitable for those who rely on their investment portfolio to generate a stable and predictable income stream. Therefore, I maintain that this ETF is best implemented by investors with a lot of time on their hands.

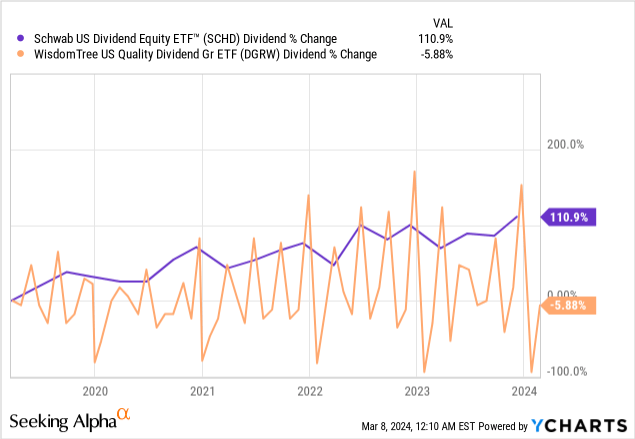

In comparison, SCHD’s dividend growth has been more stable. We can see that SCHD’s dividend grew by over 110% over the last 5 years, while DGRW’s dividend rebounded and eventually declined. Even over the longer 10-year period, SCHD’s dividends have grown at a CAGR of 11.39% and have achieved 12 consecutive years of dividend growth. If you want a growing stream of dividend income, SCHD is a better choice.

shortcoming

The risk here is how the technology performs over the next decade. I could be wrong and tech stocks could plummet in negative reaction to the rate cut. Additionally, AI demand may simply be a fad that fails to continue its recent momentum. Although it seems unlikely at the moment, the Fed is also likely to choose to raise interest rates, which would have a negative impact on the prices of technology stocks. So if you don’t believe that technology is likely to continue to grow, maybe SCHD is a better choice for you.

Additionally, while DGRW provides superior total returns, the ETF fails to achieve any significant dividend growth over time. DGRW has a lot of strong companies in its portfolio with a long history of dividend growth, so it’s surprising that dividend growth isn’t better. If you rely on income from your portfolio, DGRW is not a good choice for you, as the dividend yield remains subpar and growth is lackluster.

take away

While DGRW’s total return is better than that of peer ETFs like the S&P500 (SPY) and SCHD, the Dividend Growth ETF’s dividend growth has been lackluster. After all, that’s what we’re here for: dividend growth! If you need an immediate income stream from your investment, it’s better to invest your money elsewhere that offers greater dividend growth. For continued growing dividend income, SCHD is a good choice.

However, DGRW’s portfolio design will likely continue to outperform SCHD in terms of price appreciation due to different holding weights. DGRW is more focused on technology stocks and therefore invests in many growth companies such as Nvidia, Microsoft, Broadcom and Apple. If you truly believe technology is likely to continue to grow over the next decade, DGRW is a good choice. I believe catalysts such as the expected artificial intelligence boom, increased consumer spending, and falling interest rates will help deliver superior future returns.