Experience interior design

generalize

Readers can find my previous reports through this link. My previous rating was Hold because I believed in Armstrong World Industries (NYSE:AWI) will continue to face pressure from rising inflation and uncertain economic prospects.although For the initiatives implemented, I think it is difficult to assess the likelihood of success. As it turns out, I seriously underestimated the market’s softening of sentiment toward AWI as the stock surged all the way to its current level of $122. After reviewing the 4Q23 results, I have turned bullish on the business fundamentals; however, the valuation appears to have priced in all the upside (based on my FY25 estimates). Therefore, I reiterate my Hold rating.

Finance/Valuation

AWI reports strong 4Q23 results, EBITDA unexpectedly rises Performance. Total revenue increased 2.5% to $1.29 billion, driven by mineral fiber (MF) revenue of $220.3 million and construction specialties (AS) revenue of $92.0 million. Although the growth was modest, EBITDA margin expansion was unexpectedly strong, improving 130 basis points to 31.4% (vs. Q4 2022). This brings EBITDA performance in the fourth quarter of 2023 to US$98 million, an increase of approximately 7% compared with the same period last year.

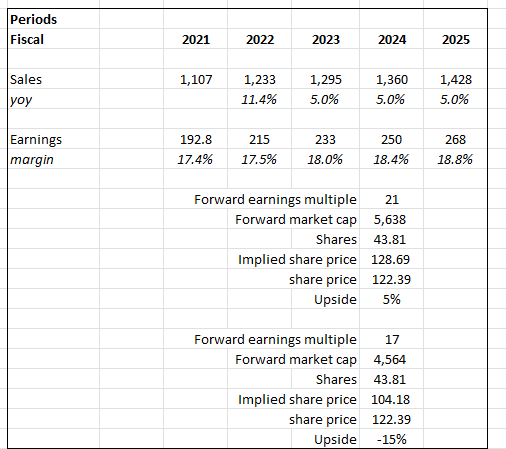

Based on the author’s own mathematical calculations

Based on my view of the business, AWI should have no problem continuing its current mid-single-digit growth rate, which is also in line with management’s guidance. With upward revisions to ARPU (from pricing normalization and positive mix shifts impacting sales growth), I think the prospects for margin expansion appear clear. Using management’s FY24 pre-tax profit and tax rate guidance, I was able to get back to FY24’s implied earnings guidance at the midpoint, which would imply ~40 basis points of margin expansion. I expect the same expansion in fiscal 2025, continuing the trend of about 40 basis points expansion over the past two years. The problem is AWI’s current trading valuation. In the past, AWI has tended to trade in a forward P/E range of 15x to 20x, and that range has remained constant over the past decade. If we look at the pre-COVID charts, every time AWI breached 20x, always Mean reversion, or at least downward pressure, will occur within a few months. The only anomaly was during the COVID-19 pandemic, when the multiple was as high as 26 times. If we put aside the COVID-19 pandemic, the trend in AWI valuations over the past few months has been almost identical to the surge between late 2018 and mid-2019, culminating in mean reversion in less than a year. Assuming that happens this time and AWI trades at 15x, the stock has room for a 15% downside. Even if it remains at 21 times, the upside potential is limited to 5%.

Comment

AWI’s performance in both areas is very promising. Sustained demand across channels in end markets, increased discretionary spending and successful execution of organic plans in recent years contributed to the MF segment’s sales resilience in the fourth quarter. As a result, Healthy Spaces delivered double-digit sales growth in 2023 as its use expanded beyond the healthcare industry, and Kanopi’s fourth-quarter EBITDA was positive. Although new construction starts are expected to remain flat in 2024 due to the longer construction periods of these projects, the impact will be compensated for through pricing, which is expected to return to the historical pattern of mid-single-digit growth. Please note that February’s price increases have already begun. In addition to a return to normal pricing growth, mixed pricing growth should be driven by a shift in product mix away from retail inventory with lower ASPs.

Yes, we are returning to our normal rhythm of two price increases per year. Again, remember, AUV is both the price, the like-for-like pricing from those two price increases that you cited, and the mix component of that, so we talked about it earlier on the call, we expect the mix to be what AUV does this year made a positive contribution.Source: 4Q23 Earnings

As far as the AS space is concerned, this year should see healthy new construction and a continuation of successful company initiatives across all verticals. Management mentioned during the conference call that airports will receive $9 billion in 2024 from the Infrastructure Investment and Jobs Act of 2021, which will boost demand in the transportation sector. They also mentioned that recent wins, such as the Pittsburgh Airport, will begin delivery in the first quarter of this year. As consumers come to realize the value of Armstrong’s comprehensive lineup of products and services, the segment should also see pricing advantages. Additionally, as returns from AWI’s recent investment in SG&A materialize, the company should experience strong operating leverage.

Through the bipartisan Infrastructure Act passed in 2021, approximately $15 billion in federal funds have been earmarked for airport infrastructure development, with $9 billion allocated through 2024.Source: Q4 2023 Earnings

We’ve discussed our big win at Pittsburgh Airport before, but we’ve also recently had job opportunities at Seattle-Tacoma and El Paso.Source: Q2 2023 Earnings

All in all, I believe the recent performance is positive for the business outlook. Increased demand for Kanopi and Healthy Spaces has contributed to recent gains in Mineral Fiber shares, suggesting the end market may stabilize this year, while stable pricing and productivity advantages should keep profits growing amid easing inflation. Strong P&L performance is expected to enable AWI to generate solid free cash flow (expected to grow 14%). Management believes that returning capital to shareholders, completing mergers and acquisitions, and investing internally are top priorities. Share buybacks have accounted for about 50% of capital allocations over the past two years so far, and given the lack of good M&A deals, I expect this trend to continue. The good news is that AWI notes an active M&A pipeline, and based on the recent record of M&A in the AS space (which has resulted in growth), I think management should allocate more cash to M&A rather than stock repurchases.

in conclusion

Despite improving business fundamentals, I reiterate my Hold rating on AWI due to unattractive valuations. Fundamentally, AWI delivered solid revenue growth and surprising EBITDA margin expansion in the fourth quarter of 2023. Management’s guidance points to continued mid-single-digit revenue growth and margin expansion in fiscal 2024 and 2025. However, the current share price already reflects AWI’s potential future growth and margin improvement. AWI’s historical P/E ratio ranges from 15x to 20x, and its current valuation is near the upper end of that range. As a result, potential upside is limited, while there is a risk of price decline if shares return to historical valuation ranges.