stevanovicigor/iStock via Getty Images

introduce

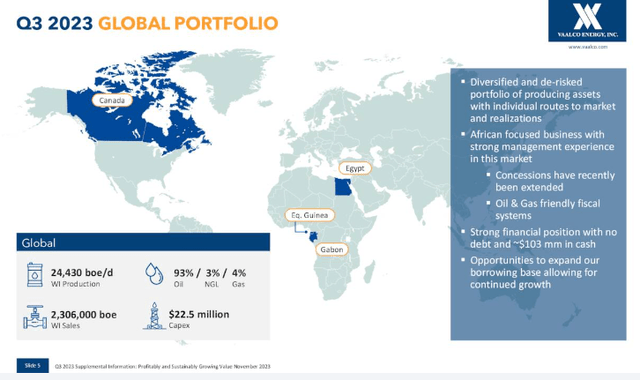

VAALCO ENERGY COMPANY (NYSE:ONE) is a small oil and gas company primarily located in West Africa, with its main production interests in Egypt and Gabon. We discussed EGY once before.It has long-term development prospect Offshore Equatorial Guinea, with the discovery of Blk-P and Venus, the first oil is targeted for 2026. It also has a small presence in Canada’s Cardium/Ellerslie field.The positions of Egypt and Canada are due to Merge with TransGlobe 2022.

VAALCO Price Chart (Seeking Alpha)

As of the third quarter of 2023, Egypt’s total production reached 24,430 BOEPD, with fourth-quarter guidance of 23,950 BOEPD.analysts are Optimistic about ONE Give it a buy rating and a target price of $7.25-$10.00. Either scenario would result in substantial growth from current discount levels.

EGY to report fourth quarter and full-year 2023 results March 14th. Let’s review what The company told us in its forecasts for the third and fourth quarters of 2023, let’s see how we stack up against analysts’ forecasts.

Fundamentals of VAALCO ENERGY

VAALCO has long been primarily a single-asset company with offshore production from the Etame field in Gabon waters. This makes its revenue and profit betas high, making strategic investments difficult. In particular, as I noted in my last report, they appear to lack understanding of shallow water completion operations. (As with most things, it’s better to get things right the first time rather than fix them later.) The 2022 merger with TransGlobe solves a lot of problems, brings new production to the combined company, and A more diversified asset base has been achieved.

VAALCO Global Portfolio (VAALCO Energy)

Since acquiring TransGlobe, EGY has been increasing dividends and stock repurchases due to its expanded asset base and expanded cash flow generation capabilities. So far in 2023, they will generate nearly $90 million in free cash flow. To date, EGY has returned 41% of this amount directly to shareholders. EGY also fully funded net capital expenditures of $22.5 million in the third quarter on a cash basis.

The company has no debt and expects to control capital spending in 2024, with capital spending falling sharply in the fourth quarter. Capital expenditures should be $9 million and $12 million this quarter, respectively, which will increase free cash flow.

Egypt has introduced hedging measures to protect cash flow while leaving room for higher product prices. A no-cost collar was implemented in Q4 2023 and a no-cost oil collar indexed to Brent crude oil has been contracted for Q1 and Q2 2024. The base price of these collars is $65, which accounts for about 15% of their production, and the collars have room to go up to between $90 and $100. 85% of their production is not hedged against rising commodity prices.

The company has several growth centers that will compete for capital this year.

Egypt

The 2023 campaign was completed faster and at a lower cost than initially forecast. In 2023, they drilled 18 vertical wells, including one injection well and two exploration wells, as well as one horizontal well.

They see a significant acceleration in drilling performance in 2023, from an average of three wells drilled every four months in 2022 to now drilling two wells per month, a 60% improvement in cycle time. Faster wells also reduce costs and improve economics. The company believes Egypt has significant and valuable organic drilling opportunities.

Canada

In Canada, two wells were drilled in the first quarter of 2023, a 1.5-mile lateral and a 3-mile lateral. The wells began production in May with good production rates, and pumps and rods were installed on both wells in early July. Both wells have exceeded production expectations and their long-term performance is currently being monitored.

Future plans will be to move almost entirely to 2.5 mile and 3 mile spur lines which we believe will further enhance the economics of our development programme. Canada also set a production record in 2023, which is another reason why our company is performing so well and exceeding production targets.

The company is evaluating facility and platform optimization, future development wells, and further refining its completions technology for potential future drilling activity in Canada.

Gabon

After intense activity in 21/22, drilling activity fell into a lull in 2023. Although there are no drilling plans for 2023, 2023 production performance remains strong.

Last year’s FSO and site reconfiguration projects enabled the company to operate more efficiently and cost-effectively in 2023. The cost savings from the new FSO will help offset some of the other higher costs resulting from inflation and industry supply pressures.

EGY is currently evaluating locations for the next drilling campaign at Etame, with the project currently expected to be a three- to four-well program, with options for additional wells. EGY continues to review rig options for our 2024 drilling program.

Then there’s Cote d’Ivoire.

Côte d’Ivoire-Egypt Catalyst

this Swedish acquisition Production increased immediately, with 99% of oil production increasing by approximately 4,500 BOPD. The one-time growth was about 19% or more, and EBITDA also increased accordingly. The Svenska pickup also has future prospects, thanks to the infrastructure included in the deal. West African production received Brent pricing, further increasing netbacks.

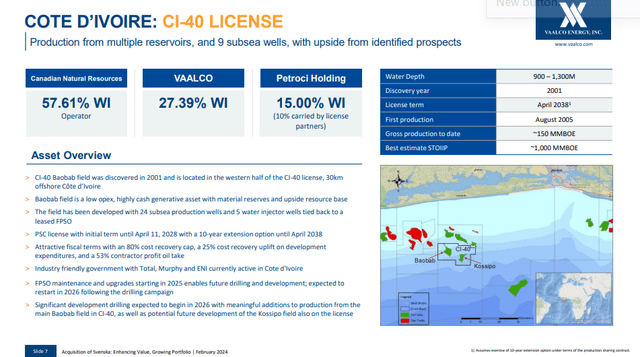

VAALCO Côte d’Ivoire (VAALCO Energy)

Svenska’s main asset is a 27.39% non-operating interest in the deepwater producing Baobab field located in the CI-40 block offshore Côte d’Ivoire, West Africa. Canadian Natural Resources (CNQ) is the operator.

The purchase price is $66.5 million, with an effective date of October 1, 2023. The total purchase price will be partially funded by pre-closing cash dividends paid to the seller on Svenska’s balance sheet, and the remainder by VAALCO’s partial cash – existing, no debt or equity issuance. VAALCO currently estimates net cash at closing will be in the range of approximately $30 million to $40 million, depending on the timing of the expected second quarter of 2024.

risk

Companies focused on West Africa are exposed to some additional political risks that may arise unexpectedly. That was the case last year, when a military coup in Gabon overthrew the previous government.As this article describes, Egypt appears to have completed the transition without major damage SP Global Report.

your takeaway

VAALCO Energy, Inc. trades at 2.87x EV/EBITDA and a flowing price of $30,000 per barrel, both of which set solid buy targets for the company. This was before the Svenska acquisition impacted the balance sheet. If you combine these numbers with ratios, they drop to 2.15x and $26k respectively. Too cheap for a company with no debt and no growth prospects.

Analysts have some ambitious price targets for the stock, which could be achieved in several areas. Increased revenue and profits from higher oil prices and lower capital expenditures in the coming quarters could push full-year EBITDA to $380. If this figure were to be magnified three times, Egypt’s total capital would become $1,114 billion. There were 106 mm shares outstanding, which would fetch a share price of $10.75, which was slightly higher than analysts’ forecasts.

Egypt has a long and successful operating record and a strong balance sheet. Cash flow covers dividends and capital expenditures, and the schedule for 2024 appears to maintain the outlook for this year. I think I agree with the analysts and give the company a Buy rating at current levels.