JHVE photos

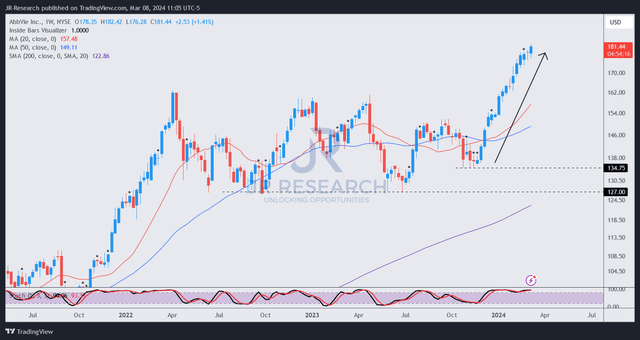

I underestimated biopharmaceutical companies AbbVie (NYSE:ABBV) the ability to overcome near- and medium-term headwinds posed by Humira’s LOE. My last update in late November 2023 assessed ABBV’s risk/reward balance. but, The hold/neutral argument turns out to be overly cautious. I expect selling pressure to intensify, possibly leading to a drop to support at $130 before a bottom is reached.

However, the market has spoken. ABBV buyers returned with confidence, helping the stock form a resilient bottom near the $130 area in November. AbbVie fourth quarter earnings report Product launches in February 2024 may validate the market’s optimism as AbbVie demonstrates its ability to advance its former Humira growth portfolio.

As a result, AbbVie reported 8% revenue growth for its former Humira portfolio in FY23. In the fourth quarter, AbbVie grew 15%.Therefore, I assess that AbbVie has proven its long-term While investors looked past the headwinds from Humira’s LOE, they looked ahead to the outlook.Management emphasizes AbbVie’s “diversified growth platform Successfully absorbed “the largest loss of exclusivity in the industry”.

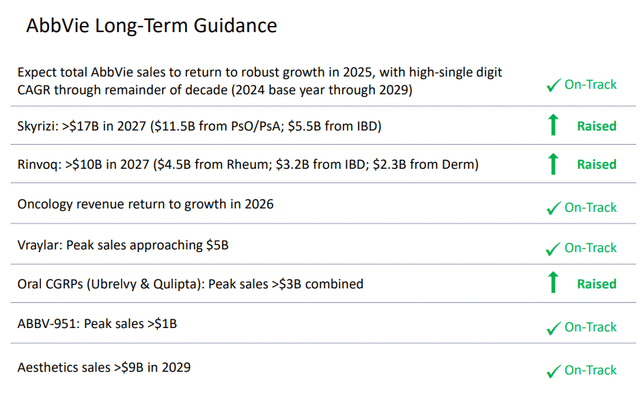

AbbVie achieved excellent metrics with Skyrizi and Rinvoq, with fiscal 2023 revenue growing 52% and 63%, respectively. In addition, AbbVie also raised the long-term outlook for the two blockbusters, with combined annualized sales likely to hit a high of $27B by 2027, $6B higher than AbbVie’s previous guidance.As a result, it is expected to pass Humira tops sales at $21B The breakthrough in 2022 demonstrates AbbVie’s ability to effectively manage Humira’s LOE.

AbbVie long-term guidance (AbbVie filing)

Additionally, management assured investors AbbVie upgrades long-term guide. Recent acquisitions of ImmunoGen and Cerevel have also contributed to the company’s revenue trajectory and reduced execution risk. Management emphasized that its long-term outlook takes into account recent acquisitions. As a result, AbbVie reported fiscal 2024 midpoint adjusted earnings per share of $11.15. Analyst estimates suggest AbbVie’s outlook may be conservative, as they forecast adjusted earnings per share of $11.21.

Additionally, AbbVie maintained its long-term revenue guidance of high-single-digit revenue compound annual growth through 2029. AbbVie has yet to significantly upgrade its long-term outlook. However, given AbbVie’s solid performance and strong guidance from the former Humira portfolio, I believe the market has lowered its assessment of AbbVie’s execution risk. Therefore, I think it’s reasonable for the market to re-evaluate ABBV’s P/E ratio, given the higher income visibility from its growth portfolio.

ABBV’s forward adjusted EBITDA valuation is 14x, well above its 10-year average of 10.6x. In other words, the market quickly reflected optimism about its long-term potential and repriced it. In my previous update, I should have been more optimistic about AbbVie’s ability to overcome Humira’s LOE risk. Still, I wouldn’t suddenly start chasing ABBV’s momentum out of FOMO. ABBV should remain a core player in a diversified portfolio of healthcare investors. However, investors must remain cautious as they chase its recent surge, as ABBV appears to be getting higher and higher.

ABBV price chart (weekly, interim, dividend adjustments) (Trading View)

Income investors may focus on ABBV’s relatively attractive forward dividend yield of 3.4%. However, ABBV’s 5-year total return CAGR of 23.8% should let investors know that ABBV is primarily a capital appreciation company. There’s no question that AbbVie is a high-quality, fundamentally strong healthcare stock with a top-notch “A+” Earnings Rating. Furthermore, with ABBV surging to new highs and resuming its long-term uptrend, I’m getting no red flags suggesting investors should consider cutting their exposure.

In other words, investors who missed out on AbbVie’s sharp decline should consider evaluating its subsequent pullback while patiently awaiting another opportunity to add to their positions.

Rating: Maintain Hold.

IMPORTANT NOTE: Investors are reminded to conduct due diligence and not to rely on the information provided as financial advice. Please always think for yourself. Please note that ratings are not intended to refer to specific entry/exit times at the time of this writing unless otherwise stated.

I want to contact you

Have constructive comments to improve our paper? Spot a critical gap in our perspective? See something important we didn’t? Agree or disagree? Leave a comment below to help everyone in the community learn better!