3 Alex de

electric car (NASDAQ: EVGO) reported that revenue in the fourth quarter of 2023 was significantly strong, with revenue increasing by 42% quarter-on-quarter, which is a strong continuation of its upward trend.Management appears very optimistic about the scale effects of the company’s business model, which includes the installation of charging stations It is said to cover operating costs after deducting company costs. Despite the optimism, I believe that, at least in the short term, the current macro headwinds are likely to have an adverse impact on EVgo as consumers continue to deal with high inflation, a new wave of corporate layoffs, and a shift in consumer preferences toward plug-in hybrid vehicles. . in hybrid cars. I maintain my sell recommendation on EVGO stock with a price target of $2.31 per share and an average TTM price/sales multiple of 1.48x.

macroeconomics

Looking at the economy from a macro perspective, the underlying data is not as strong as it actually is Be in the headlines.one factor is Simplify investor Mike Green The asset manager mentioned in the podcast Macrovoices that the unemployment rate may be artificially low due to the trade-off between being unemployed and driving ride-sharing services such as Uber (Uber) and Lyft (Blessing). He believes this will be good for the company in the short term because more drivers will be available. He went on to say that in the long term, as more layoffs occur and more drivers emerge, this parity becomes a negative factor, resulting in more drivers than passengers. Looking ahead to the most recent ISM Services PMI reading for February 2024:

As concerns about the economy remain top of mind, employers remain cautious about hiring direct employees and are considering utilizing contract workers to meet project and temporary work needs.

Another comment by Jim Bianco on the same podcast Mentioning that high inflation may not be over yet, the Federal Reserve may not cut interest rates because of this.

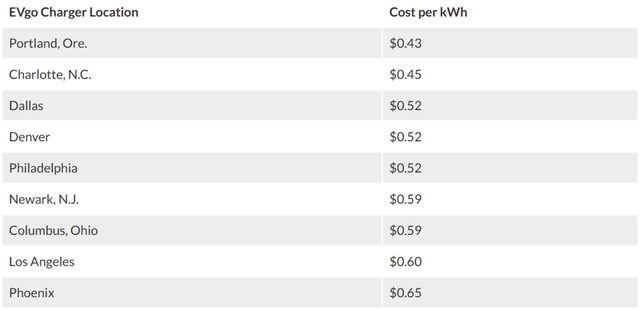

Other impacts on EV adoption include insurance premiums for EV owners. According to MarketWatch, insuring an electric vehicle costs 10-135% more than insuring a traditional internal combustion engine vehicle. In addition to this, fuel costs for electric vehicles can be much higher compared to internal combustion engine vehicles. Using data from the same MarketWatch report, EV charging ranges from $0.43-0.65/kWh.and Electric vehicle battery capacity The Mini Cooper SE and 2022 GMC Hummer electric pickups are available in power ranges from 28.9kWh to 200kWh respectively, and filling them up does increase the cost. Using the Hummer as an example, filling an empty vehicle to capacity could cost between $86 and $136 in remote vehicle charges using this charging cost range. Additionally, regarding the Hummer, Edmunds reports the 2023 model has a range of 390 miles and a fuel efficiency of 57.8 kWh/100 miles.

According to this, the average daily commute time for U.S. citizens is 40 miles per person Bureau of Transportation Statistics. Although this data is outdated, and the statistics of working from home vs. working in the office and working in the city vs. suburban areas may have changed since this report was published, I believe it can continue to serve as a baseline for the example. Taking into account charging costs, distance, and average commuting costs, Hummer EV owners could be paying more than $23.12 for their daily commute! Although this example is on the more extreme side in terms of fuel economy and charging rates, I believe it provides an eye-opening example of how the costs associated with owning an EV can be overlooked by first-time EV buyers , and I believe this group of people will consider these factors when buying their next car.

market observation

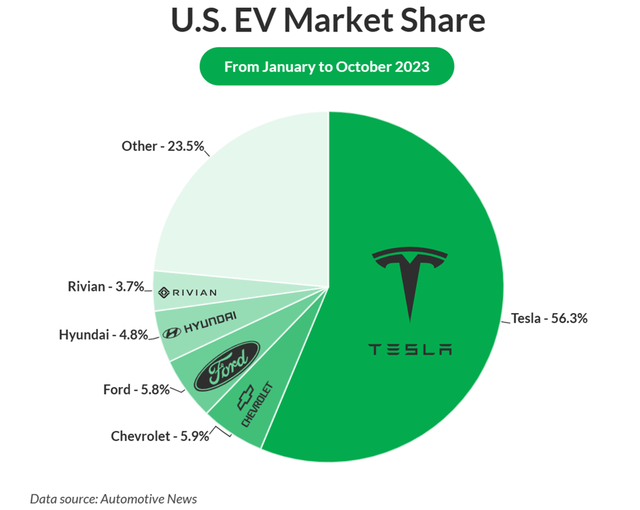

Another factor that may challenge EVgo’s growth is the US electric vehicle market share. Tesla (TSLA) remains the top electric car on the road.

market observation

I believe the last two points related to fuel costs and market share will play a large role in EVgo’s growth trajectory, as the company relies heavily on non-Tesla EV adoption. I have no doubt that adoption in other vehicles will continue. My concern is adoption and whether owners will cater to EVgo’s public charging stations, or whether consumers will charge their vehicles at work or home.

My takeaway from the Q4’23 earnings call is that a large portion of EVgo’s demand will come from rideshare drivers. I believe this will be a driver of revenue as I believe drivers would prefer to stay on the road during the day rather than being forced to go home to charge their vehicles. I believe this could also increase demand for fast charging stations, assuming EV drivers choose to stay on the road between passengers. My biggest concern is that fast charging will shorten the life of the battery, which I mentioned in a previous EVgo report, and the battery is said to be one of the most expensive components in an electric vehicle. Unlike internal combustion vehicles, which cost hundreds of dollars to replace batteries, electric vehicle batteries can cost between $5,000 and $15,000. According to Edmunds. Along with higher fuel costs and longer than an hour of charging time, I don’t see a strong reason for rideshare drivers to purposefully use electric vehicles. What I mean is that someone who wants to be a driver may not choose to buy an electric car just to get commuters to take rides, as opposed to someone who owns an electric car to drive on the side or between jobs.

Break this, According to ridesharing experts, Uber drivers earn an average of $15-20 per hour. Making the simple baseline assumption that the driver makes the most of the hour at 35 miles per hour, the Hummer costs about $20.23 per hour. Again, this is an extreme case of higher vehicle costs, but the point remains that without accounting for wear and tear, the average fuel cost of a vehicle can significantly eat into a driver’s profit. With this factor in mind, I think the case for mass adoption of shared EV drivers, barring some corporate or government intervention, is widely exaggerated.

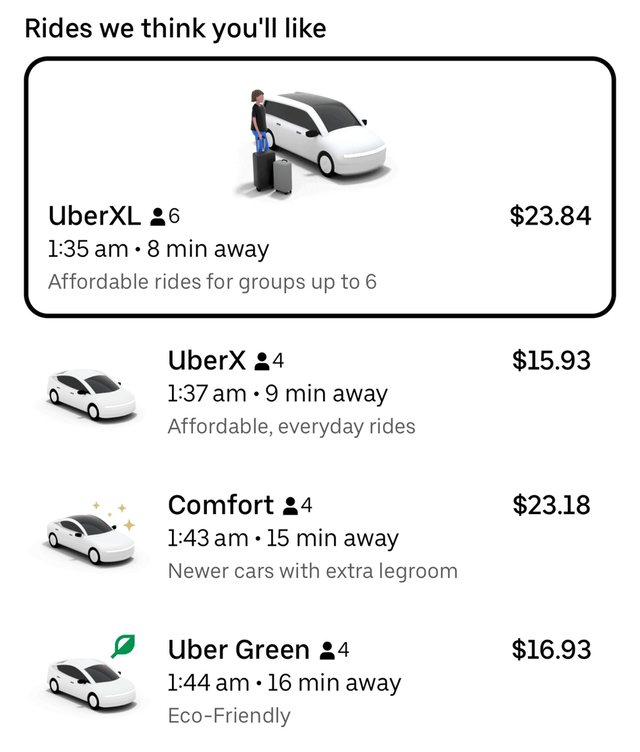

Management did find that, on average, EV drivers using ridesharing apps receive a 5x premium; however, opening my app and searching for a common destination, the cost seemed to be higher regardless of whether I took an eco-friendly ride or not All relatively stable. After discounting peak pricing and the additional cost to drivers, demand for eco-friendly rides may further eat into the cost of electric vehicle sharing drivers. While this is good for EVgo as the company acts as an electric vehicle power company, this could be a major deterrent to drivers.

Uber

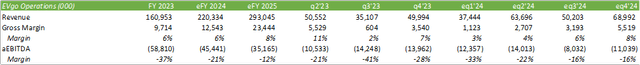

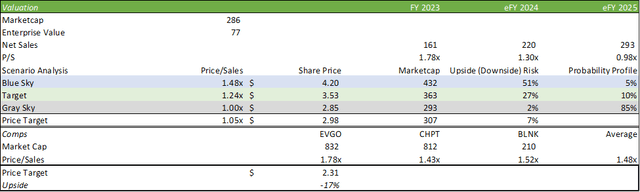

For these reasons, I model EVgo’s fiscal 2024 eFY revenue guidance at the lower end of $220. Even at that number, I think it’s very optimistic as it relates to EV adoption and what’s going on with public charging.

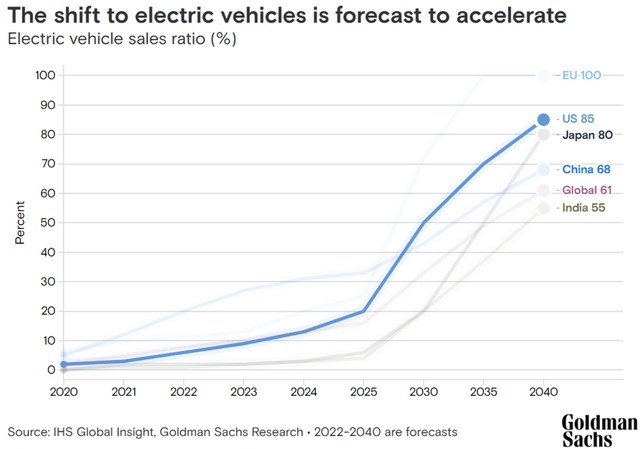

One factor that I do think is valuable is that, assuming an average utilization rate of 19% in fiscal 2023, the company has the potential to hit certain profitability numbers as the charging stations scale. Management has discovered that operating ground-based charging stations can be profitable, which is a hopeful factor.Overall, I don’t expect EVgo to be profitable anytime soon, and probably won’t be profitable until 2030 or longer, because Goldman Sachs Analyst Electric vehicle adoption is expected to really start to take off in the United States during 2025-2026.

Goldman Sachs

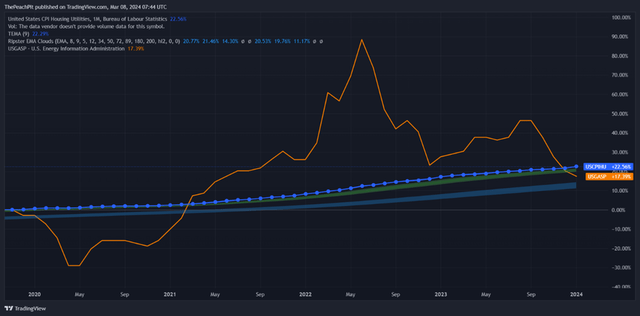

Considering that gasoline prices and utility costs have increased at relatively similar rates since 2020, weighing the difference in vehicle adoption may be a mild argument, assuming fuel economy is one-to-one between hourly and kilowatt hours.

trading view

In terms of other related costs that may affect adoption, I think financing costs may play an important role in EV adoption because domestic The average selling price of electric vehicles tends to be A $10,000 premium over an ICE vehicle. From the perspective of loan interest rates, Bank rates are currently reporting Car loan interest rates range from 6.84-15%.

finance

company report

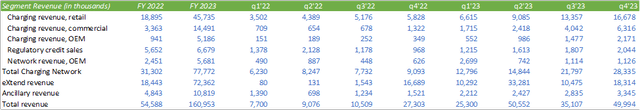

EVgo’s revenue grew across all segments, with the commercial segment growing 56% quarter-over-quarter. EVgo should be able to sustain this level of revenue growth as more consumer and commercial vehicles take to the road. According to CarEdgeIn the fourth quarter of 2023, electric vehicle sales accounted for 8.1% of total vehicle sales, and total electric vehicle sales in 2023 reached 1.19 mm.

Management expects EBITDA to break even in fiscal 2025 through EV VIO’s growth and wider adoption and utilization of the network. Management found that it is strategically targeting new regions to maximize utilization and expects to install 800-900 new stalls in fiscal 2024. Customer adoption has grown significantly across the network, with the number of customer accounts reaching 884,000 as of fiscal 2023. The average daily throughput per gear in December 2023 is 200kWh, equivalent to one 2023 Hummer electric vehicle per day.

company report

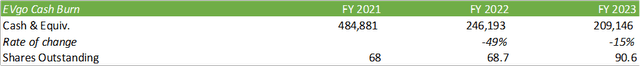

On top of this, EVgo’s cash position is shrinking and its share count is significantly diluted. I do expect cash burn to slow as the company gets closer to profitability, and I don’t think solvency is a concern.

company report

Valuation and shareholder value

company report

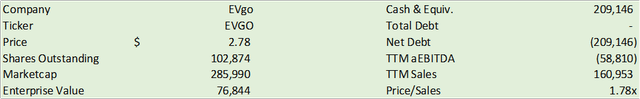

EVGO shares are currently trading at 1.78 times fiscal 2023 sales. Valuing EVGO stock will pose a challenge as its forward valuation appears attractive; however, EVGO stock is priced at a premium on a comparable basis. Using the above macro narrative as a guide, I would recommend being more bearish on EVGO stock, as I expect the company’s profitability to be lower than expected and hit the low end of revenue guidance.

company report

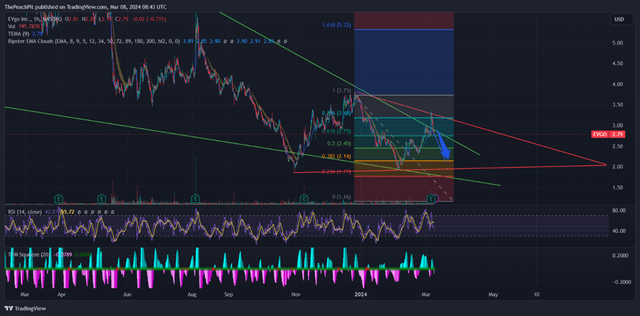

Technical charts suggest the stock is experiencing a turning point. I can see three pricing floors for the stock, one pricing around $2.16 and one pricing around $1.95, with the bottom floor pricing around $1.71. Given the downward trend in pricing data using the Ripster EMA Cloud and RSI, I think EVGO stock is likely to continue this downward trend in the near term. I believe any signs of general economic strength that could lead to continued high interest rates and an easing consumer market could challenge EVgo’s story. The upside risk is very likely, as EVgo could fight back and report stronger-than-expected revenue growth and margins. I believe that given the current valuation, any good news for EVgo will release the tight springs and will result in significant upside risk to the stock price. I believe analysts and traders focus most on signs of profitability before rewarding shareholders. I maintain my sell recommendation with a price target of $2.31 per share.

trading view