Urupong/iStock via Getty Images

This is my second Ultragenyx (Nasdaq: Rare) article, following the “Downward trajectory likely to continue” (“Trajectory”) of 09/2022. At Trajectory, I acknowledge that it has several clear appeals; nevertheless, I rate it a Sell based on the downward trend in its stock price It lacked a near-turnaround catalyst to reverse its trajectory.

As it turns out, this wasn’t a wise decision. Ultragenyx has gained about 9% in that period, which is a decent return, although it lags behind the S&P’s stronger return of about 28%. In this article, I evaluate the forward merits of Ultragenyx in 2024 as of its fourth-quarter 2023 earnings release on February 15, 2024 (the “Release”), earnings conference call (the “Calling”) and 10 As revealed in Q4 earnings. -K (“10-K”).

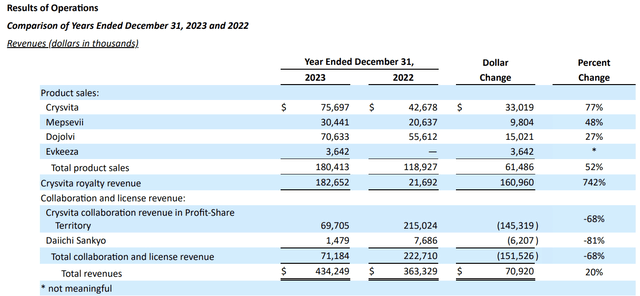

In 2023, Ultragenyx’s revenue sources will show diversified growth.

General

The 10-K sets forth the following table showing segmented revenue for 2022 By 2023:

Seeking Alpha.com

product revenue

Its three main products, Crysvita, Mepsevii and Dojolvi, show a good pattern of sales growth. The following excerpt from Locus provides a brief overview of these therapies:

- Crysvita (burosumab), an antibody against fibroblast growth factor 23, is used to treat X-linked hypophosphatemia (XLH). The FDA approved it on 04/2018 and 06/2022 for the treatment of tumor-induced osteomalacia in XLH. Symptoms (TIO);

- Mepsevii (VESTRONIDASE ALFA) is an enzyme replacement therapy used to treat children and adults with mucopolysaccharidosis VII (Sly syndrome) and was first approved by the FDA in November 2017;

- Dojolvi (UX007/TRIHEPTANOIN) FDA approved on 06/2020 for the treatment of long-chain fatty acid oxidation disorder (LC-FAOD).

Each of these diseases is extremely rare. The prevalence of XLH is estimated to be approximately 1:20,000 births; TIO is idea There are approximately 1,000 cases worldwide. The prevalence of Flirty Syndrome is approximately 1:250,000 births; the incidence of LC-FAOD is approximately 1:7,500 changing Individual prevalence.

EVKEEZA product revenue

EVKEEZA (Evinacumab) is a new member of Ultragenyx.supergene acquired Acquired ex-U.S. commercialization rights to EVKEEZA from Regeneron (REGN) in January 2022. EVKEEZA is approved in the United States and United Kingdom as a first-in-class treatment for the treatment of homozygous familial hypercholesterolemia (HoFH) in adults and adolescents 12 years and older.

While I think the ex-U.S. deal is destined to be pointless, Ultragenyx is pursuing its opportunity with all its might. During the 2023 fourth quarter earnings conference call (the “Conference Call”), CCO Harris made recommendations regarding the following developments for EVKEEZA:

- The European Commission approved the expanded indication of Evkeeza for use in children 5 years and older with HoFH;

- Positive recommendations from two Canadian health technology assessment agencies leading to Canadian approval;

- Approved in Japan in January 2024, pricing negotiations are ongoing, and launch in Japan is expected in the second quarter of 2024.

With these achievements and planned marketing initiatives, EVKEEZA is expected to join Crysvita and Dojolvi as its top product revenue generators

financial guidance

During the call, Ultragenyx provided helpful financial guidance, including the following:

- Net cash used in operations is expected to be less than $400 million in 2024;

- Total revenue is expected to be between $500 million and $530 million, an increase of 15% to 22% from 2023;

- Ultragenyx’s Crysvita revenue is expected to be in the range of $375 million to $400 million across all regions and all forms;

-

Dojolvi revenue is expected to be in the range of $75 million to $80 million, growing 63% to 13% compared to 2023 based on faster growth in countries where it is commercialized and lower growth in countries where it is responding to patient demand comprehensive consideration.

Ultragenyx does not provide specific guidance regarding Mepsevii or EVKEEZA. Obviously, these two products are constantly changing, and EVKEEZA is expected to surpass Mepsevii and become one of Ultragenyx’s top three revenue products. There were no comments, pro or con, about Mepsevii on the call.

The conference call did indicate that Ultragenyx had $777 million in cash, cash equivalents and marketable securities as of December 31, 2023.

Ultragenyx has ample liquidity in the near term.

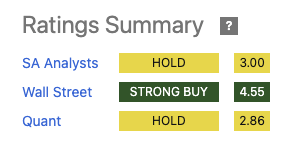

Ultragenyx is a commercial-stage pharmaceutical company with a history of losing money and expects this loss to continue for the foreseeable future. As of December 31, 2023, its cumulative deficit was approximately $3.4 billion. Its Seeking Alpha ratings summary panel includes a not-atypical rating distribution, as follows:

Seeking Aloha Website

The 20 Wall Street analysts covering the stock are enthusiastic. As I wrote on March 8, 2024, it was trading at about $51, and their average price target was about $90, with upside potential of about 76%. Its market high was $140; I later decided that was out of range, although if it was priced for a buyout, who knows?

The company Ultragenyx is a money-losing machine. Therefore, 10-Ks will continue this trend for the foreseeable future. Its mid-point 2024 revenue guidance is $515 million. Chief Financial Officer Horn said on the conference call that the company will spend $1 billion in 2023.

Net cash burn is expected to be $400 million in 2024; assets will reach $377 million by the end of 2024. That means it needs to raise cash by the second half of 2025.

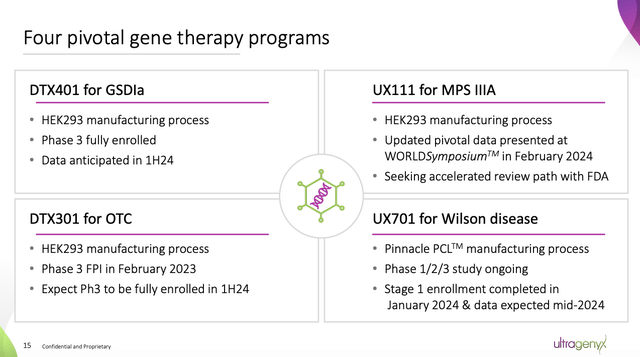

It has some late-stage projects.

Ultragenyx has good grouping of key projects in pilot development as shown on Slide 15 of 02/2024 Promotional meeting the following:

ir.ultragenyx.com

The conference call confirmed the above data for DTX401 expected in the second quarter of 2024. It gave no further timetable.

As for UX111, referred to as UX-111 on the call, it primarily addressed the viability of its Phase 3 agent endpoints, stating:

… We share results demonstrating that UX-111 treatment results in a rapid and sustained decrease in cerebrospinal fluid acetylheparin sulfate levels, and that sustained reductions in cerebrospinal fluid acetylheparin sulfate exposure are associated with long-term cognitive development over time. Improvement related. We are in discussions with the FDA about an accelerated approval pathway and we continue to believe there is a strong rationale for this plan.

As for the DTX301, Call did not provide any discussion. The 10-K provides:

- Approximately 10,000 people worldwide have this disease;

- its Orphan Drug designation in the U.S. and EU and Fast Track designation in the U.S.; and

- Its administration method is a one-time intravenous infusion. It is conducting a 64-week Phase 3 study and is expected to complete enrollment in the first half of 2024.

at ClinicalTrials.gov, NCT05345171 Reference “Clinical study of DTX301 AAV-mediated gene transfer in the treatment of ornithine transaminase (OTC) deficiency”. The trial has an estimated primary completion date of 12/2024 and an estimated study completion date of 12/2028.

Related UX701 for Ultragynyx in Wilson’s Disease on clinicaltrials.gov, NCT04884815 It’s a tricky trial, and the official title is:

Randomized, double-blind, placebo-controlled, multicenter, seamless, adaptable, safety, dose-finding and phase 3 clinical study of UX701 AAV-mediated gene transfer for the treatment of Wilson’s disease

The estimated preliminary completion date is 08/2028, and the estimated study completion date is 11/2031. Obviously, this will take some time to impact revenue.

in conclusion

Ultragenyx has had great success in bringing its therapies into experimental development and FDA approval. Still, it didn’t succeed in carving a path to financial success. I rate the stock a Hold.