Darren 415

I wrote about rural farms last time (NASDAQ:VFF) in August, following their second-quarter report. The stock has retreated after a recent surge.It’s a bit lower now than when I wrote this article, and I’d say it’s still cheap..

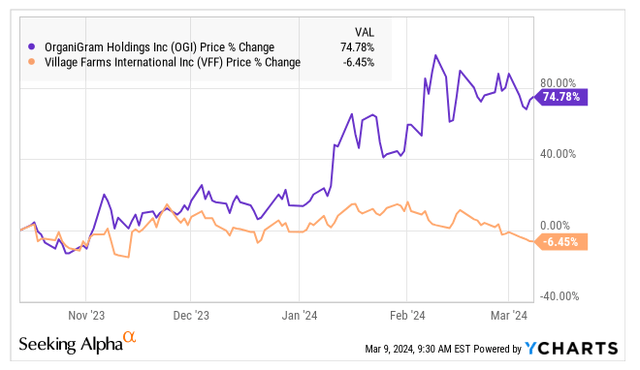

During the fourth quarter, Seeking Alpha hosted a value stock competition. I could have chosen Village Farms, but I chose Organigram (OGI), which was $1.15 at the time. I described why this stock is a great stock for value investors. it is! Organigram has rebounded above $2. Here’s what VFF and OGI have done since I shared this article in mid-October:

Y chart

In 2024, OGI is up 54%, while VFF is down 6%. Currently, I don’t own any Organigram in the model portfolio I share with my investment team, but I own a lot of rural farms.

Before Season 4 In Wednesday’s report, I will provide an updated view on the stock, which is currently the largest position in my model portfolio at 19%. On Friday I had it up 14% to $0.73.

Country Farm 2023

Village Farms reported third-quarter results in early November. The company’s overall sales were down slightly from the same period last year, but adjusted EBITDA was higher than expected. Overall revenue fell 6% in the first three quarters. Overall operating loss dropped significantly to $9.3 million. Excluding joint venture impairments and write-offs in 2022, operating loss at that time was $34 million.

In the third quarter, Canadian cannabis business revenue fell 5% from the same period last year. In the first three quarters, its revenue was slightly higher, accounting for 39% of overall revenue. Gross profit margin was US$29.1 million, accounting for 76% of the overall gross profit margin. Adjusted EBITDA was $13.3 million, accounting for 152% of total adjusted EBITDA.

One of the highlights of the third quarter was the significant improvement in operating cash flow to $12.1 million. Year-to-date, the figure is $6.8 million, a significant improvement from $13.3 million in the first three quarters of 2022. Free cash flow, after deducting $4.4 million in purchases of property and equipment, was $2.4 million.

Analysts expect fourth-quarter revenue to be flat at $70 million and adjusted EBITDA at $3 million, according to Sentieo. They expect the company’s full-year revenue to be $281 million, down 4%, and adjusted EBITDA to be $11 million, a significant increase from 2022, when the company’s adjusted EBITDA was -$21 million. While projected revenue is lower than the $288 million expected when I wrote this article in October, the adjusted EBITDA forecast has surged from $4 million.

Prospects for rural farms

Five analysts expect overall revenue to grow 7% in 2024, reaching $300 million. Adjusted EBITDA is expected to grow 29% to $14 million. In October, ahead of their third-quarter report, they expected revenue of $295 million and adjusted EBITDA of $7 million. Just before the third-quarter report was released in November, revenue was expected to be $298 million and adjusted EBITDA be $12 million. Therefore, improvements are expected from both metrics.

Two analysts forecast that revenue will grow 12% to $337 million by 2025, with adjusted EBITDA of $23 million. Ahead of the third-quarter report, they expected revenue of $330 million and adjusted EBITDA of $28 million. Revenue estimates are up, while adjusted EBITDA forecasts are down. Compared with the outlook for 2024, there is still considerable growth.

Rural farm infographic

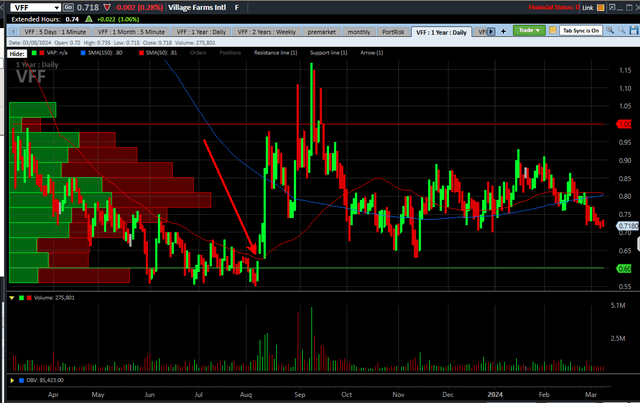

I previously noted that the trading gap created when the company reported second-quarter results in August is still open:

Schwab

The stock rose along with the rest of the cannabis industry in September after the Department of Health and Human Services recommended that the DEA reschedule marijuana from Schedule 1 to Schedule 3 in late August. This has no effect on VFF. The stock sold off but remains at multi-year lows set in early August. I see support on this chart at $0.60, below the gap, and resistance at $1.00, the Nasdaq low.

Looking at the past 5 years, the stock has fallen sharply in the past 3 years:

Schwab

There is still a gap (green arrow) compared to early 2023, when the company sold shares for $1.35 and warrants for $1.65. The gap is $1.45 and if filled, the price will double.

Country farm valuations are extremely low

In a bear market, such as what the cannabis market has experienced since early 2021, tangible book value can help investors assess downside risk. As of the end of the third quarter, Village Farms’ tangible book value was $219.4 million, equivalent to $1.99 per share. The current share price is only 36% of tangible book value. Typically, stocks trading at very low book value multiples are heavily indebted and/or losing money. As of the end of the third quarter, VFF had net debt of just $22.4 million. Its net debt was $36.7 million at the end of 2022 (before financing). A current ratio of 2.2X shows that there is no liquidity problem. The company’s adjusted EBITDA and free cash flow are positive in 2023.

The current enterprise value is $101.8 million, which is only 9.3 times estimated 2023 adjusted EBITDA and 8.5 times estimated 2024 adjusted EBITDA. The result is just 4.4 times projected 2025 adjusted EBITDA.

While it can reach tangible book value, my target is 75% of tangible book value, which is $1.49. This would be 107% higher than the current price. Projected 2025 adjusted EBITDA of 8.1x seems very low. My goal is to fill the gap created when the units are sold in January 2023, but it is below the exercise price of these warrants.

Country farm is not an organizational chart

As I mentioned above, I chose Organigram over Village Farms in the value competition in Season 4. Organigram has been doing really well since then. I have been following these two companies for a long time. At that time, the organizational chart story was more appealing to me. The company, a pure-play cannabis company, was trading at just 45% of tangible book value at the time. It has cash and no debt. The company has a very large non-industrial owner – British American Tobacco (BTI). While Country Farms trades at a slight discount to tangible book value, it’s not a pure play company. It also has a small amount of net debt. It has no outside investors or strategic partners. It’s also not in the New Cannabis Ventures Global Marijuana Stock Index due to lower trading volume.

OGI shares soared after BTI increased its stake in January at a premium. It currently trades at 0.9 times tangible book value. Based on its current share price and the issuance of 12.9 million shares to BTI for C$41.5 million, the company’s enterprise value is C$178 million. That’s equivalent to 11 times projected fiscal 2025 adjusted EBITDA, a significant premium to Village Farms.

So Village Farms lacks some of the things I really like in Organigram, but it’s much cheaper. Things may change! I don’t count on it, but the company could sell its CBD business and its produce business. It can also attract outside investors.

in conclusion

I really like VFF. It does come with some risks, such as the possibility of delisting in violation of Nasdaq rules for going below $1. Nasdaq is the only one listed. I think companies can avoid delisting through reverse spin-offs, but investors tend to view this process negatively. Another risk is that the Canadian market is maturing, more than five years after adult use was legalized. It has moved to other markets outside of Canada, such as Israel, the United Kingdom and Germany.

This company trades at less than 40% of tangible book value, which is a little crazy to me. It doesn’t have much net debt and is generating positive adjusted EBITDA and free cash flow. While it may not be another Organigram, it has the potential to rise significantly.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.