Ron Full HD

We recently purchased some from Broadstone Net Lease, Inc. (NYSE:BNL). This was through the sale of Universal Health Realty Income Trust (UHT), another real estate deal where we believe the risk-reward has become unattractive.we are looking for Used in defensive strategies, priced to withstand rate cuts in the 2024 list. At the time, we considered the option of getting into real estate income (oxygen). We last downgraded the Monthly Dividend Company to Hold after a significant share price rise. It has also retraced somewhat and provided better entry opportunities.

Seeking Alpha

We ultimately decided on BNL and tell you why this might make more sense for investors looking for a dividend stream. We also tell you why you can’t possibly make more money than in dividends.

REIT

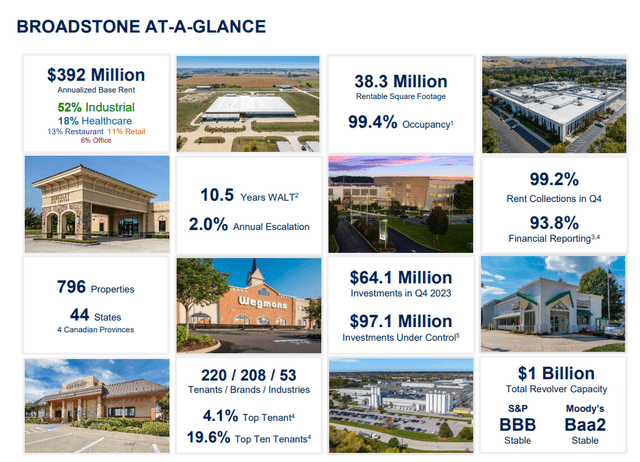

BNL has Considerable scale has been established in the triple play space, while most investors remain unaware of their existence.

Introduction to BNL

The number of followers on Seeking Alpha is simple proof of our claim that investors don’t know this. Even we don’t “follow” it currently.

Seeking Alpha

Our comparison, real estate income, is one more thing.

Seeking Alpha

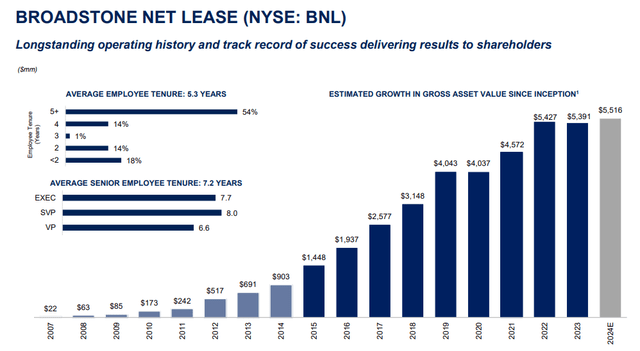

Despite a significant slowdown over the past three years, asset growth remains impressive.

Introduction to BNL

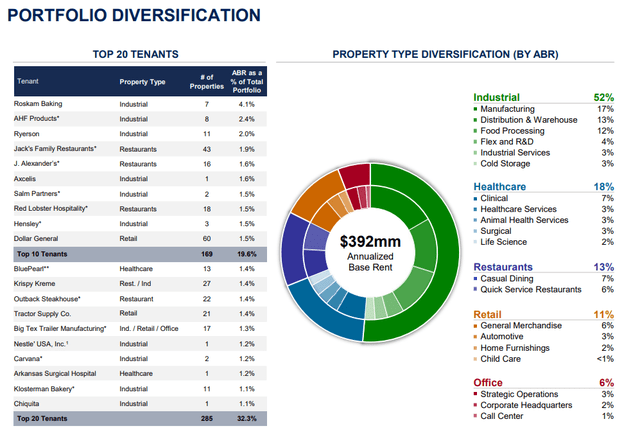

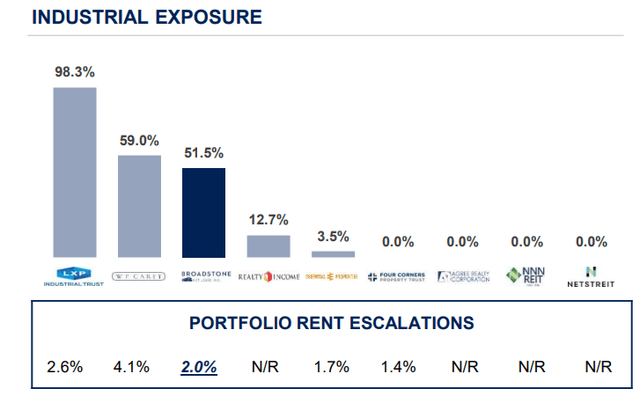

The Triple Network portfolio is primarily industrial products, which makes it different from the majority of the Triple Network, which follows a retail model.

Introduction to BNL

Reasons to Prioritize Real Estate Income

BNL has some similarities to Real Estate Income, but its key differentiator is actually pretty popular with us today. Now, these may not be for everyone, but we’ll tell you what we like and you can decide if this is the one for you. The first reason is that we like industrial exposure.

Introduction to BNL

Any dedicated REIT investor must know by now that WP Carey Inc. (WPC) and LXP Industrial Trust (LXP) have huge investments in this area, but BNL is also quite strong in this area. Real estate income does have some risk here, but after acquiring Spirit Capital, that’s down slightly. We believe industrials is a stronger institution even in the next recession as the onshore wave continues to support demand for the asset class.

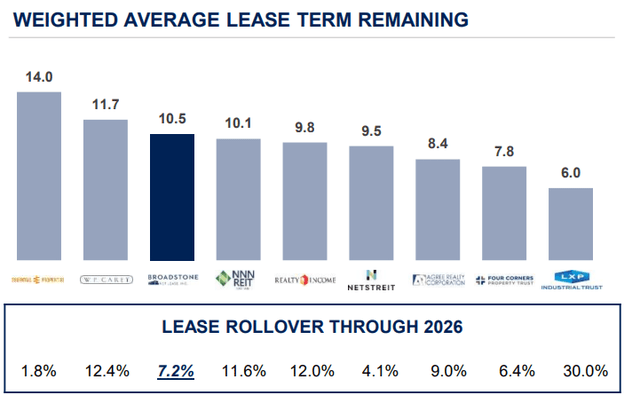

The next reason is the weighted average lease term, or WALT. BNL wins again here, although the margin is not huge. However, real estate income is much higher for leases that have recently expired.

Introduction to BNL

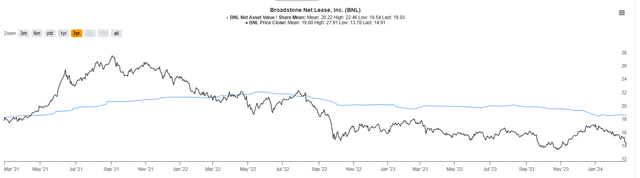

The next reason is multiples. It may seem nit-picky to argue that BNL trades at 10x funds from operations (FFO) versus 12.5x real estate revenue, but it could be a differentiating factor in a poor return environment. Real estate income has been going through multiple compression cycles, and there is a risk that future FFO will fall below 10x. BNL appears to be better priced for this risk.

Also from an NAV perspective, BNL trades at a discount of approximately 22% to consensus NAV, which is one of the most attractive discounts we’ve seen for a REIT.

actually

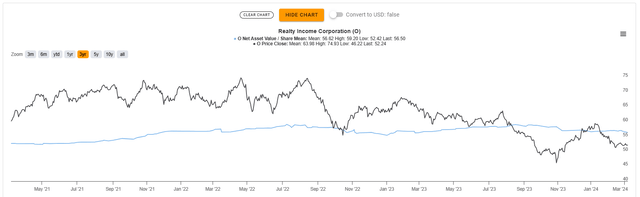

Property Income, on the other hand, trades at a discount of approximately 7% to NAV.

Introduction to BNL

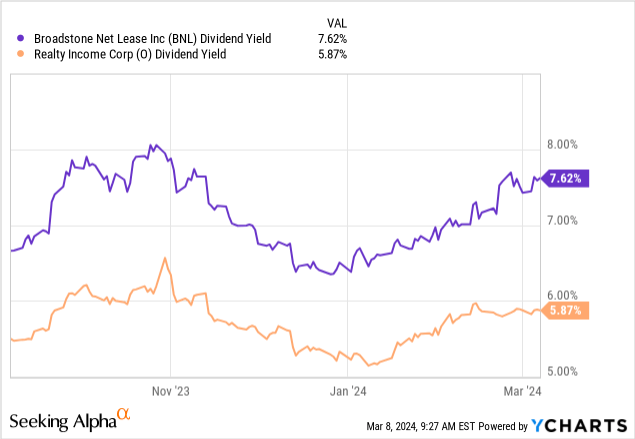

The final reason is that in a low total return environment, higher dividend yields (assuming good coverage) win out. 7.62% of BNL gives you enough extra money.

Why BNL may disappoint

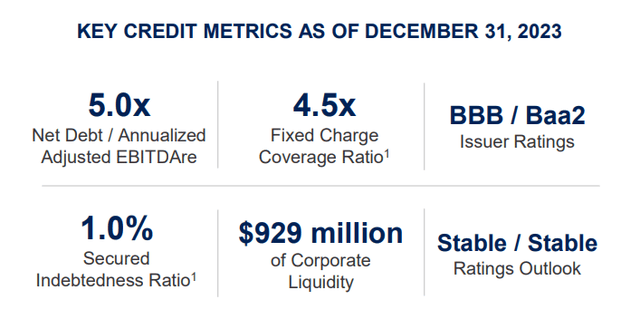

No REIT can function without good credit, and BNL’s metrics are excellent. A BBB rating is sufficient to execute its plans.

Introduction to BNL

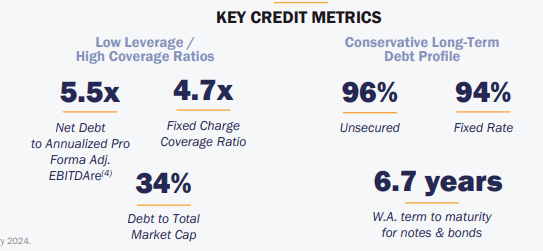

What we would point out here is that Real Estate Income is slightly more leveraged from a debt-to-EBITDA perspective, but this is offset by a better credit rating. It is one of only 8 REITs to receive an “A-” or better rating.

Introduction to BNL

Its weighted average maturity is also better than BNL. Therefore, overall real estate income has certain advantages in this area.

However, the above is not why we think BNL may disappoint. The credit difference is small and unlikely to change the return profile between the two. A possible problem is that BNL is trading at a significant discount to net asset value. It’s a matter of equity issuance that after paying out dividends to fuel new acquisitions, the flow of internal retained funds is very negligible. Realty Income has faced this problem too (much more so in the past two years than before), and their solution was to gobble up another REIT that was trading at a larger discount to NAV. Having done this, they are now trading at a small discount to net asset value and may be able to use equity to purchase suitable properties. With BNL, you’ll probably have to be content with the dividend until the market decides to revalue. Of course, it’s also possible that real estate income could eat into BNL at a premium, although depending on property selection, that may not be the most likely outcome. We still like this stock because the huge dividend with a defensive business model and rock-bottom valuation really reminds us of another triple net we bought recently. We rate it a Buy and maintain Real Estate Income Hold.

Please note that this is not financial advice. It looks like it, sounds like it, but surprisingly, it’s not. Investors should conduct their own due diligence and consult with professionals who understand their objectives and limitations.