Lintao Zhang/Getty Images News

2024 is a decisive year for Rocket Lab (NASDAQ: RKLB).The company is racing against time to launch its new neutron rocket December 15, 2024 to obtain a launch contract The third phase of the National Space Safety Launch Plan. Additionally, the company’s Electron rocket is expected to have its busiest year yet, as it has completed 2 launches and has 23 more scheduled for this year. With this in mind, management expects Electron’s release count this year to be around 30, with the ability to support 52 releases per year.

So, with Neutron’s launch closer than ever and demand for Electron at an all-time high, I believe Rocket Lab is a bargain at current levels as it expects revenue to grow over the next 6 years.Therefore I evaluate Rocket Lab is a Strong Buy with a price target of $35.52 per share by the end of 2030.

Company Profile

Rocket Lab is an end-to-end aerospace company providing launch services, spacecraft design services, spacecraft parts, spacecraft manufacturing and other spacecraft and on-orbit management solutions. The company currently relies on the small launch vehicle Electron for its launch portion 44 missions, 40 of which were successful. The company is also developing the Neutron launch vehicle, a medium-sized launch vehicle with an expected payload of about 15,000 kilograms, a feat that the Electron cannot achieve. Therefore, Rocket Lab’s growth potential mainly depends on its successful launch of Neutron, as it will have many more uses than Electron.

Electron launch finally profitable

Since Rocket Lab is still in its early stages, it has been losing money since its inception. However, the recently released 2023 annual report shows that there are signs that the company is moving in the right direction. In 2023, Rocket Lab’s revenue will increase 16% annually to $245.5 million, driven by an increase in the number of launches from 9 to 10 and a 15% growth in the space systems field. While this may not seem like a big increase, the company’s profit margins will significantly improve from 9% in 2022 to 21% in 2023.

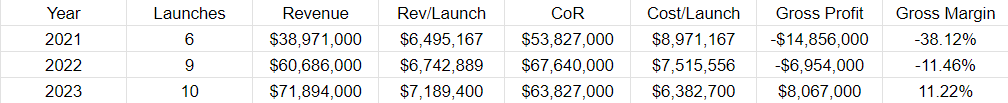

So how did the company double its profit margins in one year? The primary factor contributing to margin expansion was improved launch economics. In 2023, Rocket Lab achieved launch service revenue of $71.8 million through 10 launches, while the cost of revenue was $63.8 million. This means the company spent approximately $7.1 million per launch while incurring $6.3 million in launch-related costs, resulting in a launch services segment gross margin of 11.2%. This is the first time in Rocket Lab’s history that its launch division has turned a profit, as its profit margins have been negative for years.

annual return

Rocket Lab management, in its latest earnings call, attributed the unit’s margins to an increase in launches and higher revenue per launch. With this in mind, Rocket Lab is targeting an average selling price of $7.5 million per launch and expects to reach $8.5 million in the future. While the company didn’t quite hit its 2023 target, it hit its target in the fourth quarter, generating $8.5 million in launch services revenue from just one launch.

By 2024, the company has booked 25 Electron launches, two of which were successful. Additionally, the company expects Electron’s cadence to be around 30 this year. Therefore, I expect Rocket Lab’s margins to continue to improve as Electron launch frequency reaches its maximum capacity of 52 launches per year.

At this point, the small launch market is expected to grow at a CAGR of 11.5% From 2023 to 2030. Assuming Electron’s release cadence of 35 in 2024 (the lower end of management’s forecast), my forecasts for Electron’s releases and revenue through 2030 are as follows.

|

Year |

electron emission |

electronic renaissance/launch |

electronic income |

|

2025 |

39 |

US$8,500,000 |

$331,712,500 |

|

2026 |

44 |

US$8,500,000 |

$369,859,438 |

|

2027 |

49 |

US$8,500,000 |

$412,393,273 USD |

|

2028 |

52 |

US$8,500,000 |

$442,000,000 |

|

2029 |

52 |

US$8,500,000 |

$442,000,000 |

|

2030 |

52 |

US$8,500,000 |

$442,000,000 |

*Assumes $8.5 million in revenue per Electron release.

Based on this, I expect the company to begin expanding Electron production capacity in 2027 to meet expected demand for smaller launches.

Neutron Launch and Estimated Revenues

Although already report Because Rocket Lab may have misrepresented its intention to prepare to launch Neutron before the deadline to obtain the NSSL Phase 3 contract, management reiterated its expectation to launch Neutron before the deadline. That doesn’t necessarily mean the company will generate revenue from Neutron launches this year. However, this is a positive sign for 2025 and beyond.

Neutron will compete with SpaceX’s Falcon 9 family of rockets and ULA’s Vulcan rocket, which first flew on a mission in 2017. January This year, the target launch price is US$50 million. During the fourth-quarter earnings call, management reiterated its goal of launching Neutron three times in 2025. However, I think this is an aggressive goal and a trajectory similar to the Falcon 9 is more realistic.

First version of Falcon 9 released 5 times From June 2010 to March 2013, a second version was launched 15 times from September 2013 to January 2016. Therefore, I expect Neutron to launch once in 2025, twice in 2026, three times in 2027, five times each year in 2028, 2029, and 2030. This means that based on my projections, Rocket Lab’s revenue from Neutron launches over the first 6 years is as follows.

|

Year |

Neutron emission |

Neutron start/start |

neutron income |

|

2025 |

1 |

USD 50,000,000 |

USD 50,000,000 |

|

2026 |

2 |

US$50,000,000 |

$100,000,000 |

|

2027 |

3 |

US$50,000,000 |

US$150,000,000 |

|

2028 |

5 |

USD 50,000,000 |

US$250,000,000 |

|

2029 |

5 |

US$50,000,000 |

US$250,000,000 |

|

2030 |

5 |

USD 50,000,000 |

US$250,000,000 |

Based on projected electronic and neutron revenue, my forecast for Launch Services segment revenue is as follows.

|

Year |

neutron income |

electronic income |

Total revenue |

|

2025 |

USD 50,000,000 |

$331,712,500 |

$610,105,605 |

|

2026 |

$100,000,000 |

$369,859,438 |

$732,511,508 USD |

|

2027 |

US$150,000,000 |

$412,393,273 |

$864,443,154 |

|

2028 |

US$250,000,000 |

$442,000,000 |

$1,039,357,364 |

|

2029 |

US$250,000,000 |

$442,000,000 |

$1,091,460,968 |

|

2030 |

US$250,000,000 |

$442,000,000 |

$1,151,380,113 USD |

Space systems are partially ignored

While most investors focus on Rocket Lab’s launch segment, I believe the greater opportunity is in the space systems segment. In the fourth quarter of 2023, the segment’s backlog increased 106% year over year from $387.4 million to $797.8 million, 41% of which is expected to be realized in 2024, at approximately $327.1 million.With this in mind, the space economy market is expected to grow at a CAGR 11.5% From 2023 to 2030. Based on this, my forecast for Rocket Lab’s space system revenue over the next six years is as follows.

|

Year |

space system revenue |

|

2025 |

$364,714,270 USD |

|

2026 |

$406,656,411 |

|

2027 |

$453,421,898 USD |

|

2028 |

$505,565,417 USD |

|

2029 |

$563,705,440 USD |

|

2030 |

$628,531,565 |

That said, my forecast might be different if the company gets more deals during this period or if the space economy experiences stronger growth.

By adding in my expected revenue for each of Rocket Lab’s divisions, the company is likely to post the following revenue over the next 6 years, which gives us an idea of Rocket Lab’s valuation portion and my price target.

|

Year |

launch revenue |

space system revenue |

Total revenue |

|

2025 |

$381,712,500 USD |

$364,714,270 USD |

$746,426,770 USD |

|

2026 |

$469,859,438 |

$406,656,411 |

$876,515,849 USD |

|

2027 |

$562,393,273 USD |

$453,421,898 USD |

$1,015,815,171 USD |

|

2028 |

$692 million |

$505,565,417 USD |

$1,197,565,417 USD |

|

2029 |

$692 million |

$563,705,440 USD |

$1,255,705,440 USD |

|

2030 |

$692 million |

$628,531,565 |

$1,320,531,565 |

Valuation

Based on my expected revenue, Rocket Lab is currently trading at $4.42 per share, and its price-to-earnings ratio is a multiple of annual sales.

| Year | Estimated revenue |

After-sales system |

|

2025 |

$746,426,770 USD |

2.90 |

|

2026 |

$876,515,849 USD |

2.47 |

|

2027 |

$1,015,815,171 USD |

2.13 |

|

2028 |

$1,197,565,417 USD |

1.81 |

|

2029 |

$1,255,705,440 USD |

1.72 |

|

2030 |

$1,320,531,565 |

1.64 |

In my opinion, these multiples are very low for a company with such revenue growth potential.In fact, in my opinion, SpaceX is Rocket Lab’s main competitor, reportedly valued at $175 billion, according to Bloomberg. Considering that SpaceX is expected to generate $13.3 billion in revenue this year, this means that SpaceX is valued at 13.16 times its projected 2024 sales.

Therefore, I believe Rocket Lab will be valued at a similar multiple to SpaceX once Neutron launches, which leads me to the following price target.

| Year | Total revenue | After-sales system | SpaceX P/S PT | Upside |

| 2025 | $746,426,770 USD | 2.90 | $20.08 | 354% |

| 2026 | $876,515,849 USD | 2.47 | $23.58 | 433% |

| 2027 | $1,015,815,171 USD | 2.13 | $27.33 | 518% |

| 2028 | $1,197,565,417 USD | 1.81 | $32.21 | 629% |

| 2029 | $1,255,705,440 USD | 1.72 | $33.78 | 664% |

| 2030 | $1,320,531,565 | 1.64 | $35.52 | 704% |

risk

As with all aerospace companies, investing in Rocket Lab carries high risks.I think the biggest risk is launch failures as they can hinder a company’s growth as its Newest The launch failed, resulting in only one mission being launched in the fourth quarter of 2023. Additionally, Neutron could fail on its first launch like Falcon 9 did. Failure in its first 3 releases. As a result, the company’s losses will increase, which may lead to financing.

Another risk to consider is competition. Although Rocket Lab is currently second only to SpaceX in the aerospace industry, ULA may outperform Rocket Lab since the launch of Vulcan payload 19,000 kilograms higher than the neutron.Meanwhile, Blue Origin recently unveiling its new glen rocket 13 thousand kilograms Payload, will also compete with Neutron. Therefore, if Rocket Lab fails to launch Neutron by the NSSL deadline, its competitors will be able to gain market share, which will have a negative impact on Rocket Lab.

in conclusion

I rate Rocket Lab a Strong Buy given the company’s growth potential, given the growing demand for Electron’s expected launches, and its strong growth potential in the space systems segment. All of these factors should influence Rocket Lab’s valuation over the next few years and help it reach my price target of $35.52 per share by the end of 2030, a 704% upside from the current share price of $4.42.