Arand/E+ via Getty Images

introduce

Brembo (OTCPK:BRBOF) (OTCPK:BRBOY) is one of the world’s largest developers and manufacturers of automotive braking systems.It not only manufactures brake discs, but now develops entire braking systems and installs them in Cars and motorcycles.

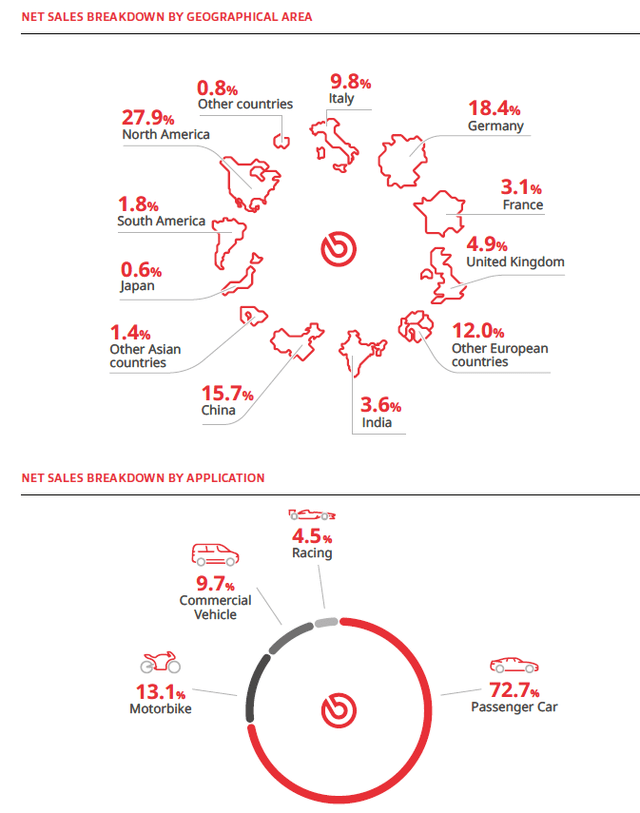

Brembo Investor Relations

As you can see above (from 2022 Annual Report), the company operates globally. Although it is an Italian company, the vast majority of its revenue comes from outside Italy, and more than half of its revenue comes from outside Europe. This makes Brembo a truly international player, but it also means that foreign exchange fluctuations can play a significant role, as Brembo reports its financial performance in euros.

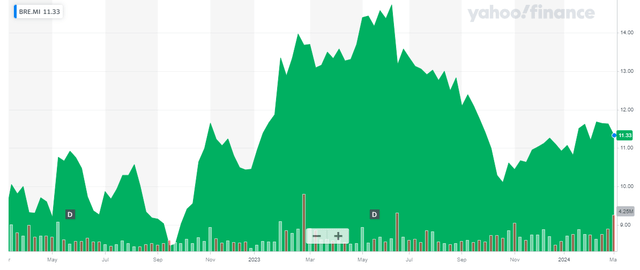

Yahoo Finance

Brembo launched in Italy for the first time Trades under BRE as its ticker symbol.average The daily trading volume exceeds 400,000 shares, equivalent to nearly 5 million euros per day. There are currently 323 million shares outstanding, with a market capitalization of just over €3.6B.

Strong cash flow creates opportunities in 2024

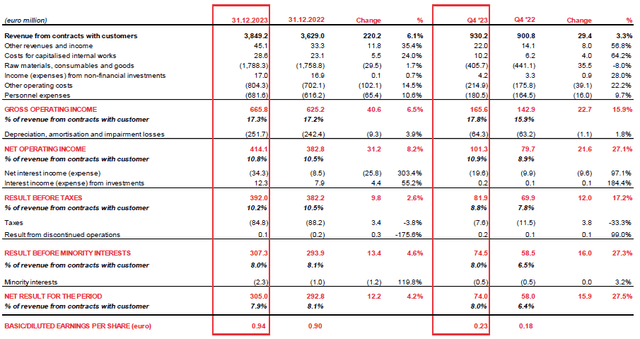

Interestingly, the company wasn’t hit too hard by the inflation numbers, as Brembo’s revenue grew 6.1% to €3.85B, while EBITDA grew 6.5% due to slightly higher EBITDA margins.

As shown below, Brembo reports Total revenue €3.85B The EBITDA of 666 million euros was mainly due to the significant increase in cost of goods sold: only 1.7% to 1.79B euros, although other operating costs increased by nearly 15%, and personnel expenses increased by nearly 11%.

Brembo Investor Relations

EBITDA of €666 million was indeed €40.6 million higher than in 2022, and EBIT jumped more than 8% from €383 million to €414 million, as depreciation and amortization charges increased by less than 4%. Unfortunately, net interest expense quadrupled to just over €34 million, but the average tax rate fell and net profit reached €307.3 million, of which €2.3 million was attributable to minority interests. This means that the net profit attributable to Brembo ordinary shareholders is approximately 305 million euros, equivalent to earnings per share of 0.94 euros. This is the first time Brembo has announced a net profit of more than 300 million euros. The company plans to pay a dividend of 0.30 euros per share, a significant increase from the 0.28 euros per share paid last year.this Dividend withholding tax rate Italy is 26%. Even after moving the company to the Netherlands (which will allow for a more flexible capital structure), Brembo has confirmed that it will still have Italy as its financial location, so I assume the dividend tax rate will not change.

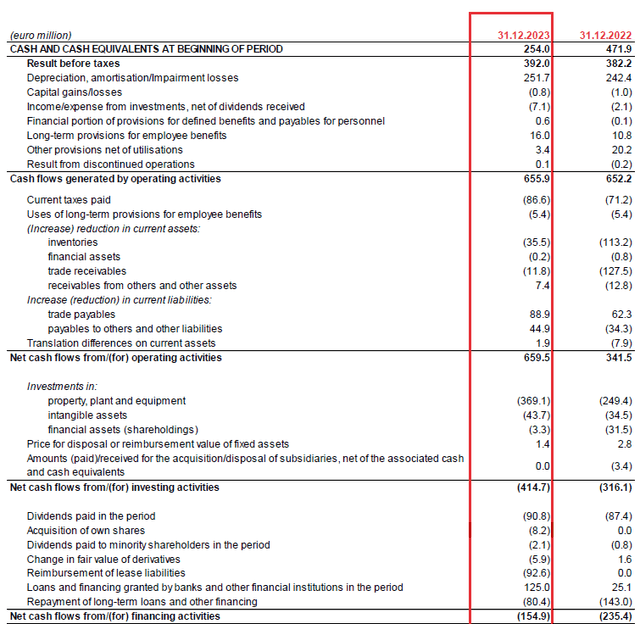

One of the things I like about Brembo is its ability to convert paper profits into real cash flow. Reported operating cash flow generated in 2023 was just under €660 million, but this includes a small contribution from changes in working capital position. On an adjusted basis, which adjusts cash flow for taxes paid versus taxes owed and deducts €93 million of lease payments and €2 million of cash paid to minority interests, adjusted operating cash flow is approximately €476 million.

Brembo Investor Relations

We know that total capex exceeds €400 million, as Brembo spent €369 million on tangible PP&E investments and almost €44 million on intangible assets. While this means underlying cash flow appears to be just €63m (a small fraction of the €305m reported net profit), keep in mind that Brembo has been investing heavily in its expansion plans.

This is clearly visible in the cash flow statement. Depreciation and amortization charges totaling €252 million were recorded in 2023, but capital expenditures and lease payments totaled more than €500 million.

Exceeded €400 million investment Related to previously announced expansion plans as the company wants to invest Mexico, China and Poland 500 million. Total capital expenditure in 2024 will be lower as the company’s total investment guidance for this year is 350 million euros, which includes construction Thailand new brake disc manufacturing plant. This will allow the company to gain market share in the motorcycle segment as this will be the focus of the new factory, which will have a production capacity of 700,000 brake discs per year. Construction of the new factory in Thailand will be completed this year and Brembo expects to start production in the first quarter of next year.

Brembo’s return on investment is at an all-time high and I have no doubts about Brembo’s expansion plans. In fact, with ongoing capital expenditures low, there is plenty of cash available to fund growth plans.

On the fourth-quarter conference call, management guided for maintenance capital expenditures of €65-70 million. Assuming this relates only to PP&A investments and the €44m of intangible capex to capitalized R&D, the total capex + lease payments would be just over €200m per year, about 50% lower than depreciation and amortization charges. This means that while reported net profit was €305 million, underlying net free cash flow on sustainment was likely to be slightly above €350 million. Divided by the current net share count of just over 323 million shares, this implies ongoing free cash flow per share of just under €1.10.

investment thesis

As a leader in the industry, and with the stock trading at a free cash flow yield of nearly 10%, Brembo is very attractive. In addition, after deducting lease liabilities, net financial debt is only 284 million euros, which is only 0.5 times adjusted EBITDA for lease payments. This also means that, at the current share price, Brembo’s EV/EBITDA multiple is only 7. While this is not necessarily low for an automotive parts supplier, what sets Brembo apart is its higher-end applications and its ability to serve the motorcycle market. Being able to use the majority of its €350m of sustained free cash flow for growth makes Brembo an interesting compound.

I don’t currently have a position in Brembo, but I would like to put some of my cash inflows related to the expected redemption of my Textainer preferred shares into Brembo.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.