loyalty

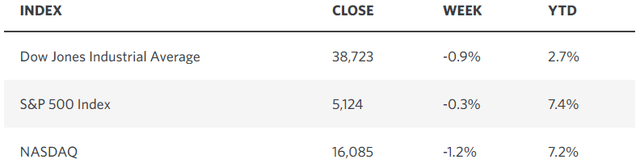

Last week may have marked a pivotal moment in this bull cycle, but it wasn’t because the S&P 500 ended the week lower for only the third time in the past 19 weeks.On the contrary, there are Lots of good news. The excellent employment report in February showed that the labor market is gradually cooling and job opportunities continue to increase, but wage growth has slowed. This is what we need to sustain the deflationary trend, leading to a soft landing and the start of a Fed easing cycle. Therefore, the probability of a first interest rate cut in June has increased significantly in the futures market, with the market generally expecting a full percentage point cut before the end of 2024.

Edward Jones

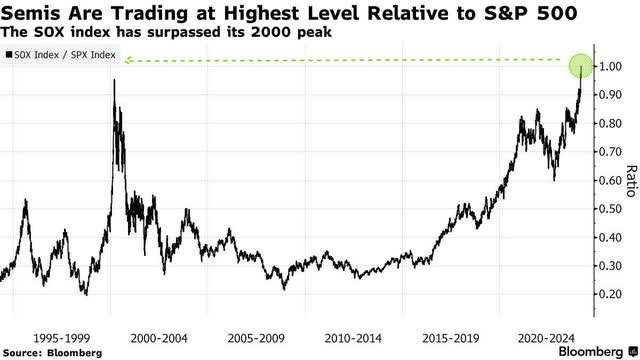

Last week the reason was The point is because growth may have peaked relative to value. What I found worth noting is that Nvidia (NVDA) is the poster child for the artificial intelligence craze, with the stock rising more than 5% on Friday morning to hit a record high before giving up those gains and ending the day down more than 5% from its opening price. Maybe this is just profit-taking from this year’s parabolic rise, but it’s events like this that make me wonder if speculative enthusiasm may be overdone. According to data from EPFR Global, as of March 6, technology funds had outflows of US$4.4 billion last week, a record high. Semiconductor stocks also trade at a historically high premium to the S&P 500 Index.

Bloomberg

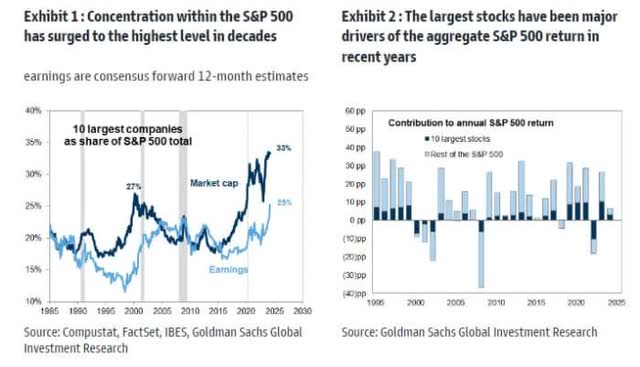

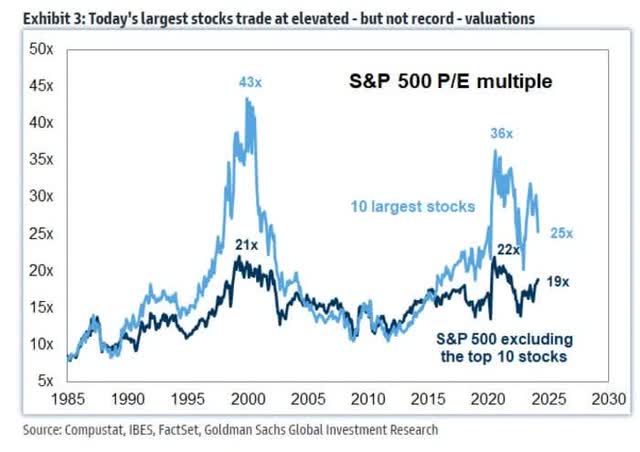

I’m not trying to call tech stocks a peak, but there is growing evidence that the sector’s performance relative to the broader market has peaked and new investment dollars may be better served elsewhere. The top 10 stocks primarily related to technology now account for 33% of the S&P 500, surpassing the 2000 peak of 27%. The big difference is that today’s top 10 stocks have stronger fundamentals that are not conducive to a bear market decline.

market observation

Additionally, the stocks’ price-to-earnings ratios haven’t come close to the nose-bleeding levels we saw in 2000 or 2020, suggesting imminent danger ahead.

market observation

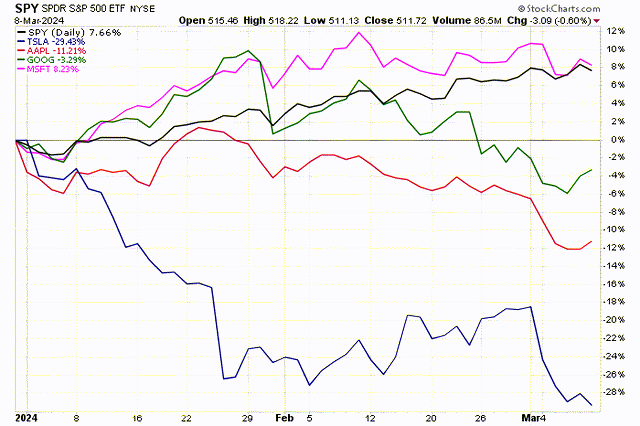

Some of the Seven’s names are starting to lose their luster. Apple (AAPL), Alphabet (GOOG) (GOOGL) and Tesla (TSLA) have underperformed the S&P 500 and are all in the red so far this year. Microsoft (MSFT) is on the verge of lagging the benchmark index.

stock chart

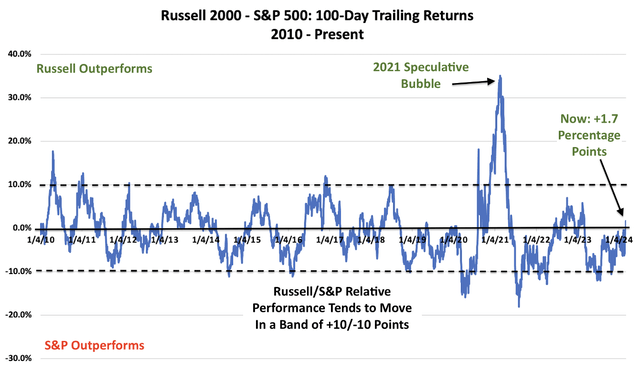

Meanwhile, small-cap stocks are starting to outperform the broader market. Bears have long viewed the underperformance of small-cap stocks as the Achilles heel of this bullish market, but that no longer appears to be the case. I have been anticipating a small-cap recovery because people have generally underestimated the potential power of economic expansion. The Russell 2000 Index has outperformed the S&P 500 over the past 100 days and is showing strong momentum. This is the rotation I’ve been looking for since the beginning of the year. If you were solely focused on waning momentum in tech stocks, you might expect a correction or bear market later this year, but this shift toward small caps suggests otherwise.

Data war

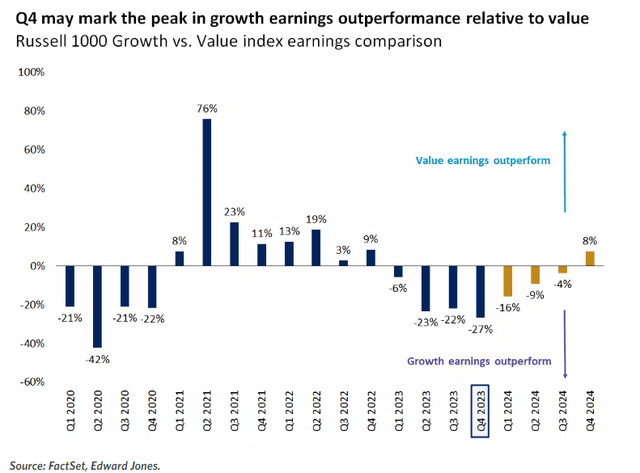

Additionally, earnings performance changes are at a critical juncture, with value stocks starting to outperform growth stocks as we enter 2024. Representatives of this comparison are the Russell 1000 Growth Index and the Russell 1000 Value Index, which are the 1,000 largest companies on the market respectively.

Edward Jones

This increasing rate of change suggests that value stocks may be experiencing a period of outperformance, led by sectors such as healthcare, financials, materials, industrials, and energy. I think an additional catalyst for future rotations will be the start of the Fed rate cut cycle, which should be a tailwind for value-oriented and rate-sensitive sectors in the market as manufacturing continues to recover. From the PMI Manufacturing Survey This can be seen in the re-expansion.

I think it’s time to rebalance the portfolio and focus more on value than growth. There are plenty of signposts indicating that this shift is already underway. With the top 10 heavily weighted today, this rotation could hinder more significant growth for the entire S&P 500. Still, when investors look past technology leadership, there are still plenty of opportunities in this market.