Sergio74/iStock via Getty Images

Three little news

First, we should start with three small news items on NewtekOne and then analyze them. All of these are small positives worth noting in any update from NewtekOne (NASDAQ:NEWT).

Partner with 1-800Accountant

Newtek One Partner with 1-800Accountant Provide accounting services to NewtekOne clients on November 29, 2023. This will add another feature to Newtek Advantage, thereby increasing the stickiness of NewtekOne’s business customer base. From a qualitative perspective, this is great for NewtekOne: On average, 1-800Accountant saves typical small business clients 20-50% on accounting costs.

SBA Loan Growth (Business as Usual)

2023 is another year of loan growth for SBA loan products.Newtek One Ending 2023 with a record 7(a) loans closed in the fourth quarter were US$262.9 million, an increase of 20.6% compared with the same period last year Same quarter last year. Total 7(a) loans closed in 2023 were $828.1 million, compared with $771.9 million in loans closed in 2022. In total, NewtekOne closed loans totaling $1.1B in 2023.

Newtek Bank expects to close $175 to $200 million in 7(a) loans in the first quarter of 2024, with the midpoint representing a 23% increase from the $152.5 million in 7(a) loans in the first quarter of 2023. recent press releases It said NewtekOne’s total loan volume from January 2023 to January 2024 reached $1.4B, up from $1.1B the previous year.

Lending is the lifeblood of the bank, so we should be pleased to see that despite disruptions in the transition from BDC to bank, and the associated share price volatility, the main core of the business has remained stable and growing.

Standard & Poor’s January 2018 and January 2019 Securitization Notes Rating Upgrades

January 18, 2024, S&P Global improved rating The Class A notes and Class B notes of NewtekOne’s January 2018 and January 2019 securitization notes were upgraded from A to A+ and from BBB- to BBB, respectively. While this won’t have a significant impact on NewtekOne’s market valuation, it is a vote of confidence in Newtek’s loan underwriting.

These securitization trusts cover the years most likely to be affected by the COVID-19 crisis, and despite the crisis, ratings remain improved. This has a secondary effect in that the corresponding equity portion of the securitization held by Newtek can be considered slightly safer.

With these three pieces of miscellaneous news out of the way, let’s dive into our Q4 2023 transcript and briefing.

First, we’ll note that fourth-quarter 2023 earnings were 53 cents per share; full-year 2023 earnings per diluted common share were $1.70. That fell right at the midpoint of original guidance for 2023 earnings of $1.60-$1.80 per share.

2023 Q4 Report Card and Briefing

Newtek Bank Efficiency Ratio

2023 is the transition period for BDC to transform into a bank model, and the same will be true in 2024. The success of this transition period can be judged by the efficiency of Newtek Bank. Here are the quarterly figures:

| Efficiency Ratio (Newtek Bank) | |

| Q1 2023 | 114.6% |

| Q2 2023 | 53.1% |

| Q3 2023 | 40.3% |

| Q4 2023 | 34.4% |

I personally expect that Newtek Bank’s own efficiency will eventually be around 20. This is because of the way the efficiency ratio is calculated: non-interest expense/revenue. Because NewtekOne’s loan book generally yields about prime + 3.0%, rather than a typical home mortgage/car loan, this means the net interest differential is very large, theoretically around 6.0%, so the denominator of the calculation is quite large.

The actual number that determines the share price is the efficiency ratio of the entire organization: this lags behind Newtek Bank’s figures:

| Efficiency Ratio (NewtekOne) | |

| Q1 2023 | 82.8% |

| Q2 2023 | 75.6% |

| Q3 2023 | 63.8% |

| Q4 2023 | 61.2% |

Generally speaking, the typical efficiency of a bank is about 50%. However, Newtek’s model is unique and as Newtek Bank continues to grow, this should ultimately be reflected in its efficiency ratios. However, NewtekOne’s overall efficiency is less than satisfactory, currently hovering around 70% in 2023; we can only wait and see if the entire organization can further improve efficiency. It’s been a year since the bank’s transformation, and it’s too early to draw conclusions.

Deposit growth temporarily halted

NewtekOne has proven that it has the ability to force deposits into Newtek Bank in the market, leading to explosive deposit growth in the second quarter of 2023. This is not without consequences: While NewtekOne will not make loans on these deposits, they are all empty calories for Newtek: the funds are deposited with the Fed in reserves, and the interest paid by the Fed is passed on as interest paid on savings accounts to customers.

At this time, NewtekOne deems it appropriate to temporarily halt deposit growth until previously collected deposits are put to use in the form of interest-bearing loans. But here’s the key going forward: We are convinced that NewtekOne has the ability to compete in the deposit funding market.

Develop non-performing loan business

During the Q3 2023 conference call and briefing, this slide was displayed:

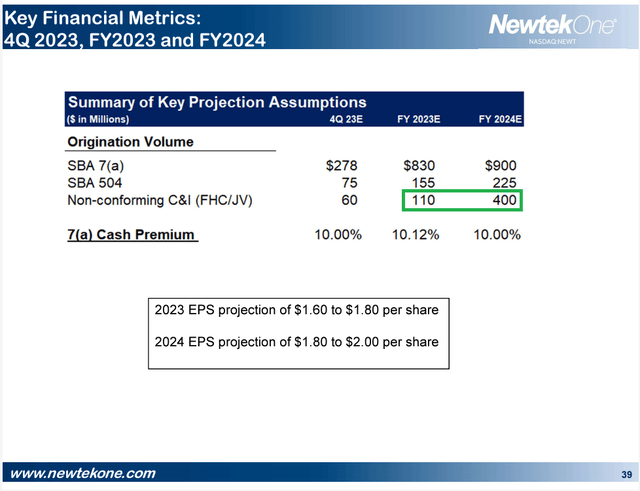

2023 Q3 Conference Call Briefing – Slide 39 (NewtekOne website)

One of the reasons I anticipate switching to banks is the greater freedom to participate in making nonconforming commercial and industrial loans. To be precise, the loans are not sold at a cash premium (because they are not SBA loans), but rather they are packaged in a securitization trust and sold with notes as collateral. The securitized trust business itself has a raw expected return on invested equity of 20-30% – recall that NewtekOne owns the equity portion of the trust with some leverage.

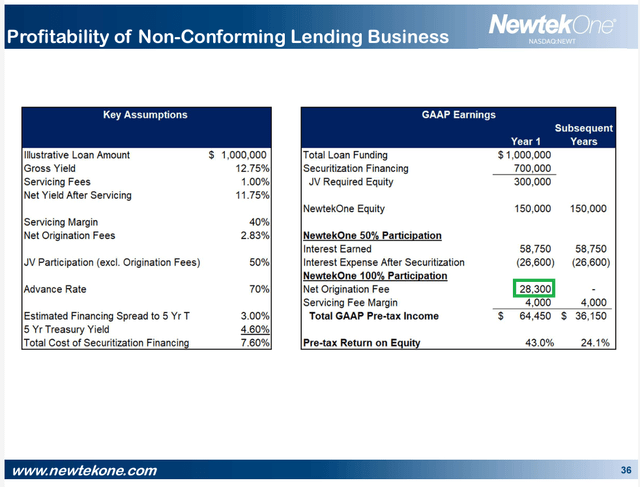

2023 Q3 Conference Call Briefing – Slide 36 (NewtekOne website)

Slide 36 contains an explanation of how this business works. All calculations are based on an illustrative loan balance of $1,000,000. Inside the green box is the origination fee that NewtekOne will earn, and sets out the total GAAP pre-tax revenue for the first and subsequent years of trading. Note the pre-tax ROE on this deal: this is NewtekOne’s new profit driver.

My main concern is that we don’t fully know what the mean, median, and pattern (in short, distribution) of NPLs look like across loan balances, credit scores, industries, firm sizes, etc. I feel like if Barry Sloane could provide some additional information on this on a future call, it would take away some of the mystery. But make no mistake, this will be the main engine of NewtekOne’s growth.

Tangible book value and retained earnings

An important long-term story is that NewtekOne retains earnings to grow the bank. Even by 2023, this is already starting to happen. I’ve listed the earnings per share, dividends paid, differences, and the running values of NewtekOne’s tangible book value per common share:

| Earnings per share | Dividends paid | the difference | Tangible book value per common share | |

| Q1 2023 | $0.45 | $0.18 | $0.27 | $6.96 |

| Q2 2023 | $0.26 | $0.18 | $0.08 | $7.05 |

| Q3 2023 | $0.43 | $0.18 | $0.20 | $7.31 |

| Q4 2023 | $0.53 | $0.18 | $0.35 | $8.61 |

Of course, we applaud the start of this development and think this will continue to be an overall trend in the coming years. I’m very confident that as earnings grow, tangible book value will accelerate over time. That said, this should be the beginning of a long, slow rise in tangible book value.

Market Pricing of Common Stock

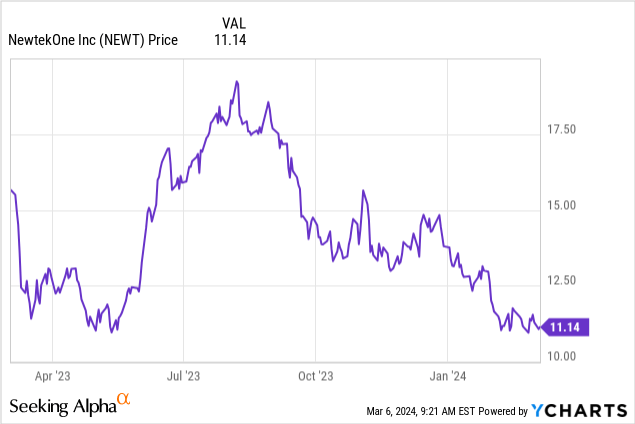

I think it’s fairly safe to say that the market doesn’t really know where NewtekOne stock is priced right now. Prices range from just over $10/share to just under $20/share, all within the past year:

Based on regular bank stock dividend yields, NewtekOne should currently be priced close to $20/share because at $11/share, its dividend yield is over 6%, which is higher than the dividend yield of almost all bank stocks, The latter is close to 3%. In my opinion, whenever NewtekOne hits lows like these, it’s a buying opportunity.

In addition, NewtekOne lowered its 2024 earnings per share guidance to $1.80-2.00 per share. That means earnings growth will be well below the original guidance of $2.80-$3.20 per share. One reason for the pricing volatility is NewtekOne’s confidence in meeting its guidance.

This is not easy to explain without further information. My best guess is that the initial guidance was overly optimistic and not well thought out. Nonetheless, as the yield curve remains relatively flat, This is not an easy time for banks, For any bank, achieving any kind of profitable growth is a laudable feat.

I think the 2024 target of $2.80-3.20/share is hastily calculated. What we see is not the reaction of stock prices to material reality, but the reaction of stock prices to uncertainty and disappointing expectations.

I have to remember that a year into BDC’s transformation into a bank, the dust has yet to settle, according to CEO Barry Sloane’s comments about “wearing three hats” and “two hats” in 2023. 2024 still has the flavor of a transition year. “2024, he said on some conference calls in 2023.

my conclusion

Guidance changes were nothing more than speed bumps and turbulence in the air, and the market, which didn’t really seem to know where NewtekOne was heading, blew the speed bumps out of proportion – and the stock price fluctuated wildly as a result. NewtekOne’s stock price is in the awkward position of being a temporary underdog in the market’s short-term popularity contest, while at the same time, the underlying numbers describing the business suggest all is well.

There is no prescription for existing shareholders other than patience: The market’s fractiousness won’t last forever.

I bet we just have to be patient and let the instructive confusing news roll off our backs. Nine years ago, when NewtekOne transformed into a BDC, the situation was similarly uncertain. However, in its eight years as a BDC, NewtekOne has earned a reputation as a BDC, and its revenue will likely gradually increase once the transition dust settles.

Chief Executive Officer Barry Sloane made a number of varied comments on the recent conference call, laying out the transitional nature of 2023 and 2024 and seeking a new normal during which NewtekOne can focus entirely on the bank’s growth. So far, everything seems to be going according to plan.

What do you get if you buy NEWT today? First, its dividend is safe, and second, its valuation may have bottomed out at 6-7x P/E. At these prices ($11-12/share) NEWT is actually an income opportunity with a good chance of capital gains.