Dimazel

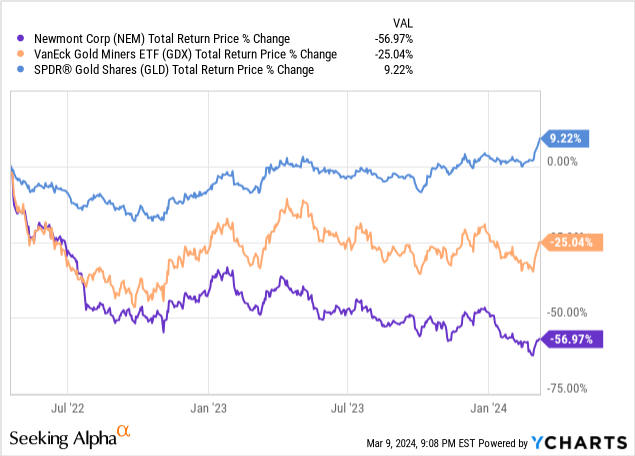

Newmont Corporation (NYSE: NoSince NEM stock peaked in April 2022, the performance of gold (GLD) and the broader gold mining index (GDX) has declined significantly:

However, its prospects look very Above board and its CEO Tom Palmer recently send a signal Extremely bullish sentiment on NEM stock, stating:

For anyone looking to put a few dollars into gold stocks, this is a once-in-a-lifetime buy…Newmont stock is at a great buy price…and you can enjoy the upside and us when we deliver on our promises.

In this article, we’ll share six reasons why we agree with NEM’s CEO that the stock is extremely attractive right now.

#1. Balance Sheet Strong and Getting Stronger

NEM’s balance sheet is currently in good shape at $6.1 billion In terms of total liquidity, the business is generating free cash flow and has very strong credit ratings (BBB+ from S&P and A- from Fitch). Additionally, its balance sheet will improve further over the next two years as it sells six assets to generate $2 billion in proceeds, about half of which will be used to reduce net debt and boost liquidity to $7 billion, of which Total cash on hand is $3 billion. This will put the company on a very strong financial footing and give it the flexibility it needs to aggressively repurchase stock and make other investments opportunistically.

#2. Expect huge synergies in the near future

NEM also expects to generate significant synergies in the near future, with annual synergies expected to total between $1 billion and approximately $500 million from the acquisition of Newcrest, in addition to approximately $500 million in annual synergies from increased productivity. Given that they expect to generate $6.5 billion to $8.5 billion in EBITDA going forward, these synergies will be a very meaningful improvement to the company’s bottom line.

#3.They own the most impressive gold mining portfolio in the world

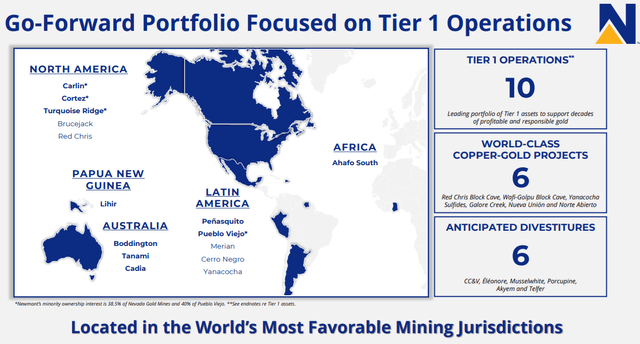

NEM plans to sell 6 Tier 2 assets in the near future, and the portfolio is expected to include 10 Tier 1 gold mines and 6 high-quality copper mines.

Not a portfolio (Investor introduction)

In addition, these mines will be concentrated almost entirely in low-risk mining jurisdictions, which account for only 6% of gold reserves, and copper reserves are not located in Africa. Just as importantly, nearly two-thirds of its gold and copper reserves will be located in North America, Australia or Papua New Guinea. Combined with its size and balance sheet strength, NEM will be one of the lowest-risk companies in the mining industry.

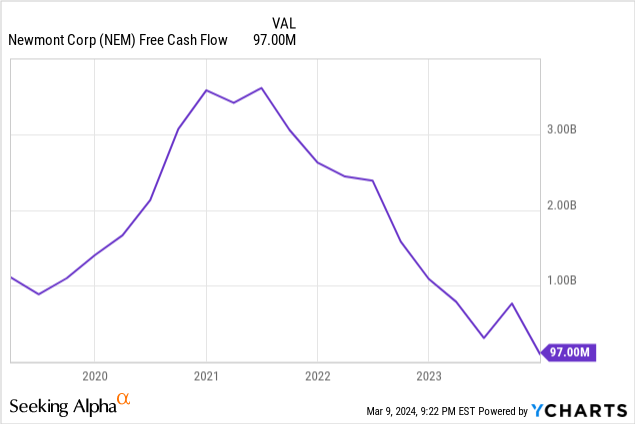

#4.Operations and free cash flow are about to improve

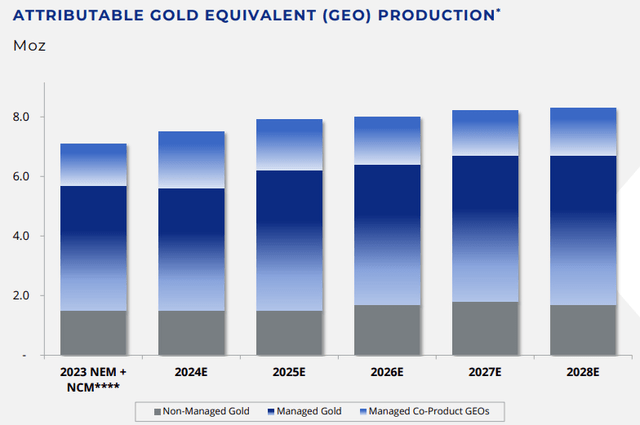

In addition to its strengthening risk profile, NEM is highly likely to improve operating efficiency and productivity in the future, as gold equivalent ounce production from its Tier 1 portfolio is expected to increase significantly in the coming years:

NEM production overview (Investor introduction)

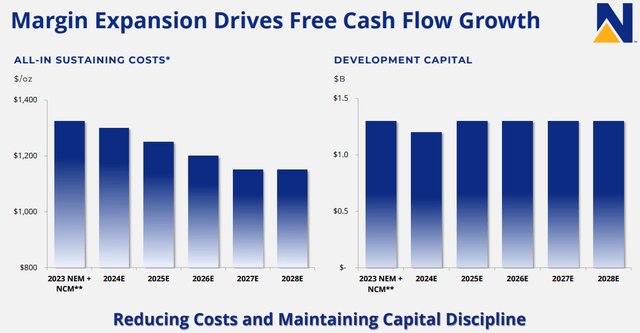

Additionally, NEM’s overall sustaining costs are expected to decline significantly due to its anticipated synergies, improvements in asset quality, and other investments in efficiency gains, while its development capex should remain fairly stable, which could weigh on the company’s profit margins Continuously expanding the neutral basis for gold prices:

NEM efficiency improvement (Investor introduction)

#5.The outlook for gold and copper is very positive

Having said that, we expect gold and copper prices to soar in the coming years. As we detailed in a recent article, gold is likely to continue its recent strong performance because:

- Fed ends rate hike cycle and begins rate cuts

- Central banks continue strong purchases of gold

- Geopolitical risks and tensions soar

- Economy may be weak

- Valuation mean reversion relative to the stock market

- The dollar continues to fall

At the same time, copper should behave well because:

- Green energy transition leads to surge in demand

- The value of the U.S. dollar is expected to continue falling

- Production has been affected by mining disruptions and is unlikely to meet demand for the foreseeable future

#6. NEM stock is significantly undervalued and will aggressively buy back shares

Last but not least, NEM stock currently looks seriously undervalued, as NEM’s CEO highlighted recently. With the recently announced $1 billion stock repurchase program, management appears ready to walk the talk.

Additionally, while the stock has historically traded at a 30% premium to its NAV, it currently trades in line with its NAV, implying near-term upside of approximately 30%. However, if gold and copper prices continue to rise, there will be room for further gains.

NEM stock risks

That being said, no stock is risk-free, and NEM certainly has a past that could put many investors into “show me” mode. In addition to the severe underperformance of the share price, NEM’s management has recently cut its dividend, which may have destroyed intrinsic value per share through the acquisition of Newcrest, which generated surprisingly little free cash flow relative to its total capacity last year.

Additionally, it must digest a major acquisition and faces some execution risk as it seeks to sell and obtain significant value for six secondary assets.As gold analyst John Ing says point out:

Sometimes with these acquisitions, you’re buying into other people’s problems… I just wonder if that’s going to work long term… when you get to a certain scale, they’re going to have 21 mines in about 10 jurisdictions, And there’s a lot to manage.

Important points for investors

NEM does look like a generational buying opportunity at the moment, while the company needs to prove to the market that it can handle its new and improved portfolio, obtain attractive pricing for the non-core assets it is selling, and effectively to reap its benefits. Projected synergies – Its strong balance sheet, world-class portfolio, improving operating and production profile, bullish outlook for gold and copper prices, coupled with a deeply discounted share price, make it appear poised to materialize over the next few years Substantial total return performance comes. As such, it’s one of my largest positions currently and I rate it a Strong Buy.