Wiz Photos

AbbVie (NYSE:ABBV), the largest healthcare stock by market capitalization after Eli Lilly and Company (LLY), performed dismally full year results Last month 2023 fell 6.4% Revenue and reported earnings per share (EPS) fell a massive 59%.

Despite this, its price continues to rise. Year-to-date (YTD), its price has risen more than 15%.To put that into perspective, the S&P 500 Healthcare Index rose less than half that amount 7.1%. Because of this disconnect between fundamentals and price action, here I take a closer look at where the stock is heading and what’s next for the stock in 2024 and beyond.

Revenues excluding Humira remain strong

As I wrote recently about Bristol-Myers Squibb (BMY))’s recent experience with its cancer treatment lenalidomide (Revlimid) has seen its revenue share more than halve and post a revenue contraction in 2023.

The same is true for AbbVie, which lost patent protection for its immunosuppressant Humira, which has been Guess so “The most profitable drug in the world.” As a result, the drug’s revenue fell 32.2%, and its share of revenue fell about 10 percentage points to 26.5%.

However, revenue excluding Humira still grew 8.4%, which was higher than AbbVie’s three-year compound annual growth rate (CAGR) of 5.9% and higher than the 3.3% revenue growth reported in 2022.

Skyrizi and Rinvoq save the world

Specifically, other drugs in its immunology portfolio, which generate nearly half of its revenue, are performing well. Two other drugs, multi-disease treatment Skyrizi and arthritis treatment Rinvoq, increased 52.6% in 2023.

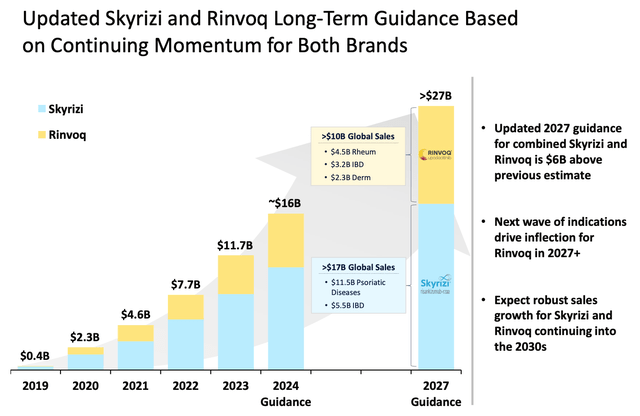

In addition, AbbVie raised its medium- and long-term forecasts by $6 billion (see chart below). Following continued strong growth in 2024 (with a growth forecast of 36.8%), the company now expects a compound annual growth rate of 23.3% (or higher) by 2027. This is higher than the previously expected compound annual growth rate of 15.7%.

Source: Seeking Alpha

Significant developments in the field of neuroscience

In addition to immunology, the neuroscience department is also very promising. It is AbbVie’s second-largest revenue source, accounting for 14% of total revenue, up three percentage points from 2022, and a healthy 18% growth in 2023, up from 10.1% in 2022. Specifically, progress on the antidepressant drug Vraylar is noteworthy. Its growth accelerated to 35.4% (2022: 17.9%), making it the largest contributor to neuroscience revenue, surpassing Botox Therapeutic this year.

The company is also growing the division inorganically through its recent acquisition of Cerevel Therapeutics (CERE), which focuses on mental illnesses such as schizophrenia and mood disorders. While Cerevel isn’t currently generating revenue, AbbVie expects to increase earnings starting in 2030, signaling its long-term plans for the fast-growing neuroscience field.

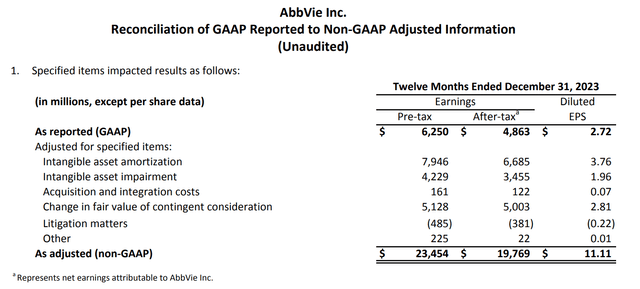

Adjusted diluted earnings per share expected to be stable in 2024

Second, while reported EPS was hit hard by the revenue contraction this year, adjusted diluted EPS was much less affected, falling 19%. This is because other drags on the reported figures such as high amortization and impairment charges are not factored into its calculations (see chart below, for more details on charges see the results link provided above on page 1 of 12 Festival).

Source: AbbVie

Entering 2024, the company expects to grow a modest 0.4% if adjusted diluted earnings per share is at the midpoint of its guidance range of $11.05-$11.25. Additionally, with revenue growth expected to improve, especially starting in 2025 (discussed next), EPS is also likely to rise.

Long term growth looks good

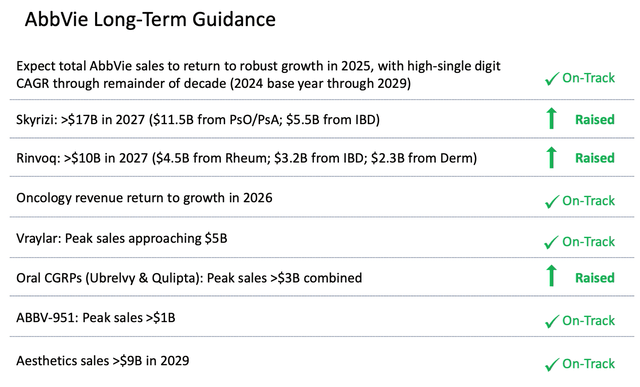

As the high base effect from Humira fades in 2023, revenue growth is likely to see a boost in 2024, and the mid- to long-term prospects also look good, as shown in the following statement:

2024 is an exciting year for AbbVie, as we are well-positioned to fully absorb erosion from Humira and deliver modest operating income growth, followed by a return to strong growth in 2025 and a high end of the decade. Single-digit compound annual growth rate. “

In addition to expected increases in immunology and neuroscience revenue, the company expects growth in oncology and aesthetics (see chart below), which is particularly good news as both areas are set to see revenue shrink in 2023 ( Please see the results link on page 8) for details provided above).

Source: AbbVie

Forward non-GAAP P/E ratio below industry average

Based on the guidance provided, the forward non-GAAP price-to-earnings ratio is 16 times, which is above the five-year average of 10.7 times. However, it’s still lower than the Healthcare industry’s median of 19.7x. As growth improves this year and over the next few years, earnings per share are likely to follow suit, and I think AbbVie still has room for upside going forward, despite what its past averages suggest.

Additionally, its dividend still looks good. Not only does the trailing 12-month dividend yield of 3.35% exceed the Healthcare industry average of 1.5%, the company has grown its dividend every year for the past decade. Those dividends contributed 178 percentage points to its 427% total return over that period.

What’s next?

The key takeaway here is that AbbVie’s poor fiscal year needs to be viewed in the context of Humira’s patent expiration. Revenue excluding Humira grew well, and even with the setback, adjusted diluted earnings per share declined much less than reported.

2024 is expected to be a better year for the company, with performance in its immunology drugs and neuroscience areas particularly promising. The company’s prospects are also good over the long term, which can also be reflected in earnings growth. So while the non-GAAP forward P/E ratio is higher than past averages, the stock still looks good, especially given its past dividend growth and dividend yield. I give it a buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.