global stocks

After a brutal start to the year, Devon Energy (NYSE:DVN) finally rebounded after solid profits.The domestic energy company has become a cash flow machine, returning significant amounts of money to shareholders, making the company’s stock attractive Weakness given the volatility in the energy industry.mine investment thesis Extremely bullish on this energy company at this valuation.

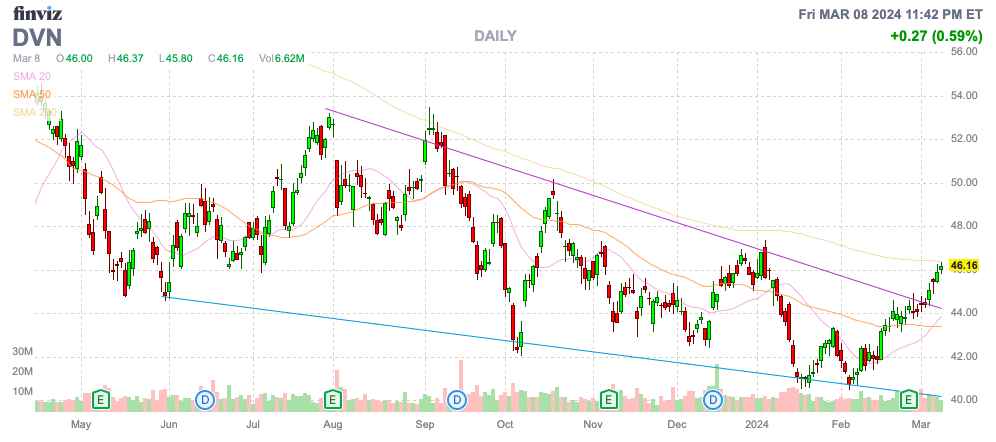

Source: Finviz

Improve efficiency

Although Devon Energy increased its oil production by 8% in 2023 to 317 million barrels per barrel, the company actually cut its 2024 capital expenditure plan by 10%. The goal is to maintain oil production at 315 million barrels per barrel and reduce capital expenditures to $3.45 billion.

Even if OPEC+ maintains production cuts of 2 million barrels per barrel, the company will not chase the market with aggressive spending to gain more market share.Devon Energy’s production may even decline By 2024, production will be only 650,000 cubic meters/boe, compared with 662,000 cubic meters/boe last year.

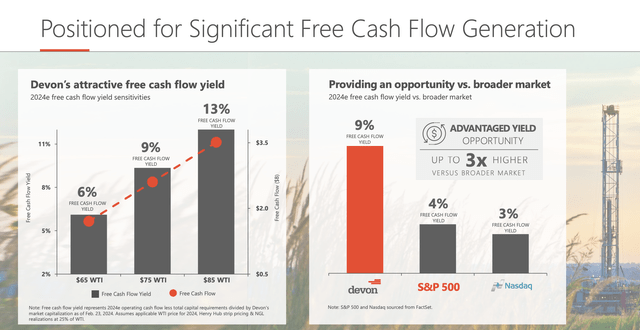

Devon Energy suggests breaking even at a WTI price of around $40 per barrel. With a low breakeven level, the company is able to generate significant free cash flow, providing a yield of nearly 10% at the current market cap (WTI price of approximately $80/barrel).

Source: Devon Energy Q4’23 Presentation

The company just raised its fixed dividend 10% to $0.22. Dividend payments will total $0.44 in the first quarter of 2024, with an annual payment of $1.76. Devon Energy only guarantees a fixed dividend, yielding 1.9%, but investors are actually guaranteed a higher dividend based on current oil prices, as well as share buybacks.

The increased fixed dividend pays out only about $600 million per year. Devon Energy generated $2.7 billion in free cash flow in 2023, and lower capital expenditures should increase cash flow in 2024, while the company expects to return 70% of capital to shareholders.

The stock is sure to fall back to the low $40s, but Devon delivered strong results in Q4’23 when oil prices were lower. The energy company achieved oil prices of nearly $77/bbl in Q4, while the company only maintained $72/bbl in Q2’23, when natural gas prices were $1.66/Mcf.

Devon was still able to generate $1.4 billion in operating cash flow in the second quarter. Although natural gas prices cannot sustain lower prices and WTI is unlikely to stay below $70/bbl for long due to OPEC+ production cuts, the company may still be able to absorb sharply lower energy prices.

For a company with over $600 million in operating cash flow and over $5 in earnings per share, the stock has a market capitalization of just $29 billion. Devon Energy is cheap by every metric, with energy prices closer to their lows than at premium levels, where downside risk is too great.

Investors can take a solid position at current cheap levels and receive dividends that are typically double the current fixed rate. Devon Energy actually paid a variable dividend of $0.29 on top of a fixed rate of $0.20 due to weaker second-quarter results due to lower oil prices.

The combined quarterly dividend of $0.49 equates to a dividend yield of 4.2%. Recently, management announced that it wants to prioritize a stock repurchase program at current stock valuations.

Devon Energy purchased 5.2 million shares in the fourth quarter of last year for $234 million. The company has reduced its diluted share count from 677 million shares at the end of the third quarter of 2021 to 636 million shares at the end of 2023. Devon reduced the share count by 6% during a period when the company was more focused on dividend payments, providing insight into the potential for a significant reduction in the number of shares outstanding.

Maximum output

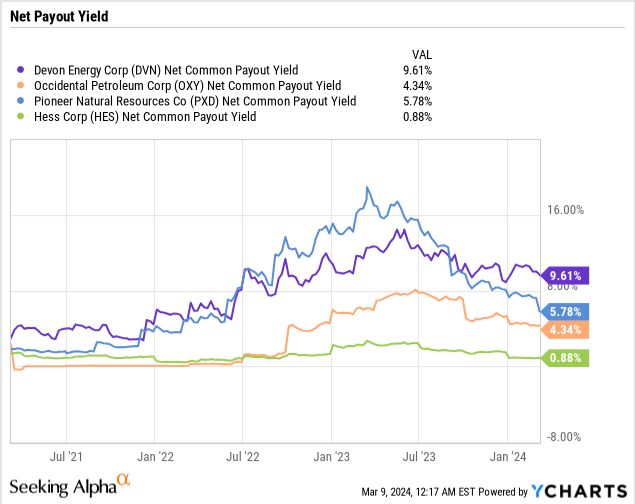

Devon Energy has been providing shareholders with one of the best net payout yields over the past few years. The current yield is close to 10% occidental petroleum corp. (oxygen), pioneer natural resources corp. (PXD) and Hess Corporation (HES) have become acquisition targets, but the combined yields of net repurchase yield and dividend yield are low.

The market clearly missed the opportunity to own a top-tier energy company at a bargain price. While oil prices are certainly headed lower, natural gas may eventually rise, and oil prices may diverge on whether to move higher or lower next.

Warren Buffett and Berkshire Hathaway (BRK.B) continues to overweight Occidental Petroleum Corp. despite Devon Energy offering a better net dividend yield and cheaper stock.

take away

The key takeaway for investors is that investors should continue to buy Devon Energy, which trades near multi-year lows while providing investors with strong capital returns from positive cash flow through disciplined capital investments . At these prices, the stock is somewhat insulated from lower oil prices, although higher oil or natural gas prices would provide upside potential.