Wirestock/iStock via Getty Images

In this season’s update of Companhia Paranaense de Energia – COPEL (NYSE:ELP), I upgrade the stock to Buy from Neutral. “

As highlighted in my previous articles, my initial investment thesis focused on Privatization of COPEL from a state-controlled entity in the Brazilian state of Paraná to a private company.

Despite the uncertainties associated with this process, including subsequent issuances that would dilute state ownership, COPEL will use a significant portion of the capital raised to secure generation concessions for the next three decades, thereby ensuring the company’s future stability.

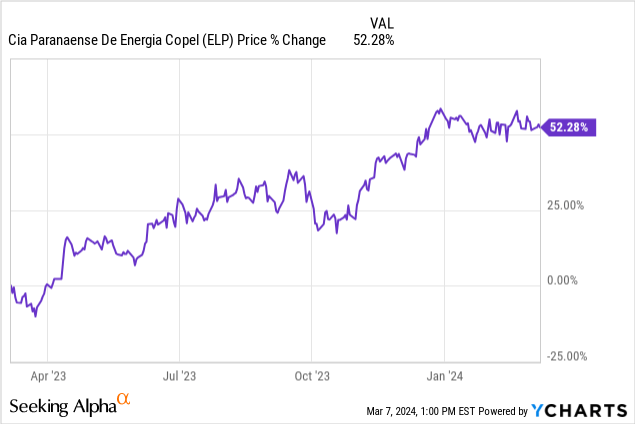

Following this development, COPEL shares have experienced significant growth, with the company’s value increasing by more than 50% in the past 12 months.

In the fourth quarter of 2023, COPEL reported results for the first time as a private entity, demonstrating improved operating efficiencies, improved profitability and positive results Cash flow, showing the potential for future profit distributions.

While I initially had reservations about COPEL’s transition to private ownership and its impact on income stock thesis, especially in the short to medium term, I’m now changing my recommendation from Neutral to Buy. This shift is based on COPEL’s theory of value, and the company’s IRR is 11%, which is an ideal rate. This puts the company well-positioned to capitalize on its continued internal improvements and efficiencies, potentially making it a strong dividend payer in the long run.

KoperFourth Quarter and Full Year 2023 Results

The fourth quarter of 2023 marked the first time COPEL reported results after completing a full quarter as a private company. The company beat consensus estimates, reporting earnings of $0.26 per share, beating estimates by 0.13 cents. Additionally, revenue reached $1.12 billion, $102.6 million higher than analysts’ forecasts.

IR of Koper

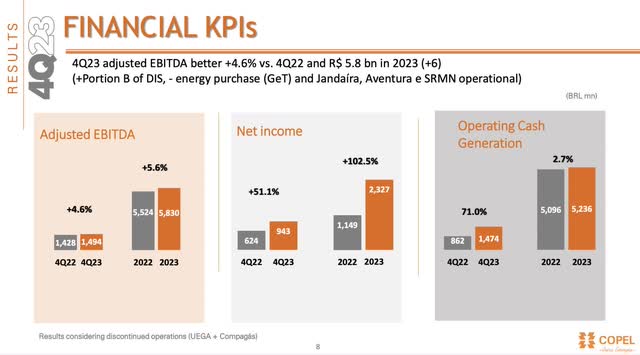

Net profit for the quarter was R$942.8 million, a significant increase of 51.2% compared with the same period last year. It is worth noting that this result significantly exceeded the market’s initial expectations.

However, it is worth noting that COPEL’s strong performance was partly due to non-recurring items, such as the impairment reversal of the Araucária gas-fired power plant (UEGA) totaling 258.6 million reais. This measure also consolidates COPEL’s position as a nearly 100% renewable energy power generation matrix.

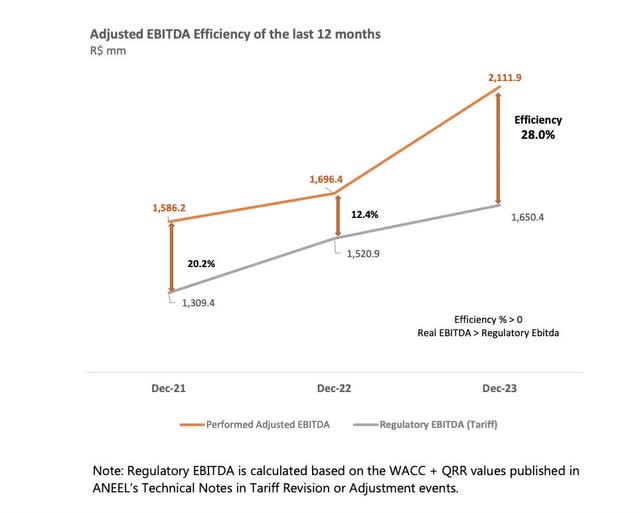

A major highlight was COPEL’s adjusted EBITDA growth, which increased by 10.1% year-on-year to R$1.48 billion (excluding non-recurring items). In the last 12 months, COPEL’s Distribuição adjusted EBITDA reached R$2.11 billion, with demonstrated efficiency of R$461.5 million, exceeding regulatory EBITDA by 28%.

IR of Koper

The improvement in EBITDA reflects COPEL’s progress in streamlining its post-privatization operations, supporting its long-term prospects. Although total consolidated debt increased by 20% to R$14.96 billion, the company’s debt metrics showed resilience, with a net debt/EBITDA ratio of 1.9 in 2023, down 1 percentage point from 2022.

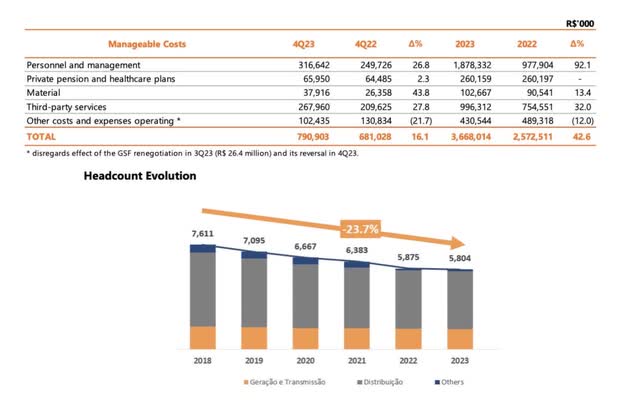

On the cost side, personnel and administrative expenses increased 1.1% in the fourth quarter of 2023 compared to the fourth quarter of 2022 and 0.9% in the fourth quarter of 2023 compared to the fourth quarter of 2022. However, COPEL’s cost-cutting measures will have a limited impact on fourth-quarter 2023 results. While the company will only reduce its workforce by 70 in 2023, it expects a further 1,400 employees (25% of the workforce) to leave through a voluntary redundancy program by August 2024, with additional staff expected to be laid off in the third quarter of 2023. Prepare for layoff costs. With their departure, the company’s operating expenses are expected to gradually improve.

In the fourth quarter of 2023, manageable costs increased by 16% from the fourth quarter of 2022 and by 42.6% in 2023 from the fourth quarter of 2022. It’s important to note, however, that these numbers include non-recurring items and reflect the company’s evolving efficiency and headcount reduction measures.

IR of Koper

During its fourth-quarter earnings call, COPEL expressed its intention to sell a 51% stake in its subsidiary Compagas, which could be worth R$800 million. according to Bradesco BBI. CEO Daniel Slaviero stressed that the company would not divest Compagas at any price, considering it is a “super-prime” asset. Slaviero said COPEL was waiting for more binding proposals from the market and would decide on the sale by the end of June.

Regarding acquisitions, COPEL is currently focused on other post-privatization priorities and plans to closely evaluate acquisition opportunities starting in 2025, particularly in renewable assets including hydropower plants.

Generational concession provides sense of tranquility for next 30 years

COPEL has allocated R$2.2 billion in investments and plans to invest an additional R$2.4 billion in 2024, mainly in energy distribution. The company’s distribution lines are protected by long-term franchises, providing stability.

When it comes to power generation, COPEL has also received long-term concessions since privatization.Last year, the company conducted Subsequent issuance Involves the sale of the controlling shareholder (in this case the Paraná state government), resulting in a significant capital injection of R$5.2 billion. This included the sale of additional shares, resulting in a dilution of approximately 56.3%.

However, subsequent offerings are not just about selling existing shares. COPEL also issued more shares to raise funds for renewing its power generation concessions. Of the 5.2 billion reais raised, 3.2 billion reais came from Paraná’s secondary offer, while 2 billion reais came from the primary offer. The latter amount will be used to cover grants for the complete renewal of the concessions of COPEL’s three largest hydropower plants (Foz do Areia, Salto Segredo and Salto Caxias). These plants contribute approximately 4.2 GW of installation capacity, accounting for approximately 60% of the company’s total capacity.

This huge capital injection gives COPEL confidence in its power generation concession prospects for the next 30 years. It’s worth noting that the money wasn’t wasted, and the dilution from the stock issuance isn’t necessarily negative. Instead, the increased share count facilitates financing of franchise renewals and alleviates the company’s future concerns.

Typically, stock dilution can have a bearish impact in the short term. However, the impact on COPEL has been muted due to the sensitivity of power sector concession renewals, mainly due to its privatization.

COPEL shares are up about 55% in the past 12 months. This reflects the market’s confidence in the privatization process, COPEL’s subsequent issuance and its strategic capital allocation to improve efficiency.

Strong dividends still elusive

Now that COPEL has been transformed into a corporation, meaning it is no longer under state control, there is a good chance the company can maintain its performance record and steadily improve efficiency. This improvement should lead to higher profits and thus potentially higher dividend payments. However, given that the company is still in a period of transformation, patience is crucial. It is important to remember that COPEL is now making long-term concessions to the future.

according to company policy, COPEL’s dividend policy is currently linked to its debt levels. If the debt-to-EBITDA ratio is below 1.5, the dividend payout ratio is 65%, subject to the constraints of available cash flow considering the investments. If leverage falls to between 1.5x and 2.7x EBITDA, payouts will be reduced to 50%. If it exceeds 2.7 times, the company only distributes 25% of the net profit. During periods of no profit, no dividends are paid. As of the first quarter of this year, COPEL’s financial leverage was 1.9 times and its payout ratio was 50%.

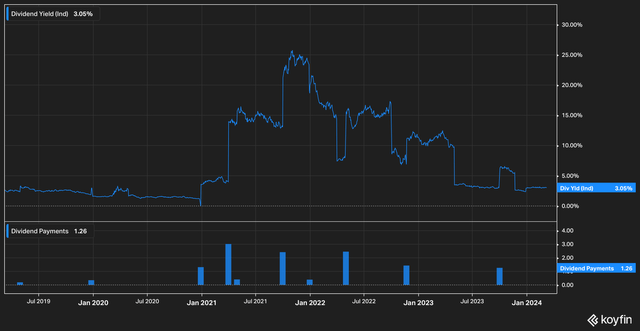

The high double-digit yields COPEL reported in 2021 and 2022 were not replicated in 2023 as the company was in a transition phase. The recent yield was around 3.02%. Consensus estimates from S&P Global Intelligence via the Koyfin platform suggest COPEL’s 2024 net profit is expected to be $491 million. A payout ratio of 50% would result in a dividend yield of less than 1%.

COPEL’s Dividend Yield (Koyfin, data from S&P Global Intelligence)

Even as efficiencies continue to improve, I don’t expect profits to increase significantly in the short term, nor does leverage fall significantly. Even if the company achieves 22% profit growth and pays out 100% dividends in 2026, the dividend yield will remain below 3%.

Valuation

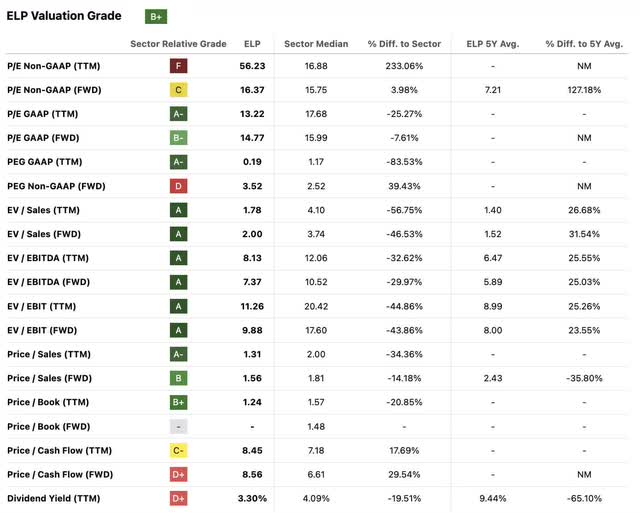

As COPEL undergoes a transition from public to private ownership, its near-term earnings results have seen natural fluctuations, primarily due to non-recurring effects distorting the P/E valuation multiple. This puts the company’s price-to-earnings ratio well above the industry average, which currently stands at about 56 times.

Seeking Alpha

However, considering its forward multiple, COPEL’s P/E ratio of 16.3x is still not very attractive compared to the historical average of 7.2x over the past five years.

Looking at its PEG ratio, COPEL trades at 3.5x, which is nearly 40% higher than the industry average, which doesn’t suggest it’s attractive at this level.

However, when it comes to examining cash flow, using the S&P Global Intelligence on the Koyfin platform, estimate As the company continues to improve efficiency post-privatization, COPEL will report negative free cash flow of R$325 million in 2024, followed by R$483 million in 2025 and R$659 million in 2026.

Based on this data and using a discount rate of 11%, I think this is fair for Brazilian stocks given Brazil’s long-term interest rates and the country’s risk profile, the approximate present value of the cash flows at a discount rate of 11% Approximately 644.25 million reais.

Since the present value is positive, this suggests that a discount rate of 11% would result in a positive net return on the initial investment of R$325 million. This suggests that the internal rate of return (“IRR”) may be close to 11%, which is perfectly acceptable and promising given the weak macroeconomic situation in Brazil. potential decline By the end of the year, rates will drop from double digits to single digits.

bottom line

COPEL’s performance in the first quarter after privatization was stable, with EBITDA increasing by 10% year-on-year, reflecting more significant efficiency. Furthermore, the company’s annual profits doubled even after accounting for non-recurring events. It also generates free cash flow, providing good profits for future dividend payments. In addition, COPEL Distribuição demonstrated highly efficient operating performance, with EBITDA exceeding regulatory expectations by 28%.

Although the company’s share price has increased 56% over the past 12 months, COPEL’s real internal rate of return (“IRR”) remains above 10%. This suggests the company is likely to resume dividend payments soon, especially after receiving another 30 years of concessions following a subsequent issuance that reduced state control of the company.

As a result, I believe in COPEL’s value thesis, not just the dividend, so I’m cautiously leaning toward taking a more bullish stance on the company, upgrading my neutral stance to bullish.