Baroncic

In the lab, we like paper companies. Smurfit Kappa ( OTCPK:SMFKY ) ( OTCPK:SMFTF ) is one of our top picks for 2023.Our team’s bullish case is built on best-in-class profitability and M&A selectivity.This is what happened next Acquisition of WestRock. Before continuing with our upside view, it’s worth reviewing the company’s most recent results.

Mare Past Analysis – Strong Buy in 2023

Fourth Quarter and Fiscal Year 2023 Results

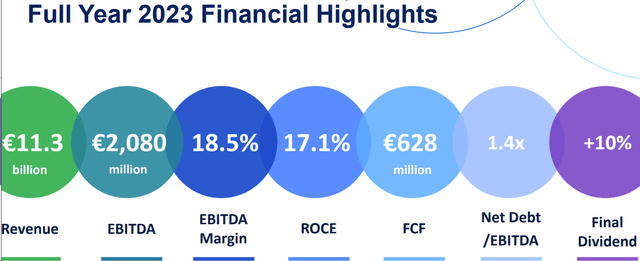

Starting with the CEO’s words, we are pleased to report that Smurfit Kappa posted its second-best results in its 90-year history.CEO is Happy “By 2023, the group will achieve excellent results, with full-year EBITDA reaching 2.08 billion euros, an EBITDA profit margin of 18.5%, and ROCE higher than our target.“

Looking at financial performance, the company’s revenue reached 11.3 billion euros.Smurfit’s income This was down 12% compared to the prior year due to lower box prices and volume, which are key value drivers in our investment thesis. Nonetheless, looking at the income statement, EBITDA amounted to €2.08 billion, with a profit margin of 18.5% (Figure 1). EBITDA also declined 12% in absolute terms; however, the company’s margins were better. Don’t expect positives from us, but we should report that the company improved EBITDA margins on lower prices and sales in a challenging market environment. Smurfit Kappa’s organic investments are helping to improve its cost curve.

In addition, this year, Smurfit has recorded a one-time negative number due to the impact of the WestRock combination. This special item reduced the company’s operating profit by €152 million. Despite this, the company has an ROCE of 17.1% and free cash flow of €628 million. Free cash flow increased by €83 million compared with 2022.

Cash interest payments were lower than last year (€123 million vs €132 million). The decline was due to interest income generated by the company’s deposits and ongoing deleveraging process. Debt-to-EBITDA ratio reached 1.4x.For this reason, despite In combination with WestRock, The company proposed to increase final dividends per share by 10% to 118.4 cents per share.

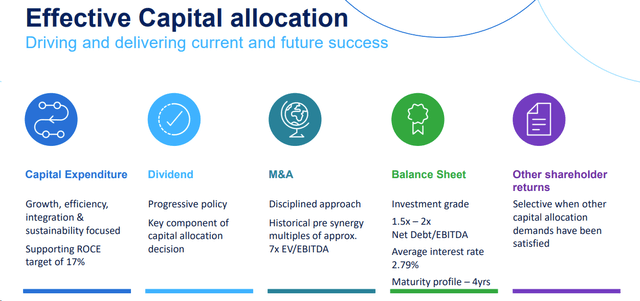

Consistent delivery and correct capital allocation prioritization (Figure 2) make Smurfit Kappa a top choice.

Smurfit Kappa Fiscal Year 2023 Results at a Glance

picture. 1

Capital allocation priorities

figure 2

Why are we positive?

In addition to positive results in a challenging market, we report the following:

- Sales growth will resume in the fourth quarter of 2023. Europe was flat, but sales in the Americas increased 1.6% year-on-year. Still, there are signs of recovery in the Old World. The German market in particular is improving, with better trends starting from the third quarter of 2023. The UK market is also showing good progress. The CEO confirmed this positive trend. Although sales are down 3.5% in 2023, the CEO reported that sales are gradually improving and accelerating in the fourth quarter. At the lab, we believe destocking activity has bottomed out;

- Second, prices may rise sooner than we expect. At the lab, we have been cautious about price increases. We previously forecast no price increases in 2024. Our assumptions are supported by sufficient supply and cost stability. That said, according to RISI’s latest report, we report on how containerboard producers are looking for price increases in the range of €65 to €80 per ton. These are all important news from the game.Specifically, Heinzel has declare The price per ton increased by 85 euros, World Championship It was also mentioned that the price of containerboard paper has increased;

-

Considering the company’s operating leverage, if the price increase is implemented, the effect will be felt in the third quarter. This means that upside in 2024 is limited. However, we value the company on a 12-month basis. Therefore, it is important to report our forward-looking views. Looking at the numbers, with a price increase of €80/ton, Smurfit Kappa’s EBITDA could increase by €180 million. This alone could lift our target price by £3.50 per share;

- Following the WestRock transaction (Figure 3), we believe there will be significant value creation for shareholders. As the CEO reports, the merger is an opportunity “Should not be missed.“We expect that the combined entity is likely to create value in the long term. The US market is more unified than the EU. Price decline cycles are shorter, which is very beneficial for Smurfit Kappa. The CEO has a strong track record in M&A and There is strong evidence of extracting results from underutilized assets in the Old World. Furthermore, even if we do not price this development, the company is likely to rebalance trading multiples. US peers are trading at higher prices than EU players ( US PKG trades at 10x EV/EBITDA, while Mondi trades at 7x EV/EBITDA.

Xiyan Assemblage

image 3

Valuation and risk

For 2024, we still expect lower first-quarter sales given box demand. We expect EBITDA margin to be 18.2%, or €1.95 billion in absolute terms. However, if price increases of around €80 per ton are realized, the company could significantly increase production in 2025. Smurfit Kappa trades at 6x and 5.4x EV/EBITDA in 2024 and 2025, respectively. We continue to value the company at 7x 2025 EV/EBITDA, confirming a valuation of €45 per share.

Downside risks to our price target include 1) declining box demand and prices, 2) rising feedstock costs, 3) energy price fluctuations, 4) paper capacity that could impact the supply-demand balance, and 5) WestRock trade execution.

in conclusion

We believe the company is a reliable operator in the paper space. Smurfit Kappa is a vertically integrated business with a strong record of mergers and acquisitions. Prices continue to rise thanks to the WestRock deal and entry into the US market. Our Buy rating has been confirmed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.