black bet

Above: Revenue and AEBITDA grew significantly across every vertical in LNW’s portfolio this fiscal year.

From scientific games to light and wonder

We go back a long way Light and Miracle Company (Nasdaq ticker: LNW) inventory, although we haven’t covered it yet From 2022 (Hold rating) because it’s stuck in a poor business model. We’re resuming coverage now as the company transforms into a tightly managed, innovative leader in gaming devices and systems. We expect future earnings to continue to be better than expected.

We started in the early 1980s when I created the first industry publication covering the entire spectrum of legal gambling including casinos, gaming equipment, horse racing, lotteries and surveillance systems.

One of our early game advertisers was a company called Scientific Games, which specializes in the creation, production and distribution of games. A scratch-off game for the state lottery. The two partners visited our New York headquarters as part of a marketing campaign for their latest cards featuring gambling icons.

They were also planning an initial public offering at a time when the industry was going through a major growth cycle. But in the days since that visit, we have been convinced that their long-term plan is to expand the lottery business to the entire gambling ecosystem.

We bought the stock at a low point when the stock was performing well, and sold it in 2014 after the company merged with traditional slot machine maker Bally Manufacturing Corp.

Then, over time, we watched the company grow exponentially, eventually spanning all verticals to which they committed. The problem is, by 2021, they’ve clearly exceeded their target. Their pursuit of investments and mergers and acquisitions has made companies deeper in debt. The originally clear vision became blurred and confused. By the early 2020s, both their core lottery and sports betting operations were in real trouble.

The choice going forward is clear: Consolidate and streamline the company, or risk more financial trouble than it can handle. In fact, their situation was in many ways similar to that of Walt Disney today. They expanded too much and took on too much debt. The solution to their problems must be to slash their ambitions and focus on building a profitable core.

So they sold their lottery and sports betting businesses. The stock has become easier to understand for investors. Concentrated efforts in remaining verticals have paid off.

Online Archives

Above: Strong growth in online casino mobile gaming.

In 2022, the company name will be changed to Light& Want to know (LNW) focuses on three verticals: gaming machines and revenue sharing slot machine systems, IGaming and Sci Play social platform gaming business. They paid $22.95 per share. All acquisitions will be completed in the fourth quarter of 2023.

Which brings us to now. They have achieved their goals and Mr. Market has emerged as a believer.

Google

Above: Despite being under the radar, smart money has spotted LNW.

LNW Today: A strong buy after strong performance in fiscal 2023

LNW: $99 at time of writing

Fiscal Year 2023 Revenue Results

- Revenue has grown for 11 consecutive quarters. Revenue increased by 13% year-on-year. Share repurchases this year totaled $170 million.

Results by segment:

- Gaming (machine sales and revenue sharing casino slot machine revenue) was $490 million, an increase of 31% from the same period last year.

- SciPlay: Online social gaming platform US$204 million, a growth of 12%.

iGaming (online casino) revenue was US$70 million, an increase of 16% compared with the same period last year.

Online Archives

Above: LNW’s ability to continually add new games keeps revenue growing.

- The installed base of shared casino slot machines grew 7%.

- Gaming division AEBITDA was US$245 million, a growth of 12%.

- Debt: $3.9b. Despite the cash outlay required to complete the SciPlay merger, LNW repaid its term loan last month, saving 35 basis points or $8 million in interest costs.

- Cash on hand: $425 million.

- Total revenue for FY23: $2.9b.

return on investment model

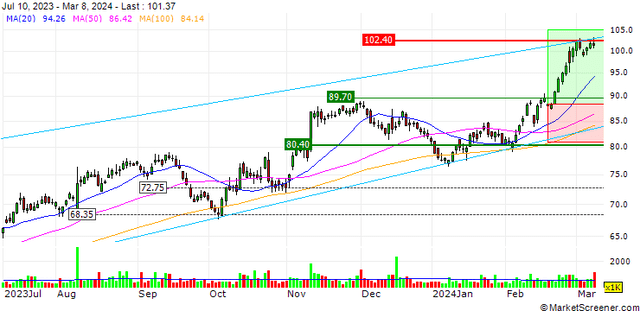

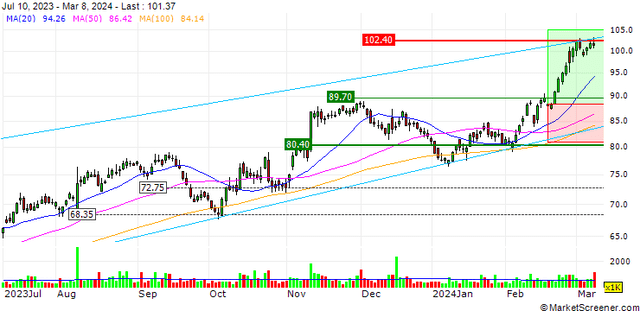

To illustrate Mr. Market’s reaction to the LNW trend, this investment return model is clear:

- The one-year purchase price is $10,000 and the final value is $15,700.

- Starting price per share (one year ago) $62.29.

- Final price at time of writing: $101.83.

- Compound annual return: 61.74%.

- EBITDA margin: 39%.

- Free cash flow was $291 million.

in conclusion

Our strong buy-in guidance here is rooted in the admonitions of veteran poker players famous for the success of Kenny Rogers, You have to know when to hold them and when to fold them.

In my opinion, this adage expresses one of the best characteristics of smart business management: recognize and reduce losses, and then rebuild your business model to reflect the reality of your market.

In the case of LNW, the restructured management team struggled to address the accumulated problems that had led to its overexpansion. They emerge on the other end with a solid cross-platform gaming set of devices, systems and online operators with promising prospects. Currently, Statistica has $50 billion worth of dollars spent on all forms of legal gambling worldwide. With a compound annual growth rate of 5.7%, the industry’s output value will reach US$800 billion by 2030.

This reflects not only the growth of existing markets but also the launch of legalization in new markets. This growth includes planned or under development brick-and-mortar casinos, online betting sites and social gaming sites where customers are switching to real money betting. What this all means is that companies like LNW will participate in this growth cycle through all their verticals.

To meet this demand, Las Vegas-based LNW develops new games every year to meet the market needs of each region. These include the United States, Asia, Oceania and the European Union, where they currently have sales operations.

We believe the margin of safety comes from tracking the stock over a year as we mentioned above. It’s not like some sports betting platforms, which tend to rise or fall sharply based on investor overreaction, whether quarterly or event-driven data shows a big surge or slowdown in betting activity. In contrast, our research into LNW’s trading patterns shows that its trading patterns are more closely related to quarterly results or the release of a well-received new game.

Google

For these reasons, we set a price target on Light & Wonder, Inc. stock of $135 based on results in the second or early third quarter of this year.