Miscellaneous Photography

With the S&P 500 very expensive and the market feeling good about growth stocks, one way to invest in technology is becoming very popular again: high price, high quality.While these stocks have performed very well at the high end of the market, my macro strategy We believe we are more likely to see major stock index declines over the remainder of the year as we face many uncertainties: the pace of Fed rate cuts that will be critical to today’s market enthusiasm, the volatility of the U.S. election cycle, and the macroeconomic recovery uncertain.

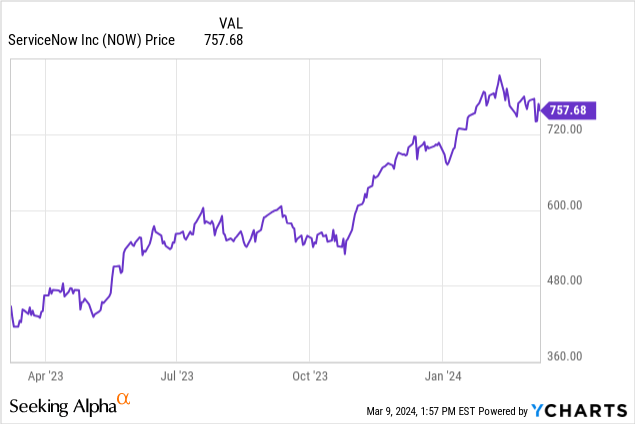

In this context, ServiceNow (NYSE: Now) is a stock worth keeping a close eye on. The cloud company led by Bill McDermott (former SAP CEO) has grown about 80% in the past 12 months, but the company’s strong earnings cycle in late January failed to bring any meaningful momentum to the company. the name.

ServiceNow’s strengths are baked into its massive valuation

The last time I wrote a bearish article on ServiceNow was in September, when the stock was trading around $550 (but before the broader market, especially tech stocks, rebounded in the last quarter of the year). Since then, ServiceNow has steadily risen, along with other software peers, to achieve richer valuations – and at the same time, the company has also managed to accelerate its subscription revenue growth rate while maintaining high levels of profitability.I put all this together neutral Rating of the company.

Of course, the company has many meaningful positives worth pointing out, including:

- The scale growth is impressive. Despite annualized revenue exceeding $10 billion, ServiceNow’s subscription revenue is still growing in the mid-20s. This is a testament to its scale across multiple end markets, including IT service management, customer service management, and security and risk management.

- A free ride on artificial intelligence. ServiceNow benefits from artificial intelligence innovation across many products across its portfolio, enabling virtual agent assistants that help reduce issue resolution time and identify needed repairs across its field service operations.

- 40 rules. ServiceNow has successfully achieved growth in the mid-20s, and is also expected to have operating profit margins in the mid-20s, completely building the company into a “Rule of 40” software company that balances growth and profitability.

But at the same time, we have to point out that these advantages have been more than compensated by ServiceNow’s record-breaking share price – we note that the stock is currently at higher That’s higher than its pandemic-era record, which not many tech stocks have been able to top yet.At its current share price of nearly $760, ServiceNow has a market capitalization of $155.32 billion; the company’s final results after deducting the $8.08 billion in cash and $1.49 billion in debt that ServiceNow had on its most recent balance sheet Enterprise value is US$148.73 billion.

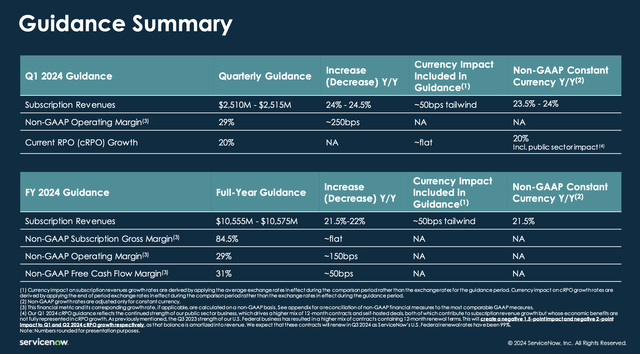

At the same time, in the current fiscal year 2024, ServiceNow expects subscription revenue to increase by approximately 22% annually, and operating profit margins are expected to expand by 250 basis points:

Service Outlook (ServiceNow fourth quarter financial report)

At the same time, analysts expect ServiceNow’s total revenue this year to be US$10.89 billion, an annual increase of 21%; the estimated EPS is US$13.23. This gives ServiceNow a valuation multiple of:

- 14.3x EV/FY24 revenue

- 57x FY24 P/E

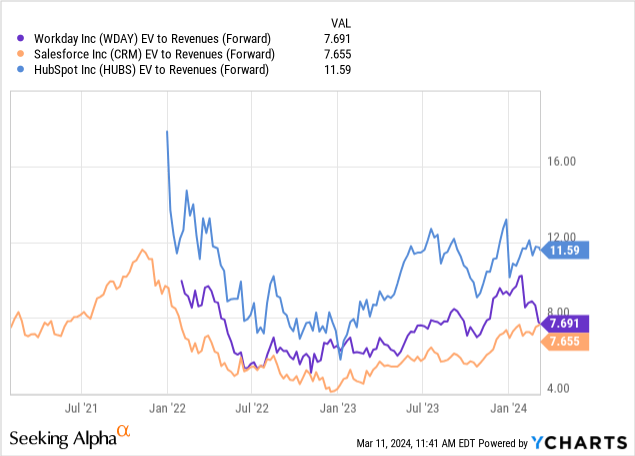

Compared with other medium/large software peers, the growth rate is approximately 20%:

With interest rates still at multi-year highs, we really have to ask ourselves: Is ServiceNow’s premium really sustainable? Yes, the company’s performance is good; but are there really any catalysts that could effectively drive future growth that would push ServiceNow’s already expensive valuation multiple upwards?

In my opinion, the answer is no. I’ll stay on the sidelines here and wait for better prices to take advantage of.

Season 4 download

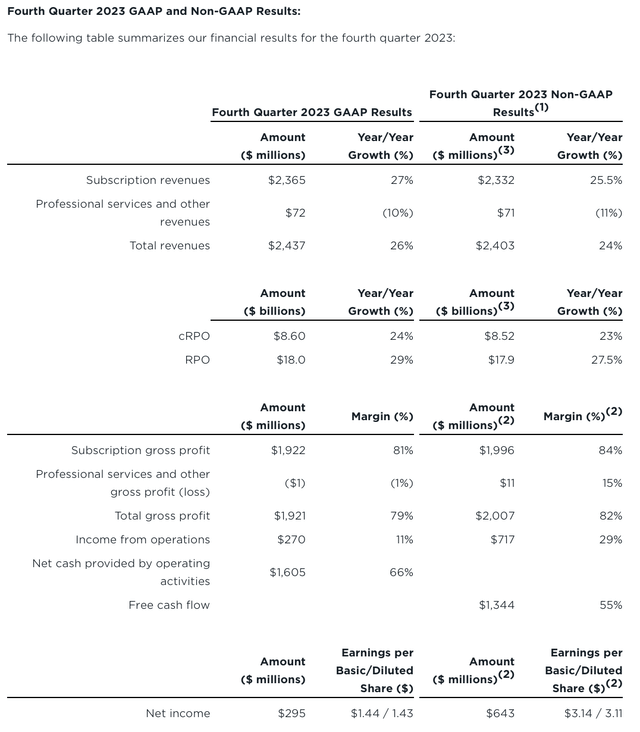

Now let’s take a closer look at ServiceNow’s latest quarterly results. A summary of fourth-quarter earnings is as follows:

ServiceNow fourth quarter results (ServiceNow fourth quarter financial report)

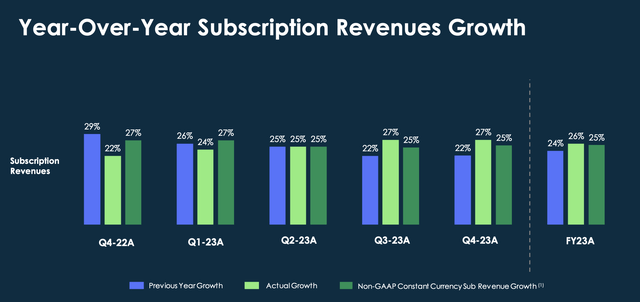

Revenue increased 26% year-on-year to US$2.44 billion, higher than Wall Street’s expectations of US$2.40 billion (year-on-year growth of 24%). Impressively, ServiceNow’s subscription revenue (on a constant currency basis) has maintained an annual growth rate of 25% over the past few quarters, as shown in the chart below:

ServiceNow growth trends (ServiceNow fourth quarter financial report)

Meanwhile, many software competitors continue to cite IT budget challenges as a reason for slowdowns. Transactions, including AI-driven generative products, are one of the core reasons why ServiceNow has been able to sustain its growth trajectory. According to Chief Financial Officer Gina Mastantuono’s speech on the fourth-quarter earnings call:

In Q4, our Gen AI products delivered the largest net new ACV contribution in the first full quarter of any new product line we have ever launched, including our initial Pro SKU (…)

We are raising our outlook for 2024 to reflect the strong momentum we have as we exit 2023. This partly reflects our early success with our Gen AI products, as these investments are accelerating our already strong product pipeline and customers are lining up to pioneer the next wave of business transformation. As always, we continue to be cautious about incremental customer budget and macro cost assumptions in our guidance. “

From a profitability perspective, operating margin is expected to rise 1 percentage point in the fourth quarter to 29%. We did note that ServiceNow is still actively increasing its headcount, with a net increase of about 500 employees (about 3%) in the fourth quarter, and the number of full-time employees at the end of the quarter was 22,700. We like the fact that ServiceNow expects operating margin expansion in fiscal 2024, but it seems that belt-tightening and accelerating margin expansion are not as important to ServiceNow as other software giants such as Salesforce (CRM), and its attitude towards profits is happening. A 180-degree change.

focus

Unfortunately, while growth is expected to slow to the mid-20s, I think ServiceNow shares are already trading at over 10x revenue, so I don’t see much upside in the stock. With margins expanding, but slowly, it will be some time before we can adjust ServiceNow’s valuation based on earnings per share. Avoid here and invest elsewhere.