Voloyar

Following the release of its fiscal 2023 results, we’re back to analyze Stevanato Group (NYSE:STVN).As a reminder, our team’s Buy rating view is backed by long-term tailwind Biologics Demand2) a capital expenditure plan with an economic moat, and 3) Profit expansion forecast. We upgraded Stevanato Group to Neutral following its fourth-quarter results. In fact, the company has already hit our price target of $31.8 per share, and even though it’s trading lower now, we think the downside risk outweighs the upside potential.In short, our team long term demand (Figure 1), but we have an equal-weight view on the company, mainly based on end-of-cycle destocking and high valuations.

Stevanato’s positive outlook

picture. 1

Fourth quarter and fiscal year results

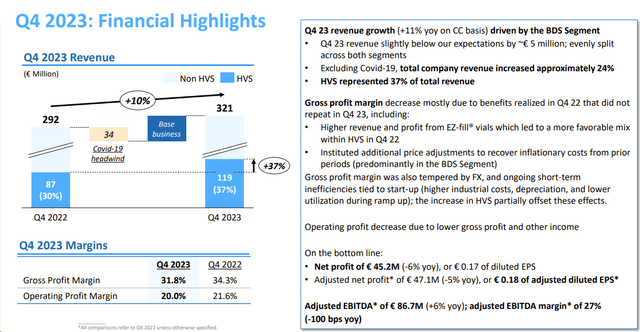

Before moving on to our point of view, an update on the situation Company updates are essential. Stevanato’s turnover will achieve double-digit growth in 2023, with revenue reaching 1.1 billion euros, a 10% increase over 2022 performance. The decrease in the income statement, EBITDA and net profit was due to start-up costs for two new plants in Latina (Italy) and Fishers (USA). Cross-checking Wall Street expectations, fourth-quarter sales were higher than expected, with sales of 321 million euros, while gross margins came in at 31.8%, below consensus forecasts for an average margin of 33.0%. Stevanato’s adjusted EBITDA was €87 million (Figure 2). In particular, the company reported unfavorable currency effects last quarter. In addition, Stevanato was slightly affected by strict comparisons and lower margins on ready-to-use EZ-fill bottles. COVID-19-related sales have fallen again and now account for less than 1% of total turnover. Finally, net profit fell to 45.2 million euros in the fourth quarter and 143 million euros for the full year, a decrease of 6.4% and 1.9% respectively.

Stevanato’s fourth-quarter results grow rapidly

figure 2

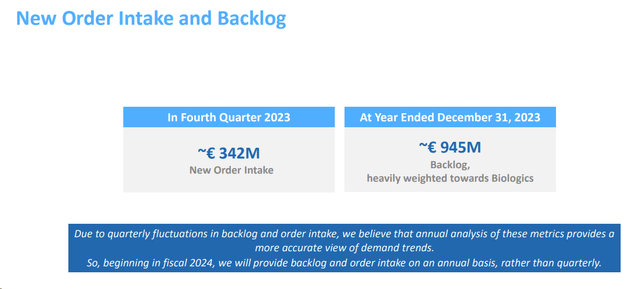

On the positive side, Stevanato expects revenue to grow further in 2024. In addition, as of the end of December, the company’s order backlog reached approximately 945 million euros, with new orders of 342 million euros last quarter (Figure 3).

Stevanato order backlog

image 3

Why are we neutral now?

- Stevanato shares are up more than 40% in the past 12 months. The company provided a preliminary outlook for 2024, with sales in the range of €1.080 to €1.210 billion, adjusted EBITDA in the range of €31.41 to €329.5 million, and adjusted earnings per share in the range of €0.62 to €0.66 . From a comparison point of view, the EBITDA and EPS figures were lower than expected, with adjusted EBITDA and EPS of 338 million euros and 0.67 euros respectively. That’s not good and we shouldn’t see an adverse reaction in the stock price after the stock price. We may expect more rating downgrades in the coming period;

- Peer reports from multiple companies. In detail, western medicine company (WST), Datwyler (OTCPK:DATWY), Gerresheimer (OTCPK:GRRMF), and Scott All destocking activities are reported. Gerresheimer highlighted the decline in vial sales (Stevanato is well known in this area). West Pharma reports decline in biologics sales and expects sales to fall 2/3% this year;

- At the lab, we are also neutral on peer and Stevanato capacity expansion. Additionally, they may become an asset replacement risk in the HVS market due to lower revenue lines due to COVID-19.

Valuation and risk

Beginning with the words of the CEO, he reported how “Despite near-term headwinds from destocking, revenue grew 10% compared to fiscal 2022 as we increased our portfolio of high-value solutions.We remain optimistic about our mid-term target for 2027The company should be aware of competitive prospects. Despite our cautious optimism, we think Stevanato’s valuation looks full. Even applying the company’s 25x 2024 forward guidance (we value the company at 24x EV/EBITDA), there’s a valuation mismatch. For comparison, on average, Schott Pharma AG, Gerresheimer AG and West Pharmaceutical Services Inc trade at a P/E ratio of 24 times and a P/E ratio of 33 times. Stevanato trades at a price-to-earnings ratio above 40 times. 25.75x EV/EBITDA. For the above reasons, we continue to value the company (in line with peer valuations) and confirm our previous target price of $31.8 per share with an equal weight rating.

Downside risks to our price target include 1) increased competition, 2) asset replacement risk, 3) lower industry multiple valuations, 4) lower than expected demand, and 5) customer destocking activity.

in conclusion

Stevanato’s fourth-quarter results were below consensus, but from our forward view we see a different outlook for companies like Schott and Gerresheimer. Destocking activities should be kept quiet throughout the space. Even if management confirms financial targets for 2027 (and we see favorable tailwinds ahead), we are now more cautious. Therefore, we confirm a valuation of $31.8 per share and a Neutral rating. We expect Wall Street to call for destocking impacts, profit growth and new capacity coming online. This may cause share price fluctuations.