Le Chatrenoy

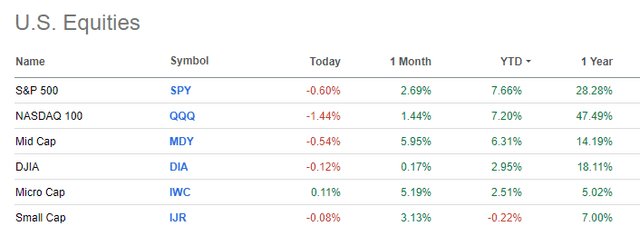

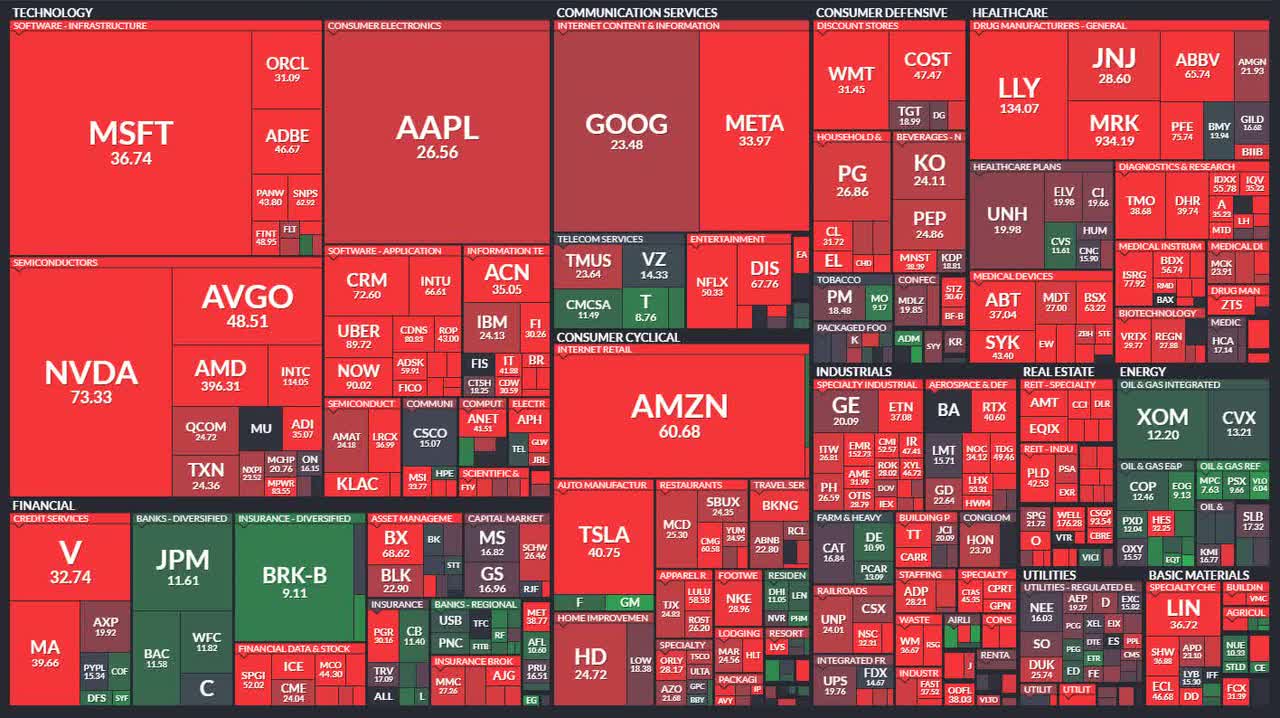

U.S. stocks defied Wall Street strategists’ pessimistic view at the start of the year. Powered by Mag 7as of March 8, S&P 500 rises nearly 8%excluding dividends, exceeds Nasdaq 100 ETF (QQ) and domestic small and medium-sized stocks. Roughly 50 trading days of strong moves in 2024 have investors wondering whether a pullback may be in the offing.

While stocks with recent momentum have driven stocks higher, there are signs that hot stocks like chip stocks may have reached peak excitement. still, Risk areas such as cryptocurrency Assert that the company is going all out to drive a widespread buying frenzy. and, Friday’s jobs report That’s exactly what the Bulls want to see.

I have a Hold rating on the SPDR Portfolio S&P 500 ETF (NYSE: SPLG).The fund is comparable SPDR S&P 500 Trust ETF (spy) and the Vanguard S&P 500 ETF (flight). Later, I will outline areas of potential support that U.S. investors should focus on. But first, we’ll look at the fundamentals and valuation views.

S&P 500 Leading Index Returns So Far 2024

Seeking Alpha

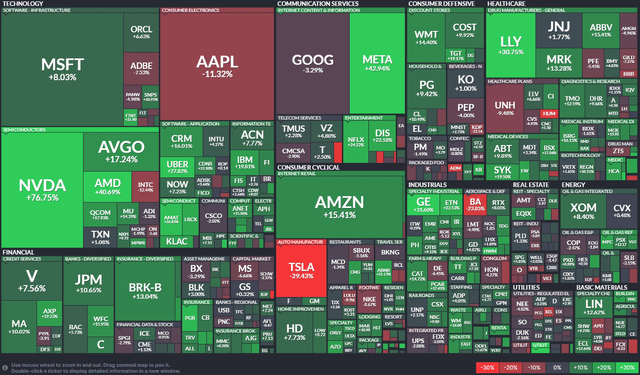

S&P 500 year-to-date performance heat map

Fenwitz

According to the issuer, SPLG seeks to present prior investment results, net of fees and expenses, that generally correspond to the total return performance of the S&P 500 Index. It is a low-cost ETF designed to provide precise, comprehensive exposure to the U.S. large-cap market, which accounts for 80% of the U.S. stock market.

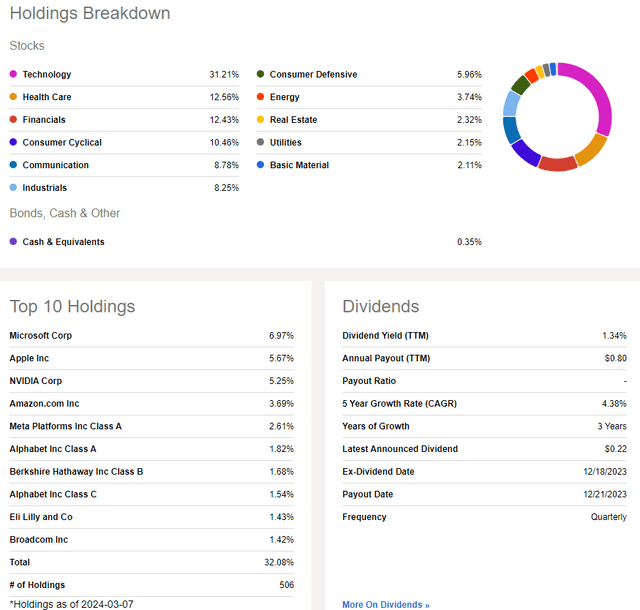

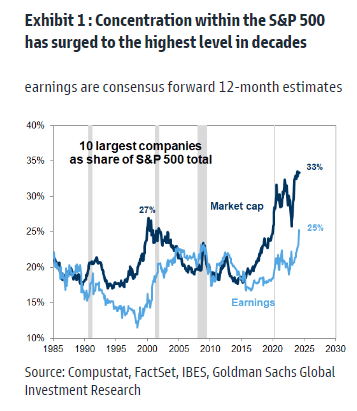

SPLG is a large-cap ETF with nearly $33 billion in assets under management as of March 8, 2024. Stock price momentum has been strong recently, the fund has an A ETF rating from Seeking Alpha, and that rating has remained unchanged over the past six months.and Low annual expense ratio of 0.02%, actually cheaper than SPY and VOO.it is Dividend yield hits record low, only 1.34% past 12 months but Risk rating is very high Despite concentration concerns, U.S. large-cap stocks remain so today.and High liquidityWith daily trading volume of nearly 8 million shares and a 30-day median bid-ask spread of just two basis points, investors can be confident that the fund will generate fair prices throughout the trading day.

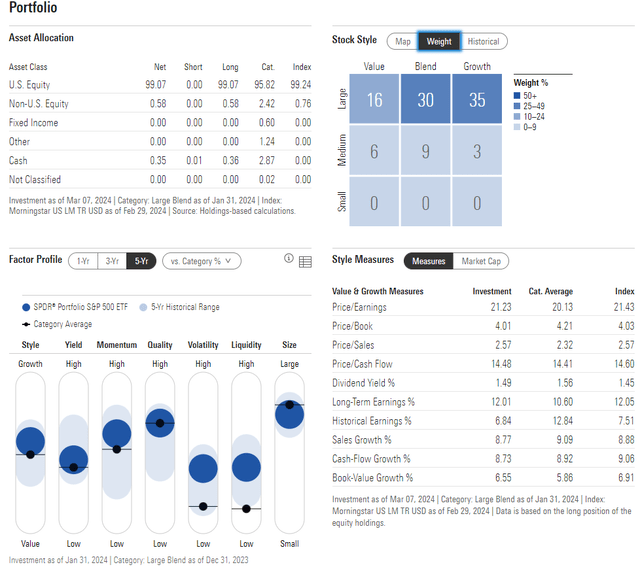

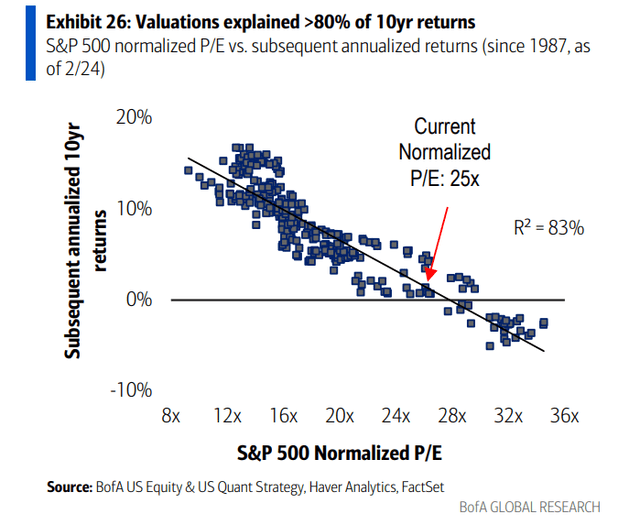

Morningstar’s Four-Star Gold-rated ETF is plotted along the top row of the style box, tilting toward the growth style. The price-to-earnings ratio currently exceeds 21, and the valuation is not very attractive to long-term investors. Bank of America’s quant team asserts that looking out ten years, the S&P 500’s forward annualized return is almost zero. Still, the SPLG portfolio has a long-term EPS growth rate of 12%, so the final PEG ratio is below 2.

SPLG: Portfolio and Factor Overview

Morningstar Corporation

Bank of America: Forward U.S. large-cap returns likely to weaken based on starting valuations

Bank of America Global Research

Microsoft (MSFT) is the king of the S&P 500 ring today, accounting for nearly 7% of the fund, while Apple (AAPL) has fallen to less than 6% of the index fund. Shares of NVIDIA (NVDA) have surged in almost no time and now account for over 5% of SPLG. The top 10 positions combined account for nearly one-third of the ETF.

SPLG: Holdings and Dividend News

Seeking Alpha

Concentration Risks Rising Within SPX, Profit Lagging

Goldman Sachs

Today’s high P/E ratio

Fenwitz

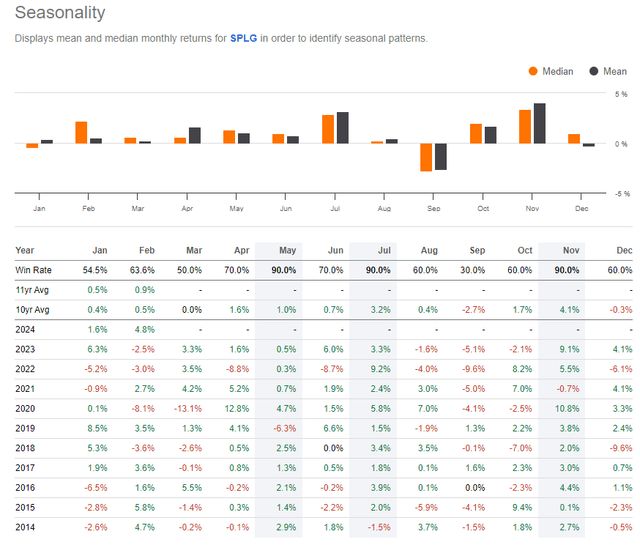

Seasonally, SPLG tends to generate flat returns in March, but earnings from April to August are solid, so there could be some turbulence in the coming weeks as the end of Q1 approaches. , but we have weathered the changes. Recent history has been a period of weakness.

S&P 500 Seasonality: Bullish April-August Period

Seeking Alpha

Technical points

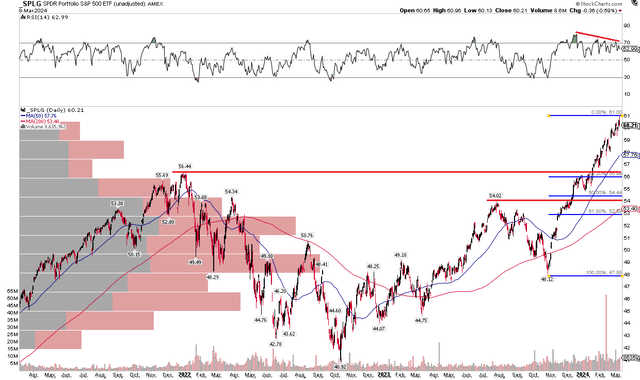

My chart analysis tends to focus on a few key indicators. Let’s change things this time. Note that in the chart below, I plotted Fibonacci retracement levels from last October’s low to the recent high. My CMT colleagues may be surprised by such a confident move – which suggests that stocks have peaked in the near term – but this move could help investors spot where the S&P 500 could fall during a pullback.

While the 50-day moving average is about $2.50 below SPLG’s most recent price, I believe potential support from the previous high water level is near or just above $56 – which is where the 38.2% retracement comes into play. It also converges with the short-term consolidation range we saw at the start of the year.

Looking further down, the 50% retracement (although not technically a Fibonacci point) is very close to the July 2023 market peak. So, keep an eye out for $54. The long-term 200-day moving average fell sharply to $53.40, more than 10% below last week’s close and the 61.8% retracement level.

With the RSI momentum oscillator in a downtrend, we must be wary of at least some consolidation of the significant gains seen over the past 19 weeks.

SPLG: First support level near early 2022 all-time highs

Stockcharts.com

bottom line

I have a Hold rating on SPLG as we believe the stock market may give back some of its recent gains. Given high valuations and signs of some technical issues, some caution is warranted after a positive run in 16 of the last 19 weeks.