Leland Bobbe/DigitalVision via Getty Images

paper

Payne Entertainment (NASDAQ ticker: Penn) is a regional casino operator in the United States. The company recently partnered with ESPN to expand its sports betting and iCasino operations with the launch of ESPN Bet.In my opinion it’s worth it Investors should keep an eye on the company for at least six months, as I believe PENN Entertainment is undervalued in the market right now and ESPN Bet could spark some upside in the stock price.

Business Overview

annual report

PENN Entertainment is a casino operator focused on the U.S. market. Through its casino operating segments (Northeast, South, West, Midwest), the company generates the majority of its profits from land-based and marina gaming and owns multiple brands, including Hollywood Gaming, L’Auberge and Boomtown.Unlike competitors like Wynn Resorts (WYNN) or MGM Resorts (MGM)), PENN Entertainment does not have five-star landmark casinos; instead, it operates four- or three-star regional casinos across the United States. I believe that focusing solely on the U.S. market could generate stable profits even in a downturn, but the potential for revenue growth may be limited compared to competitors that expand internationally.

Through its interactive unit, the company is trying to promote sports betting and online casino businesses. Prior to partnering with ESPN, it had partnered with Barstool to launch Barstool Sportsbook, which ultimately ended in huge losses. ESPN bet launches in November 2023, and the company is investing heavily in promotions to gain share in a market already dominated by DraftKings and FanDuel. According to the most recent fourth-quarter earnings call, ESPN BET has a market share of about 7%.

Profitability

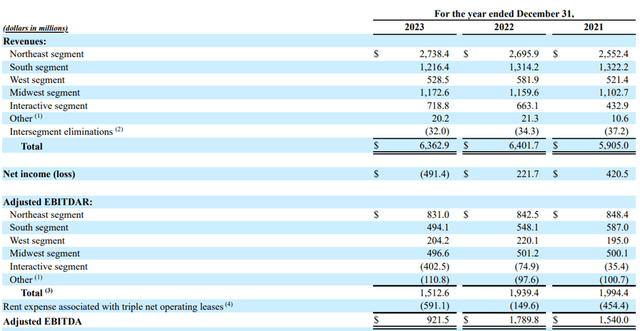

Before investing heavily in interactive business, the company maintained a good gross profit margin, recording 47.8% and 49.7% in 2020 and 2021 respectively. However, as the company struggled to gain market share in the sports betting market, gross profit margins deteriorated to 47.6% and 43.5% in 2022 and 2023, respectively. To delve deeper into the margin side, operating margin will decline from 18.2% in 2022 to 6.3% in 2023. The interactive business will experience a loss of US$400 million in adjusted EBITDAR in 2023, mainly due to promotional expenses. Considering the roughly $900 million loss from the disposal of Barstool, I think the company’s efforts to gain market share in the sports betting market are becoming a liability on profitability. In addition, inflation and a tightening labor market have impacted the company, with food, beverage and other expenses increasing by $244.2 million this year compared to 2022, and gaming expenses, including payroll costs, increasing by $125 million.

Fourth quarter financial report

When focusing on fourth-quarter earnings, it’s understandable that the stock price fell sharply following the announcement due to doubts about the company’s ability to control costs. Revenue for the quarter was US$1.3954 billion, a decrease of approximately US$190 million compared with the same period last year. The main reason for the decline was poor performance in the interactive segment market, which only recorded US$31.5 million in the quarter due to high user acquisition costs. This represents a revenue decline of more than $170 million compared to the fourth quarter of 2022. The company operates a casino business and needs sufficient revenue to cover fixed costs. As a result, the company lost more than $350 million in net income.

Financially sound

On the balance sheet, I think it’s extremely unlikely that the company will experience a serious credit event in the next few years. Although the company’s profitability has declined significantly, it will still generate more than $800 million in EBITDA in 2023, more than enough to cover interest expenses. Excluding capital leases, long-term debt, and cash and cash equivalents, this figure would be $2.718 billion and $1.0718 billion, respectively, in 2023, resulting in net debt of approximately $1.6 billion. I don’t think net debt will be a significant burden in the short term, given the company’s cash generation capabilities.

Valuation

I think the purpose of valuing a company is not to calculate the exact share price in the future, but to see if the chance of making money is higher than the chance of losing money when investing in stocks. To do this, I would use the P/S multiple method to determine if PENN is expensive.

Seeking Alpha

This chart shows the company’s historical record of P/E multiples. Due to the recent share price decline, the multiple is hovering around 0.44, which is close to its historical bottom of around 0.3. That multiple drops to about 0.4, given the revenue guidance the company provided on its most recent earnings call.

However, investors should be aware that the price-to-sales multiple is a function of net profit. In corporate finance, a company’s intrinsic value can be calculated by discounting future cash flows.

• Value = Dividend/(Discount rate – Growth rate)

If we divide this formula by revenue, we can find that P/S (or value/revenue) is calculated by (net margin) * (payout ratio) * (1 + growth rate) divided by (discount rate – growth rate) derived).

• P/S = (NI profit margin) * (payout ratio) * (1 + growth rate) / (discount rate – growth rate) Therefore, the key to using P/S multiples is the company’s net profit margin.

To dig deeper into the company’s history, the P/E ratio dropped to around 0.3 in 2014, when net margin was -7.1%. Since then, performance has improved, causing the multiple to rise to about 0.5 in October 2015. Although the multiple fell again to 0.3 in 2016, the share price surged due to better profitability, with the multiple reaching approximately 1.0 by January 2018.

I think there’s a good chance valuations are near a bottom. The company guided for Interactive segment EBITDA loss of approximately $400 million, similar to 2023, excluding one-time gains from REIT transaction gains in 2023 and losses on the disposal of Barstool, which were $500 million and $900 million, respectively. They respectively stated that the company’s net profit margin is likely to improve in 2024. As we have observed from the history of a company’s stock performance, if net profit margins improve after the P/E ratio reaches a level of 0.3, the stock price performs well.

Additionally, ESPN Bet’s momentum could trigger a re-evaluation of the stock’s value. According to the most recent earnings call, management expects the interactive business to generate revenue of $1.905 billion to $2.02 billion by 2024. That’s more than double from 2023, which is a huge boost to revenue. However, it seems to me that the market is currently discounting the interactive space due to doubts about the company’s ability to control costs. If the company can meet the guidance provided during the earnings call, which is to grow revenue and reduce losses, the market will start to reassess the stock’s valuation.

risk

- The appeal of the ESPN Bet app

Maintaining new user retention will be another challenge for the company due to heavy promotional spending. By leveraging ESPN’s brand and huge sums of money to attract users, ESPN Bet achieved a higher market share than the previous Barstool Bet. However, ESPN Bet is just a rebrand of Barstool Bet, which in my opinion does not provide a good user experience compared to its competitors. If ESPN Bet can’t figure out how to create an incentive for users to continue using the app, the company may not be able to reach double-digit market share in the near future.

- Retail decline

The base scenario for my investment thesis is to sustain a retail casino business. For the company to promote the development of ESPN Bet, cash flow from the retail business is crucial. However, if the casino business experiences revenue declines for various reasons, including a recession, investors may have to apply a larger discount to the company’s stock valuation.

I think many investors have lost faith in current management because of the Barstool deal failure that occurred within a year and the company suffered huge losses. If management makes similar mistakes again and suffers further losses, the stock price could fall significantly.

in conclusion

It will take at least half a year for the market to reassess the current valuation, as investors want to test whether the company can control costs related to ESPN Bet and whether the company can maintain market share in the sports betting market. However, given ESPN Bet’s attractive valuation and momentum, I believe PENN is worth keeping an eye on for investors.