Professor Dennis

summary

LKQ Company (NASDAQ: LKQ) is a global distributor of automotive and specialty aftermarket products. It is also a component of the S&P 500 Index. Despite years of inconsistent revenue growth, it has maintained healthy profit margins.Its European division is As the largest company in the FY23 portfolio, LKQ has been consolidating and centralizing its key operations in Europe to centralize its distribution network, streamline operations and improve its trading working capital. The average vehicle age has continued to rise over the past six years, and as demand for repair and maintenance services increases, the outlook for the aftermarket parts market is positive. My relative valuation shows that LKQ outperforms its peers in terms of revenue growth prospects and margins. The 2025 price target is $60.93, representing an upside potential of 18%. Therefore, I recommend giving LKQ a Buy rating.

historical analysis

Parts and services revenue is generated from the sale of parts, specialty merchandise and accessories used in vehicle repair and maintenance. Parts and services account for the majority of revenue, while other revenue comes from the sale of scrap and other metals. Other income accounts for approximately 6-7% of total income.

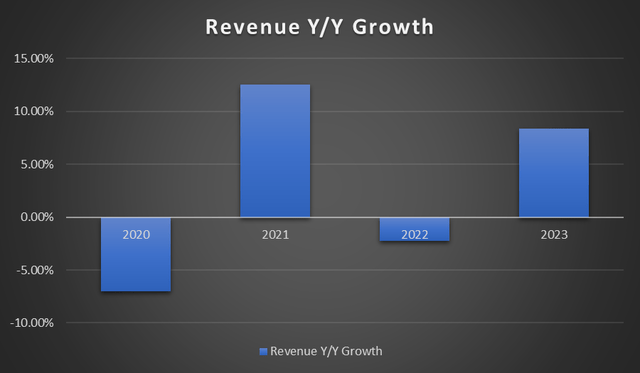

Author’s chart

Revenues have fluctuated over the years but ultimately ended with ~8.38% Year-over-year growth in 2023. Overall growth was attributed to a 4.7% increase in organic growth and a 4.8% increase from acquisitions and divestitures. This was slightly offset by a 19.6% decline in other revenue, driven by unfavorable price movements in precious metals and scrap. Aftermarket parts volumes increased in 2023 due to reduced supply chain pressure, State Farm’s push for aftermarket products, and the positive impact of the UAW strike. Pricing strategies across Europe help offset increased costs from inflationary pressures in the European region. Due to the adverse impact of the conflicts in Ukraine and Russia on operations and product lines, which affected the European business, there will be a slight negative growth of 2.3% in 2022.

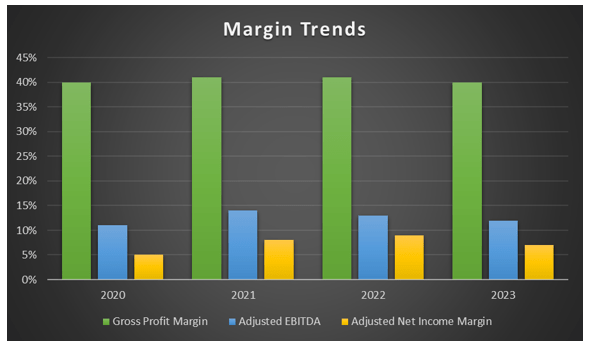

Author’s chart

Speaking of margins, despite inconsistent revenue growth trends, it has remained strong over the years. Cost of goods sold has remained flat over the years, in the 59%–60% range. On an unadjusted basis, operating margin was 9.8%, compared with 12.4% in 2022. Operating income contracted slightly due to higher SG&A, restructuring and transaction-related charges and gains from the sale of PGW Auto, as well as self-service business sales of $4 million in 2022. Therefore, margins remained unchanged on an adjusted EBITDA basis.

Segment Overview

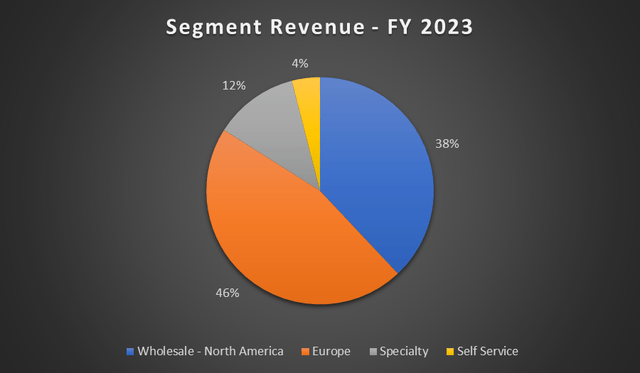

Revenue can be divided into 4 groups: Wholesale – North America, Europe, Professional and Self-Service. The Wholesale-North America group owns the after-sales and salvage business and sells products to the collision and repair business, which accounts for the majority of the segment’s revenue. Purchasing from a small number of aftermarket product suppliers, a large portion of aftermarket products come from Taiwan. Their end market is for wholesale customers such as collision shops, machine repair centers, dealers, and retail customers. Most of these are privately owned small businesses, although the number of independent and dealer repair centers has declined due to consolidation.

Auto insurance companies do influence demand for collision and repair products. Since the goal of these insurance companies is to minimize repair costs, they prefer replacement parts provided by LKQ over new OEM parts. It has an extensive distribution network of aftermarket parts and accessories in the North American collision and repair market. Its European division operates in 20 different European countries. It has a large share of the aftermarket industry, larger than any competitor. LKQ is a major supplier of automotive replacement and maintenance projects in Germany, the UK and many other European countries.

Author’s chart

European business centralization

this 1 Lectra Q The European plan will be for LKQ to form a centralized structure and integrate its main functions to operate as a business in Europe. To date, its operations span European countries, independently of each other. LKQ plans to accelerate the integration process to fully utilize its inventory network. By centralizing and connecting the distribution network of LKQ’s European operations, a more unified and cohesive European business will be formed, thereby simplifying operations, improving efficiency and improving service levels.

LKQ will be able to drive higher levels of productivity and improve its fulfillment rates. Ensure the right parts are available at the right time and place. Better inventory management practices, procurement processes and streamlined operations will significantly reduce costs, free up resources and improve trading working capital. Additionally, there are opportunities to expand LKQ’s product offerings in Europe, such as private label ranges, collision products, recycling, aftermarket parts for electric vehicles, and more. In the long term, this ongoing, comprehensive strategy is designed to help consolidate LKQ’s position in the automotive aftermarket industry in the European market.

State Farm and UAW push

LKQ sales grew at the end of the year, in part due to a slight increase in the use of replacement parts.Part of the reason for this trend is state farm It has been decided to stop using non-OEM collision parts from October 2023. State Farm, one of the largest auto insurance companies in the United States, is shifting more of its business to aftermarket solutions. This may also be due to greater availability of aftermarket parts and recognition of quality and cost-effectiveness, resulting in increased utilization of vehicle repair center parts covered by State Farm policies.

The UAW strike was a headwind for the Detroit Three. However, this may prove to be a tailwind for LKQ. The UAW strike caused a temporary disruption in the supply of new OEM parts. This situation may result in temporary changes in demand for replacement/aftermarket parts, which is part of the reason for LKQ’s sales growth in 4Q23.

Vehicle aging

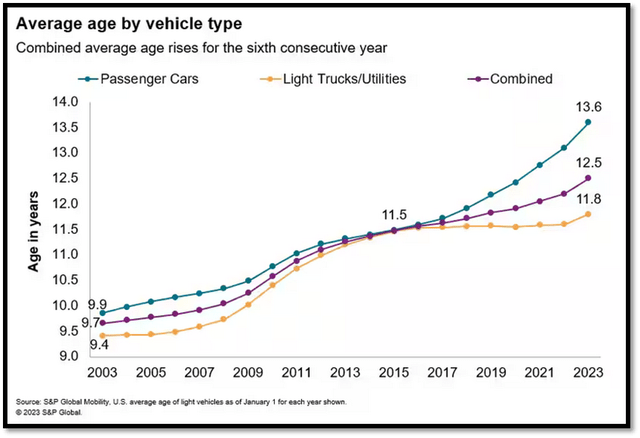

S&P Global

The average age of cars has hit a record 12.5 By 2023, it will have increased for 6 consecutive yearsth for one year in a row. This growth trend, combined with new vehicle sales restrictions, will continue to put upward pressure on the average age of vehicles. This is partly due to low new vehicle inventory levels due to supply constraints. Second, demand for new cars has fallen due to ongoing inflation and high borrowing costs, forcing Americans to repair older cars rather than buy new ones, driving up demand for parts. This is good for the car service industry.

Older fleets require more maintenance services to function properly, resulting in higher demand for auto parts. The typical age of a vehicle requiring after-sales maintenance is 6 to 11 years, with the current average age being 12.5 years. There are currently approximately 122 million vehicles of this age. S&P Global predicts that by 2028, 74% of vehicles will be more than 6 years old. As a result, LKQ is well-positioned to meet the growing demand for vehicles and aftermarket products as more consumers will require repairs and maintenance on aging vehicles.

Disruption caused by Red Sea crisis and strike in Bavaria

The Red Sea crisis has been plaguing LKQ’s procurement in Europe. As Yemeni armed groups have been launching attacks on one of the busiest shipping routes, this has led companies to reroute cargo ships across South Africa, resulting in higher freight costs and longer transit times.Shipping costs increased by more than double The route was rerouted to avoid attacks from the Red Sea. LKQ is taking steps to address longer shipping times by increasing orders. However, this was only a temporary measure; attacks continued, causing shipping costs to skyrocket. Therefore, this supply chain disruption is a test of resilience for LKQ.

In Germany, LKQ operations are affected by employees strike Activities at the Bavaria Distribution Center. While the strike continues, management is taking action to fill temporary capacity to support its operations and services. These social and geopolitical tensions have adversely affected the European segment’s revenues, testing LKQ’s resilience during turbulent times.

relative valuation

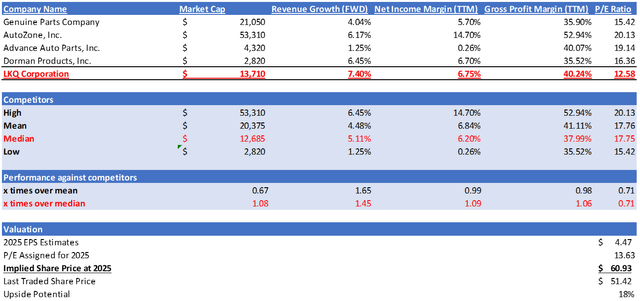

Vehicle collision and mechanical product suppliers and replacement parts dealers may be considered LKQ’s competitors. I’ll compare LKQ to its peers in terms of revenue growth prospects and margins. In terms of profitability, LKQ outperforms its competitors in both net profit margin TTM and gross profit margin TTM, albeit by a smaller margin. TTM’s net profit margin is 6.75% and its gross profit margin is 40.24%, which are 1.09 times and 1.06 times the industry medians of 6.20% and 37.99% respectively. In terms of revenue growth prospects, its expected revenue growth rate is as high as 7.40%, which is 1.45 times the industry median of 5.11%.

Currently, LKQ’s forward price-to-earnings ratio is 12.58 times, which is much lower than its peers’ median of 17.75 times. LKQ shows stronger growth prospects and profitability compared to peer indicators. Therefore, I believe LKQ should trade at a higher forward P/E ratio. To remain conservative, I limit LKQ’s P/E to the 5-year average of 13.63x.

In 2025, market earnings per share are expected to be US$4.47, and revenue is expected to be US$15.85 billion. Market estimates are reasonable as they are consistent with the growth factors discussed previously. By applying 13.63x to 2025 EPS forecasts, my 2025 price target for LKQ would be $60.93, representing an upside potential of 18%.

Author’s Relative Valuation

risk

So far, LKQ has shown resilience in a challenging macro environment in 2023, but there are potential downside risks. This includes disruptions to global supply chains, which may impact parts availability. The ongoing Red Sea crisis has disrupted several European operations, forcing LKQ to place additional orders as a precautionary measure. However, if this situation continues, it could lead to further delays in deliveries and increased shipping costs. Geopolitical tensions could have widespread ramifications, affecting LKQ, which relies on international trade. Logistics disruptions, sanctions, and even threats of war (conflicts in Ukraine and Russia) could pose threats to LKQ’s supply chain, particularly in North America, Europe, and Taiwan.

in conclusion

LKQ has had a difficult year, facing supply chain disruptions from the Red Sea crisis, the conflict in Ukraine and Russia and a worker strike in Bavaria. However, LKQ has remained resilient, consistently maintaining healthy margins and outperforming its peers in both revenue prospects and margins. In addition, as the average age of cars continues to rise and consumers are reluctant to purchase new cars due to inflationary pressures and high borrowing costs, demand for after-sales products will increase. With double-digit upside potential and its growth catalysts, I recommend a Buy rating on LKQ.