imagine

Co-author of Hidden Opportunities.

In the world of retirement planning, dividends are a steadfast pillar of financial stability, providing a steady stream of income that can withstand the storms of market volatility.Like a master blazing a path through turmoil Waters, reliable dividends provide investors with a sense of security and predictability that is critical for those navigating the uncertain waters of retirement.

In this landscape, Antero Midstream Corporation (NYSE:AM) has emerged as a beacon of hope – a company that can weather economic fluctuations and thrive, supported by strong cash flow and a commitment to maintaining shareholder value.

AM owns, operates and develops midstream energy assets primarily serving Antero Resources’ (AR) production and completions activities in the Appalachian Basin of West Virginia and Ohio.This includes gathering systems, compression facilities, water treatment and blending facilities, processing and fractionation plants, and additive manufacturing These services are provided to AR under long-term, fixed-fee and cost-of-service contracts. On top of that, AM has signed agreements for collection and compression services until 2038 and water services until 2035.

notes:

-

AM files taxes as a C corporation and issues 1099 forms to shareholders.

-

As of December 2023, AR owns 29% of AM.

solid financial performance

AM had a very good year as business grew more than total production. This is because midstream companies focus on growing parts of the company’s footprint. AM’s operations demonstrated strong resilience in the fourth quarter, with low-pressure collection and compression volumes significantly increasing by 10% and 14%, respectively.

yes report On February 14, its fourth-quarter and full-year profits set adjusted profit records. EBITDA was $989 million, at the high end of the guidance range. In the fourth quarter, AM’s adjusted net profit was $254 million. EBITDA grew 10% year-on-year, while capital expenditures fell 27%. On top of that, AM reported free cash flow after dividend payments of $48 million, compared with $8 million in the fourth quarter of 2022. In fiscal 2023, AM reported free cash flow after dividend payments of $155 million, compared with a deficit in fiscal 2022.

reduce debt

AM paid off $150 million of debt, taking leverage to 3.3x as of December 2023. At this point, AM’s debt ratios are already as conservative as those of industry leaders like Enterprise Products Partners (EPD). Since the company actually has only one customer, the debt’s financial rating is limited by the lower of the company’s own rating or its only customer’s rating. In this case, AR’s debt rating essentially becomes the upper limit of AM. But clearly the financial position is in place to take advantage of any improvement in AR’s debt rating.

Even so, management aims to further reduce debt levels. AM expects leverage to reach 3x by the end of fiscal 2024 (although we note this could be achieved by simply increasing adjusted EBITDA). The reduction in the debt and equity footprint bodes well for shareholders, as excess free cash flow will increase, providing room for healthy dividend increases in the future.

Free cash flow after dividends continues to grow

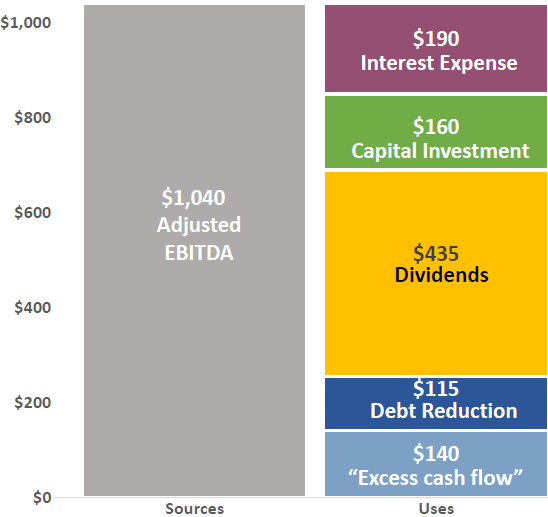

AM Adjustments expected. EBITDA will grow by 5% in fiscal 2024, and capital expenditures will decrease by 14% compared with the same period last year. An expected breakdown of planned spending shows nearly $140 million of excess free cash flow available for stock repurchases this fiscal year. source.

AM Investor Presentation – February 2024

stock buyback program

“Thereafter, we plan to use any excess cash flow to further reduce debt and conduct opportunistic share repurchases under our new $500 million open market stock repurchase program.” – Brendan Krueger, Chief Financial Officer.

midstream operator declare The stock repurchase plan worth US$500 million is equivalent to nearly 9% of AM’s market capitalization at the time of the earnings release. This impressive capital return is strongly supported by favorable prospects for 2024 and beyond. If the company used the entire $500 million in repurchase authorization around current prices, this would allow them to increase the dividend by approximately $0.08/year without spending an additional penny.

Readers must note that there is often a huge disconnect between what management says and what it actually does when it comes to buyback programs. The company has access to $500 million in repurchase authorization over multiple years without using any of the funds. They also only had $10 million to work with, which was relatively paltry. Fiscal 2024 guidance indicates free cash flow of $140 million after all planned activities – a portion of which we expect will be used for share repurchases, if any.

Improve dividend coverage

AM expects free cash flow after dividends in fiscal 2024 to be between $235 and $275 million. The company expects its dividend level to remain unchanged at $0.90 per share per year, citing debt reduction and share repurchases as top priorities. Things to consider.

“Once that level is reached, we will evaluate what makes the most sense among share repurchases, asset-enhancing acquisitions and further dividend increases” – Brendan Krueger, Chief Financial Officer.

AM spent $435 million on common stock dividends in fiscal 2023. Assume no change in shares outstanding. In this scenario, the dividend payout would enjoy a comfortable payout ratio of 63% by the time of the 2024 FCF forecast (using fiscal 2024 guidance adjusted EBITDA and excluding interest and capex).

AM expects capital expenditures of $160 million in fiscal 2024, with projects including the addition of collection systems and facilities, water treatment systems and investments in certain unconsolidated affiliates. The projected capital expenditure amount does not include any acquisitions that management has hinted will be made in 2024.

in conclusion

Overall, we are pleased with AM’s fourth quarter and full-year financial performance. There’s plenty more coming from it, and we’re motivated to continue holding/buying for income as the company’s revenue security and growth prospects look brighter in 2024 and beyond.

The signs are clear, and investors should expect steady business and dividend growth over the next few years. AM currently has an enterprise value of $9.6 billion and trades at less than 10 times EV/EBITDA. That’s extremely low for a growing midstream company with a “Fort Knox” balance sheet. A reasonable price-to-earnings ratio is close to 13x, which means there’s huge potential for long-term price appreciation, and dividends can be used as a waiting fee.

When it comes to retirement, reliability is crucial. With a yield of 6.5%, Antero Midstream stands out in complex financial markets by providing low volatility cash flows through its strong infrastructure and strategic positioning. With fee-based contracts, controlled capital expenditures and industry-leading debt management, AM ensures investors receive a stable and predictable income stream. With each passing quarter, AM becomes a more powerful free cash flow machine, making it a perfect fit for your retirement income needs.