Peshkov

Editor’s note: Originally published in tsi-blog.com March 12, 2024

(This article was published in speculative investor last week)

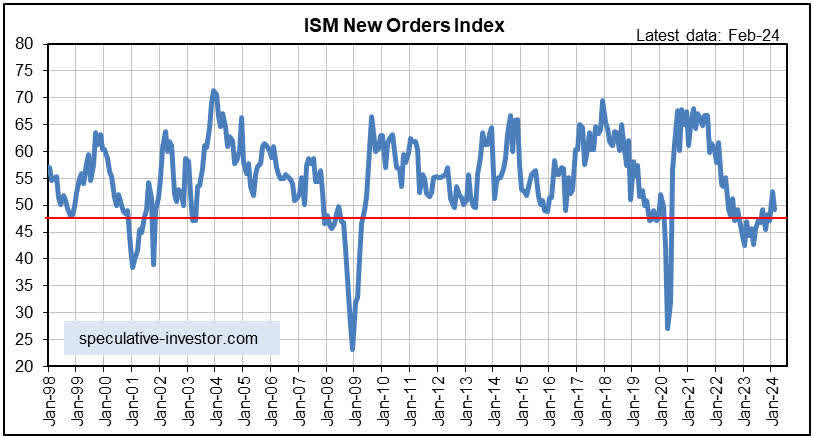

A combination of the ISM Manufacturing New Orders Index (NOI) and the yield curve, our two The most popular high-frequency leading indicator of a U.S. recession has been warning of an impending economy since September 2023. Clearly, this warning is not timely as there has not yet been any recession. Additionally, a month ago we noted that while the yield curve information had not changed, the NOI had just risen well above the recessionary threshold of 48. Although this does not cancel its recession warning (it would have to rise above 55), January’s rise to 52.5 was unexpected. Did subsequent data provide useful new clues?

the answer is Yes and no. The monthly chart below shows that the NOI fell back in February, meaning its recession warning remains intact. Meanwhile, the SPX hit a new all-time high on Monday, March 4.As previously suggested, a new 52-week high for the SPX would be unprecedented back Official recession start time.

This means that recession warnings remain in place, but the earliest possible onset of a recession has been pushed back. Specifically, a new March 2024 high for the S&P 500 suggests a recession will begin no earlier than May 2024.

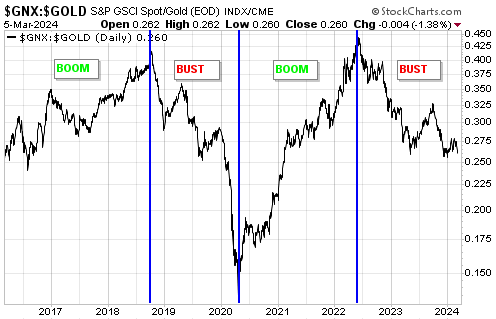

According to our calculations, in the first half of 2022, the U.S. economy has entered the depression stage of the economic boom-bust cycle caused by monetary inflation (rapid monetary inflation leads to prosperity, followed by depression, and the monetary tide recedes. exposed to the risk of economic recession). Bad investments during boom times). The depression phase almost always ends in a recession, although this is not guaranteed.

So far, commodity price performance in USD and gold has been consistent with the recession phase, as the Goldman Sachs Commodity Spot Index (GNX) hit a 2-year low in USD in December 2023 and is now close to Three-year low. The daily chart below shows GNX in gold terms. At odds with the bust phase, credit spreads have returned to boom-era levels. Note that the narrowing of credit spreads and the strong uptrend in equity markets are related because they are both symptoms of the prevailing view that, in the absence of a severe recession, a new boom will begin.

These conflicts must be resolved in the coming months, either through a sharp widening of credit spreads on signs of economic weakness or a sharp rise in industrial commodity prices on signs of renewed prosperity. We believe that, by far, the former is more likely.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.