Win McNamee

this YieldMax TSLA Option Yield Strategy ETF (NYSE:TSLY) is sold as an income product while retaining a (cap) interest in the upside of the stock. The manager accomplishes this by selling Tesla call options.Initially, I was surprised by these companies focusing on a single stock Options writing products exist.But then I discovered there’s a whole series (which I reviewed a few weeks ago A version focused on Coinbase This product).

I’m becoming increasingly interested in these options-related ETFs because they can grow to very large sizes. The company has $732 million in assets under management. There are also leveraged funds. I am curious whether these funds create mispricings in derivatives markets and would like to see more research on this.

This charges a 0.99% management fee. That would be a hefty fee for an ETF that grants exposure to large, liquid U.S. public companies.In this case it’s just a company.

However, due to the options coverage, replicating this strategy on your own will require extensive study of the options market, probably on a daily basis. Depending on the amount of money involved, it might make sense to have someone else handle this if you want to implement this strategy from the beginning.

I can imagine people buying and holding this ETF because its current allocation is astronomical. The fund website promotes an allocation rate of 60%!

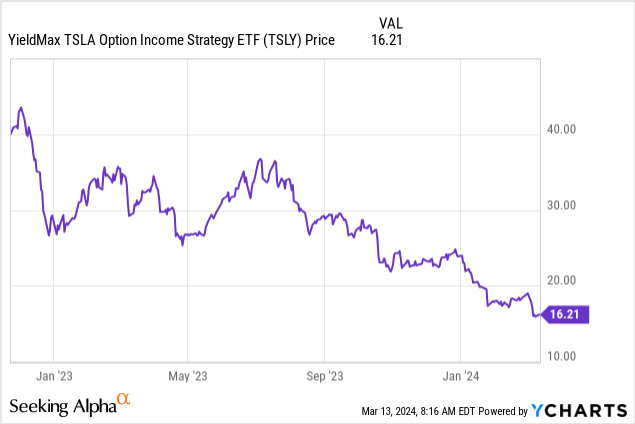

This distribution rate is the annual rate of return you would receive if the recently announced distributions remained unchanged in the future. In practice, this is always subject to change, but is achieved when the share price remains stable and volatility is similar to the period in which the distribution was generated. Most allocations in this category come from call option premiums. For volatile stocks, especially ones with meme potential like Tesla, the option premium can be very high. TSLY launched in November 2022 at a price of approximately $40 and has since fallen to its current price of $16.21:

But along the way, dividend payments to date have been extremely high:

| distribution per share | Announcement date | Explosion-proof date | Record date | Payable date |

|---|---|---|---|---|

| 0.8109 | March 5, 2024 | March 6, 2024 | March 7, 2024 | March 8, 2024 |

| 0.8092 | February 6, 2024 | February 7, 2024 | February 8, 2024 | February 9, 2024 |

| 1.1130 | January 4, 2024 | January 5, 2024 | January 8, 2024 | January 9, 2024 |

| 1.2078 | 12/06/2023 | 12/07/2023 | 12/08/2023 | December 13, 2023 |

| 1.1692 | 11/07/2023 | 11/08/2023 | 11/09/2023 | 11/16/2023 |

| 1.1538 | 10/05/2023 | 10/06/2023 | 10/10/2023 | October 16, 2023 |

| 1.1698 | September 7, 2023 | September 8, 2023 | September 11, 2023 | September 18, 2023 |

| 1.6606 | August 3, 2023 | August 4, 2023 | August 7, 2023 | August 14, 2023 |

| 2.1322 | July 6, 2023 | 07/07/2023 | July 10, 2023 | July 17, 2023 |

| 1.6066 | 06/06/2023 | June 7, 2023 | June 8, 2023 | June 15, 2023 |

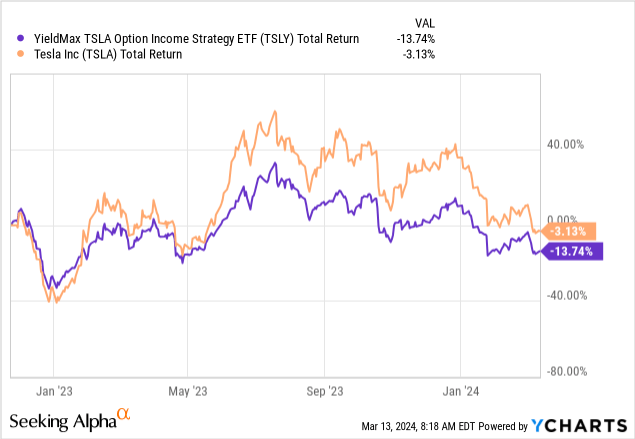

This still resulted in a negative total return, slightly lagging Tesla stock itself:

So, how is this rate of return achieved?

The fund doesn’t actually buy Tesla stock. Instead, it establishes a synthetic long position. This means they use option positions that mimic the behavior of stocks. They do this by going long call options with maturities between 6 months and 1 year and shorting a similar amount of 6-month puts with maturities between 6 months and 1 year, according to their prospectus summary . This method requires less capital to invest in Tesla, and the remaining funds can be invested in short-term Treasury bonds. The current yields on these products are attractive, adding to the appeal of the strategy.

The calls sold by the Fund generally expire in one month or less. The fund’s goal is to sell call options at a price of 5%-15% above TSLA’s stock price.

If I sell the TSLA call at $185 (a 5% increase from $177), that’s $7. $205 sells for $2.26 (up 15% from $177). The $185 call option implies a “yield” of 3.9% over the next 30 days. The $177 call option implies a “yield” of 1.27% over the next 30 days. If you multiply the 3.9% forward yield by 12, you get about 46%. Add to that the 4% Treasury yield, and we’re pretty close to the advertised distribution yield. Not exactly, but the premium will vary based on the implied volatility of TSLA stock.

Surprisingly, the ETF has consistently underperformed TSLA stock since its inception. Notably, Tesla shares fell only 3% during this period. Intuitively, you would expect to make a lot of money by selling calls on stocks that have barely moved. I’m not going to recreate exactly how this happened. But if you look at the TSLY and TSLA price charts above, you’ll notice that the ETFs fell sharply immediately after their launch. Then Tesla shares exploded, which is typical price action and very detrimental to covered call sellers. Call selling offers little protection against a large short-term decline (the premium is negligible compared to a 40%+ drawdown). On a sharp rally, call sellers again receive a negligible premium and limit upside while the stock soars .

If you look at Tesla stock since the ETF launched, you’ll see that it has repeated this pattern many times. Violent rallies and sharp sell-offs. The stock rarely dips into a downturn. Option premiums compensate to some extent. A very calm stock will not generate 4% per month because of selling 5% out-of-the-money options. But sometimes that’s not enough to compensate for the price path the ETF follows.and please understand Option Risks Before making any transaction.

Both volatility and implied volatility have stabilized. The premium generated by selling the option will fluctuate continuously. Personally, I don’t like Tesla as an investment, but I’ve been wrong about that for years. If I like Tesla as an investment, I’d rather simply own the stock.

I’m most interested in selling 1-month covered calls if: 1) I think the downside to the current stock price is limited (I’m not convinced); 2) I think the upside is limited, 3 ) I suspect speculators are overbuying calls.

Currently, TSLA’s implied volatility is around 47%. Realized volatility over the past 20 days was approximately 41.5%. Tesla options have been one of the most heavily traded option chains for quite some time. This remains the case. However, put volume was slightly higher than call volume. The stock price has been falling recently. Gains (which are often accompanied by higher realized volatility) have already occurred in April.

All things considered, now doesn’t seem like a good time to sell Tesla covered calls. Even if I’m interested in this strategy, I might give up temporarily and look for a better target.