Stefano Zakaria

March 12 is a very positive day for shareholders ArcelorMittal (NYSE:MT). The company’s shares rose 3.4%. After the close of the day, news comes out think The company agreed to acquire a company called Valurek (OTCPK:VLOUF, OTCPK:VLOWY) in exchange for 955 million euros, approximately US$1.04 billion. Management has made it clear that they do not plan to make an offer to acquire the remaining business for at least the next six months. But considering how cheap the stock is right now, it might not be a bad idea for management to finally consider doing so. All in all, this move delivers significant additional value to shareholders. Investors would be wise to give this deal a thumbs up.

Necessary comments

Unless otherwise stated, and Even so, on a case-by-case basis, all financial data in this article will be in U.S. dollars. These include Vallourec’s reported historical financial performance and the terms of its deal with ArcelorMittal. For these numbers, I’m using current exchange rates.

a great deal

According to a press release issued by ArcelorMittal on March 12, the company agreed to acquire approximately 65.24 million Vallourec shares at a price of 14.64 euros per share, equivalent to a 28.4% stake in Vallourec. That’s about 955 million euros, or $1.04 billion.The shares do not come directly from the company, a move that would bring it additional capital but also result in a reduction in ArcelorMittal’s ownership stake, but from funds managed by ArcelorMittal Apollo Global Management (Military Post Office).

ArcelorMittal

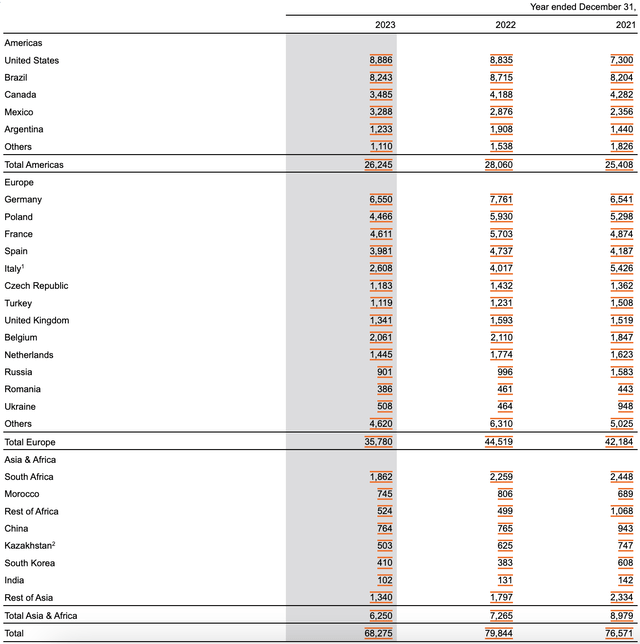

ArcelorMittal’s management team praised Vallourec for the “successful restructuring” that has taken place over the past few years. As you will see, this statement is certainly true. Of course, it’s not just the financial numbers that matter. Equally important are the products produced by Vallourec. You’ll see that an estimated 85% of the company’s 2.2 million tonnes of annual rolling capacity is concentrated in integrated low-carbon production centers in the markets in which it operates. This will be the United States and Brazil.Strategically this is perfect for ArcelorMittal because Astonishing 13% of its revenue comes from the United States and another 12.1% from Brazil. In fact, these are ArcelorMittal’s two largest markets from a sales perspective.

Operationally, Vallourec focuses most of its efforts on the production and sales of pipes. The company produces pipes for a variety of uses. For example, in the oil and gas sector, the company manufactures casing, tubing and fitting products for exploration and production. It produces pipes that are used to solve pipeline challenges in pipelines transporting oil, natural gas and refined products. They also offer seamless pipes for oil and gas processing. However, the business is not limited to the oil and gas market. It actually caters to various industries such as automotive space, steel structures, etc. For example, its automotive product portfolio includes tubes used in the production of axles and truck trailers. Its precision tubes can be used in airbags, diesel injection pipes, gear shafts, suspension parts, etc. Some of them are even used in the railroad industry. Geothermal wells require tubular solutions to deal with high temperatures, corrosion, and more. The list of its products and their uses could fill an article in itself.

Author – SEC EDGAR Data

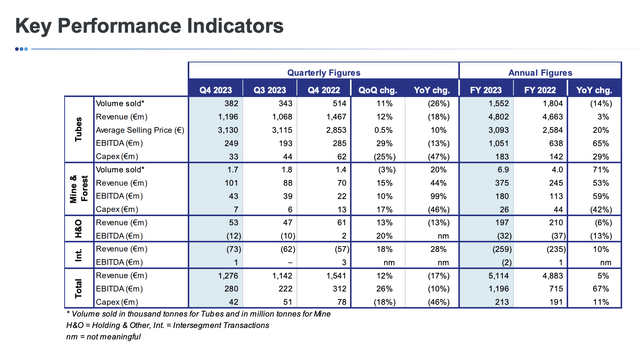

Based on fiscal year 2023 data, it’s clear that the company’s pipe manufacturing segment accounts for the vast majority of its business. Approximately 93.9% of the company’s total revenue comes from the pipe segment. However, the company does have some other businesses. For example, it has a separate division called Mines and Forests, which manages the iron ore and forests owned by the company. The latter supplies charcoal for its blast furnaces in Brazil.

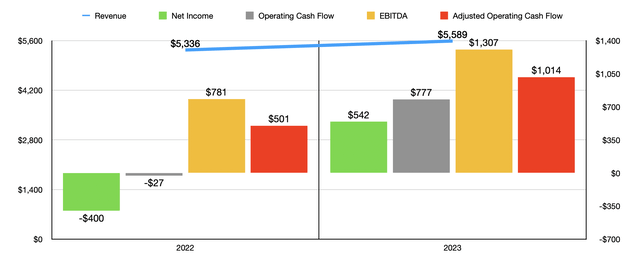

from a financial perspectiveThings have been improving for Vallourec and its investors. Take the period from 2022 to 2023 as an example. In 2023, the company’s revenue will be approximately US$5.59 billion. That’s a 4.7% increase from the company’s $5.34 billion in revenue a year ago. While the company’s mine and forest segment sales grew from $245 million to $375 million, the lion’s share of the growth came from the pipe segment’s revenue, which grew from $5.1 billion to $5.25 billion. Although the company’s total sales volume fell from 1.8 million tons to 1.55 million tons, the price per ton soared from US$2,584 to US$3,093. In the Mines and Forestry segment, the company also benefited from an increase in sales from 4.0 million tonnes to 6.9 million tonnes.

Valurek

Increased revenue also led to higher profits. The company went from a net loss of $400 million in 2022 to a net profit of $542 million last year. Other profitability indicators followed a very similar trajectory. Operating cash flow went from negative $27 million to positive $777 million. Even after adjusting for working capital changes, our funding increased from $501 million to $1.01 billion. Finally, the company’s EBITDA jumped from $781 million to $1.31 billion. Improved profitability also allowed management to reduce overall debt. Net debt was $685 million at the end of the most recent quarter. That’s down from the $1.05 billion the company had at the end of fiscal 2021.

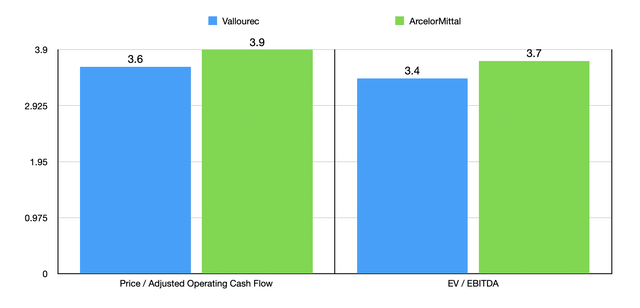

In addition to opening the door to additional market control, the acquisition also makes sense from a financial perspective. Under the terms of the acquisition, ArcelorMittal paid 3.6 times adjusted operating cash flow. It also pays an EV to EBITDA multiple of 3.4x. By comparison, ArcelorMittal itself has an adjusted operating cash flow multiple of 3.9 and an EV to EBITDA multiple of 3.7. Considering how cheap the shares are, management could easily justify taking on debt to complete the deal. But there is no need to do this. Although ArcelorMittal has net debt of $2.9 billion, it has total cash on hand of $7.78 billion.

Author – SEC EDGAR Data

take away

Who knows what will happen between ArcelorMittal and Vallourec in the future. I would say that eventually acquiring the company outright may be a wise decision. But even if that doesn’t materialize, it’s an interesting acquisition that increases ArcelorMittal’s market share in the two countries with the largest revenue. I think both companies’ stocks are very cheap right now. But there’s no denying that the price ArcelorMittal is paying represents a discount to the price at which its own shares are trading. When you add all of this together, I think this is a bullish development that investors should be excited about.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.