just_super

generalize

The following is my report on Thoughtworks (NASDAQ: TWKS), I upgraded it to a Buy rating as I think the business is performing much better than expected – as evidenced by how they have changed their strategy to fit the macro Environment – This article is to provide my latest thoughts on business and stocks. I am downgrading my rating to Neutral from Buy as TWKS performed very poorly in 4Q23 and is expected to continue to underperform its peers in FY24. And, at its current premium valuation, the stock price is simply unattractive.

investment thesis

My last update on TWKS was in June 2023, and despite the massive share price decline, I think the business is still performing well (3Q23 revenue growth beat consensus by 1%, earnings and gross margins were ahead by a wide margin, ahead of expectations About 200 basis points) expected).However, the performance of Season 4 in 2023 Really terrible and disappointing. The results severely undermined my confidence in my management abilities and prevented me from continuing to perform at the level I originally expected.

In Q4’23, TWKS reported revenue of $252 million, missing the consensus estimate of $267 million. To make matters worse, negative growth actually accelerated to -18.8% from -15.7% in 3Q23. In constant currency terms, revenue fell even more sharply (-22%). In terms of market segments, Technology/Services declined the most, down -23% from the same period last year; Retail/Consumer Goods fell by 19%; Energy/Public/Health fell by -12%; Automotive/Travel/Transportation fell by 7%; and Finance / Insurance industry fell 3% respectively. Growth was also weak in all regions (all down double digits, including a 37% decline in Latin America). This set of results clearly shows that TWKS is severely impacted by supply challenges, pricing pressures, and ongoing macro headwinds. As a result, gross margin was as low as 33.6%, compared with the consensus estimate of 37.9%. This also leads to adj. EBITDA margin was 5.5%, well below expectations of 11.5%.

About two-thirds of revenue shortfalls are due to specific supply-side constraints. This is primarily due to the larger scale of structural changes in our operating model, which caused some disruption to our operations in the fourth quarter.

Continued customer caution has resulted in smaller project increments, more project delays, and our pricing pressure is slightly higher than we expected. We expect this cautious behavior to continue into 2024. 2023 Q4 Earnings Conference Call

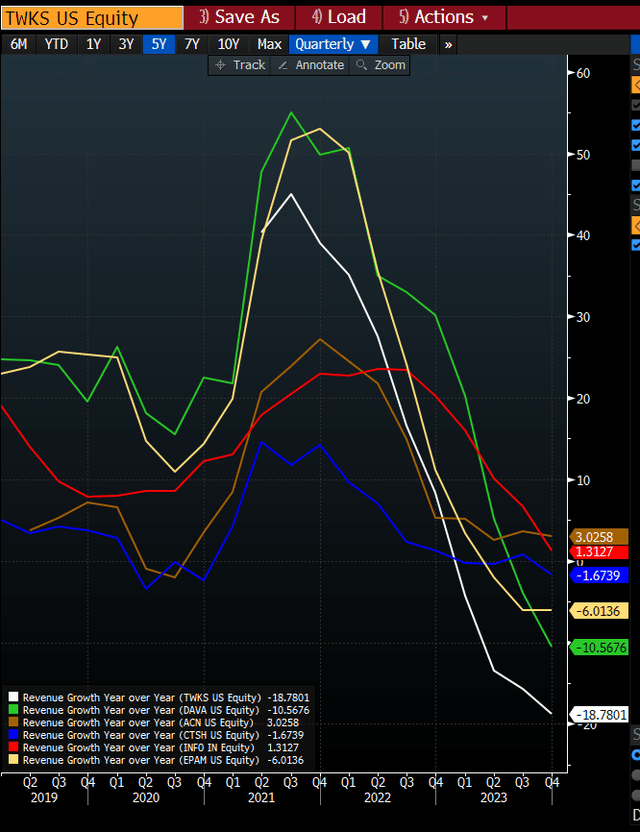

Bloomberg

My biggest concern is TWKS’s relative performance relative to its peers, which is a red flag indicating significant market share losses. If you look at the chart (year-over-year Q4 performance), TWKS’s Q4’23 performance shows a share loss of at least 800 basis points (compared to the second worst performer, DAVA). Initially, I thought it was a matter of scale (i.e. greater distribution capacity so they can find more deals). But that doesn’t appear to be the case, as Endava’s revenue was about the same size but outperformed the others by about 750 basis points. This really makes me question management’s ability to execute.

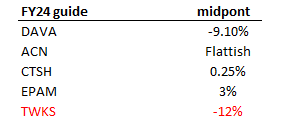

Management’s guidance for fiscal 2024 also implies further growth pressure. TWKS 2024 guidance calls for revenue of $980 to $1.01 billion, or a decline of 11% to 13% in constant currency, which is 1,000 basis points below the pre-results consensus revenue estimate of $1.121 billion and consistent with my 2024 forecast of $1.4 billion. Even more than expected. income. Likewise, this guidance was significantly worse than peers, indicating further downside for the stock price. Qualitative comments from management further support the argument that results will remain weak. While they say growth is stabilizing due to project cancellations, pricing pressures, delays and slower growth remain. In particular, while budgets are also expected to be in line with last year, pricing will come under greater pressure. Hopefully pricing will stabilize so that TWKS can see sequential improvements; however, at this point, I think weak execution leading to huge share losses will be the market’s main focus. Until TWKS shows better execution (i.e. growth returns to be in line with or better than its peers), the market will likely continue to punish the stock.

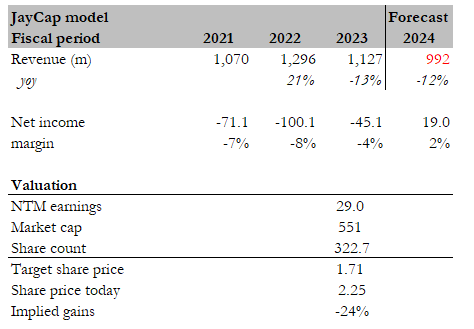

Calculate yourself

TWKS may also face pressure on profits. The obvious reason is lower income. The second reason is that TWKS is increasing its offshore delivery capabilities, which means a lot of fixed costs will flow into the income statement until utilization picks up over time (which depends on the macro environment and management executing better). While a shift in the offshore mix may improve margins in the long term, the problem is that it will cut into the higher-margin onshore business (which is more stressful) in the short term. Finally, TWKS is also still in the process of restructuring. While restructuring costs in 2024 should be lower than in 2023, management does expect capital expenditures to increase from 2023 levels, putting further pressure on free cash flow margins (which are already under pressure from declining margins).

Valuation

Calculate yourself

Based on my model, my price target for TWKS is $1.71. This is a significant reduction from my previous price target of $12.74. I admit that I made a mistake in overestimating TWKS’s management’s ability to execute, which was very apparent in the 4Q23 results and FY2024 guidance. Rather than taking a more conservative approach to modeling the business, I focus on the short-term outlook rather than the medium-term (3-year outlook). Using fiscal 2024 guidance as a guide (giving management the benefit of the doubt), I forecast revenue to decline 12% to $992 million. As for margins, I use management’s EPS guidance back to earnings of about $19 million, which implies a net margin of 2%. Here’s the thing: Even if management does achieve this goal and the valuation remains at the current high level of 29x, the stock price remains unattractive at this level. While the consensus expects net income to grow to $60 million (with 9% revenue growth in FY25), I’m reluctant to put any weight on the FY25 numbers given that near-term execution remains a question mark.

in conclusion

I downgrade TWKS to Neutral. The core reason for the downgrade is TWKS’s weak execution in 4Q23. In particular, the recent Q4 2023 results were very disappointing, with revenue and margins falling below expectations across all segments and geographies. More worryingly, TWKS is underperforming compared to its peers, suggesting potential market share losses. TWKS’s fiscal 2024 guidance paints a grim outlook. The company expects further revenue declines and comments indicated continued headwinds from project delays, pricing pressures and budget constraints.