D3signAllTheThings

Sigma Lithium Corporation (NASDAQ:SGML) is one of the leading producers of low-cost, high-purity lithium, driving the development of electric vehicle technology.Notably, SGML’s commitment to green practices through its quintuple zero lithium program highlights its focus on sustainability and enables it to Let customers like environmentally friendly Glencore. Likewise, the securing of a US$90 million credit line to fund a US$100 million investment in the Grota do Cirilo project expansion program demonstrates the financial institution’s support for the company’s strategic vision. However, valuation issues and additional financing have led to a weakening of my optimism on the stock, which is why I rate the stock a Hold at current levels.

Lithium Mining Industry: Business Overview

Sigma Lithium is a Canadian company and one of the largest lithium producers in the world. SGML was founded in 2011 and is headquartered in Sao Paulo, Brazil.Originally Sigma Lithium Resources Corporation, but changed its name to Sigma Lithium Corporation in July 2021. The company has approximately 196 employees. Since SGML is purely a lithium business, it is closely tied to EV demand and related OEMs that need lithium.

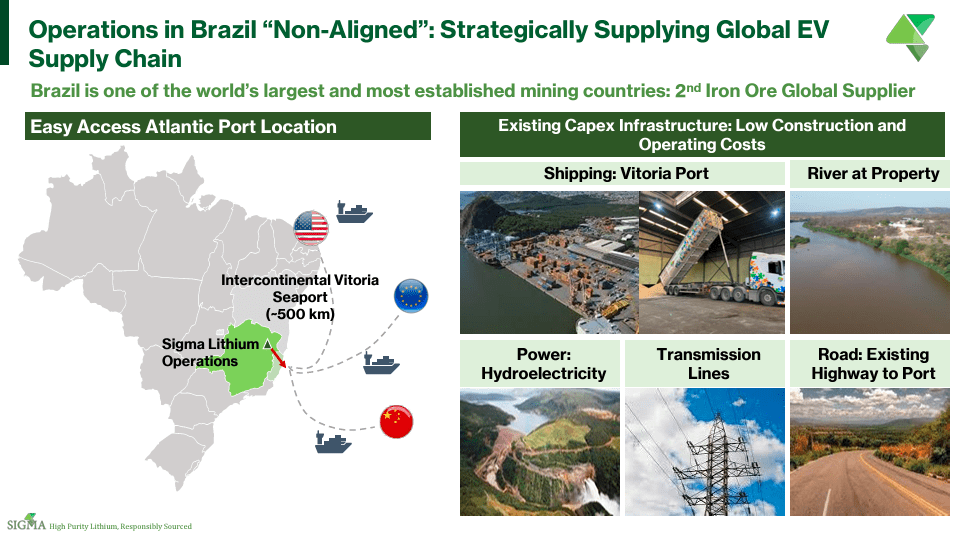

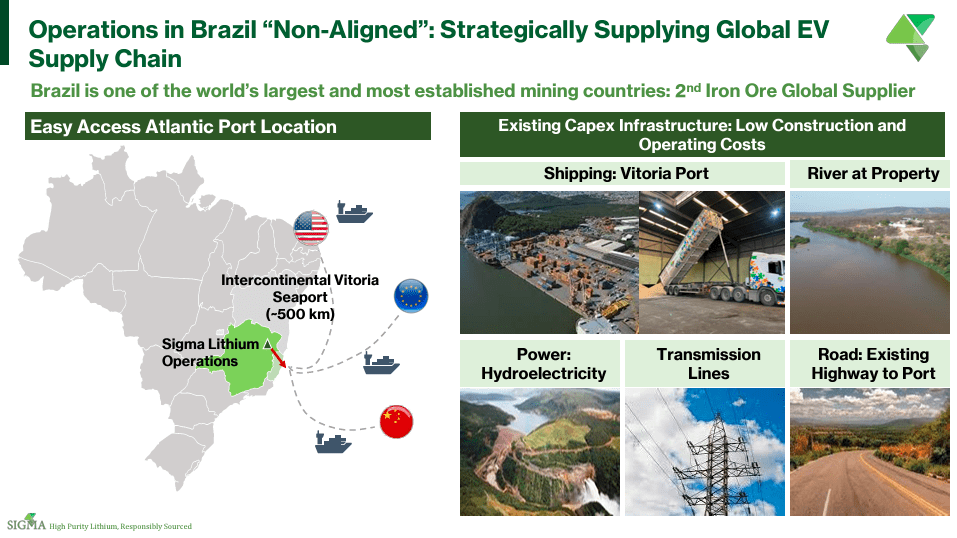

SGML explores and develops lithium deposits primarily in Brazil.The total area of property owned is approx. 185 square kilometers Located in the Arazuí and Itinga regions of the state of Minas Gerais, including properties in Grotta do Cirillo, Ginipapo, Santa Clara and São José. The company contributes to the development of the electric vehicle (EV) industry by providing the lowest cost, highest purity, and environmentally sustainable lithium.

Source: November 2023 company presentation.

As you might imagine, SGML is positioned as the leading lithium supplier to the EV industry because Increase in demand Because this mineral is an important component of batteries. One good thing about SGML is that Brazil, the world’s second iron ore producerthere is one Robust mining infrastructure and established renewable energy grids, such as hydroelectric plants. In addition, the production area has a highway leading to the riverside port. These existing facilities enable efficient logistics, low construction and operating costs, and reduce the need for additional investment. Additionally, the company claims that Brazil is a low-cost environment, making SGML the second-lowest operating cost among lithium producers.

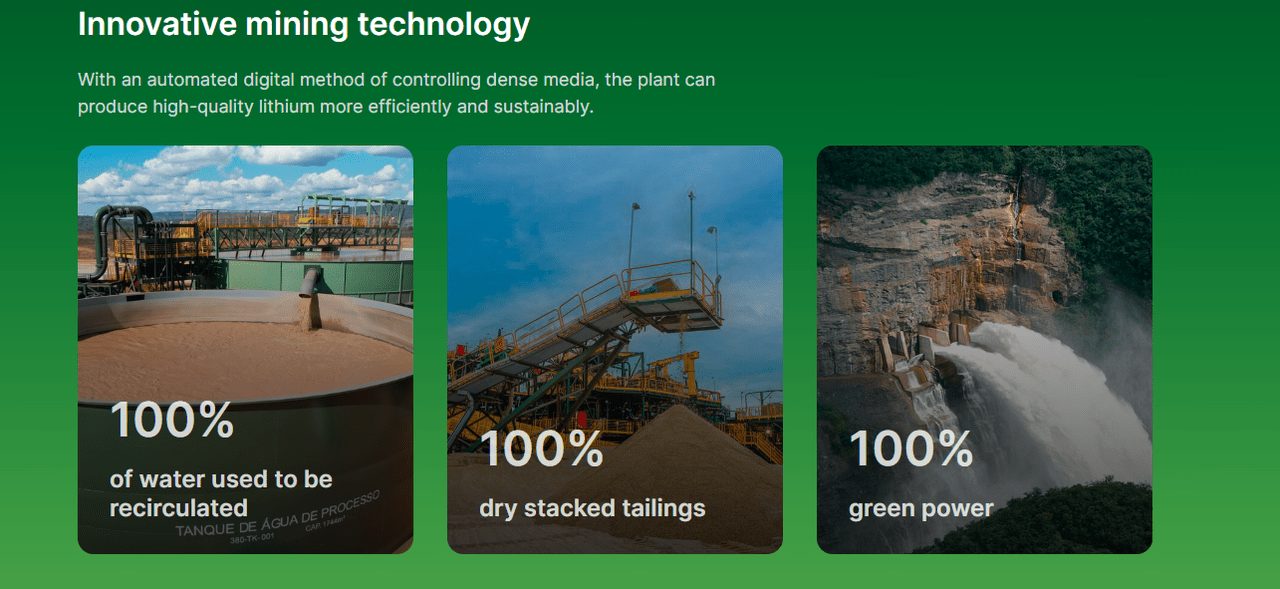

SGML’s business is focused on extracting lithium from lithium hard rock mine. However, it has developed a refined, sustainable process that minimizes environmental impact. The “Five Zero Lithium” initiative combines zero toxic chemicals, zero carbon, zero drinking water, zero tailings dams and zero polluting electricity. This may help alleviate some ESG concerns some investors may have, so that’s a positive, although the mining business is certainly not a favorite among some investors.

Source: SGML website.

Nonetheless, SGML’s environmental and social impact plans Alignment As the company is committed to green mining from extraction to lithium processing, it is aligned with the United Nations Sustainable Development Goals. It is also noteworthy for its community engagement that considers the rights of local residents in protecting natural water resources for residents’ daily needs and agricultural use.

Financing and production ramp-up at Brazilian lithium hub

Additionally, on March 8, the company announced that it had secured a $90 million financing credit line from: Citibank: $10 million, Santander: $20 million, Banco do Brasil: $10 million, XP Inc.: $10 million. The company plans to invest US$100 million to expand the Grota do Cirilo project, with audited mineral resources of 109 million tons. This financial support reflects the agency’s confidence in SGML’s ability to expand its business. This large audited lithium reserve highlights the richness of SGML’s mining property and its potential to produce this mineral. Since SGML currently holds only about $28.1 million in cash and equivalents, these credit lines may be critical in funding mining operations.

In addition, on the same day, SGML preloaded 22,000 tons of lithium concentrate for Glencore and prepaid 85% of the cargo at a premium, which was 7.5% higher than the standard rate. This shipment demonstrates SGML’s ability to achieve and maintain annual production of 270,000 tons of quintuple zero lithium. Additionally, the partnership with Glencore demonstrates strong demand for high-quality lithium produced by SGML. Finally, Spark Energy Minerals Inc. announced in March this year the expansion of its exploration activities in the same area as SGML in the Brazilian state of Minas Gerais, commonly known as the Lithium Valley. SGML’s Grota do Cirilo project has contributed to the region’s recognition and is an indicator of its potential to extract high-purity lithium.

Source: November 2023 company presentation.

The overall picture, therefore, suggests that SGML is expanding its operations and is in need of financing. Such funding will likely come from debt, which I suspect would make SGML a relatively highly leveraged company in the lithium industry. For context, the company currently has approximately $115.3 million in total debt and obligations on its balance sheet. Meanwhile, its January 2024 report showed a significant 27% increase in audited mineral resources to 109 tonnes, placing its Grota do Cirilo industrial chemical pre-lithium beneficiation complex among the top four in its category globally. Furthermore, it is undeniable that SGML’s resources and focus on the Brazilian market could be a promising strategic selling point for investors, with future plans to expand production to meet growing lithium demand.

Baking: Valuation Analysis

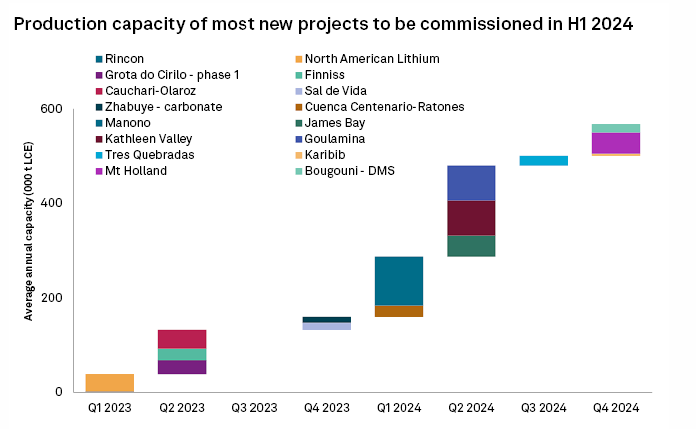

From an investment perspective, SGML’s business should receive a long-term boost for the foreseeable future. Although lithium is currently driven mainly by the electric vehicle market, the supply of this commodity is also relatively limited. Adding additional capacity online is challenging due to the associated capex investments, so SGML has gained a foothold in an increasingly promising resource pool, which is good news for investors. That’s why, in general, S&P Global Overall, the lithium market remains relatively optimistic, which is good news for SGML.

Source: S&P Global.

At the same time, it’s important to understand that the market appears to be taking a more modest view of overall EV growth. The KARS ETF tracks investor sentiment in the electric vehicle industry relatively well, but is still down about 32% from its July 2023 high. But this may be more of a respite from optimism in the industry than an underlying fundamental issue.After all, S&P Global Still predicting The revenue of pure electric vehicles in the international market has achieved strong double-digit growth. Therefore, the underlying demand drivers are hardly in a down cycle. Therefore, in my opinion, the lithium market remains promising and SGML is well-positioned to capture this market as long as it executes and deploys its capital wisely.

However, looking at SGML’s P/E ratio does suggest that the stock has been priced in with such promising long-term tailwinds. The stock is currently valued at about $1.6 billion, which compared to its book value of $161 million implies a high price-to-earnings ratio of 9.93. Additionally, industry peers have a price-to-book ratio of about 1.67, so SGML has included a valuation premium. Also, as I said before, the likelihood of SGML leveraging its credit lines to fund future expansion is relatively high, so this only adds to its risk profile. Finally, the company burned approximately $22.4 million in the third quarter of 2023, which represents an annual burn rate of $89.6 million. I get these numbers by adding up the company’s CFO and capital expenditures and annualizing them. Such a cash burn rate means additional financing is imminent, as it currently holds just $28.1 million in cash.

Source: TradingView.

As a result, I think the company’s already high valuation multiples and somewhat stretched balance sheet weaken its investment appeal. Of course, I don’t think it’s time to be bearish on lithium or miners yet, but overall, I think SGML is a “hold” right now.

Reserved: Conclusion

Overall, I think the company’s underlying business is likely to do well. Lithium appears set to continue growing in all international markets, driven primarily by electric vehicle demand. These fundamental long-term bullish factors should translate into successful expansion for SGML. However, its valuation already includes a hefty premium and it may soon take on debt. Therefore, I think a “Hold” rating is appropriate today.