Kristian Nafziger

First National Bank of Alaska (OTCQX: FBAK ) earnings are likely to remain flat this year. Below-average loan growth could provide some support for profits.On the other hand, interest rate cuts and subsequent profit compression could limit earnings grow. Overall, I expect the company to earn $18.88 per share in 2024, nearly in line with last year’s earnings.compared to mine last report My profit expectations haven’t changed much for the company, as my outlook is more or less the same. The year-end target price has room for double-digit upside from the current market price. Additionally, the stock offers an attractive dividend yield of over 6% (excluding special dividends). Given total expected returns, I maintain a Buy rating on First National Bank of Alaska.

Loan growth is expected to be below historical averages

First National Bank of Alaska’s loan portfolio fell 1.9% in the final quarter of 2023, leading to a disappointing 2.1% gain for the full year. Last year’s growth rate was lower than the compound annual growth rate of 3.1% over the past five years and 4.9% over the past eight years.

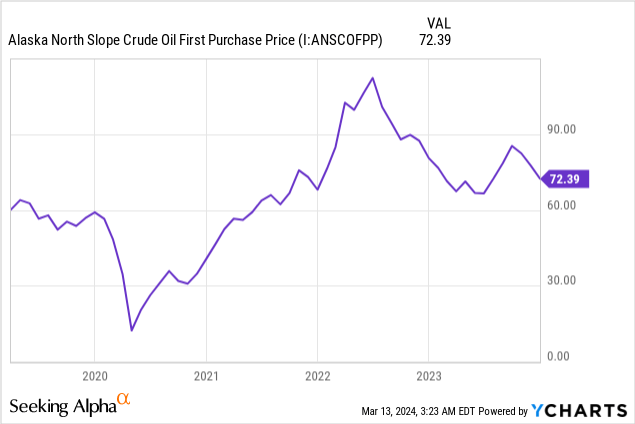

I believe that due to the severe operating environment, loan growth this year is likely to remain below the historical average. Alaska’s economy relies heavily on crude oil prices, which have fallen in recent months.

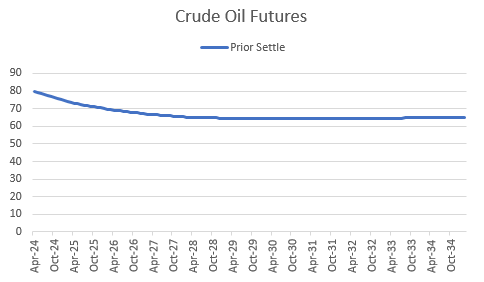

In addition, crude oil prices forward curve A continuation of the backwardation is bad news not only for the energy sector but also for credit demand elsewhere, given the reliance of Alaska’s economy on crude oil.

CME Group

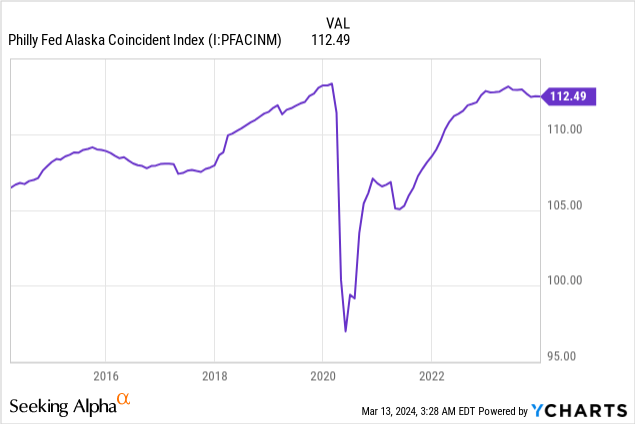

Additionally, Alaska’s economy has gotten worse in recent months, as economic indicators over the same period show.

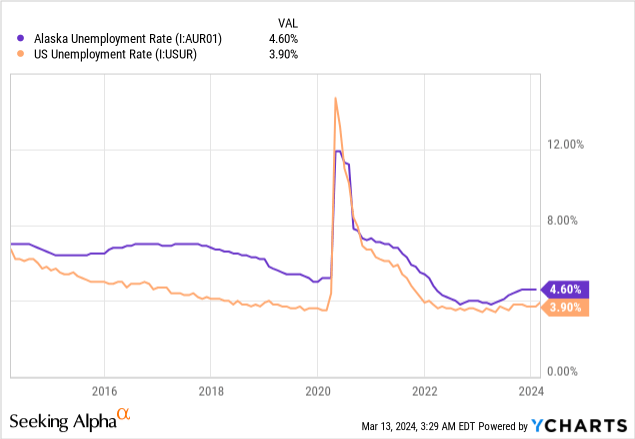

The state’s unemployment rate has also worsened recently, which bodes ill for loan growth.

Taking these factors into account, I expect the loan portfolio to grow 2.0% in 2024. Additionally, I expect most other balance sheet items to grow in tandem with loans. The table below shows my estimates for the balance sheet.

| Financial status | fiscal year 2019 | fiscal year 2020 | FY21 | FY22 | FY23 | FY24E |

| net lending | 1,992 people | 2,190 | 2,104 | 2,208 | 2,256 | 2,301 |

| net loan growth | 2.9% | 9.9% | (3.9)% | 4.9% | 2.1% | 2.0% |

| Other profitable assets | 1,589 | 2,391 | 3,356 | 2,886 | 3,291 | 3,357 people |

| deposit | 2,388 | 3,113 | 4,217 | 4,225 | 3,780 | 3,856 |

| total liabilities | 3,261 | 4,109 | 5,027 | 4,930 | 5,266 | 5,371 |

| common stock | Chapter 548 | Chapter 587 | Chapter 555 | Chapter 408 | Chapter 465 | Chapter 474 |

| Book value per share (USD) | 172.8 | 185.2 | 175.1 | 128.7 | 146.8 | 149.7 |

| Tangible BVPS ($) | 172.8 | 185.2 | 174.1 | 127.8 | 146.1 | 149.0 |

| Sources: FDIC call reports, annual financial reports, author estimates (in millions of U.S. dollars unless otherwise stated) | ||||||

Margin bucks trend as deposit costs stick

First National Bank of Alaska’s net interest margin at the end of 2023 increased by 16 basis points compared with the end of 2022. Although the proportion of non-interest-bearing deposits in total deposits declined during the year, the proportion was still quite high at the end of the year and will reach about 51% in 2023. As a result, deposit costs remained quite sticky last year, while average loan yields rose due to the rising interest rate environment.

I expect the federal funds rate to fall 50-75 basis points this year. In a falling interest rate environment, sticky deposit costs can hurt margins because they won’t fall as fast as loan yields. Therefore, margins are likely to decline in 2024, unlike last year.

Overall, I expect net interest margins to be about 20 basis points lower by the end of 2024 than at the end of 2023.

Profit likely to be flat

First National Bank of Alaska’s profits are likely to be little changed this year. Expected loan growth is likely to offset modest margin contraction and normal growth in non-interest expenses. Overall, I expect the company to earn $18.88 per share in 2024, down just 0.4% year over year. The table below shows my income statement estimates.

| Proof of income | fiscal year 2019 | fiscal year 2020 | FY21 | FY22 | FY23 | FY24E |

| net interest income | 137 | 145 | 146 | 145 | 154 | 159 |

| Loan loss provisions | 0 | 2 | 2 | (1) | (1) | 0 |

| non-interest income | twenty three | 26 | 27 | twenty four | 25 | 26 |

| non-interest expense | 86 | 91 | 92 | 93 | 98 | 104 |

| Net profit – ordinary SH. | 56 | 58 | 58 | 58 | 60 | 60 |

| Earnings per share – diluted ($) | 17.56 | 18.17 | 18.45 | 18.39 | 18.95 | 18.88 |

| Sources: FDIC call reports, annual financial reports, author estimates (in millions of U.S. dollars unless otherwise stated) | ||||||

I haven’t changed my earnings forecast much from my last report on the company, as the outlook for the year hasn’t changed much over the past three months.

Location, unrealized losses pose risks

Due to the geographical concentration of its business, oil and gas price fluctuations are a major source of risk for First National Bank of Alaska. In addition, a portfolio of available-for-sale securities has higher unrealized mark-to-market losses, posing a risk to earnings because management can sell these securities and convert unrealized losses into realized losses. According to details provided in the financial report, these unrealized losses amounted to $98.4 million as of the end of December 2023, accounting for approximately 21% of the total equity balance at the end of the period.

FBAK offers an attractive dividend yield of over 6%

First National Bank of Alaska currently pays a quarterly dividend of $3.20 per share. It also pays an annual special dividend of $3.20 per share. Excluding special dividends, the company’s current dividend levels suggest an impressive dividend yield of 6.4%. After including special dividends, the dividend rate jumps to as high as 8.0%!

As discussed below, the dividend payments appear to be safe.

- Total dividend and earnings forecasts for 2024 imply a dividend yield of 84.7%, very close to the five-year average of 85.6%. Therefore, my profit forecast suggests that FBAK should have no problems paying its common stock and special dividends this year.

- FBAK’s capital position remains strong; therefore, the company will not face regulatory pressure to cut its dividend. According to the financial report, the company’s Tier 1 leverage ratio as of the end of December 2023 was 9.85%, while the regulatory requirement is a minimum of 5.0%.

Maintain buy rating

I use historical price-to-earnings (“P/TB”) and price-to-earnings (“P/E”) multiples to value First National Bank of Alaska. The stock’s past average P/E ratio was 1.43 times, as shown below.

| fiscal year 2019 | fiscal year 2020 | FY21 | FY22 | FY23 | Average | |

| T. Book value per share (USD) | 172.8 | 185.2 | 174.1 | 127.8 | 146.1 | |

| Average market price (USD) | 248.2 | 202.4 | 227.9 | 248.2 | 201.9 | |

| Historical P/TB | 1.44 times | 1.09 times | 1.31 times | 1.94 times | 1.38 times | 1.43 times |

| Source: Corporate Finance, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average price-to-earnings ratio by the forecast tangible book value per share of $149.0 yields a year-end 2024 price target of $213.4. The price target implies a 7.1% upside from the March 13 closing price. The chart below shows the sensitivity of price targets to price-to-book ratios.

| P/TB Multiple | 1.23 times | 1.33 times | 1.43 times | 1.53 times | 1.63 times |

| TBVPS – December 2024($) | 149.0 | 149.0 | 149.0 | 149.0 | 149.0 |

| Target price (USD) | 183.6 | 198.5 | 213.4 | 228.3 | 243.2 |

| Market price (USD) | 199.2 | 199.2 | 199.2 | 199.2 | 199.2 |

| Up/(Down) | (7.8)% | (0.4)% | 7.1% | 14.6% | 22.1% |

| Source: Author’s estimates |

The stock’s past average P/E ratio is approximately 12.36 times, as shown below.

| fiscal year 2019 | fiscal year 2020 | FY21 | FY22 | FY23 | Average | |

| Earnings per share (USD) | 17.6 | 18.2 | 18.5 | 18.4 | 19.0 | |

| Average market price (USD) | 248.2 | 202.4 | 227.9 | 248.2 | 201.9 | |

| historical price to earnings ratio | 14.13 times | 11.14 times | 12.35 times | 13.50 times | 10.66 times | 12.36 times |

| Source: Corporate Finance, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E ratio by forecast earnings per share of $18.9 yields a price target of $233.3 for the end of 2024. The price target implies an upside of 17.1% from the March 13 closing price. The table below shows the sensitivity of price targets to price-to-earnings ratios.

| P/E ratio | 10.36 times | 11.36 times | 12.36 times | 13.36 times | 14.36 times |

| 2024 EPS (USD) | 18.9 | 18.9 | 18.9 | 18.9 | 18.9 |

| Target price (USD) | 195.5 | 214.4 | 233.3 | 252.2 | 271.0 |

| Market price (USD) | 199.2 | 199.2 | 199.2 | 199.2 | 199.2 |

| Up/(Down) | (1.9)% | 7.6% | 17.1% | 26.6% | 36.0% |

| Source: Author’s estimates |

The target prices of the two valuation methods are equally weighted to obtain a comprehensive result. Target price $223.3, which implies an upside of 12.1% from the current market price. Including the forward dividend yield, the total expected return is 20.1%. Therefore, I maintain a Buy rating on First National Bank of Alaska.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.