59 yuan

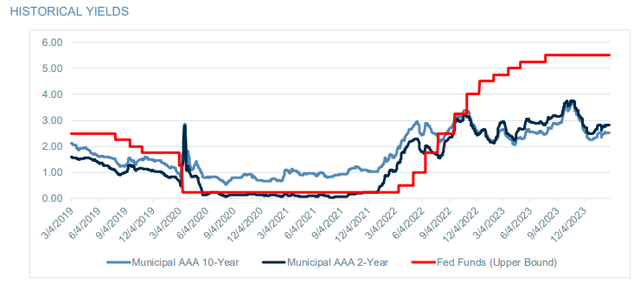

In this article, we revisit the municipal funds sector, focusing specifically on tax-exempt municipal CEFs.The industry has experienced a rollercoaster ride, with yields rising sharply starting in 2022, while It looks like there was a peak late last year, with yields declining and stabilizing since then.

Our main conclusion is that long-term municipal bonds look quite attractive relative to short-term municipal bonds and corporate bonds on a tax-equivalent basis. Second, high-yield municipal bonds are no longer as compelling as they once were due to tighter credit spreads. Third, muni continuing fund discounts remain attractive and may tighten from now on, especially if the cost of leverage begins to subside.

The layout of municipal land

Let’s review the relevant investment factors and whether they favor municipal sustainment funds.

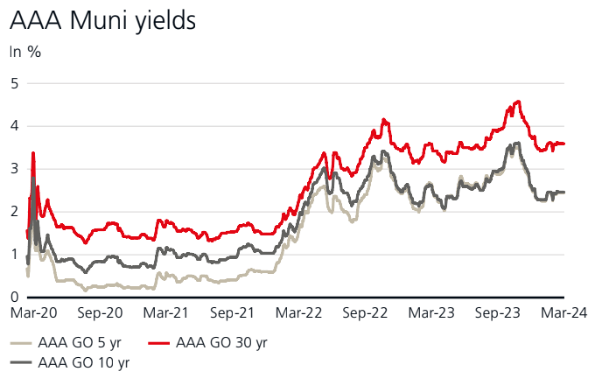

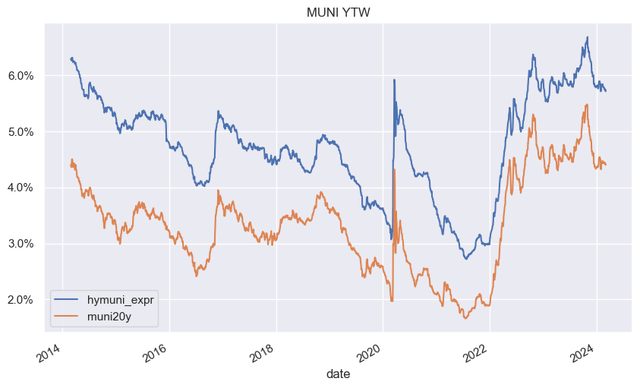

Not surprisingly, the first port of call was Yield. Having said that, the story is pretty good. While yields are off their peak in late 2023, they are still well above average levels over the past few years.

UBS

If we look further at long-term investment grade bonds (blue line) and high-yield/unrated bonds (orange line), we see that yields are flat from their pre-2022 peaks. In short, despite the recent pullback, the absolute level of yields remains very attractive.

systematic income

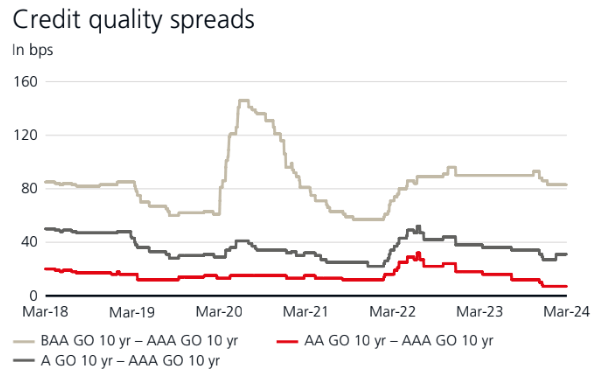

There are three relevant valuation metrics for the municipal market—credit spreads, municipal/treasury yields, and tax-exempt value. The beauty of the credit spread metric is that it allows investors to measure the valuation of bonds with different ratings.

The credit spread situation is somewhat complicated. Higher-quality bonds, such as bonds rated AA, appear relatively expensive (i.e., trade at tight credit spreads), while lower-quality bonds, such as bonds rated Baa (i.e., BBB equivalent or minimum investment grade ratings) are less expensive.

UBS

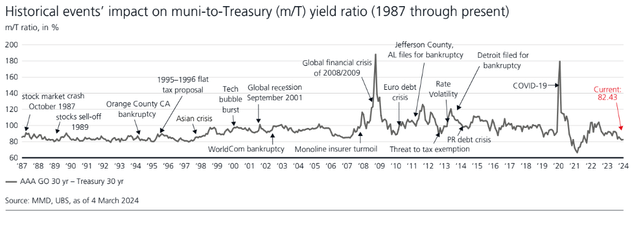

The yield metric can be used to gauge the attractiveness of the high-quality municipal bond market (particularly the AAA segment) relative to Treasuries. Yields suggest that the higher-quality municipal market looks quite rich — but yields are significantly lower in 2021.

UBS

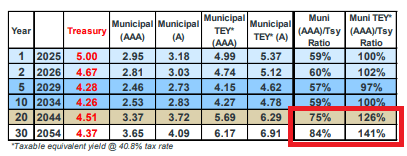

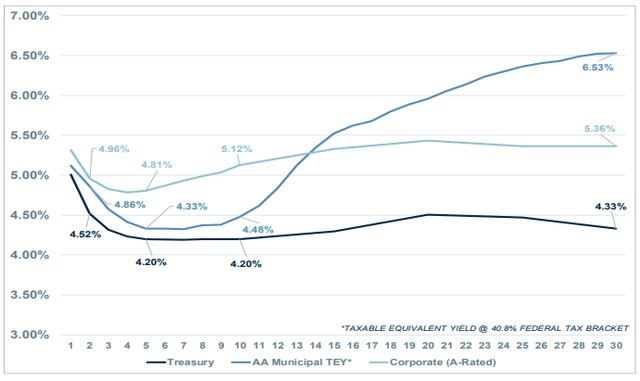

There are better opportunities further down the yield curve on long-term bonds, where yields are more attractive.

raymond james

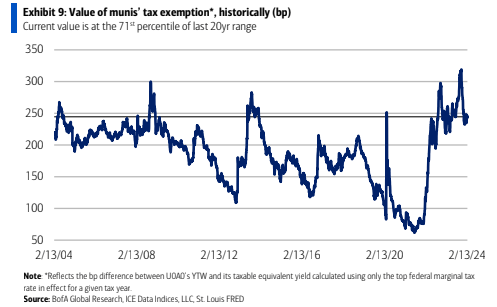

Finally, tax-exempt value is defined as the difference between the municipal yield and its taxable equivalent yield, assuming the highest federal marginal tax rate. Here we see that despite tight credit spreads and lower yields, high levels of absolute yields have kept tax-exempt values at very healthy levels. We believe this compensates for the impact of tighter spreads and lower yields, and is likely to keep both metrics below where they would have been if yields were lower.

python

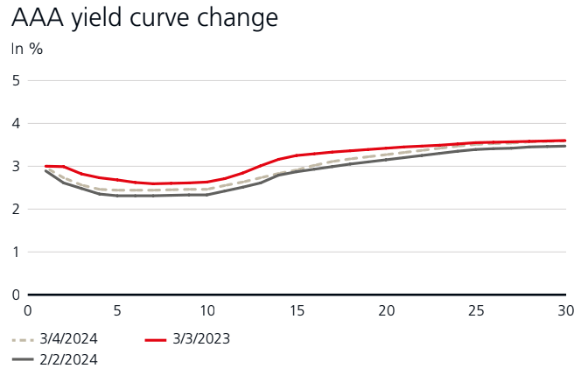

Turning to the second indicator—— yield curve – It is relevant for two reasons. First, it allows investors to pick where to invest on the yield curve. For example, as shown below, longer-maturity bonds have significantly higher yields than intermediate-term bonds, but at the expense of higher duration risk.

Second, yield curve driven leveraged continuing funds can leverage the additional net income generated by their leveraged assets. The steeper the yield curve, the more net profit leveraged assets bring to shareholders.

The municipal yield curve is more favorable than what we have in the taxable space. Most municipal CEFs hold bonds with longer maturities, and the chart below shows that underlying municipal yields over 15 years are higher than short-term municipal rates, which are the base rates for municipal CEFs’ leverage costs. In the taxable space, the relevant yield curve is inverted by about 1.4% – a significant hurdle for corporate bond CEFs from a net income generation perspective.

UBS

If we look at the yield curve over time, as shown in the chart below, the yield curve (at least the 2s10s version) is both inverted and flatter than historically the case. In short, while the net income profile of municipal persistence funds isn’t as bad as the taxable bond space, it’s also not as strong as it has historically been. Still, the situation will improve as the Fed begins its rate-cutting cycle this year.

raymond james

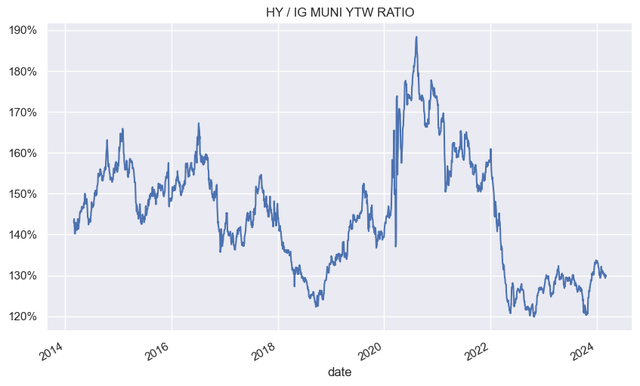

Municipal investors can choose where to make distributions credit quality For example, whether to hold higher quality investment grade bonds and lower quality high yield/unrated bonds. Yields are currently relatively low between the two, which means yield increases on high-yield municipal bonds aren’t particularly attractive.

systematic income

Finally, investors can allocate between corporate and municipal bonds. The chart below shows that longer-maturity municipal bonds look more attractive than corporate bonds on a tax-equivalent basis.

raymond james

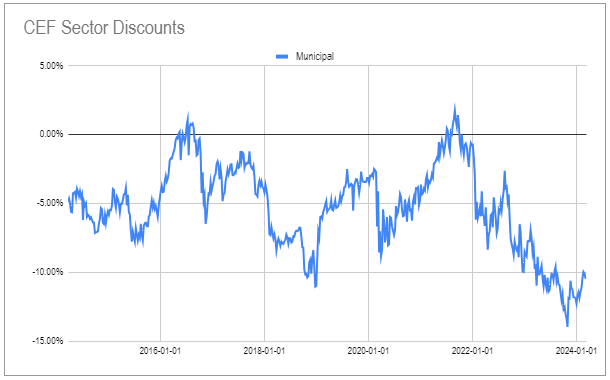

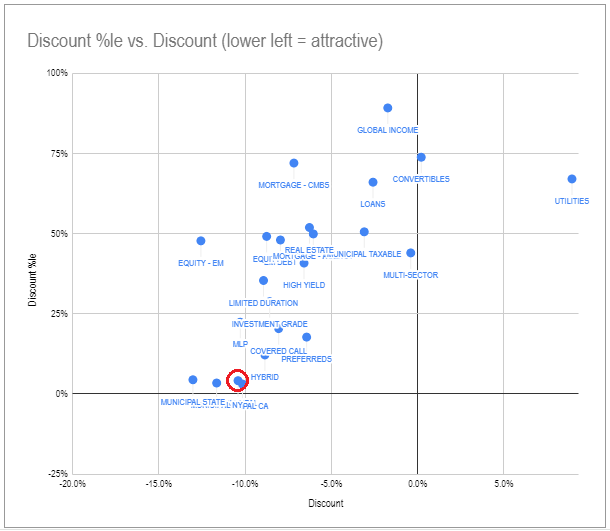

Finally, Municipal CEF Discount Still quite broad in its historical context.

Systematic Income CEF Tool

As shown in the chart below, the municipal CEF sector’s discount is relatively wide compared to other sectors (x-axis), and historically the discount has only been in the 4th percentile this century (i.e., only wider about 4%). time).

Systematic Income CEF Tool

The key takeaways here are as follows. First, while other valuation metrics are mixed, overall municipal yields remain elevated from a historical perspective. Second, bonds with longer maturities offer higher yields and better valuations. Third, investment grade municipal bonds look more attractive than high yield/unrated bonds. Fourth, on a tax-equivalent basis (assuming the highest marginal tax bracket), municipal bonds look more attractive than corporate bonds. Finally, discounts on muni continuing funds are unusually broad overall, and we suspect the discounts will tighten as the cost of leverage declines over time.

A note about taxable municipal bonds

Most municipal investors know that they can allocate tax-exempt and taxable municipal bonds. Although the taxable municipal sector is relatively small, it does own three CEFs: BBN, NBB and GBAB, with GBAB allocating only about half of its portfolio to taxable municipalities. Taxable municipal bonds are a better choice for investors who hold tax-deferred investment accounts.

Build America bonds, or BABs, are taxable municipal bonds introduced in 2009 as part of the American Recovery and Reinvestment Act. A recent development is that since 2013, BAB’s 35% subsidy has been reduced through sequestration.

A recent court case concluded that sequestration or spending cuts during federal government budget negotiations constituted a MAC or material adverse change. This ripple effect could trigger the right of an issuer to seek special selective redemptions of its bonds, which could be more damaging to holders than a more common blanket redemption.

There may be $20-30 billion in BAB redemptions this year, accounting for 10-15% of the entire market. Some call options may result in actual losses for the holder. This issue is likely to be a headwind for the industry in the coming years.

Positions and Points

We recently rebalanced our tax-exempt municipal portfolio based on the factors noted above. Specifically, we made three shifts—reducing our high-yield footprint, increasing allocations to low-leveraged/unlevered funds, and increasing exposure to municipal CEFs relative to longer-term target durations.

Within the broader portfolio, we continue to hold multiple CEFs.

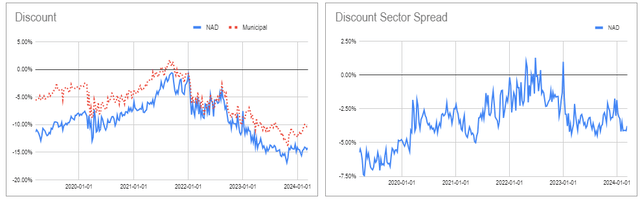

Nuveen Quality Municipal Income Fund (NAD) remains one of our core assets. The fund trades at a 14.2% discount and has a yield of 5.47%. Despite its historical outperformance and above-average yields, the fund still trades at a discount to the industry average, as shown in the chart below.

Systematic Income CEF Tool

NAD has ramped up distribution efforts twice recently to further tighten discounts. This hasn’t worked yet, but eventually investors may take notice. If there’s a downside to the dramatic increase in distribution, it’s that it comes at the expense of distribution coverage. However, it also means that allocation risk from lower coverage is not as high as it usually is as fund managers raise interest rates for other reasons.

We also added a pair of MacKay ETF holdings – IQ MacKay Municipal Insurance ETF (MMIN) and IQ MacKay Municipal Intermediate ETF (MMIT). Given the above discussion, this allocation checks the higher quality, unlevered box. The trading yield of the two funds is 3.6-3.7%. Associate Counsel MacKayShields is a long-time Muni manager with a proven track record. While the yields on these funds aren’t particularly impressive, this allocation works as dry powder given the fairly high valuations of high-yield municipal bonds.

The BlackRock 2037 Municipal Term Trust (BMN) has been on our radar for some time. The fund meets the requirements for a long-term, low-leverage CEF. The fund’s discount extends relative to sectors that provide good entry points. Its target maturity feature also provides potential performance boost in the form of discounted amortization.

Systematic Income CEF Tool

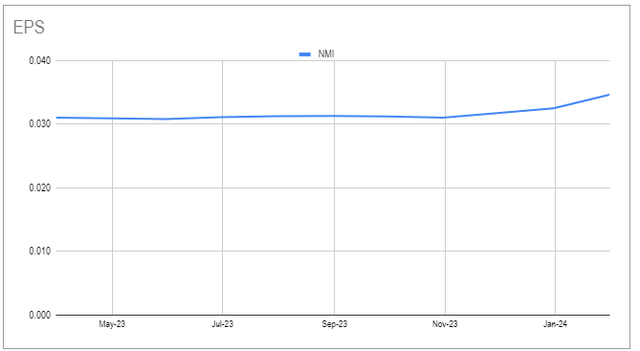

We also increased allocations for the unlevered Nuveen Municipal Revenue Fund (NMI). NMI trades at a 9.1% discount and currently has a yield of 4.72%.

The fund’s allocations have gradually increased – tripling last year. Unlike the net profits of leveraged funds, their net profit profile has been stable and has actually increased recently. The fund has a longer duration, which allows it to generate relatively higher yields as mentioned above. Its credit profile is very serious, with 60% of its investment grade portfolio and 32% in unrated bonds.

Systematic Income CEF Tool