Cn0ra/iStock via Getty Images

It’s been a tough few years for Chinese investors, and 2023 will be no exception, with the largest and most liquid instrument – the iShares MSCI China ETF (NASDAQ: MCHI), experiencing another year of negative impacts return. But the Year of the Dragon has quietly arrived. If this year’stwo meetingsJudging from this meeting, the need for policy support is greater this time.

To recap, Beijing has made its GDP growth target exist “About 5.0%,” Unlike last year, there won’t be the benefit of a low base this year. Meanwhile, the deficit-to-GDP ratio is 3.0%; at first glance, this does not seem that aggressive, but including the issuance of ultra-long-term government special bonds, the implied target deficit ratio is closer to the high single digits.Additionally, the positive factor is that the consumer inflation (CPI) target is around 3%, at Data in recent months have been flat or even negative, indicating that there is considerable room for easing to achieve the implied +7-8% nominal GDP growth target (relative to the 2017 GDP growth target). 4.6% growth in 2023).

Caixin

News after the meeting further supports Beijing’s case for taking more measures to stimulate economic growth this year.On the monetary front, the president of China’s central bank stressed that there are still “The room is spacious” Lower interest rates further – just now lower its baseline Mortgage rates hit a record high last month.On the financial front, reports indicate that US$27 billion will be allocated fundraiser The “National Semiconductor Industry Investment Fund” responds to US chip sanctions. Even stock valuations that have historically been on the lower end of the list for policy support consideration look poised to gain momentum from “national team”, essentially creating a “floor” value for the benchmark index.

Bloomberg

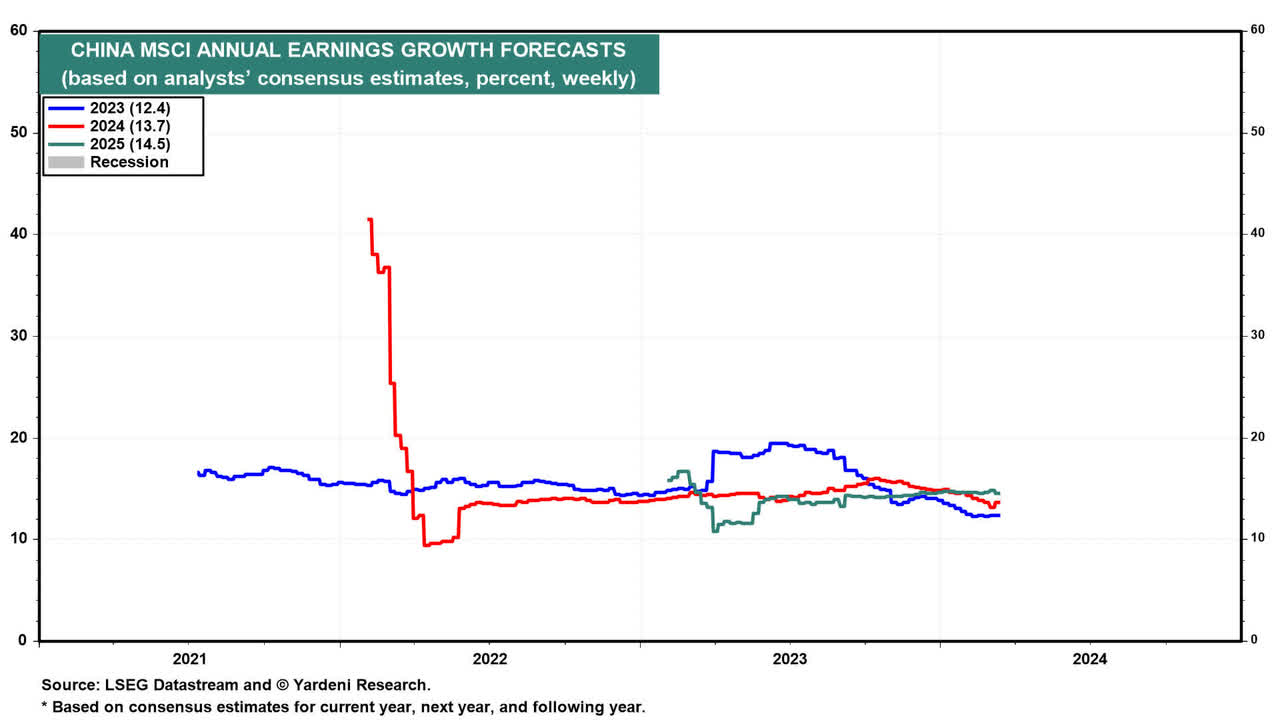

As for stock fundamentals, they check all the right boxes. Consensus EPS growth estimates have been trending downward for some time, but have started to stabilize in the mid-teens to low-teens by 2024/2025. The current expected earnings are relatively low, about 9 times, and investors simply haven’t paid much for this growth. I was initially cautious on China before the massive sell-off before the Lunar New Year, but today I see better risk/reward, especially with the new policy support pipeline.

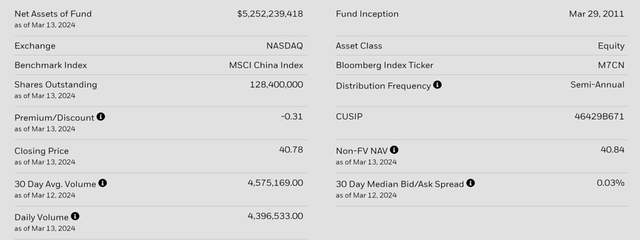

MCHI Overview – The largest and most liquid Chinese car

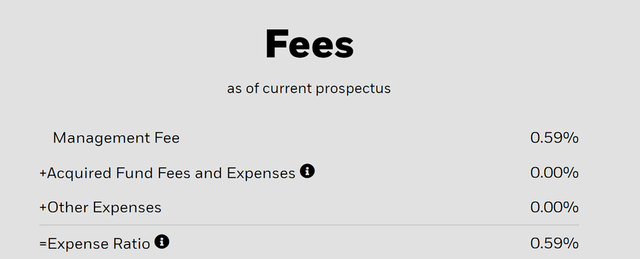

iShares’ MSCI China ETF tracks the market capitalization-weighted MSCI China Index, which covers a basket of Chinese stocks listed domestically (A shares) and overseas (H shares, U.S.-listed ADRs, etc.). Its breadth is a key differentiator compared to similar China ETFs like the iShares China Large Cap ETF (FXI) , which focuses on China’s megacap stocks. Meanwhile, State Street’s (STT) SPDR S&P China ETF (GXC) goes in the opposite direction, with twice as many onshore and offshore listings in its portfolio.

Anshuo

MCHI is also the largest and most liquid instrument on the market – currently managing $5.2 billion in assets and offering a median 30-day bid-ask spread of 3 basis points (FXI is around 4 basis points and GXC is 15 basis points). While GXC matches MCHI’s competitive expense ratio of 59 basis points (FXI lags far behind at about 74 basis points), MCHI still comes out ahead. Only the Franklin FTSE China ETF (FLCH) (see recent report here) beats MCHI in terms of overall costs, with an industry-leading expense ratio of 0.2%, but investors in large trades need to be careful because of FLCH’s expense ratio Far less liquid than MCHI.

Anshuo

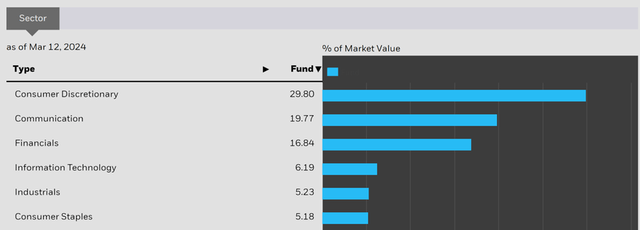

Like other similar China funds, MCHI’s industry allocation is mainly concentrated in consumer discretionary (29.8%) and communication services (19.8%), with the main difference being the weighting of the respective industries. Financials, one of the most resilient industries to last year’s underperformance, is another major sector with a 16.8% stake. Only three other industries crossed the 5% threshold – information technology (6.2%), industrials (5.2%) and consumer goods (5.2%).

Anshuo

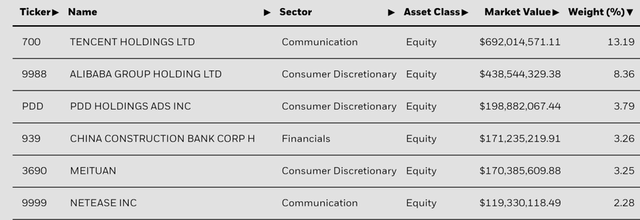

Unsurprisingly, MCHI’s single-stock positioning is consistent with its consumer- and communication services-heavy industry makeup (note that most Chinese “big tech” companies are officially classified into these two industries). Its most important holdings are Tencent Holdings (OTCPK:TCEHY) and Alibaba Group (BABA), with 13.2% and 8.4% respectively. The next largest consumer/tech companies, such as Pinduoduo Holdings ( PDD ), Meituan-Dianping ( OTCPK:MPNGF ) and NetEase ( NTES ), have much smaller allocation ratios of 3.8%, 3.3% and 2.3% respectively. Also worth noting are major bank holdings such as China Construction Bank (OTCPK: CICHY ) and Industrial and Commercial Bank of China (OTCPK: IDCBY ). Overall, the breadth of MCHI’s portfolio (covering 661 stocks) keeps the fund’s single-stock positions fairly diversified.

Anshuo

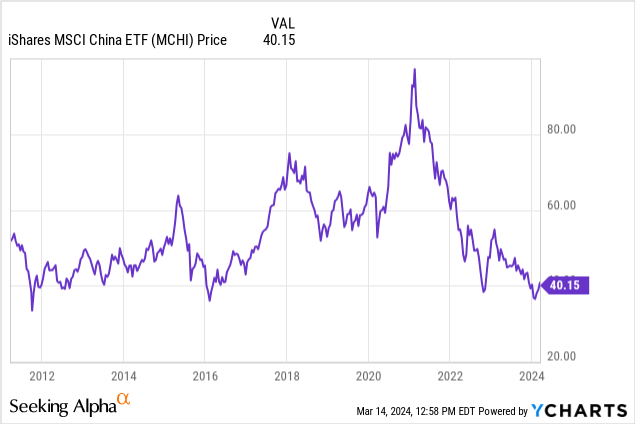

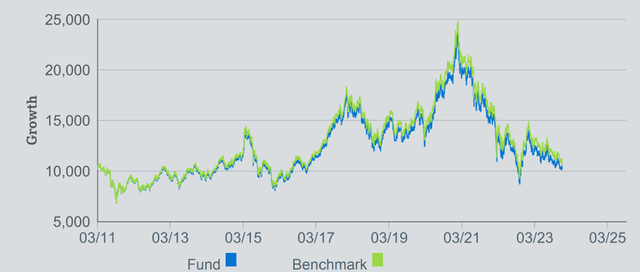

MCHI Performance – Recent pullback aside, it’s hard to ignore the value

The fund ended 2023 with another low, falling -11.1% for the year. However, this retracement also occurred after two consecutive years of declines of 22-23%, which undoubtedly exacerbated the extreme pessimism among investors today about the Chinese stock market. Note that even with the stock market rebounding after the Lunar New Year, MCHI’s full-year total returns remained flat. Zooming out, the fund’s annualized return over the past decade was +0.4%, which means almost zero shareholder value creation.

In relative terms, though, MCHI’s strategy has outperformed similar China funds such as FXI (-1.6%) and has been nearly in lockstep with more diversified options such as GXC (+0.8%). When you also consider MCHI’s liquidity advantage and its small tracking error relative to its benchmark, it becomes clear why the fund remains the vehicle of choice for China investments.

Anshuo

The semi-annual distribution is likely to look pretty solid at 3.6% on a trailing 12-month basis and down to 2.1% on a 30-day SEC basis, so I wouldn’t hold it just for the income.It’s also worth noting that MCHI’s major holdings are deploying Capital investment buyback rather than dividends, partly due to pressure from Beijing but also in recognition of the current undervalued nature of Chinese stocks.

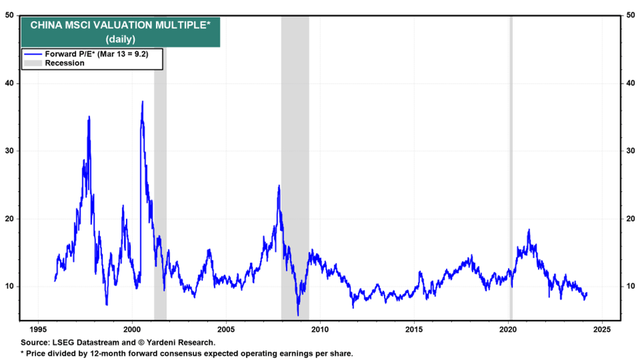

For context, the MSCI China index tracked by MCHI has been downgraded to a historically low forward price-to-earnings ratio of about 9 times. Compared to the currently expected earnings growth rate (after 12% growth in 2023), which is now very achievable, there are all the signs of a “deep value” situation here. However, unlike last year, Beijing has strengthened its policy this time, creating an attractive tactical environment for MCHI to enter the Year of the Dragon.

Yardni

China’s stock market finally gets policy green light

Given the catalyst-rich pipeline of policy support now in place, consensus EPS growth for China’s large-cap stocks may actually prove conservative this time around, especially as earnings revision trends show signs of generally stabilizing so far this year. In terms of valuation, the current forward price-to-earnings ratio of about 9 times (EPS growth rate is low to mid-single digits) has been very favorably screened, reflecting the rather extreme pessimism of investors.

Of all the available options, a tactical rally by China’s large, consumer/tech-focused MCHI (the largest and most liquid U.S. public company) makes a lot of sense to me. Not only because of its huge exposure to corporate buybacks (led by Chinese “big tech” companies, which are currently at multi-year highs), but also because of purchases by state/state-related funds (i.e., “national teams”), which Demonstrates a preference for allocating funds to large-cap ETFs. Last year fell far short of the promise of a post-COVID rebound, and 2024 may finally be the year we have long awaited China’s economic recovery.

Yardni