VitaPix

Electronic Arts (NASDAQ: EA) has done an outstanding job in innovating and expanding its influence in recent years. Even as new game genres continue to emerge across the globe, the company still manages to stay at the forefront of the gaming industry. Popularity. Despite the increasing competition in the gaming industry, EA continues to enjoy great success with flagship games such as FIFA, Madden NFL, and Apex Legends.

EA continues to successfully capitalize on the explosive growth of the gaming industry.

successful growth plan

EA has managed to capture a significant share of the increasingly profitable global video game market. The company’s highly diverse lineup of games allows it to satisfy a wide audience, from sports fans to first-person shooter enthusiasts. EA’s strong presence in most major game genres ensures that the company will receive steady traffic income and reduce volatility.

While EA may not be as innovative as other gaming companies, the company does a good job of adapting to new market trends.Apex Legends, for example, was largely a response to the battle royale trend and is now one of the most popular games Popular headlines in all games. While EA wasn’t the first company to enter the battle royale space, it captured a large portion of the market by making its own quality battle royale games. By quickly adapting to new trends, EA continues to drive growth.

EA’s partnerships and strategic acquisitions also continue to play an important role in the company’s growth. By acquiring smaller, less well-known studios, EA has expanded its gaming portfolio and integrated new technologies into its gaming ecosystem. The company also works with sports organizations to secure exclusive rights to their sporting events.

Digital transformation and mobility

The industry’s shift toward digital distribution is a major positive for EA, as it allows the company to bypass retail channels and reach consumers directly. Digital sales have higher profit margins, thereby increasing EA’s profitability. More importantly, the development of the Internet and the rise of smartphones have opened up a new market for EA.

EA’s mobile The gaming division will likely continue to generate a large portion of the company’s revenue, especially as it continues to port its popular games to mobile devices. Mobile games such as “FIFA Soccer” or “Star Wars: Galaxy of Heroes” are huge successes and validate the company’s push into the mobile market.

healthy financial status

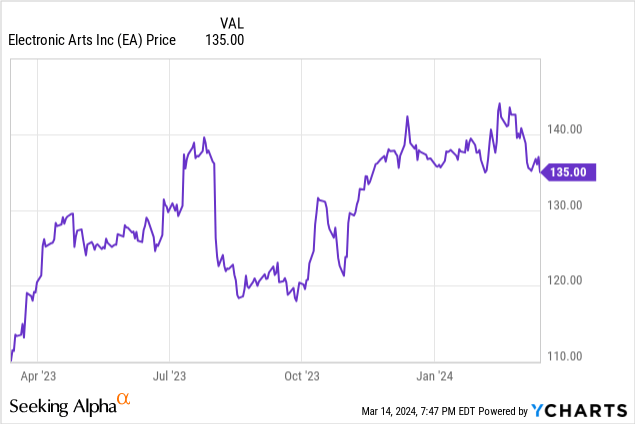

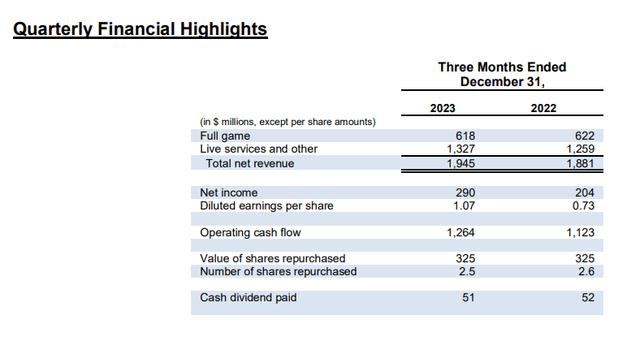

EA remains one of the more financially stable gaming companies. The company still achieved year-over-year growth despite reporting mixed third-quarter results, with bookings of $2.37 billion missing forecasts by $30 million. EA also topped its third-quarter GAAP EPS estimate by $0.19, to $1.07. Despite its weak quarter, EA remains one of the more profitable video game companies.

Other major pure-play gaming companies like Take-Two Interactive (TTWO) and CD Projekt RED (OTCPK:OTGLY) are more reliant on their flagship series. This is reflected in the fact that their finances are heavily dependent on the success of a single franchise. EA avoids this problem by having a more diverse product lineup.

EA

risk factors

Most of EA’s top series face stiff competition in their respective genres. Battlefield and Apex Legends were among their top-performing games, ranking second in the category behind Call of Duty and Fortress Heroes. Now that Activision Blizzard has been acquired by Microsoft, considering Microsoft’s strong resources, EA’s competition with “The Final Hour” will be even more difficult. Epic Games, on the other hand, is very focused on Fortress Legends because it’s their biggest game yet, which means EA has to keep pouring a lot of resources into Apex Legends in order to stay competitive in the battle royale genre.

EA’s sports titles are also highly dependent on the popularity of the sports they simulate. If sports like American football decline in popularity, popular franchises like Madden could suffer as well. EA also needs to maintain good relationships with sports leagues in order to continue making games for them. Additionally, EA faces stiff licensing competition given the popularity of FIFA, NFL, and NBA.The company has lost FIFA rights The collapse of negotiations showcased the risks involved in building a brand around a sports league.

in conclusion

EA is well-positioned in the booming video game industry. The company’s P/E ratio is 19 times, compared with other pure-play video game companies such as Take-Two Interactive and Capcom ( OTCPK:CCOEY ), which trade at 52 times and 25 times, respectively. EA’s current market value is $38 billion, and it still has more room for growth.